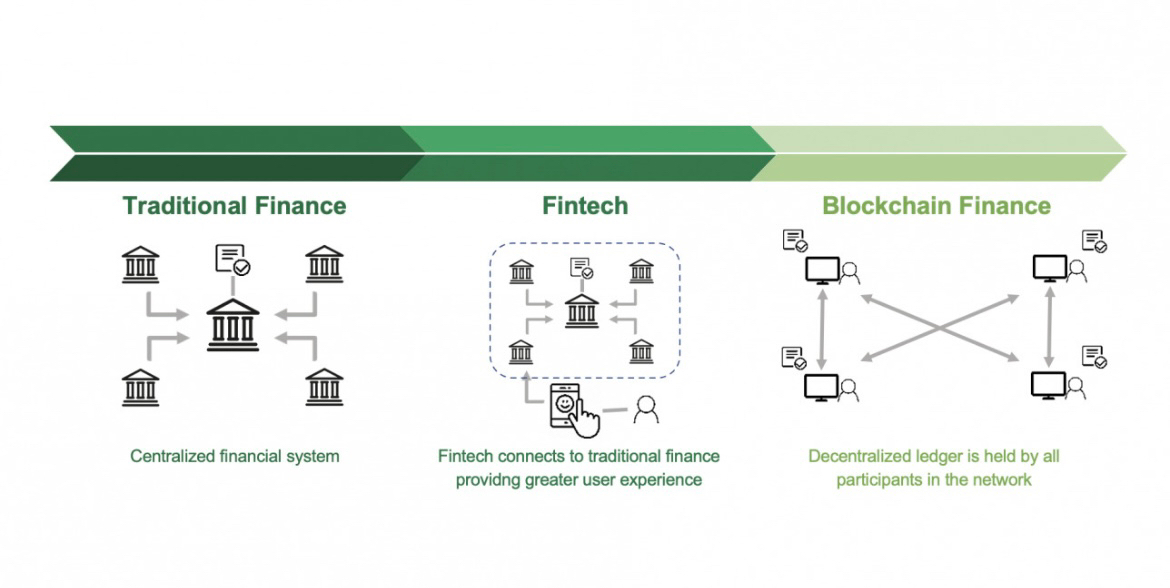

Dusk Network (ticker: DUSK) is a privacy-focused, public blockchain that explicitly targets a hard niche: regulated finance and real-world assets (RWAs) where privacy is needed without throwing compliance out the window. Binance’s own research note frames the project’s mission as becoming privacy infrastructure “for an entire ecosystem,” while emphasizing a core positioning around privacy + compliance especially for the security token / financial industry use case.

1) Why Dusk exists: “privacy with proof”

Most privacy chains optimize for hiding everything; most “compliance chains” optimize for transparency and control. Dusk’s stated thesis is that institutions need a middle path: keep user and transaction data private, but still allow selective proof of correctness (e.g., “this transfer is lawful,” “this auction bid is valid,” “this user has access rights”) using zero-knowledge cryptography. Binance Research describes Dusk as enabling network participants to prove correct outcomes of operations without revealing identities or transaction details, while still providing verifiable computation.

That framing matters because regulated assets (tokenized securities, funds, credit instruments, etc.) often require:

• confidential identities and balances (privacy / business secrecy),

• auditability (proofs, reporting),

• and enforceable rules (transfer restrictions, lifecycle management).

Dusk’s design choices especially around consensus and transaction models are aimed at those constraints.

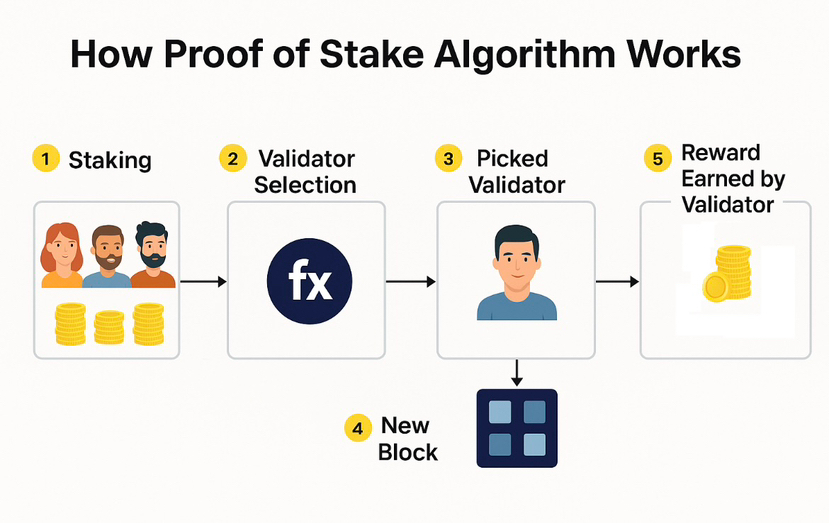

2) Core technology: SBA consensus + Proof-of-Blind-Bid (fairness and privacy at the validator layer)

From the project’s whitepaper (v3.0.0), Dusk introduces:

• Segregated Byzantine Agreement (SBA): a permissionless, committee-based Proof-of-Stake consensus mechanism designed for fast finality characteristics (the paper discusses statistical finality properties and roles inside consensus).

