Bitcoin ke Google Trends mein aane wali achanak tezi ne bhavkund mein halchal macha di hai. Haal hi mein worldwide Google Trends data ne dikhaya ki February 2026 ke shuruaat mein “Bitcoin” ka search index 100 tak pahunch gaya – pichhle 12 mahine ka sabse uchch star. Yahi hafta Bitcoin ka bhav ~$81,500 se $60,000 tak dhil gaya, phir mid-$70,000 par lachaar-tod. Is sudden spike ka matlab samajhne ke liye abhi kai pehluon ka jaayza lena hoga – retail aur institutional sentiment, purane patterns, investor mansikta, macro-economic ghatnayein aur kshetriya rujhan. Niche diye gaye vishleshan mein hum in sab binduon par gaur karte hain:

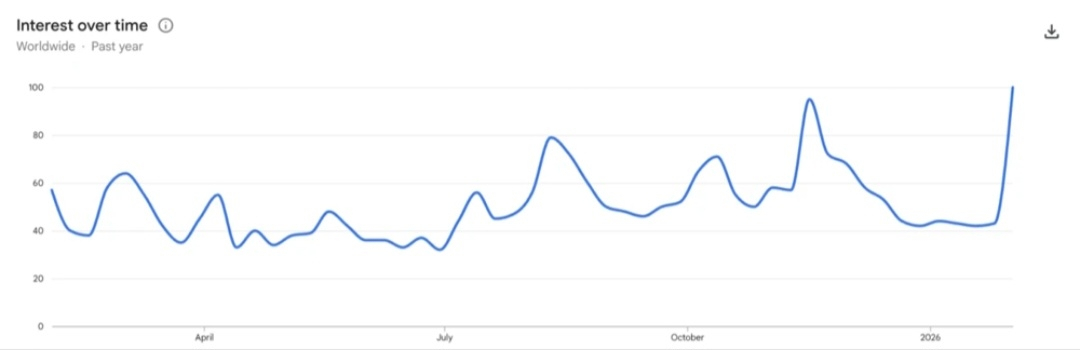

Chart: Google Trends “Interest over time” (pichhle ek saal) for “Bitcoin” worldwide, dikhata hai late 2025 aur early 2026 mein search interest ke peaks. Upar ke chart mein nazar aa raha hai ki Feb 2026 ke shuruat mein search interest sabse uncha hua. Yeh badhotri batlati hai ki aam investing public Bitcoin par nazar rakh rahi hai.

Bazaar ki Bhavna (Market Sentiment)

Retail rush wapas:* Tez search surge se lagta hai ki retail investors phir se market mein aa rahe hain. Jaise ek observer ne kaha hai, high Google search activity aksar “naye aur retail investors ki badhti jigyasa” ko dikhati hai. Yani aam log bitcoin ki taraf jhukav dikha rahe hain – chaahe woh josh ya dar ki wajah se ho.

Fear & Greed index: Iss sab ke bawajood market mein chah-chahari bhi hai. Crypto Fear & Greed Index abhi “Extreme Fear” ke level (6) par hai, jo batata hai ki halat abhi bahut cautious hai. Maksad yeh ke buyers bhi sambhal sambhal kar chal rahe hain.

On-chain signals – Coinbase premium: Kuch institutional sanket positive hain. CryptoQuant ke hisaab se Coinbase premium (US exchanges par BTC ka premium) positive hua hai, jo darshata hai ki America mein naye kharidaar aa rahe hain. Matlab kuch bade players ya domestic buyers is dip ka fayda utha rahe hain.

Hype vs caution: Market mein do mukh pravrittiyan milti hain. Ek taraf search spikes dikhate hain ki Bitcoin “back in spotlight” hai; doosri taraf kuch analysts chetavani de rahe hain. Jaise Bitget ki ek report ne note kiya ki 2021 mein jab Google searches spike hue the, uske baad BTC 26–50% tak duba tha. Yani extreme search interest kabhi kabhi bubble ya top signal bhi ho sakta hai. Traders isliye is data ko sabr ke saath dekh rahe hain – sentiment ko price aur on-chain metrics ke saath cross-check karke.

Itihaasik Namune (Historical Patterns)

2017 bull run: Bitcoin ki history mein pehle bhi search aur price ek dusre ke saath chaley hain. December 2017 mein jab BTC ne ~$20,000 chhuh liya tha, Google Trends mein bhi “Bitcoin” keyword 100/100 par tha. Is jamaat mein FOMO itna tez tha ki har koi “Bitcoin kya hai” type searches kar raha tha. Data analysis firms ne 2017 mein price aur search volume ke beech 0.91 tak ka correlation nikala tha.

2021 ka boom: Dubara 2021 ke dauraan bhi search interest kafi uncha tha. Ek analysis ke mutabik, January–May 2021 mein Google Trends score ~70 tha jab BTC $64,000 all-time high par tha. Aise myan, jab price badhta hai, public jigyasa bhi tez hoti hai – log “Bitcoin price” ya “Kaise kharide” searches karte hain.

