Let me talk to you like one human to another about what’s been unfolding with Plasma, its XPL token, and the bigger picture we all care about as builders, investors, and believers in a new money system that actually works. This isn’t some dry press release vomited onto a page. This is the real story of where this project is today how it got here, what it’s building, what’s stalled, and why you should care.

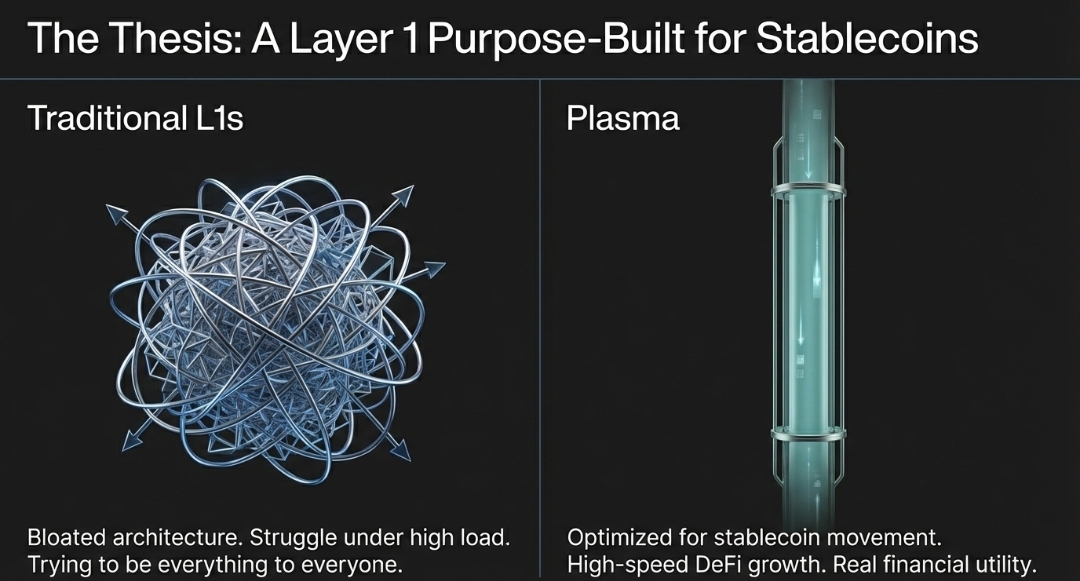

The Big Picture: Layer 1 for Stablecoins

Remember when most blockchains tried to be everything to everyone? Plasma took a completely different route. Instead of trying to be a jack-of-all-trades, the team committed to building a purpose-built Layer 1 optimized for stablecoin movement, DeFi growth, and real financial use. That might sound like buzzword bingo, but when you peel back what they’re actually doing with the tech, it’s clear they’re serious about it. Plasma launched its Mainnet Beta, a functioning network where real money flows are possible, with the native XPL token powering the system.

