@Dusk There’s a certain kind of calm you only trust after you’ve watched a system absorb stress without changing its story. Dusk is built around that kind of calm. Not the calm of “nothing happened,” but the calm of “things happened and the chain didn’t flinch.” In finance, “safety” usually means nothing unexpected happens. On Dusk, that becomes real: once a block is confirmed, it’s confirmed—no waiting around wondering if it might change. Deterministic finality isn’t a performance claim here. It’s a promise about what people are allowed to believe, and when.

In practice, it changes the emotional temperature of every interaction. A trader moving collateral, a treasury operator settling invoices, a compliance lead reconciling a report—these aren’t romantic activities, but they are full of quiet fear when the system is ambiguous. If you’ve ever had to tell a client “it should be fine, just wait for more confirmations,” you know how quickly trust turns into a bargaining exercise. Dusk tries to remove that negotiation. It narrows the window where human beings have to guess whether reality has already happened.

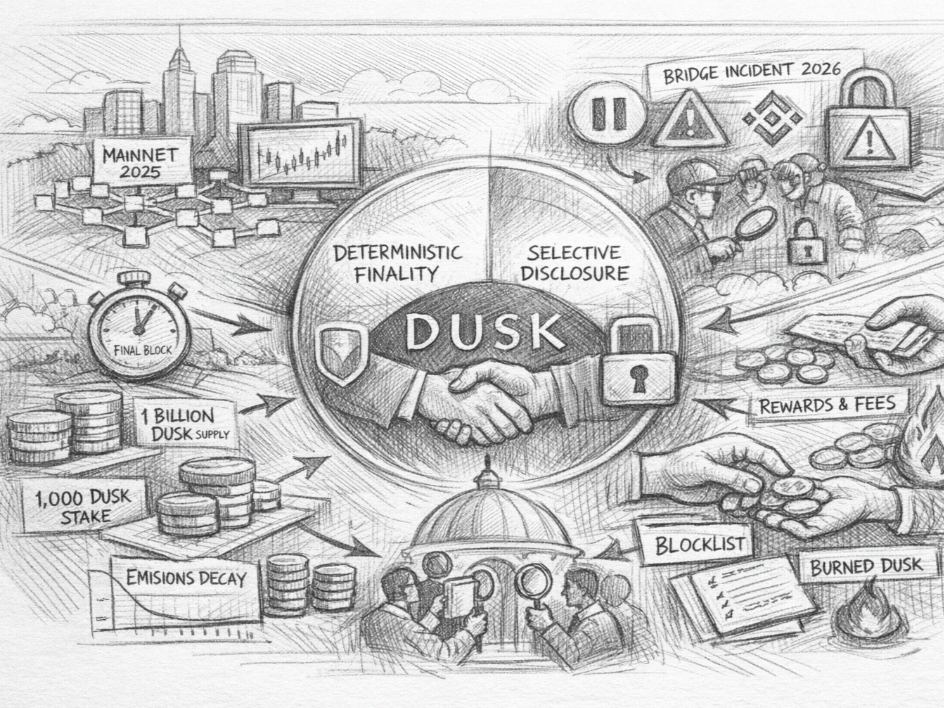

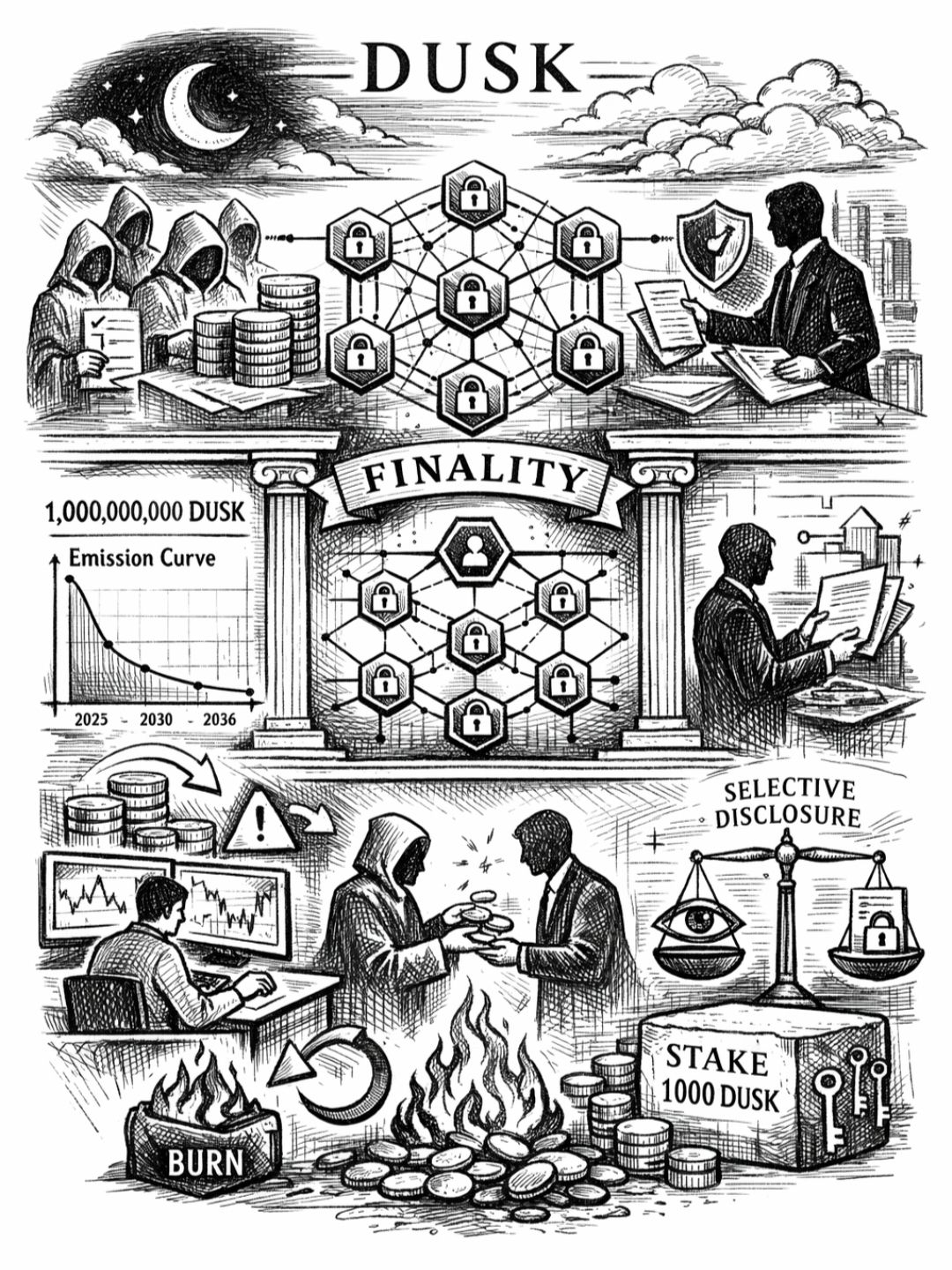

That discipline becomes more obvious when you look at how Dusk actually reaches agreement. Dusk’s proof-of-stake system doesn’t say “it’s probably final.” It says “it’s final” after a small, randomly chosen group proposes a block, checks it, and confirms it. That’s why finality feels like a clear decision, not gossip.It also makes failure modes easier to reason about: if something is wrong, you don’t blame “the network” as a vague cloud—you can point to how the checks are supposed to happen, and how incentives are supposed to punish dishonesty.

