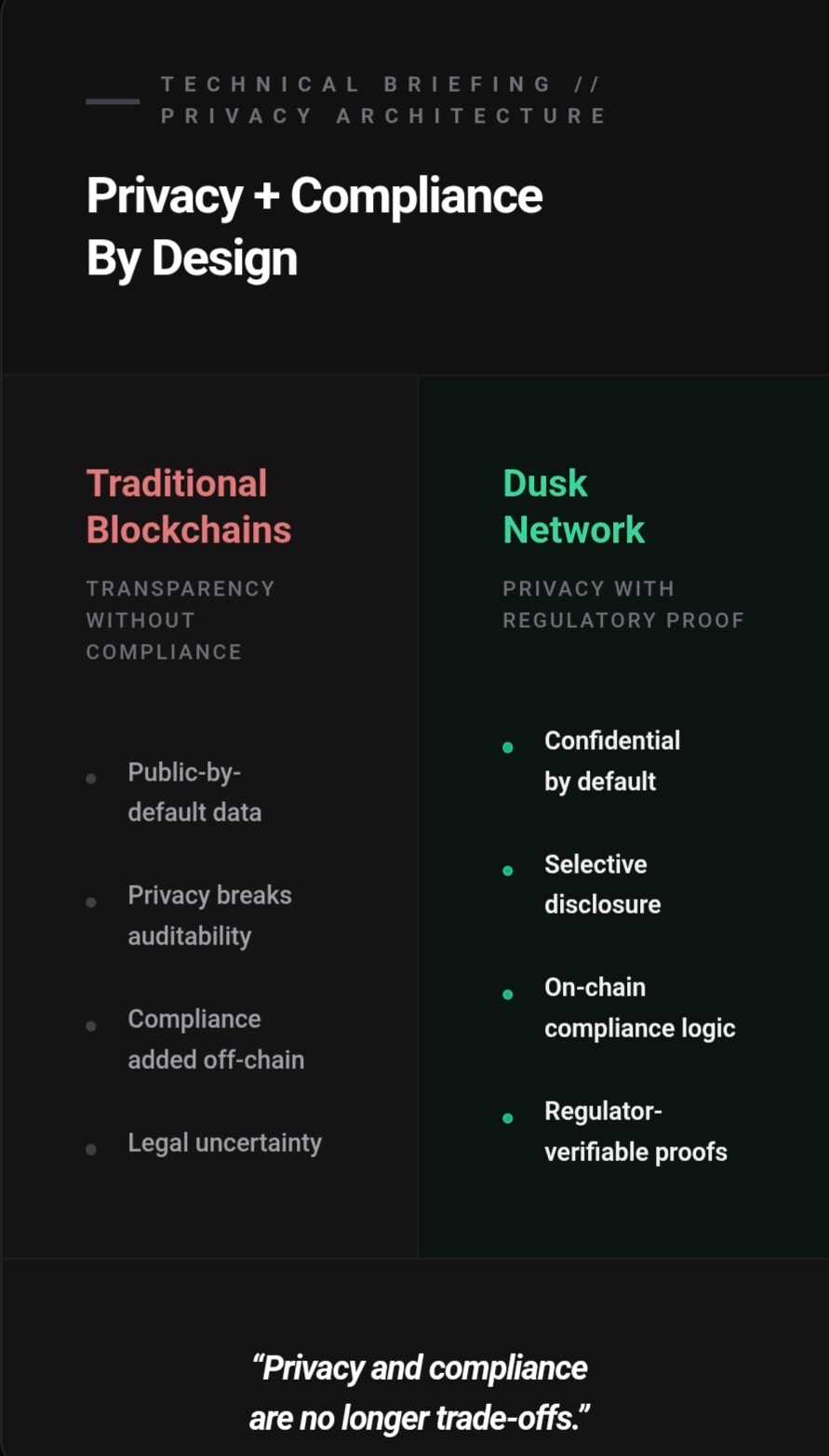

Dusk has quietly evolved from a privacy-focused experiment into a living, institutional-grade financial infrastructure. Its mainnet launched in January 2025 with a “purposeful and gradual” approach, eschewing hype for stability. By early 2026, Dusk’s proponents describe it as “not a crypto experiment but rather a solid foundation of future financial markets”. The network was explicitly designed to balance two historically conflicting goals: confidentiality and compliance. Traditional markets demand auditability and legal certainty, yet also require confidentiality of positions and sensitive transactions. Dusk addresses this tension by building privacy and regulatory features into its protocol from day one.