2020 ke baad farak: Lekin ek bada farq 2017 ke baad dikha: 2020-21 ke rally mein search volume chhota raha jabki price record tod raha tha. Kyon? Us daur mein institutional money ne churn kiya. Aise mein Google searches kam hui, matlab zimmedar retail FOMO ke bajaye boards aur terminals se trades chali. Ab jo ho raha hai, woh thoda dekha gaya: jab searches ek saal ke peak par pahuche, market mein girawat bhi hui. Purane dauron jaise hi, yeh Retail-Centric wave sabko repeat kar sakti hai.

Recent comparisons: February 2026 wala spike pehle se milta-julta nazara (pattern) hai. Crypto reports batate hain ki 1 Feb 2026 ko search index 100 pe gaya, jo pichhle saal se sabse zyada tha. Usse pehle November 2025 mein bhi ek search spike dekha gaya tha jab BTC $100k se neeche aaya tha. Matlab, jab bhi tezi se dam ghata ya rally hui hai, public interest wahin badhi hai. Ek dusri baat: har search peak price top nahi hota – kabhi market ke bottom par bhi sab izzat dekhte hain (people searching “Bitcoin price prediction” jab girawat ho jati hai). Isliye historical pattern ke hisaab se, search spikes batate hain ke curve strong hai, par exact trend confirm karna mushkil hai.

Niveshakon ki Mansikta (Investor Psychology)

FOMO (Fear of Missing Out): Bitcoin rallies aur dips par logo ki aisii mansikta kaafi maayne rakhti hai. Jaise hi price jaldi se gir ke upar aata hai, “missed gains” ka darr logo ko prabhavit karta hai. Ek CryptoMarket report kehti hai: “Fear of missing out phenomenon aksar tez price recoveries ke dauran dikhai deta hai,” jisse naye log “Bitcoin kaun kharide?” type searches karte hain. Agar Bitcoin 2017 jaisa craze jari rahe, toh har chote bounce par log FOMO me search karenge.

Information-seeking during panic: Jab price down-swing hota hai, toh existing investors apne portfolio dekhne lagte hain aur news/news analysis khojne lagte hain. Usi tarah, prospective buyers is drop ko “discounted entry” samajh ke research mein lag jaate hain. Search queries jise “Bitcoin price chart”, “how to buy bitcoin” surge kar jaati hain. Yeh naraazgi aur utsukta ka mix hai – ek taraf dar (panic selling ya uncertainty), doosri taraf sambhav kharidaari ka motivation.

Hype aur media ka khel: Media coverage bhi sabka focus badhati hai. Jaise hi media bada price move dikhaye (up ya down), search activity ka feedback loop chalu ho jata hai. Social media par memes aur headlines momentum thoda aur tez karte hain. CoinCodex ke ek vishleshan kehta hai ki 2017 me “retail FOMO in its purest form” tha – wo absolutely mad rush jisne price ko aur high tak le gaya. Aaj bhi, jab whales transfer karte hain ya tech reports Bitcoin ki solid news dete hain, search volume turant badh sakta hai.

Mansikta ka balance: Ek tarah se, search spikes humaare mann ke halat ka snapshot dete hain. Agar anek log bajaar ke upar ke hisse ko dekh rahe hain, to woh caution se feel kar sakte hain ki top aa raha hai. Traders ke liye Google Trends ek signal ki tarah hai: extreme spikes se market “exhaustion point” ka andesha ho sakta hai. Matlab agar sab log suddenly padhna-chahna shuru kar dein, toh aksar picture ye hi hoti ki cycle apne end ke kareeb hai.

Global Trigger Factor (Maha-arthavyavastha aur Ghatnayein)

Bazar halchal: Bitcoin abhi bhi tezi aur mandi dono ke sensitive cycles mein hai. Global stock markets ya economy me koi stress (jaise 2026 ke shuruaat mein tech stocks ki girawat, ya $1T market wipeout reports) se crypto me bhi fear feel ho sakta hai. Jab duniya bhar ki arthavyavastha unstable ho (high inflation, rates uncertainty), kuch log Bitcoin ko hedge ya alternative samajh ke dekhenge, jisse search aur volume badh sakta hai.

Geopolitical Tension: Hal filhal ke geopolitical issues bhi logon ki interest ko provoke kar sakte hain. Misal ke taur par, US-Iran ya anya regional tensions ke dauran kuch log Bitcoin me safe haven ki tarah dekhte hain. Ek Binance square post ne mention kiya ki Middle East ki khabar se “Bitcoin vs Gold” jaise searches trend mein hain, jo dikhata hai ki log apne paiso ko secure place dene ke liye crypto vs traditional comparisons soch rahe hain. Aisi ghatnaye public curiosity badhati hain.

Holiday aur seasonal effect: January end 2026 me Lunar New Year tha, jiski wajah se trading volumes low hogaye the. Holiday baad retail phir se market me engage karte hain, aur searches revive ho jati hain. Usi tarah, regional holidays (jaise India ka Holi, ya paanch aftari month Ramadan in Islamic countries) bhi crypto interest ko asar daalte hain. Shayad kuch as well-known seasonal patterns search data ko influence karen.