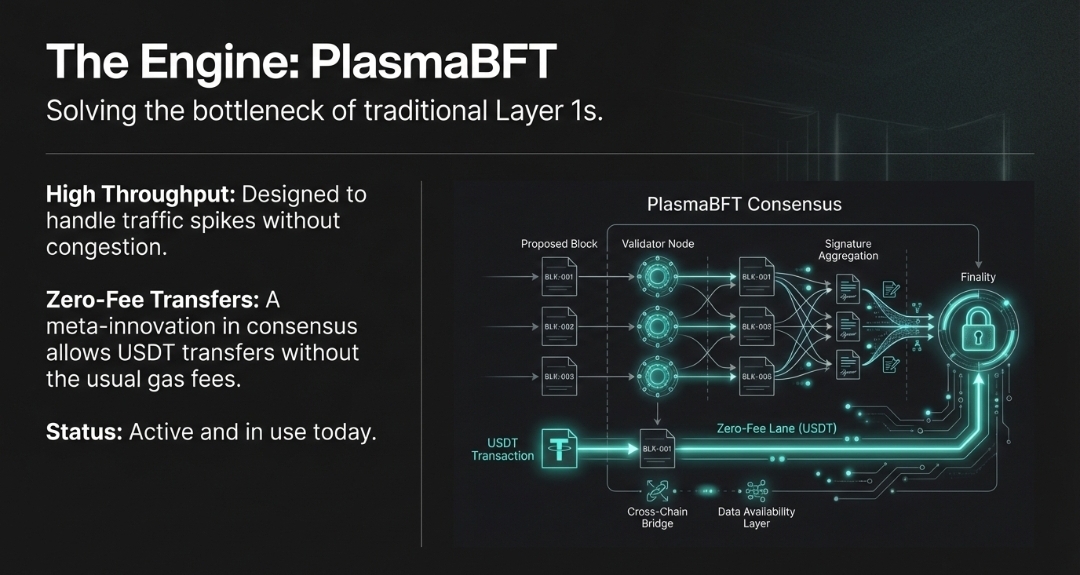

This isn’t just another chain for NFTs or yield farming. The focus here is utility fast, cheap, efficient movement of the digital dollar. To make that happen, Plasma built its own engine called PlasmaBFT. Fundamentally, PlasmaBFT is about high throughput and near-zero fees on certain transfers, especially USDT something that traditional blockchains still struggle with when traffic spikes.

But let’s walk through how we got here and where things stand today.

The Journey to Mainnet Beta

The Plasma team didn’t just drop a token and call it a day. They went through a period of intense foundation building. Behind the scenes, engineers were quietly refactoring major parts of the system to improve peer discovery and node communication stuff most users never see, but it matters big time for long-term scaling and reliability.

Then came the public sale of XPL. The community rallied, and participation beat expectations. The idea was to kickstart utility and ownership across a broad base, with deposits flowing in early via campaigns designed to bring liquidity and interest to the network.

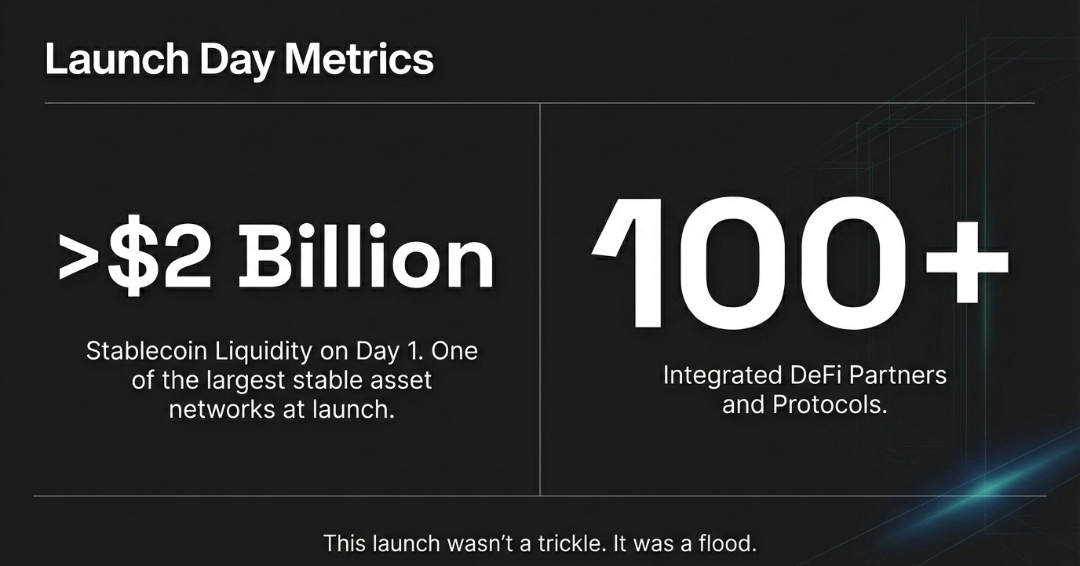

Finally, on September 25, 2025, Plasma flipped the switch and went live with Mainnet Beta, throwing open access to real-world money flows powered by billions in stablecoin liquidity. The network integrated with over 100 DeFi partners and major protocols from the start, putting itself immediately in the conversation with some of the biggest chains by stablecoin utility.

What Plasma Actually Built

This is where the community needs to understand the real mechanics because most other narratives gloss over what Plasma is truly enabling:

Stablecoin Optimization First

Plasma is designed specifically to make stablecoins fast, cheap, and usable in everyday scenarios. Think low-cost remittances, merchant payments, FX, and even saving mechanisms powered natively on-chain. That alone differentiates it from bloated smart contract platforms that struggle under high load.