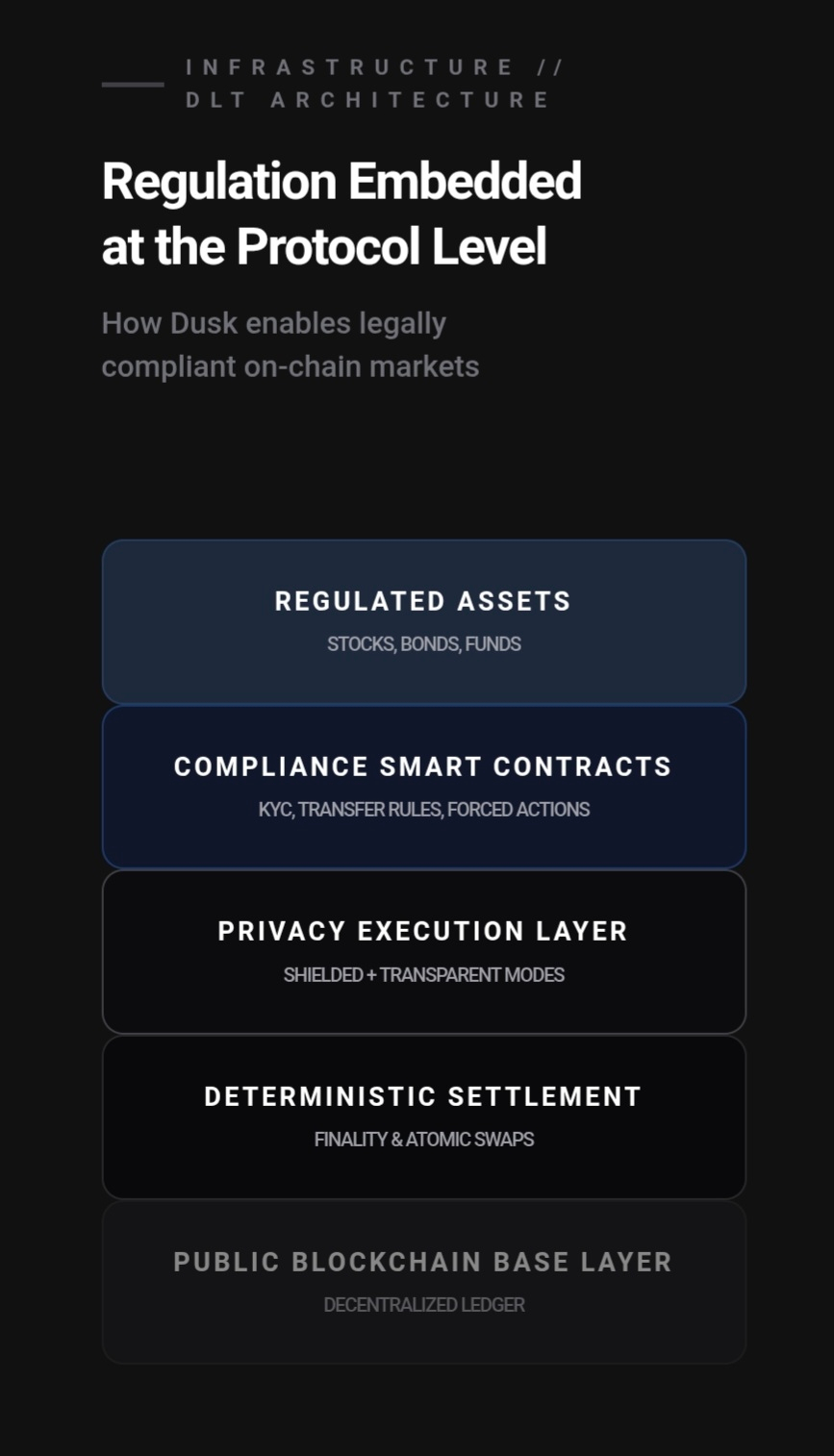

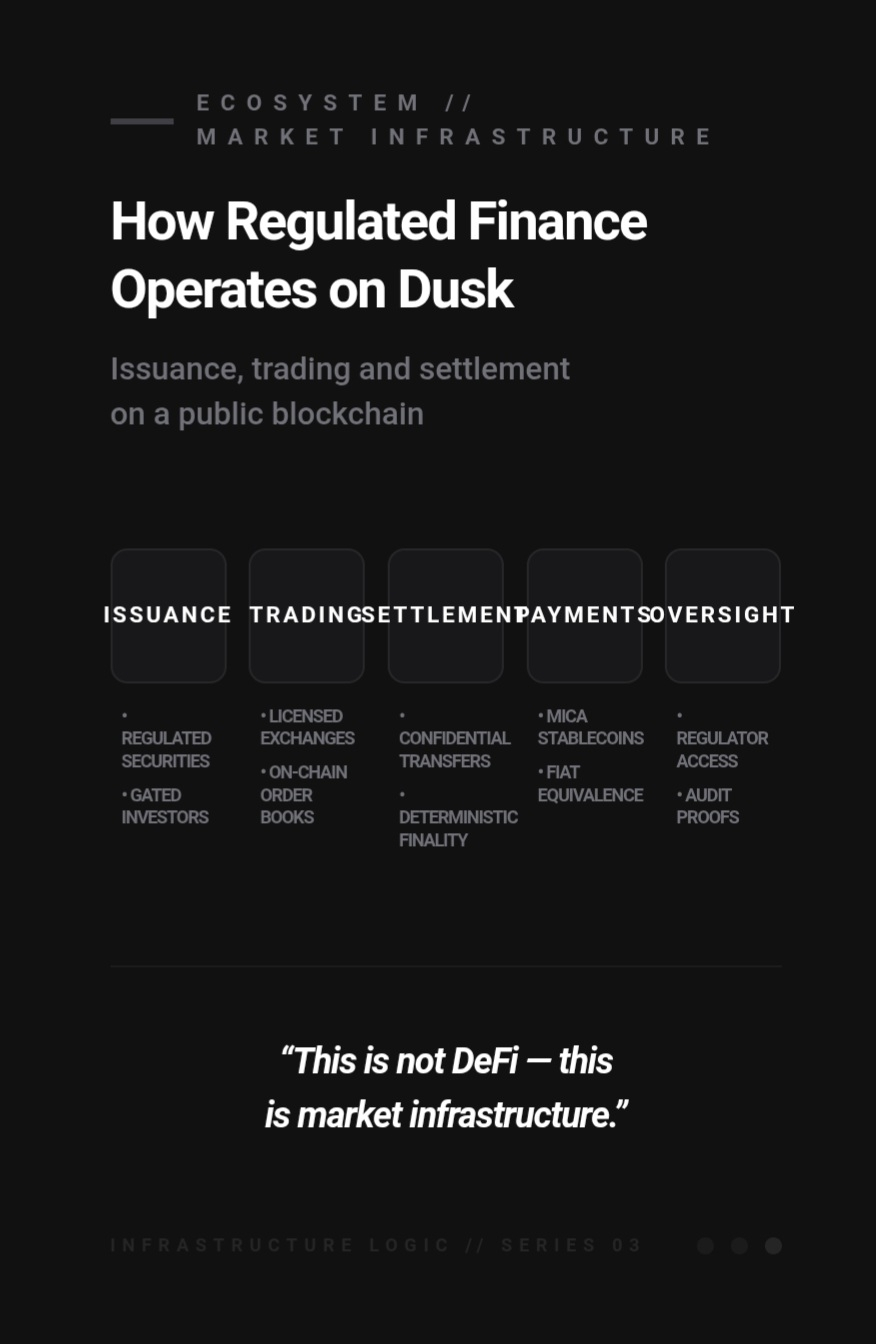

Institutions care less about decentralization as an ideology and more about data integrity and trust. In Dusk’s case, privacy isn’t about hiding wrongdoing – it’s about “lets regulated assets function normally without leaking sensitive data, while still being provable when required”. In practice, Dusk offers a dual-mode ledger: transparent “Moonlight” transactions for public flows and shielded “Phoenix” transfers for confidential settlement. Developers can thus choose the right mode for each use case. The network is secured by a novel proof-of-stake consensus (“Succinct Attestation”) that provides fast, deterministic finality – a must for financial markets. Crucially, Dusk’s whitepaper and docs emphasize on-chain compliance: institutions can enforce KYC/AML, reporting and trading rules directly in smart contracts. As one author notes, Dusk is not trying to build “a better DeFi playground” – it’s trying to become regulated market infrastructure on a public blockchain. This is a radical departure from permissioned systems or “hobbyist” privacy coins; Dusk’s goal is to win the trust of regulators and banks by design.

Regulation by Protocol: Licensing and Legal Frameworks

From the outset, Dusk aligned itself with European regulatory innovation. The project is actively pursuing the EU DLT Pilot Regime (the DLT-TSS framework) that allows blockchain systems to operate trading and settlement as a single regulated infrastructure. In fact, Dusk is seeking