Naitik niyam aur media: Regulatory news bhi factor ho sakti hai. 2026 ki shuruat me kuch desh stablecoin ya crypto trade rules ke liye proposals rakh rahe hain. Aise discussions se log uneasy ho sakte hain aur “naye niyam aane se kya hoga?” type searches karte hain. Saath hi mainstream media me crypto coverage (jaise CNN, Bloomberg reports) bhi search interest ko shoot kar deti hai. (Udaharan: recent Bitcoin whale transfers ya ETF news logon ki nazar me aaye ho toh search bar traffic badhega.)

Expert insights: Kuch crypto analysts ne bhi highlight kiya ki “retail wapas aa raha hai”. Bitwise Europe ke Andre Dragosch ne coin post kiya ki hal hi me retail demand me wapas jump dikh raha hai. Isi tarah CryptoQuant ke Julio Moreno ne bataya ki US me buying suru ho gayi hai (Coinbase premium wapas positive). Yah sab indicate karta hai ki macro perspective me BTC ke liye log fir se jagruk ho rahe hain.

Kshetriya Rujhan (Regional Trends)

El Salvador aur anya mukh desh: Pichhle kuch samay mein kuch regions ka crypto adoption high raha hai. Udaharan ke liye, mid-2025 mein El Salvador ne highest Bitcoin search interest dekha (shaayad unke national reserves ki wajah se). Emerging markets jaise Nigeria, Ghana, aur India bhi historically crypto searches mein age rehte hain (yahaan paisa transfer aur inflation ke concerns Bitcoin ko popular banate hain). Halanki abhi Google ne February 2026 ke liye country-level data share nahi kiya, lekin pehle ki trends dekh kar yeh andaza hai ki Asia-African markets mein ab bhi active jagrukata hogi.

Amerika aur Europe: Reports se pata chalta hai ki US aur Europe mein bhi interest tej hua hai. CryptoQuant ka data keh raha hai ki “US investors phir se BTC kharid rahe hain” (Coinbase premium positive). Isi tarah Bitwise Europe ke head ne bhi likha ki “retail wapas aa raha hai”, jo Europe ke logon ke sentiment ki taraf ishaara karta hai. Europe mein crypto ETFs aur regulations par clarity aane se retail confidence badh raha hai.

Bhasha aur lokpriya markets: Hinglish bhasha mein bolen to, duniya bhar ka interest wide hai. Koi khaas “pakka winner” country toh abhi confirm nahi, lekin Asia-Pac, North America, aur EMEA sab jagah se traffic aane ke sab sign hain. CoinDesk ya CoinTelegraph jaise global media outlets pe bhi Bitcoin ki coverage hone par har region ke log search bar mein “Bitcoin news” daal rahe hain. Binance Square posts bhi highlight karte hain ki Latin America ya Middle East jaise unstable areas mein bhi log crypto alternative dekh rahe hain.

Samghikta: Antatah, is surge mein duniya bhar ke log shaamil nazar aa rahe hain. Jaise hi Bitcoin phir se news banta hai, sab deshon mein search volume barh jati hai. Halaanki kuch analysts ne El Salvador aur US ko special mention kiya hai, overall yeh pheli hui lhar hai jo har region ko effect kar rahi hai. Policy ya economic developments ke hisaab se aage bhi alag-alag deshon se search interest me uttar-chadhav dekhe jayenge.

Sankshipt Suchna: Bitcoin ki Google searches ka haali surge retail investors ke josh aur market volatility dono ka sanketik mix hai. Past cycles me aise spikes ne price rallies ke saath ya unke pehle sign diye hain, lekin kabhi kabhi bubble alerts bhi. Mansik roop se, FOMO aur panic dono is search behavior ko drive karte hain. Macro aur media factors (jaise broad market drop, geopolitical tension, holiday season, regulatory news) timing kaar kaam karte hain. Region-wise, abhi global level par jagrukta hai – Udaharan ke liye, El Salvador jaise kuch country historically top interest rakhte hain, aur US-Europe me bhi activity barh rahi hai. Yani, Bitcoin phir se sabke radar par aa gaya hai – aage kya hoga, woh market signal, macro cues aur investors ke behtar vishleshan par nirbhar hoga.

Mool Sutra: Google Trends ka surge ek taraf market psychology dikhata hai, aur doosri taraf system ke fundamentals samajhne me madad karta hai. Traders aur researchers dono is metric ko price swings ke saath milakar dekhte hain. Abhi scenario yeh hai ki ubal bhari bazaar me retail interest fir se zinda hua hai, lekin sentiment abhi bhi khatarnaak “fear” mein hai. Jitni der tak market ka support mazboot rahega aur retail demand dikhega, utni der ek potential recovery ki umeed bani rahegi – lekin uppar kitaab mein koi comment nahi kiya ja sakta.

#BitcoinGoogleSearchesSurge #USIranStandoff #RiskAssetsMarketShock #WhenWillBTCRebound #BinanceSquare