Zero-Fee Transfers (In Practice)

One big talking point is zero-fee USDT transfers. Through Plasma’s unique consensus and authorization model, sending USDT doesn’t carry the usual fees we see elsewhere. Yes, this meta innovation is very real, and users are actively using it.

Deep Stablecoin Liquidity From Day One

Plasma’s launch wasn’t some trickle; it debuted with more than $2 billion in stablecoin liquidity flowing through it, making it one of the largest networks for stable assets on launch day.

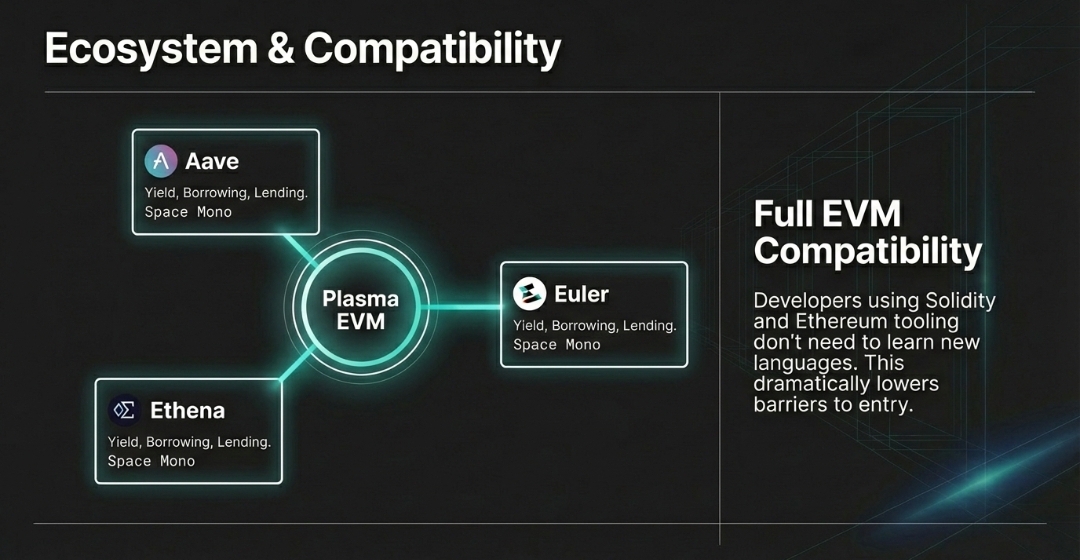

EVM Compatibility and Developer Access

The chain supports Ethereum tooling, meaning developers who know Solidity and the EVM environment don’t have to learn a new language or rebuild everything. That dramatically lowers barriers for ecosystem growth.

DeFi Integrations That Actually Matter

Names like Aave, Ethena, and Euler weren’t afterthoughts. They are integrated in ways that give real yield and utility options for stablecoin users borrowing, lending, savings, and more.

The XPL Token: What It Is and What It Does

Let’s clear up confusion around the XPL token because this is where a lot of people get lost.

