Something profound is happening beneath the surface of decentralized finance that most casual observers miss entirely. While attention focuses on individual protocol innovations, token price movements, and headline-grabbing yield opportunities, a quieter and ultimately more consequential development is unfolding. The blockchain ecosystem is slowly, unevenly, but unmistakably moving toward a world where multiple chains coexist serving different purposes for different users while remaining economically interconnected. This evolution doesn’t happen automatically. It requires infrastructure that most users will never directly interact with but upon which everything they do depends. Plasma Protocol is building that infrastructure, working toward a position as the settlement layer that makes multi-chain DeFi function as unified financial infrastructure rather than a collection of isolated experiments.

#

#

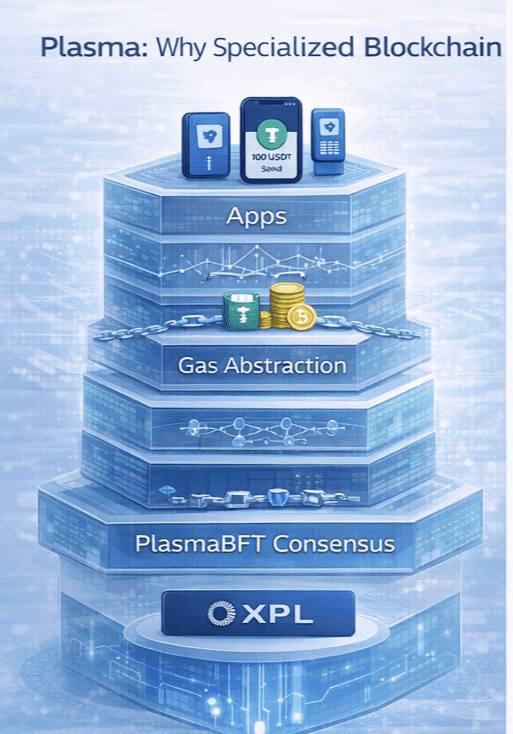

The distinction between settlement layer and application layer matters enormously for understanding what Plasma is and why it matters. Applications are what users interact with directly. Settlement infrastructure is what makes applications possible. Users don’t think about TCP/IP when browsing websites, but websites couldn’t exist without it. Users don’t think about payment clearing networks when swiping credit cards, but transactions couldn’t complete without them. Settlement infrastructure becomes valuable not through direct user relationships but through the indispensable role it plays enabling everything built on top of it. Plasma is pursuing this settlement infrastructure position within multi-chain DeFi, a position that historically captures significant and durable value once established.

Reaching this position requires solving problems that have defeated numerous well-resourced teams before Plasma. The graveyard of failed cross-chain bridges and interoperability protocols is extensive and instructive. Projects failed for different proximate reasons but shared deeper common failures. Some prioritized speed and cost over security, resulting in catastrophic exploits that destroyed user trust permanently. Others prioritized security so heavily that they created unusable systems too slow and expensive for practical applications. Still others built technically sound systems but failed to develop the liquidity and ecosystem integrations necessary for practical utility. Plasma’s development approach reflects careful study of these failures, attempting to navigate between their pitfalls while building something genuinely useful and secure.

Rethinking Cross-Chain Security from Foundations

The security architecture Plasma developed departs from previous approaches in ways that address root causes of historical failures rather than symptoms. Most bridge exploits didn’t result from novel cryptographic attacks or previously unknown vulnerability classes. They resulted from predictable consequences of architectural choices that concentrated enormous value in ways creating irresistible targets. When bridge contracts hold billions of dollars secured by validator sets of limited size and diversity, the economics favor attackers who invest sufficient resources in compromise. Increasing validator set size or improving key management provides marginal security improvements without addressing the fundamental problem that concentrated custodial value creates attack incentives exceeding any reasonable defense investment.

Plasma’s response to this fundamental problem is architectural rather than incremental. The distributed liquidity pool design means cross-chain transfers don’t require locking user assets in custodial contracts at all. Users wanting to transfer value across chains swap against liquidity pools on their source chain while liquidity providers on the destination chain release equivalent value. This pool-based mechanism means there’s no single custodial contract holding concentrated user deposits that represents an obvious attack target. Attacking Plasma requires simultaneously compromising multiple independent pools across multiple chains, an enormously more difficult proposition than compromising a single bridge contract.

