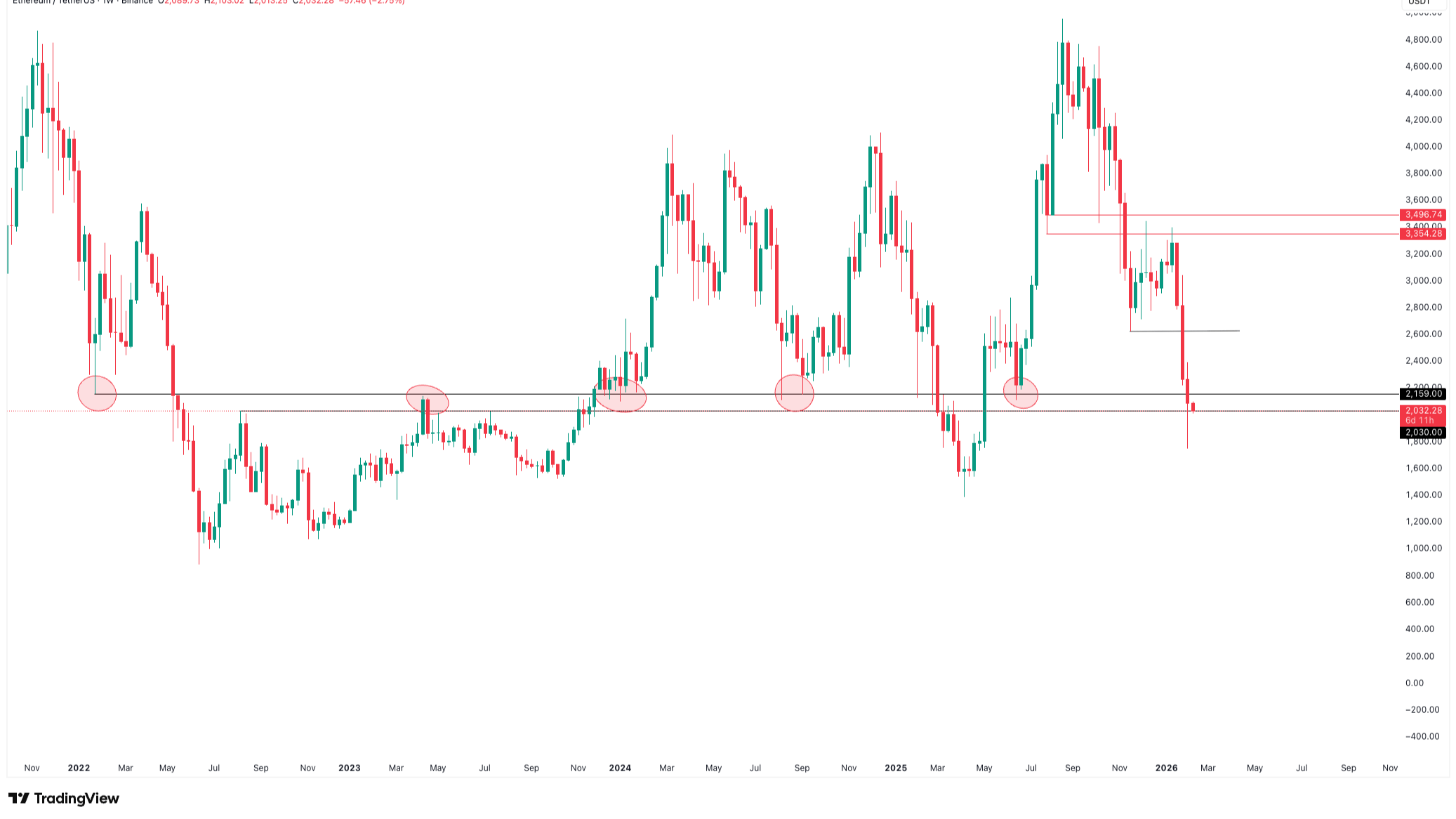

$ETH 2000 isn’t just a round number for the sake of psychology (though two thousand carries a lot of weight in a trader’s lizard brain). Technically, the $1,980–$2,000 range is a fortress built on historical significance. #MSTR

Just last week, ETH took a nasty spill toward $1,740 before buyers stepped in with enough force to shove price back above $2,000. That reaction confirmed that there is still big money interest in this area. #TrendingTopic

You have to look back to late 2023 and early 2024 to see why this level is so sticky. It has flipped from resistance to support more times than a pancake at a Sunday brunch.

On the daily timeframe, Ethereum is currently flashing extreme oversold signals (RSI is practically in the basement). Typically, when price hits a major historical support zone while being this exhausted, a relief bounce isn't just a hope—it’s a statistical probability.

Analysts are eyeing a liquidation magnet around the $2,100–$2,150 range. There are a lot of over-leveraged shorts sitting there who would be forced to buy back if price ticks upward, potentially fueling a fast rally. However, don't mistake a bounce for a reversal. The broader market structure is still broken until we can reclaim $2,400. For now, we're just looking for a sign of life.

It’s the question nobody wants to ask, but everyone is thinking. A clean break and a daily close below $1,980 would likely trigger a capitulation event. Without the $2,000 floor, the next meaningful support isn't until the $1,750–$1,800 region, which served as the absolute bottom during the 2025 flush.

We are currently in a wait and see phase. The institutions—Standard Chartered and Citi—are still shouting about $7,500 by the end of the year, but the tape tells a different story for the short term.

Ethereum has a habit of making people look foolish right when they think they've figured it out. Whether you're a long-term hodler or a scalper, all eyes are on that $2,000 ticker. If it holds, we play for the bounce. If it folds, we look for lower entries.

Sharing my personal market observations daily.

Follow for more crypto insights.