There is a growing divide in blockchain today. On one side are networks built for experimentation, layered with features that look impressive on paper but struggle under real economic load. On the other side are systems quietly positioning themselves as financial rails. Plasma belongs firmly in the second category. Its design is not driven by novelty, but by the demands of stablecoin-dominated capital flows.

Stablecoins now underpin most on-chain activity. They are the unit traders measure profits in, the medium exchanges use for settlement, and the tool businesses rely on for cross-border transfers. Despite this, stablecoin users are still exposed to unpredictable fees, network congestion, and unnecessary complexity. Plasma is built around removing those frictions by treating stablecoins as the primary asset, not a secondary use case.

A defining aspect of Plasma is how it simplifies participation. By abstracting gas mechanics and allowing transactions directly in stablecoins, the network removes one of the most persistent barriers in crypto. Users no longer need to manage multiple assets just to move value. This shift might seem subtle, but it has deep implications. It aligns blockchain payments with real-world financial behavior, where users expect clarity, consistency, and simplicity.

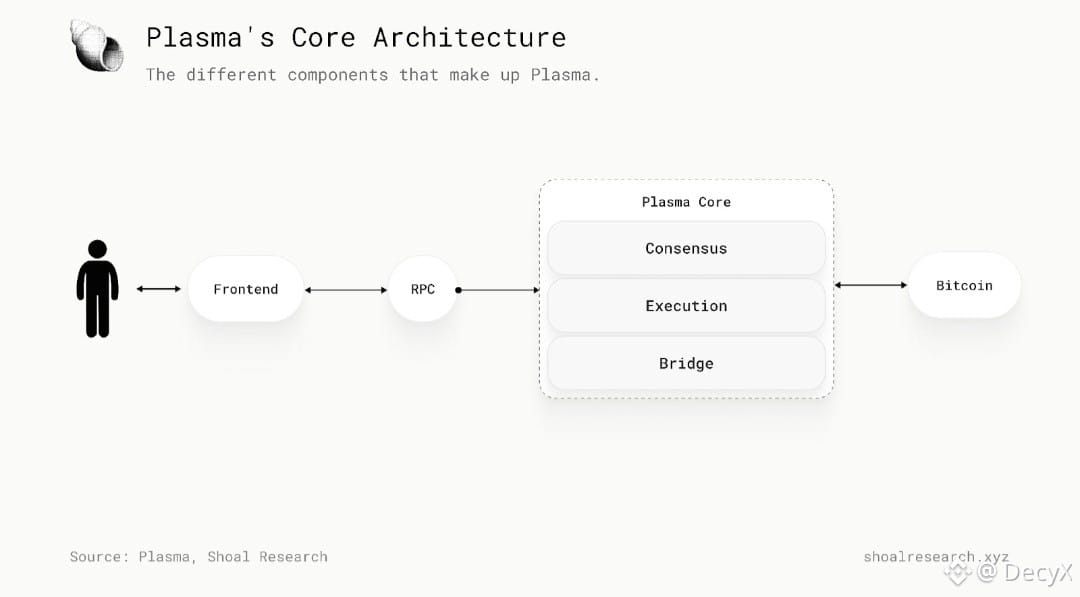

From a performance perspective, Plasma emphasizes finality over spectacle. Its consensus design ensures transactions are confirmed quickly and decisively, which is critical for financial applications that cannot tolerate ambiguity. This makes Plasma suitable for high-volume environments such as exchanges, payment processors, and treasury operations, where reliability is more important than theoretical throughput claims.

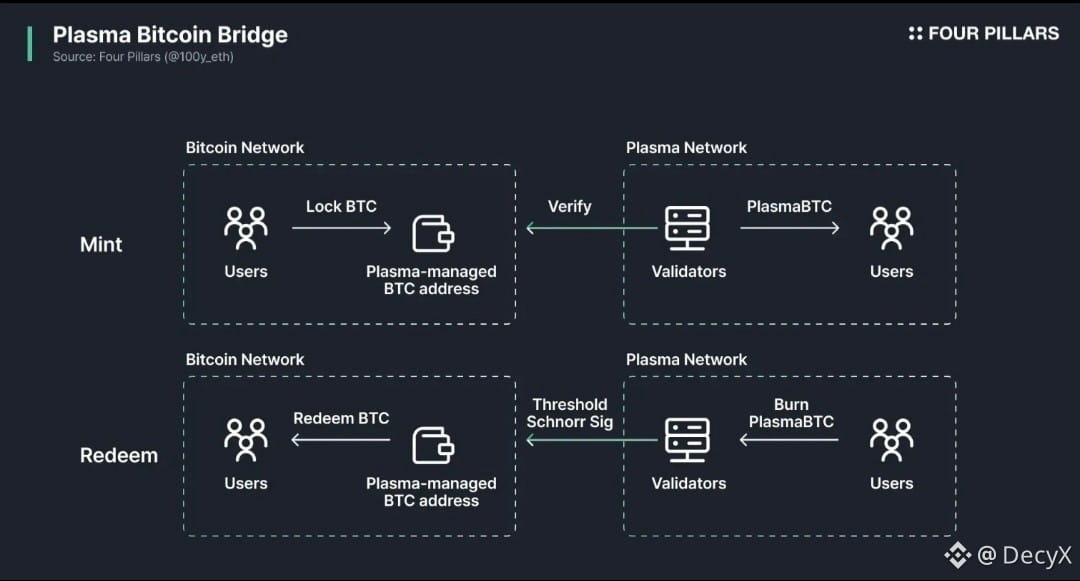

Security is approached with equal restraint and intent. Plasma anchors settlement to Bitcoin, leveraging the most established security model in the blockchain ecosystem. This choice reflects a broader philosophy of borrowing strength from proven systems rather than reinventing trust. At the same time, Ethereum compatibility ensures developers retain flexibility, allowing smart contracts and existing tooling to operate without friction.

What sets Plasma apart is its alignment with real usage rather than speculative cycles. It does not rely on artificial incentives to attract activity. Stablecoins already move massive volumes every day. Plasma simply offers a more efficient environment for that activity to occur. This creates a natural growth path driven by demand, not promotion.

In many ways, Plasma represents a maturing mindset in crypto infrastructure. The industry is moving away from chains that promise everything and toward systems that do one thing exceptionally well. Plasma’s specialization around stablecoin efficiency positions it as foundational infrastructure rather than a transient platform.

As digital dollars continue to integrate into global finance, the networks that support them will need to be invisible, dependable, and scalable. Plasma is building toward that future. Not as a headline-grabbing experiment, but as the kind of infrastructure that quietly carries value at scale, day after day.