a special DLT-TSS license, which would make it a legally recognized trading and settlement venue on-chain. If granted, Dusk would effectively function as a Central Securities Depository (CSD) on a public blockchain, keeping official ownership records and settlement finality in smart contracts. This contrasts sharply with most public chains, which traditionally ignore securities law.

Dusk’s design embeds compliance at the asset level. European frameworks like MiCA and MiFID II are explicitly referenced in its documentation. For example, payment tokens on Dusk must comply with the EU’s Digital Money Token rules, and regulated securities on Dusk have mandatory identity gates and transfer controls. The protocol supports features like forced transfers (allowing a regulator or court to move tokens in a wallet under duress), on-chain governance (to vote on dividends or contract changes), and strict whitelist/KYC for investors. These mechanisms introduce centralized controls – by design – so that securities can be issued and traded legally on-chain. As one write-up emphasizes, Dusk’s smart contracts “include identity checks, transfers and recovery options” built in from day one. In other words, compliance is not bolted on later; it is woven into the fabric of the blockchain.

By contrast, most public ledgers were built to maximize censorship-resistance, not to honor broker-dealer licenses or shareholder voting rules. Dusk boldly asserts that “regulated finance will move on-chain only if blockchain behaves like infrastructure, not rebellion”. Its entire protocol is aimed at satisfying regulators rather than flouting them. As a result, institutions can issue securities or funds on Dusk, confident that the rules governing ownership, transfers, and reporting are enforced by code. Dusk’s documentation even promises that issuers and investors can “meet today’s industry compliance standards” without losing the benefits of a public blockchain.

Tokenizing Real Assets: NPEX, Cordial, and Security Tokens

Real-world assets (stocks, bonds, funds) are not plain ERC-20 tokens. They carry legal obligations: ownership restrictions, dividend logic, voting rights, and audit trails. Dusk was built to handle those complexities. For example, Dusk is architected to behave like a custodian and registry. Its team speaks of becoming “one system” that handles custody, clearing and settlement by executing all steps on-chain.

Key to this vision are partnerships with licensed financial platforms. In the Netherlands, Dusk teamed up with NPEX, a regulated stock exchange for SMEs. NPEX already has all the required licenses (MTF, broker, etc.), so under this collaboration it will use Dusk’s blockchain as its settlement layer. Issuance, trading and settlement of NPEX-listed securities will all be recorded on Dusk’s chain. Importantly, because NPEX is regulated, the arrangement puts actual market activity (not just test tokens) on Dusk. For instance, the partners plan to list and trade hundreds of millions in securities on-chain, fully compliant with investor qualifications and transfer rules.

