I've spent years watching blockchain projects try solving cross-chain stuff and honestly most of it is complete garbage. You get wrapped tokens splitting liquidity across fifty different chains, or you're trusting some centralized bridge operator, or the solution is so absurdly complicated that nobody bothers. When Plasma added NEAR Intents late January, it wasn't just another integration checkbox. Plasma actually fixed something real about moving big stablecoin amounts between chains.

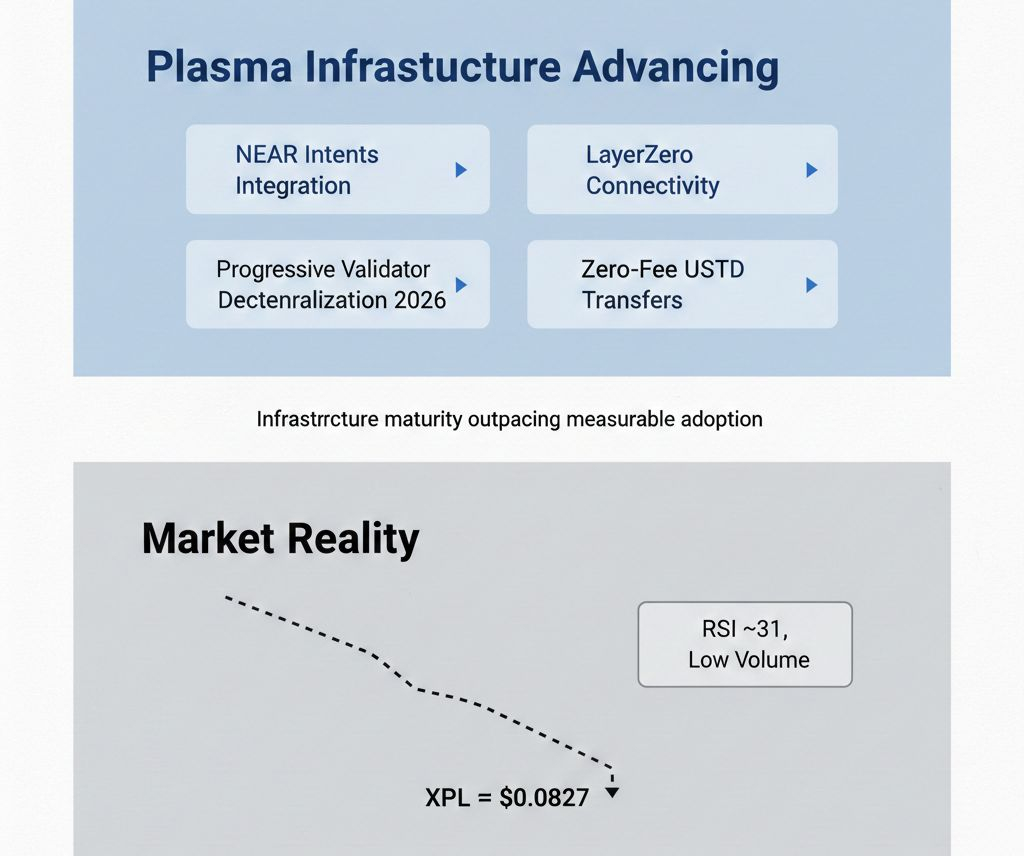

XPL sits at $0.0827, RSI at 30.99, deep oversold after months bleeding. Volume dropped to 6.02M USDT, lowest in weeks. But price doesn't show what's happening with Plasma infrastructure, which keeps being the pattern here.