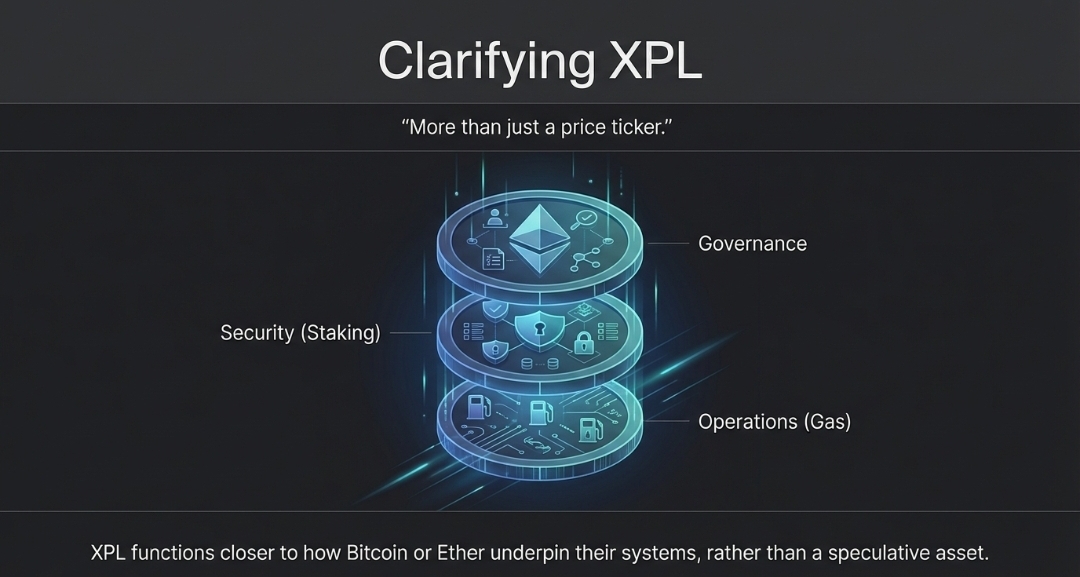

XPL is not just a price ticker.

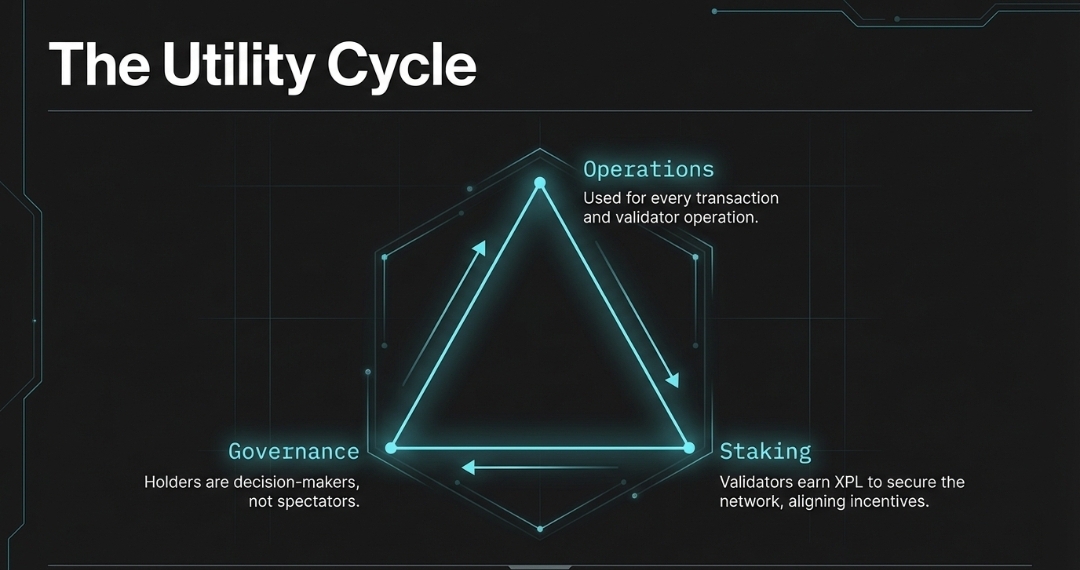

It functions in several roles:

Utility Token

Every transaction, validator operation, and stake action uses XPL under the hood. It is how you interact with the blockchain’s security and governance parameters.

Staking and Validator Incentives

Validators earn XPL as a reward for securing the network. That aligns long-term incentives and ensures decentralization growth.

Governance and Network Alignment

Holders are part of the ecosystem decision landscape not just passive spectators.

Distribution Philosophy

The initial supply was pegged at 10 billion tokens, with about 10 percent allocated to public sale participants and the rest split between ecosystem growth, team incentives, and strategic contributors.

In many ways, Plasma positioned XPL more like how Bitcoin or Ether underpin their own systems not just a speculative ticker.

