📊 What This “Largest U.S. Debt Holders + 2026 Cycle” Chart Really Means (And Why Crypto Traders Should Pay Attention)

Recently a chart has been circulating showing two ideas combined:

Who owns U.S. government debt (Treasuries)

A long-term economic cycle pointing toward the year 2026

Many people are sharing it without explanation — so let’s actually break it down properly.

Part 1 — Largest Holders of U.S. Debt

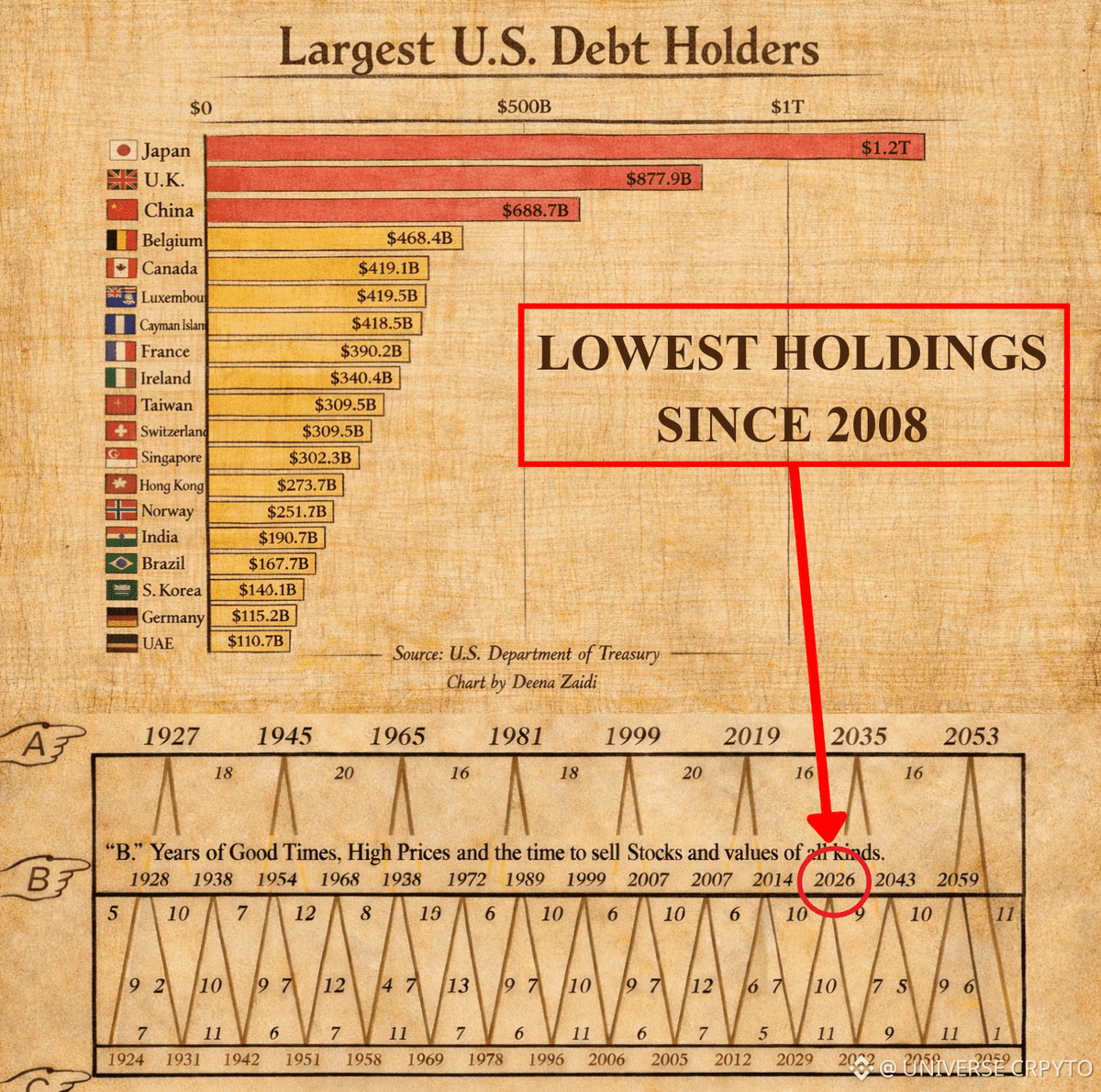

The first half of the chart shows countries holding U.S. Treasury bonds.

Top holders: • Japan ≈ $1.2T

• United Kingdom ≈ $877B

• China ≈ $688B

• Belgium, Canada, Luxembourg, Cayman Islands, France, Ireland, Taiwan follow after.

What does this mean?

When a country buys U.S. Treasuries, it is basically lending money to the United States government.

Why would they do that?

Because U.S. Treasuries are considered: ✔ very liquid

✔ globally accepted

✔ historically one of the safest assets

Countries park their reserves there instead of holding cash.

So this is not a “weakness” — it actually shows how central the U.S. dollar system is to the global economy.

Why the “Lowest Holdings Since 2008” part matters

The chart claims foreign holdings are at their lowest level since 2008.

In simple words: Some countries are slowly reducing reliance on U.S. debt and diversifying into: • gold • local currencies • trade agreements • sometimes Bitcoin

This doesn’t mean the dollar collapses tomorrow.

It means the global financial system is gradually changing.

Part 2 — The 2026 Economic Cycle (The Important Section)

The bottom part of the image shows a repeating historical pattern.

It is based on a very old market observation:

Financial markets move in long cycles, not straight lines.

The chart highlights:

“Years of good times, high prices and the time to sell stocks and assets”

Examples shown: 1929 → Great Depression

1968-1972 → inflation & oil crisis period

1999-2000 → Dot-com bubble

2007 → Housing crash / Global Financial Crisis

The next projected peak on that cycle is around 2026.

This does NOT mean a crash must happen exactly in 2026.

It means: Markets may enter a late-cycle overheating phase around that period.

Why This Is Important for Crypto

Crypto doesn’t move alone.

Bitcoin and Ethereum are now tied to: • liquidity • interest rates • money printing • global risk appetite

Here is the key relationship:

When central banks print money →

liquidity increases →

risk assets rise →

crypto bull market.

When interest rates stay high →

liquidity drops →

risk assets struggle →

crypto slows or corrects.

The Bigger Picture

Right now the world is in a transition:

Old system: Bank-centered, debt-based, dollar-dominant

Emerging system: Digital assets, tokenization, decentralized settlement

This is why: Gold is rising

Central banks are buying assets

Bitcoin ETFs were approved

And institutions are entering crypto

A Possible Timeline (Educational View)

2024-2025 → liquidity expansion phase

2025-2026 → late bull market / hype stage

After → potential macro correction cycle

Again — this is not a prediction, but a historical pattern observation.

What Traders Should Learn

The chart is not telling you to panic.

It is teaching a very important lesson:

Markets are not random.

They are liquidity driven.

If you only look at candles, you see noise.

If you understand macro cycles, you see context.

Crypto traders who survive long-term are not the ones who trade the most —

they are the ones who understand when the environment is favorable.

Trade smart. Manage risk. Think in cycles, not days.

#USIranStandoff #BitcoinGoogleSearchesSurge #RiskAssetsMarketShock #ADPDataDisappoints

BNBUSDT

Perp

636.74

-1.6%

ETHUSDT

Perp

2,073.53

-0.6%

BTCUSDT

Perp

70,051.2

+1.24%