The validator network provides security for cross-chain message verification through economic mechanisms rather than trusting validator identity or reputation. Validators stake XPL tokens that get slashed for dishonest attestations, creating financial consequences for misbehavior that persist regardless of who the validator is or what reputation they’ve built. This economic security model means the network gets more secure as more economic value gets staked rather than getting more fragile as stakes increase. The counterintuitive result is that Plasma’s security actually improves as it becomes more valuable, exactly the opposite dynamic from custodial bridges that become more attractive targets as they accumulate value.

Optimistic verification with cryptographic challenge mechanisms achieves the performance necessary for practical applications without sacrificing the security guarantees that make the protocol trustworthy. Most transactions complete in seconds at minimal cost because the optimistic assumption of validity holds for legitimate transfers. The security guarantee comes not from verifying every transaction but from ensuring that attempting fraud is economically irrational. If the expected value of fraud attempts is negative due to stake slashing and challenge rewards, rational actors don’t attempt fraud regardless of technical capability. This game-theoretic security model scales effectively because it gets stronger as economic stakes increase rather than weaker.

Economic Architecture Supporting Sustainable Growth

The XPL token economics were designed around a principle that I’m convinced is fundamental to sustainable protocol economics: token value should be a consequence of protocol value rather than a precondition for it. Many protocols create token utility through mechanisms that require token holders to coordinate or pay premiums regardless of whether the underlying protocol is delivering genuine value. This creates fragile economics where token value depends on continued coordination rather than organic demand from platform utility.

Plasma’s token economics create utility through functional requirements that grow naturally with platform usage. Validator staking requirements mean that network security demand scales with transaction volumes. As Plasma processes more cross-chain transfers with higher aggregate values, more validators join to handle the load and earn fees, each staking proportionally more XPL. This creates organic supply pressure connected directly to platform usage rather than artificial mechanisms disconnected from operational reality.

Liquidity provider economics create another demand source connected to genuine platform utility. Liquidity providers earn fees from swap operations enabling cross-chain transfers. The yield available to providers depends on transaction volumes generating fees relative to total liquidity deployed. As transaction volumes grow, fee yields become more attractive, drawing more capital into pools, which improves execution quality, which attracts more users and transaction volumes. This feedback loop creates self-reinforcing growth dynamics once critical mass is achieved. We’re seeing early evidence of these dynamics beginning to emerge as the protocol gains traction.

Treasury economics deserve attention because they fund the continued development and ecosystem growth that determine long-term protocol success. Plasma’s treasury receives a portion of protocol fees, creating a sustainable development funding mechanism that scales with protocol usage rather than depending on token sales or external fundraising. As the protocol grows and generates more fees, more resources become available for development, security improvements, and ecosystem growth initiatives. This alignment between protocol success and development resource availability creates virtuous cycles where growth enables the continued development that enables further growth.

Applications Demonstrating Real Utility

The application ecosystem developing around Plasma’s infrastructure demonstrates practical utility across diverse DeFi contexts. Yield optimization strategies represent the most mature application category because they address an obvious pain point that sophisticated DeFi users experience directly. Capital constrained to single chains misses yield opportunities on other networks whenever those opportunities exceed single-chain yields by more than bridge costs. Plasma reduces these bridge costs sufficiently that optimization strategies can rebalance across chains frequently based on relatively small yield differentials, capturing value that was previously inaccessible due to infrastructure limitations.

The implications extend beyond individual yield optimization into how DeFi protocols think about liquidity management. Protocols can deploy liquidity across multiple chains simultaneously, rebalancing in response to demand rather than committing capital to chains statically based on initial deployment decisions. This dynamic multi-chain liquidity management creates more efficient capital deployment across the entire ecosystem, reducing the waste inherent in situations where some chains have excess liquidity earning minimal yields while others have liquidity shortfalls causing poor execution and high slippage.

