In an industry addicted to exclamation marks, Vanar has chosen to be a period. While the rest of the market is busy screaming about the latest AI demos and speculative pumps, a quiet infrastructure is being laid underground. Most people are looking at the price; very few are looking at the foundation.

The Illusion of Strength: The Genius Madman

OpenAI’s Sora and other visual generators have gone viral for their stunning outputs. But if you talk to professionals in commercial delivery, the story is different. They describe these tools as stunning but unusable. Why? Because of uncontrollable randomness. One frame looks perfect, the next frame the character has a different face.

The current dilemma of AI is not that it is not strong enough; it is that it is unreliable. It is like a genius madman—capable of brilliance one moment and total chaos the next. This is where the gap exists, and this is where Vanar has positioned itself.

Curing AI Amnesia: The Need for Persistent Memory

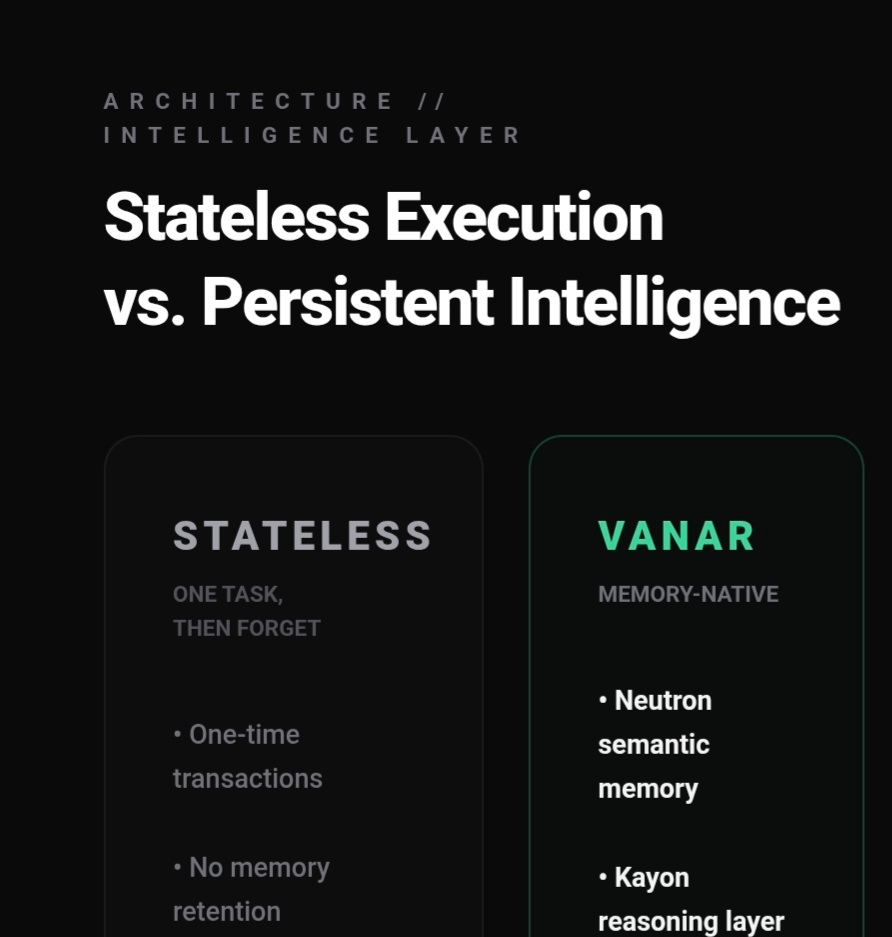

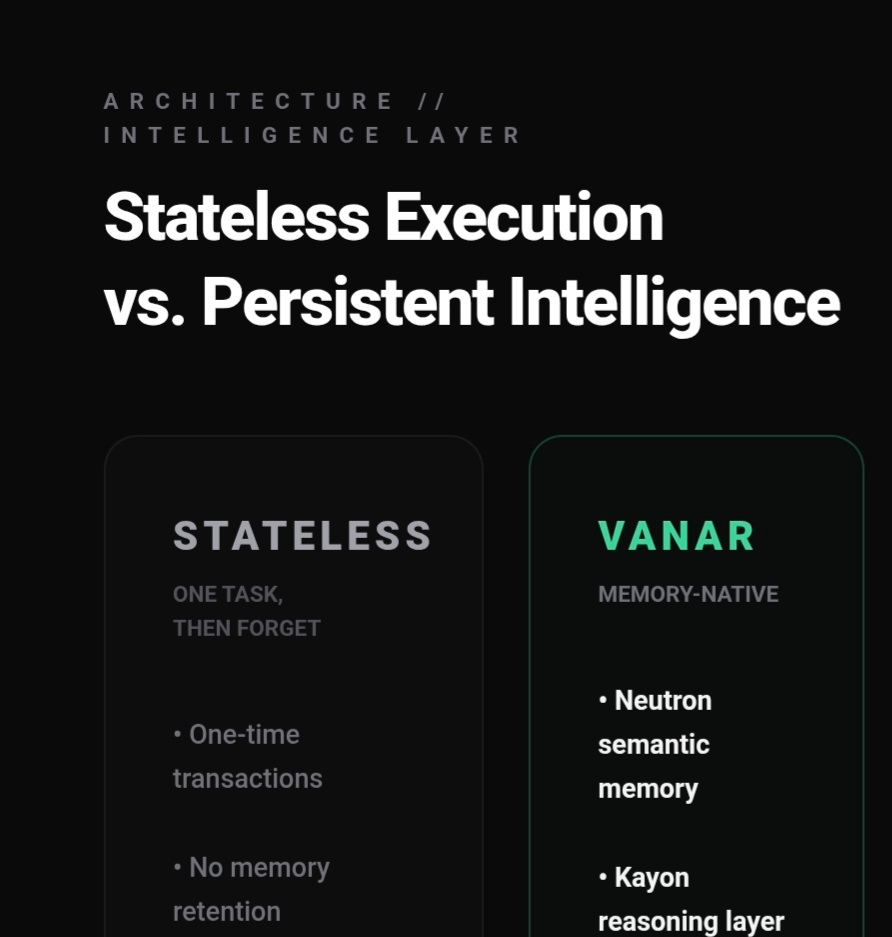

The biggest technical pain point for AI agents is forgetfulness. Traditional blockchains are stateless; they are designed for one-time transactions. Once a task is done, the chain forgets. If you entrust your assets to an AI agent that forgets who you are every few seconds, you are not investing; you are gambling.

Vanar’s architecture—specifically the Neutron and Kayon layers—is designed to provide these AI agents with a long-term residency permit. Instead of being temporary workers, AI on Vanar gains the ability to remember, reason, and accumulate experience. Through semantic compression, Vanar can shrink massive files into on-chain Seeds that stay queryable. This transforms AI from an uncontrollable generator into a reliable, auditable executor.

