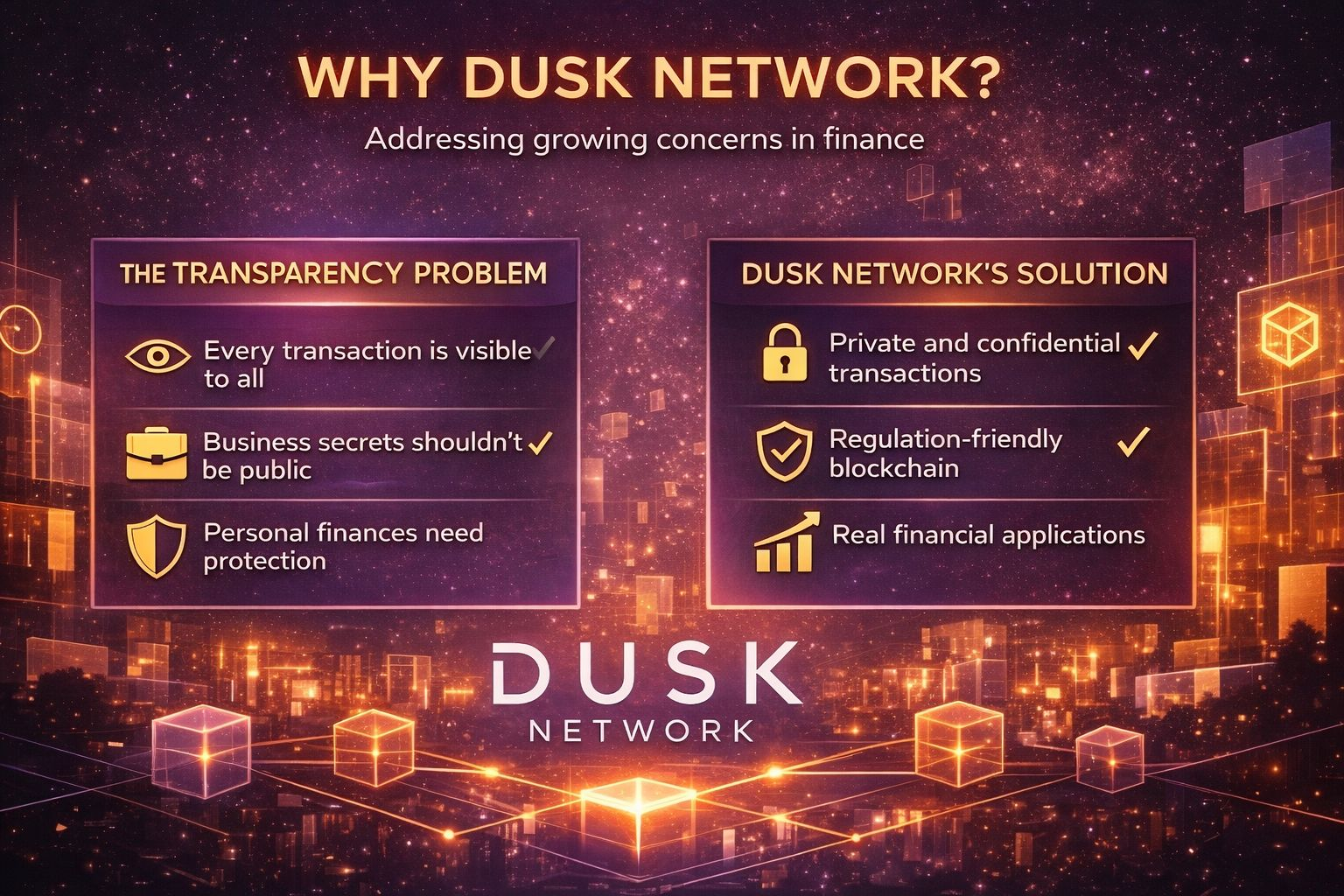

Dusk Network exists because the financial world reached a strange moment where transparency became both a strength and a weakness at the same time. Blockchains showed everyone that money could move without permission, without borders, and without middlemen, and that idea changed everything. But as time passed, a problem became impossible to ignore. Complete openness works well for experimentation, but real financial systems cannot live fully exposed forever. Businesses do not want every transaction visible. Institutions cannot operate if every detail is public. Users want control, not a spotlight. That is where Dusk began its journey. It was not created to chase hype or trends. It was created to solve a quiet but serious issue that kept growing in the background while the rest of the market was busy watching prices move.