Another partner, Cordial Systems, brings an institutional-grade custody solution. In a joint effort, Dusk + NPEX + Cordial aim to create a blockchain stock exchange where issuers and investors keep control of their keys, while the network guarantees compliant settlement and privacy. Early reports from these pilots suggest integration cost was low and real assets (on the order of €300M) are already live on Dusk..

Meanwhile, Dusk promotes an XSC (Confidential Security Contract) standard for tokenized securities. The idea is to issue equity or debt tokens that carry all the legal metadata (shareholder lists, dividend entitlements, etc.), yet still allow shielded transactions. In short, Dusk is giving a blueprint for “fully private yet auditable securities” on-chain.

The STOX Trading Platform

Beyond partnering with existing exchanges, Dusk is developing its own on-chain trading venue called STOX. STOX is conceived as a regulated marketplace for tokenized assets, built directly on Dusk’s smart-contract layer. It will launch gradually with a handful of licensed assets and investors, then expand. Through STOX, investors should be able to trade tokenized stocks, bonds, or even regulated funds in a controlled environment. The platform will be “deeply integrated” with Dusk’s core features – meaning every trade on STOX inherently respects the network’s compliance rules and privacy modes.

In practice, STOX lets Dusk stress-test new financial concepts without regulatory gaps. It even offers novel incentives: holding regulated assets on STOX can earn staking rewards, and tokenized collateral can secure new offerings. The ecosystem updates promise an early access program for STOX, expecting it to “boost Dusk TVL and encourage investors from both TradFi and DeFi” to join. Crucially, STOX is not meant to replace NPEX or 21X, but to complement them. Any insights or workflows proven on STOX can later flow into the larger partner markets. In all, STOX represents Dusk’s ambition to become a one-stop platform for regulated trading on blockchain.

Stablecoins and Payments: EURQ and DuskPay

Dusk’s ambitions extend to stablecoins and payment rails. In early 2025 it announced a partnership with Quantoz Payments to bring its EURQ stablecoin onto Dusk. EURQ is not a speculative crypto token but a fully MiCA-compliant euro-denominated Electronic Money Token (EMT) – in essence, a “digital euro”. This lets Dusk support real-euro settlements on-chain. For example, stock trades on NPEX can now settle in EURQ, meaning investors truly receive “a digital euro” instead of an abstract token.

Quantoz’s EURQ also powers DuskPay, the network’s on-chain payment system. By integrating a licensed stablecoin, DuskPay can offer fast, low-cost euro transactions that meet financial regulations. In Jade Doherty’s words: Dusk is “not confined to the crypto sandbox, but instead has access to the entire economy”. In practice this means people and businesses can use Dusk for everyday high-volume payments and savings, without even knowing they’re on a blockchain. Dusk envisions a world where retail users and SMEs transact in EURQ on the network seamlessly, while the system handles AML/KYC behind the scenes.

Meanwhile, at the institutional end, Dusk works with 21X, a Frankfurt-based securities market licensed under the DLT pilot regime. 21X uses Dusk’s privacy chain for stablecoin reserve management. Large stablecoin issuers often back their coins with cash, bonds or money-market funds, requiring high-value trades that would be dangerous to broadcast publicly. By executing those moves on Dusk (shielded by Phoenix mode), 21X can manage reserves discreetly while still giving regulators audit proofs. In fact, 21X plans to integrate DuskEVM as a supported settlement chain, giving institutions yet another route to leverage Dusk’s infrastructure.

Chainlink Integration and On-Chain Data

A defining feature of Dusk’s 2025–26 push is its embrace of reliable market data through Chainlink oracles. Unlike most blockchains that rely on crowdsourced price feeds, Dusk is adopting Chainlink’s CCIP, DataLink and Data Streams standards so that official exchange data flows on-chain. In practice, this means NPEX’s real-time trade prices are published onto Dusk as authenticated data points, not as a generic median. This shift is profound: “Official exchange-grade market data is being published on-chain by the exchange itself, not inferred by third-party oracles”.