The Strategy of the Quiet Anchor

I call Vanar’s approach the anchor tactic. It does not try to initiate new hype cycles. Instead, it waits at the end of every AI narrative. Whether the trend is AI agents, PayFi, or tokenized assets, they all eventually hit the same wall: the need for memory, privacy, and continuity. Vanar has been waiting at that endpoint for a long time.

This strategy is boring for short-term traders. It does not create FOMO or impulsive green candles. But institutions hate surprises and love predictability. By building a rational persona and focusing on infrastructure rather than noise, Vanar is positioning itself as the first choice for institutional builders.

The Psychology of the Bottom: Smart Money vs Retail

Looking at the current capital flows, the divergence is clear. Retail investors, driven by a lack of patience, are flowing out. They see the sideways movement as a sign of a dead project. Meanwhile, the order books show a significant wall of smart money accumulation near the 0.00629 level.

This is a classic game of time. Vanar today is like a cloud computing company in the year 2000. The direction is correct, but the industry is still in its demo phase. The real explosion happens when the bubble bursts and companies demand tools that actually work for commercial delivery.

The 2026 Turning Point

The year 2026 will be the milestone when AI moves from being a toy to becoming a tool. When that shift happens, the need for a memory-native blockchain will become a necessity, not an option. For those who can navigate this cycle, the current market boredom is not a problem—it is the scarcest asset.

In this high-frequency market, patience is the most expensive currency. While the world chases the next flash in the pan, the smart money is betting on the foundation.