Selective disclosure is the other half of that emotional promise, and it’s harder to explain because most people confuse it with secrecy. Dusk doesn’t treat privacy as hiding from accountability. It treats privacy as control over exposure, which is a different moral posture. In the real world, disclosure is rarely binary. Some information must be public. Some information must be shielded. Most information must be shareable with the right people at the right time, without becoming public property forever. Dusk’s settlement layer supports both public and shielded value movement while keeping everything anchored to the same finality guarantees, so the chain can be one shared book without forcing every line item to be readable by everyone.

The subtle point is that selective disclosure only feels safe if finality is strong. If outcomes can wobble, then the act of revealing anything becomes a risk you might have to repeat, defend, or unwind. Dusk reduces that risk by making the timeline of “this is done” clean. When the world is calm, that sounds like a nice-to-have. When the world is messy—when counterparties disagree, when someone claims they didn’t receive funds, when a regulator asks why a record changed—finality becomes the difference between a conversation and a conflict.On December 20, 2024, Dusk began launching its network. By January 7, 2025, it reached the point where the first record was made that no one can change.That date matters because it marks the moment Dusk stopped being “almost real” and became a place where mistakes could have consequences. It’s one thing to design a chain for regulated reality. It’s another thing to live inside the operational cadence of it, where users expect continuity and the team has to treat incidents as governance and risk, not as drama.