The partnership is deliberate. By using DataLink, Dusk+NPEX become certified data publishers. Their on-chain price feeds have “the same degree of confidence as a settlement system in TradFi”. This makes smart-contracts on Dusk truly auditable by regulators. For example, an institutional bond redemption can use the official closing price from NPEX’s trading venue, with an unbroken legal audit trail. Similarly, Chainlink Data Streams provide low-latency updates so that algorithms, AMMs or lending protocols on Dusk can operate on fresh, high-integrity prices.

Chainlink’s CCIP (cross-chain protocol) also plays a key role. Dusk is integrating CCIP so that assets (and data) can move securely between chains while preserving regulatory guarantees. For instance, a tokenized security issued on DuskEVM could be settled on Ethereum, but still query the same certified price feed back on Dusk via CCIP+DataLink. In short, Dusk aims to ensure that data moves with the asset and not just trust assumptions. By codifying financial market data as first-class on-chain assets, Dusk converts the blockchain from a mere settlement layer into a trusted data surface for regulated finance.

Developer Ecosystem and EVM Compatibility

On the tech side, Dusk has adopted a modular architecture to bridge new and existing ecosystems. The base layer, DuskDS, handles consensus, data availability and settlement. Above it sits DuskEVM, an Ethereum-equivalent execution environment. Gas on DuskEVM is paid in native DUSK tokens, and thanks to this compatibility, most Ethereum tools and smart contracts can be deployed with minimal changes. In parallel, a dedicated DuskVM privacy engine (codenamed Hedger) is being built to bring confidential transactions into Ethereum-land via zero-knowledge and homomorphic encryption.

This strategic choice widens Dusk’s reach. Ethereum developers can tap into Dusk’s privacy primitives without learning a new language. Many DeFi dApps (DEXes, lending protocols, etc.) are already in discussions to port over once DuskEVM goes live. And because DuskEVM “inherits security, consensus and settlement guarantees from DuskDS,” these ports don’t dilute Dusk’s regulated-finance promise. In parallel, Dusk has native bridges (via CCIP) to let assets like DUSK or tokenized securities move to Solana or Ethereum while keeping their identity/transfer restrictions intact.

Outlook: Adoption and Challenges

For Dusk to succeed, it must demonstrate real usage by issuers and institutional investors. So far, interest has been tangible: its token saw big volume and price spikes in early 2026 as the project’s utility became clear. However, the foundations are still being laid. Market participants are skeptical by default, and all of these complex workflows must be proven in practice. Key tests will be the upcoming NPEX listing dApp (on which €300M AUM will start trading on Dusk) and the phased rollout of STOX. These will show whether truly regulated assets can move, settle and be audited on a public network without violating privacy or laws. If successful, Dusk won’t just be another blockchain — it will have “established a new market base” by bridging TradFi and DeFi.

It’s also worth noting Dusk’s philosophy of “boring upgrades.” The network’s launch has been “tranquil,” with developers slowly adding stability and speed rather than flashy features. This cautious approach may seem dull to crypto speculators, but institutional finance prizes reliability over excitement. As Cas Abbé put it, Dusk’s calm mainnet and steady updates are “a transition between startup vigor and actual delivery”. In the long run, predictable finality, backed by a 36-year token emission schedule, is the kind of design both bond issuers and regulators appreciate.

In short, Dusk is betting big on the idea that “the next wave of adoption will not come from memes or faster TPS, but from making on-chain markets legally defensible”. That path is harder and slower than chasing DeFi yields or anonymity buzzwords. But if Dusk can earn the confidence of institutions – by proving that “privacy cannot be ideal if the chain is used in controlled markets”, and showing that compliance primitives are up-front – then it may indeed become “a public blockchain that functions like a real market”. In a crypto landscape awash in unfulfilled promises, Dusk’s fusion of on-chain privacy with built-in regulation could mark a turning point for blockchain adoption in mainstream finance.