At its core, Dusk is a blockchain built for privacy, compliance, and real financial use. It focuses on regulated environments instead of fighting them. While many projects tried to avoid rules, Dusk chose a different path. It accepts that laws exist and that finance must work within them. The clever part is how Dusk balances privacy with accountability. Transactions can stay private while still being verifiable when needed. This means businesses can protect sensitive data and regulators can still do their job. That balance is not easy, and it is the main reason Dusk feels different from most networks we have seen before.

The technology behind Dusk is designed to support confidential smart contracts. These are programs that run on the blockchain but do not expose all internal data to the public. Normally, smart contracts show everything, inputs, outputs, balances, logic. Dusk changes this by using cryptographic proofs that allow actions to be verified without revealing private information. If you think about it, this is closer to how real finance already works. Your bank balance is not public. Your contracts are not broadcast to the world. Yet trust still exists. Dusk brings that familiar structure into a decentralized system without losing the core benefits of blockchain.

Value inside the Dusk Network moves in a controlled and purposeful way. The native token plays multiple roles instead of being just a speculative asset. It is used for transaction fees, staking, and securing the network. Validators stake tokens to participate in consensus, which helps keep the chain secure and aligned with honest behavior. If someone acts against the rules, they risk losing their stake. This creates a natural incentive system where long term thinking is rewarded more than short term games. We’re seeing this model mature across the industry, but Dusk applies it with a strong focus on institutional stability rather than fast growth.

One of the most interesting aspects of Dusk is its focus on tokenized real world assets. Traditional assets like bonds, shares, and financial instruments are slowly moving onto blockchains. The problem is privacy and regulation. Public chains make this difficult. Dusk is built specifically to handle these assets in a way that respects legal frameworks while still benefiting from automation and efficiency. Imagine a future where regulated securities settle instantly, audits are simpler, and ownership transfers happen without friction. Dusk is positioning itself as the infrastructure layer that makes this possible without breaking existing systems.

The network uses a consensus approach designed to be efficient and fair. It avoids unnecessary energy waste and focuses on finality and reliability. This matters more than it sounds. Institutions care about predictability. They want to know that transactions settle on time and that the system behaves consistently. Dusk is not trying to impress with speed alone. It is trying to be dependable. That mindset shows up in every design choice, from governance to upgrades. Changes are meant to be deliberate, tested, and safe rather than rushed.

If you look at the broader blockchain space, you will notice that many projects are built for users who already understand crypto. Dusk feels like it is built for the next wave, organizations, financial platforms, and regulated entities that have not fully entered yet. It speaks their language without abandoning decentralization. That is a hard balance to strike, but it is also where long term value often hides. Markets tend to reward loud ideas first, but quiet infrastructure often lasts longer.

Over time, the role of Dusk could grow as privacy expectations increase. Data protection laws are becoming stricter. Financial oversight is expanding. At the same time, people do not want to give up control to centralized systems again. Dusk sits right in the middle of that tension. It offers a way forward where privacy is not a loophole and compliance is not a cage. Instead, both work together inside a transparent but discreet framework.

I’m not looking at Dusk as a quick story or a fast narrative. It feels more like a foundation being laid slowly. They’re building something meant to support real activity rather than temporary attention. If adoption comes, it will likely come through partnerships, financial products, and systems that most users never see directly. That is often how the most important infrastructure works. It fades into the background while quietly moving value, trust, and information where it needs to go.

As the market matures, projects like Dusk may start to make more sense to more people. The excitement phase of crypto taught us what is possible. The next phase is about making it usable, stable, and compatible with the real world. Dusk Network exists for that next phase. It is not trying to replace finance overnight. It is trying to upgrade it piece by piece, without noise, without shortcuts, and without exposing what should stay private. That patient approach may be exactly why its story is only just beginning.