That brings us to a January 2026 moment that revealed more about Dusk’s temperament than any marketing line ever could. On January 17, 2026, Dusk published a notice about unusual activity involving a team-managed wallet used in bridge operations. They paused bridge services, recycled related addresses, coordinated with Binance where flows intersected centralized infrastructure, and stated that no user funds were impacted based on the information available at the time. Just as important, they were explicit that this was not a protocol-level issue and that the main network continued operating normally. That separation—operational tooling can be paused and hardened while the base settlement keeps its integrity—is the kind of boundary that serious systems need.

What stood out to me wasn’t just the pause. It was the instinct to reduce harm before the full story was comfortable. They also shipped a web-wallet mitigation during the response window, including a recipient blocklist to prevent transfers to known dangerous addresses and to surface a clear warning before a transaction can be submitted. That’s not the posture of “nothing happened.” It’s the posture of “we assume the world is adversarial and we design user experience like a safety rail, not a convenience.” People underestimate how much trust is built by these unglamorous interventions.

Economics is where this discipline becomes enforceable rather than aspirational. Dusk’s token story isn’t just “there is a token.” The supply ceiling is defined: 1,000,000,000 DUSK maximum, built from a 500,000,000 initial supply plus another 500,000,000 emitted over 36 years. Emissions follow a geometric decay that halves every four years, starting with an initial per-block emission of 19.8574 DUSK/block in the first period. This is what makes long-term security feel like a plan instead of a mood: the chain doesn’t have to pretend fees alone will carry everything from day one, but it also doesn’t pretend inflation should be permanent.

Even the smallest units tell you what kind of system Dusk wants to be. Fees are denominated down to the nano scale: 1 LUX equals 10⁻⁹ DUSK. That kind of granularity is practical, but it’s also psychological. It lets users pay for execution without feeling like every action is a tax that requires a second thought. And it lets Dusk keep fee logic legible: you set a limit, you pay for what is used, and if execution fails mid-way, you still pay for the work consumed. That last part is not “nice,” but it is honest. It removes a whole category of accidental denial-of-service behavior that appears when failure is free.

Staking details matter here because they reveal how Dusk balances participation with safety.To stake, you need at least 1,000 DUSK. Your stake becomes active after two epochs (4,320 blocks). Unstaking is described as having no penalties and no waiting time.Those parameters are not just mechanical. They shape how people behave under uncertainty. If exiting is punitive, people hide risk. If exiting is clean, people are more likely to make rational decisions and less likely to stay trapped in fear. But clean exits only work when slashing and reward logic still discourage sabotage, which is why the reward split and penalty pathways matter too.

And then there’s the way Dusk treats rewards as a composite of new emissions and real activity. The block reward is described as newly emitted DUSK plus transaction fees, and the distribution is explicit: a majority flows to the block generator, portions go to the committees involved in checking and finalizing, and a share goes to a development fund, with undistributed parts of a certain component burned through the gas-burning mechanism. That design isn’t about making anyone rich. It’s about making honest participation feel like the default path, even when nobody is watching and even when the temptation to cut corners is real.

All of this lands back on the core topic: deterministic finality under selective disclosure. Dusk is trying to make a specific kind of user experience possible—one where the chain can say “this is final” without asking you to overexpose your life to prove you acted correctly. That combination is rare not because it’s philosophically complex, but because it forces you to respect the messy parts of finance: disputes, partial visibility, contested narratives, operational incidents, and incentives that shift when markets turn. Dusk keeps building as if those messy moments are the normal case, not an edge case.

The quiet responsibility here is easy to miss because it doesn’t look like attention. It looks like timelines with real dates, like a mainnet that has to be lived in after January 7, 2025, like an incident notice on January 17, 2026 that pauses a risky surface area while the base layer stays steady, like a token schedule that acknowledges both early security needs and long-term restraint. Dusk is the kind of infrastructure that won’t feel exciting when it works. It will feel like relief. And in systems that carry other people’s money, other people’s reputations, and sometimes other people’s legal exposure, relief is the most human metric that matters.