Where Things Stand Now

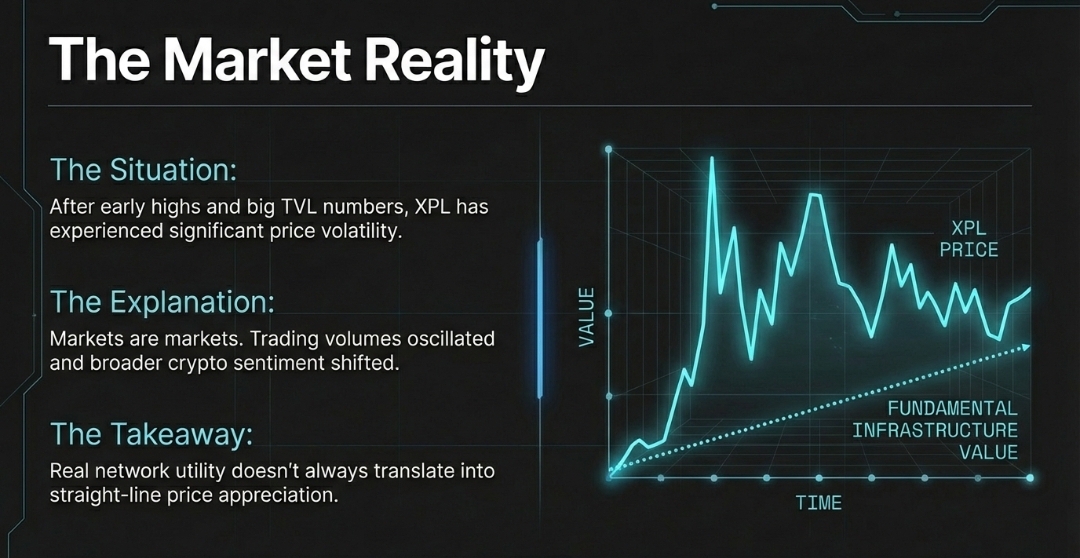

Here’s the part I want everyone reading this to reflect on critically. When Plasma launched mainnet, it had a period of real excitement with early token activity, big TVL numbers, and DeFi integrations. But markets are markets. After early highs, XPL has experienced significant price volatility and pulls as trading volumes oscillated and broader crypto sentiment shifted.

That doesn’t diminish what was built, but it does remind us that utility adoption and real networks don’t always translate into straight-line price appreciation.

Expanding Real-World Utility

Beyond the tech launch and token mechanics, Plasma has been actively expanding into actual financial infrastructure:

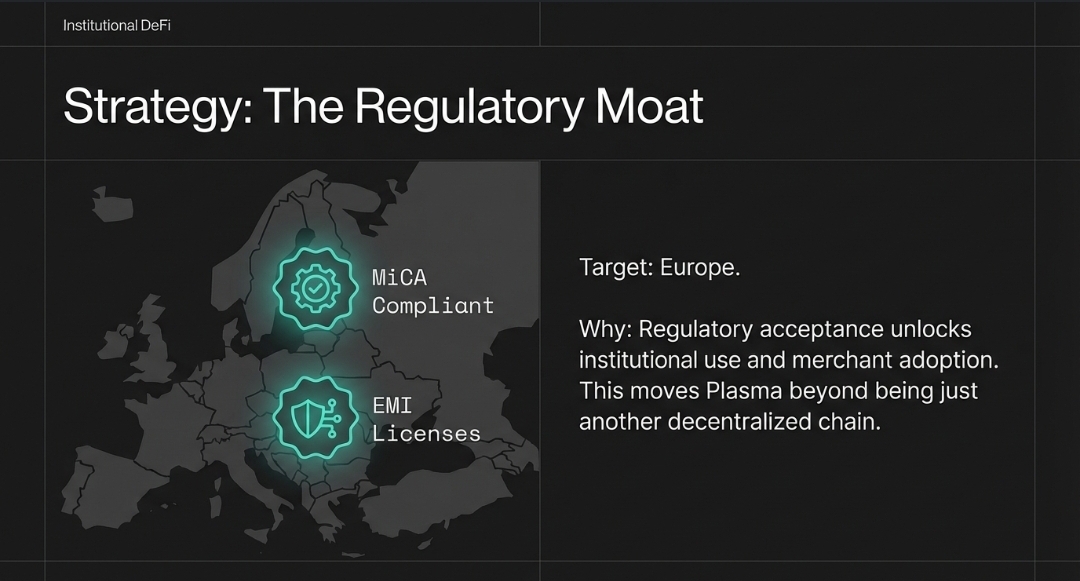

Pushing Into Europe

The project is working on securing regulatory licenses like MiCA and EMI to operate more fully in European markets and not just as a decentralized chain. That’s huge because regulatory acceptance can turn on the faucet for institutional use and merchant adoption.