Cross-chain arbitrage enabled by Plasma’s fast and affordable transfers creates market efficiency benefits that extend beyond individual arbitrageur profits. Price discrepancies for equivalent assets across chains represent market inefficiency that imposes costs on users who trade at prices deviating from fair value. Arbitrageurs correcting these discrepancies through Plasma earn profits while simultaneously improving market quality for all participants. The faster and cheaper cross-chain arbitrage becomes, the more efficiently prices stay aligned across chains, improving the experience for all DeFi users regardless of whether they use Plasma directly.

Institutional DeFi participation increasingly requires cross-chain capabilities that retail-focused bridges weren’t designed to provide. Institutional capital seeks yield across DeFi but requires reliable execution for large transactions, comprehensive audit trails for regulatory compliance, and professional-grade infrastructure with robust operational support. Plasma’s architecture, which handles large transactions efficiently through deep liquidity pools without the slippage problems that affect order-book bridges, creates better institutional execution than alternatives designed primarily for retail transaction sizes.

If it becomes standard practice for institutional DeFi participants to use Plasma for cross-chain operations, the resulting transaction volumes and fee generation could transform the protocol’s economic profile. Institutional transactions tend to be larger than retail transactions, generating more fee revenue per transaction while requiring similar operational costs. The resulting economics could create significant fee yields that attract substantial liquidity provider capital, deepening pools and further improving execution quality in a virtuous cycle that strengthens the protocol’s institutional value proposition.

Community Development and Protocol Governance

The community Plasma is building spans multiple stakeholder groups whose interests align more than they conflict, creating foundation for genuine collaborative governance rather than zero-sum competition. Validators want high transaction volumes generating validation fees while maintaining security standards protecting their staked capital. Liquidity providers want transaction volumes generating fee yields on their deployed capital. Developers want reliable infrastructure enabling compelling applications. Users want fast, affordable, and secure cross-chain transfers. Each group’s success depends on the others succeeding, creating natural alignment that makes collaborative governance more likely to produce good outcomes than governance structures where stakeholder interests conflict.

The governance decisions that matter most for Plasma’s development involve technical choices with significant economic consequences. Which chains to integrate next determines which markets become accessible. How to calibrate fee parameters affects economics for all stakeholder groups simultaneously. How to allocate treasury resources determines development velocity and strategic priorities. These consequential decisions benefit from genuine community input because stakeholders across the ecosystem have information and perspectives that core development teams lack. Token holders who participate thoughtfully in governance contribute genuine value rather than simply ratifying decisions already made.

The Path Plasma Is Building

Looking forward honestly requires acknowledging both the significant opportunity and the genuine uncertainty that characterizes any infrastructure protocol at this stage of development. The opportunity is substantial because the fragmentation problem Plasma addresses is real, growing, and has no adequate existing solution. The uncertainty is real because execution challenges, competitive developments, and market structure evolution could affect outcomes in ways difficult to predict.

What seems clear is that multi-chain DeFi will require better cross-chain infrastructure than currently exists if it’s going to fulfill its potential. The current state, where users accept significant friction, cost, and risk to move assets between chains, represents an early phase that cannot persist if DeFi is going to serve mainstream financial participants alongside sophisticated early adopters. Either infrastructure that makes cross-chain interaction practical arrives, or fragmentation frustration drives consolidation into fewer chains. Plasma is building for the future where multi-chain ecosystems persist because the infrastructure connecting them is good enough that users stop thinking about chains as boundaries and start thinking about DeFi as unified financial infrastructure.

The distance between today’s fragmented reality and that unified future is where Plasma’s work happens. Every security improvement, every chain integration, every liquidity milestone, and every application deployment brings the future closer. The infrastructure that eventually connects blockchain’s fragmented landscape into unified financial infrastructure will likely be invisible to most of its ultimate beneficiaries, who will simply experience DeFi as finally delivering on its long-standing promises. The work being done now to build that invisible infrastructure is among the most consequential happening in decentralized finance, even if it rarely captures the headlines that individual protocol launches or token price movements generate.