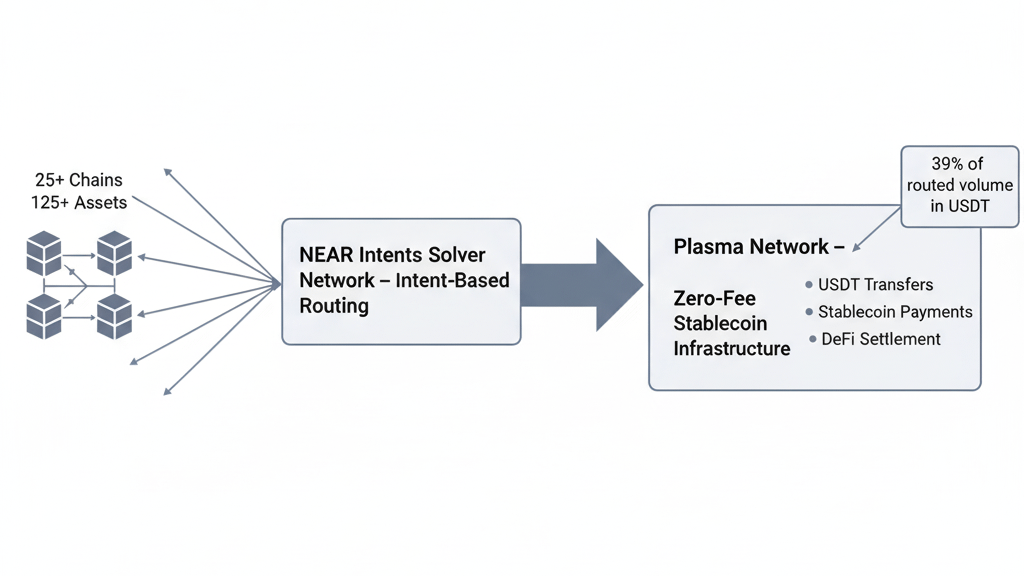

NEAR Intents connects Plasma to 25+ blockchains through intent swaps where you just say what you want and solvers handle routing. Sounds like marketing nonsense until you get what it means for moving serious money onto Plasma from other chains.

Normal bridging sucks. Go to website, approve tokens, start transfer, wait for confirmations, claim on other side. Five steps, five ways it breaks. NEAR Intents on Plasma makes it one step. Say "swap USDC from Arbitrum to Plasma" and it executes through solvers instantly.

What makes this useful specifically for Plasma is tapping into liquidity covering 125+ assets across those 25 chains. Plasma's USDT0 and XPL get direct swap routes to everything without needing separate bridges per chain. Real interoperability without fragmenting liquidity or creating wrapped variants Plasma avoided on purpose.

Data shows 39% of NEAR Intents volume is USDT, exactly what Plasma built for with zero fees. Half million addresses used it last month, so solver network has real depth, not theoretical infrastructure nobody touches. Plasma using existing liquidity instead of building from zero makes strategic sense.

For institutions moving millions in stables onto Plasma, NEAR Intents fixes execution issues. Move huge USDT amounts from Ethereum to Plasma without slippage worries because solvers route through best path. Basic stuff professionals expect that most integrations don't deliver but Plasma needs to compete.

Plasma developers can plug NEAR Intents into apps through 1Click API, meaning third-party stuff on Plasma gets cross-chain liquidity automatically without coding bridge logic themselves. Cuts dev work massively, makes building on Plasma more attractive for multi-chain needs.

Timing matters given Plasma roadmap extending zero-fee USDT to third parties in 2026. Free transfers inside Plasma plus easy cross-chain routing creates infrastructure for payment apps moving money between chains smoothly. Whether devs actually build that stuff on Plasma is unknown, but foundation exists now.

Cross-chain competition is brutal though. LayerZero connected Plasma at launch, enabled USDT0 hitting $7 billion on the network. Chainlink integrated October for price feeds. Rubic added Plasma connecting seven bridge providers. Plasma doesn't do exclusive deals, connects everything at once.

Multi-integration makes sense for Plasma maximizing connectivity instead of betting one standard wins. But means Plasma has no moat on cross-chain since competitors copy same integrations. Difference has to be what happens after assets land on Plasma, not just getting there easily.

Progressive decentralization expanding Plasma validators happens 2026 with these integrations. Right now Plasma team runs validators keeping tight control during beta. Opening to external operators with XPL staking changes Plasma security completely.

Reward slashing instead of stake slashing is weird choice for Plasma. Bad validators lose rewards they would've earned but keep staked XPL. Reduces risk for Plasma validators, encourages participation versus protocols slashing entire stakes for downtime mistakes.

Staking delegation lets normal XPL holders delegate to Plasma validators, earn without running nodes. Creates XPL utility beyond transaction fees on Plasma, might absorb selling if holders stake instead of dump. Whether yields justify locking depends what Plasma validator rewards become once inflation starts.

Validator expansion happens as July 2026 unlock dumps 2.5 billion XPL from US lockups. If Plasma staking launches before with good yields, maybe that XPL gets delegated not sold. If staking is late or yields suck, unlock floods without demand absorbing it.

XPL at $0.0827, RSI 30.99 prices in worst scenarios for that unlock. Volume 6.02M lowest in weeks means even traders quit on Plasma. NEAR Intents and decentralization don't change dynamics unless driving real usage on Plasma creating organic demand.

What proves integrations matter for Plasma? Transaction counts on Plasma rising from cross-chain flows. Third-party apps launching using NEAR Intents on network. Validators expanding beyond Plasma team with outside operators staking. Metrics showing Plasma infrastructure becomes commercial adoption not just tech capability.

Metrics are harder tracking than price but determine if Plasma builds sustainable business or connects infrastructure nobody needs. Plasma has cross-chain liquidity and decentralized validation capabilities now. Whether anyone builds on those or uses Plasma for real money flows stays open.

NEAR Intents integration fixes real stablecoin liquidity problems moving between chains onto Plasma. Combined with Plasma zero-fee USDT and coming validator decentralization, infrastructure looks complete. Missing is proof completeness drives Plasma adoption versus just more unused capacity in crowded markets.