Stablecoin Payments and Consumer Onramps

Plasma isn’t just about movement of assets on-chain; the team has stated intentions to build payment rails, local on/off ramps, and consumer-friendly apps that bridge digital dollars to everyday spending and remittances.

This is where you see the real ambition: building something that competes with traditional rails, not merely adding convenience for crypto-native users.

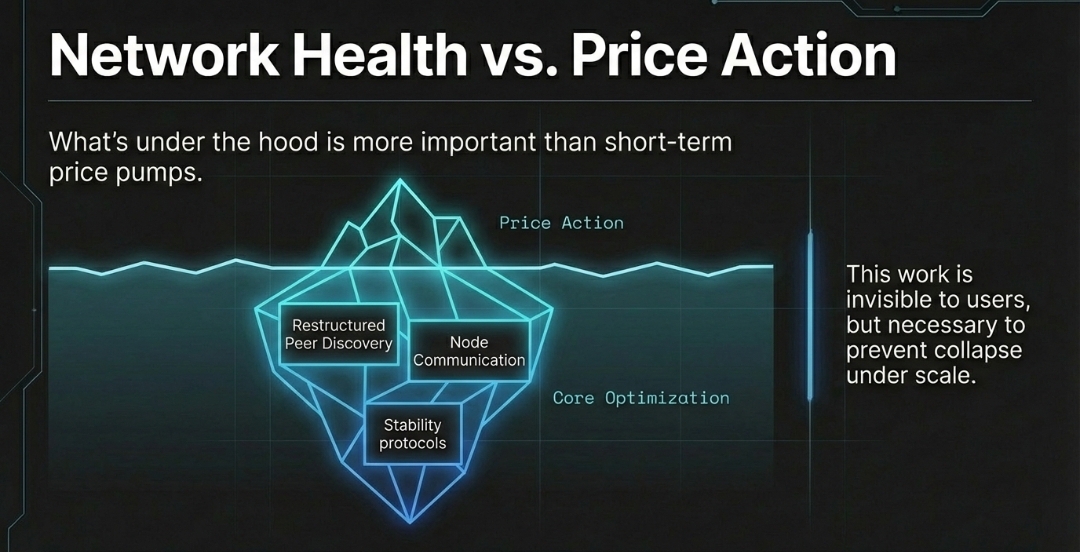

The Network Health and Backend Work

What most people overlook is that major blockchain projects often spend months optimizing core components that users never see. Plasma is no exception. Developers spent many weeks restructuring critical systems like peer discovery to ensure nodes can find each other efficiently, improving network stability and responsiveness.

This is boring to some, exciting to others, but absolutely necessary if you want a chain that doesn’t collapse under real-scale usage.

So What’s Next?

For anyone in the community watching closely, several developments are on the horizon:

1. Wider Adoption of Zero-Fee Transfers

Bringing those fee savings to third-party apps and real users across borders is the next big step.

2. Growth of Ecosystem Products

Beyond swaps and lending, expect more products built on Plasma that leverage stablecoin utility in practical scenarios from FX tools to merchant payment systems.

3. Enterprise and TradFi Bridges

Licenses, partnerships, and regulation-friendly integrations could make Plasma relevant not just in DeFi, but in traditional payments infrastructure too.

4. Continued Network Expansion and Protocol Enhancements

Behind-the-scenes development will continue to bolster scalability and composability for developers.

Final Word to Our Community

Let’s be honest: Plasma isn’t perfect. It hasn’t turned into a one-trillion-dollar phenomenon overnight, and the token’s price action has been volatile like most crypto is. What it has done is build a real network with real liquidity and real utility focused on a use case that actually matters moving dollars cheaply and efficiently in a digital-first world. That’s something worth celebrating, worth watching, and worth being part of if you believe money should be free and open to all.

If you’re in this because of the promise of new infrastructure and use-case driven growth, Plasma’s journey is far from over. And it’s one of the rare projects where what’s under the hood is more important than the short-term price pumps. That’s the real story here, and I hope this breakdown gives you a clear, honest look into what we’re building and why it still matters.