• Proof-of-Blind-Bid: a privacy-preserving leader extraction procedure that underpins SBA intended to let validators participate without broadcasting exactly how much stake they’re committing in a way that could encourage cartel behavior or targeted attacks.

Why this is strategically important: in many PoS systems, stake weight and validator identities can become highly observable, which can encourage centralization dynamics (delegation to big visible operators, MEV concentration, bribery/targeting). Dusk’s approach tries to reduce that visibility while remaining permissionless an unusual combination that, if executed well, could be attractive for financial applications that prefer fewer “obvious chokepoints.”

3) Transaction models: Phoenix + Zedger (and why “compliant privacy” is hard)

The whitepaper also names two transaction models:

• Phoenix: a UTxO-based model aimed at confidential spending, and

• Zedger: a hybrid model designed with regulatory compliance for security tokenization and lifecycle management in mind.

This is one of the most “make-or-break” aspects of Dusk’s thesis. Privacy alone is common; privacy that still supports the full lifecycle of regulated assets (issuance, transfers with rule checks, corporate actions, reporting proofs) is rare. If Dusk can provide tooling that lets issuers generate compliant proofs while preserving user confidentiality, that is real differentiation because it speaks directly to the operational pain of tokenized securities and RWA platforms.

4) Tokenomics and economic design: what DUSK is for (and how supply works)

Dusk’s own documentation is unusually explicit and provides a clean baseline for “serious” due diligence:

• Initial supply: 500,000,000 DUSK (represented across ERC-20 and BEP-20 forms initially)

• Emissions: an additional 500,000,000 DUSK emitted over 36 years to reward stakers

• Max supply: 1,000,000,000 DUSK total (500M initial + 500M emitted)

• Utility includes staking for consensus, rewards, network fees/gas, and deploying dApps

Two details that often separate surface-level writeups from “leaderboard” research:

1. Dusk documents the emission schedule concept as a long-horizon distribution with a geometric decay pattern reducing issuance every 4 years (similar in spirit to “halving-like” issuance control, though not identical).

2. The docs say mainnet is now live and users can migrate to native DUSK via a burner contract mechanism.

That second point is important operationally: it implies the project is not just a “token on chains,” but is aligning the asset with its own network economics (native fees, staking, validator incentives).

5) Binance context: listing history and why it matters

DUSK is not a brand-new listing chasing attention, it has been on Binance for years. Binance’s official announcement states it listed Dusk Network (DUSK) on July 22, 2019, opening multiple spot pairs (including DUSK/BNB, DUSK/BTC, DUSK/USDT, etc.).

Binance Research also maintains a detailed project overview page describing Dusk’s mission, design principles, and token use cases.

From a credibility lens: long-standing exchange availability doesn’t “prove” fundamentals, but it does mean (a) the market has had years to price information, and (b) you can focus your research on technology, adoption path, and economic sustainability not merely listing speculation.

6) What to watch: adoption signals and realistic risks

If you want your writeup to read like deep research rather than hype, balance the thesis with measurable checkpoints:

Adoption signals worth tracking

• Growth in on-chain activity driven by privacy/compliance applications (not just transfers).

• Validator/staking participation metrics and decentralization quality (operator diversity).

• Evidence that issuers or platforms are using Dusk-style ZK proofs for real compliance workflows (audits, reporting, transfer rules).

Key risks (the honest part)

• Complexity risk: ZK systems + novel consensus + regulated-asset features are all hard individually; together they increase execution and security risk.

• Market positioning risk: Dusk competes with multiple categories privacy chains, RWA platforms, and smart-contract L1s adding ZK features. Differentiation must show up in real deployments, not only architecture.

• Regulatory ambiguity: “Compliant privacy” is attractive, but requirements vary heavily by jurisdiction; product-market fit may be regional and slow-moving.

Bottom line

Dusk (DUSK) is best understood as an attempt to build institution-grade privacy infrastructure: a public, permissionless network where privacy features are not purely “hide everything,” but are paired with zero-knowledge proofs that can satisfy real compliance and auditing constraints. Binance’s research describes that privacy+compliance positioning clearly, while the whitepaper provides concrete mechanisms (SBA, Proof-of-Blind-Bid, Phoenix, Zedger) that justify the narrative at a technical level. The tokenomics documentation then ties that tech to a long-horizon economic model (500M initial supply + 500M emissions over 36 years, max 1B), with DUSK serving as staking collateral and network “fuel.”