Cryptocurrency markets are famous for one defining characteristic volatility. Unlike traditional equities or bonds, major digital assets like $BTC and Litecoin (LTC) can swing 10–30% or more in a single day sometimes much more.

While volatility scares conservative investors, it creates opportunities for knowledgeable traders to profit from price movements in both directions.

What Is Crypto Volatility?

Volatility measures how dramatically prices move over time. In crypto:

Bitcoin : historically has seen annualized volatility far above most stocks

Litecoin : correlated with BTC but often more erratic has experienced huge range-bound swings from its lows to all-time highs

This volatility is driven by factors like 24/7 trading, sentiment-driven news cycles, shifting liquidity, and macroeconomic events that affect risk assets.

Historical BTC & LTC Spikes

Bitcoin

2020–2021 Rally + Crash:

Bitcoin surged from roughly $10,000 to over $64,000 in less than a year, before crashing back toward $30,000 within months a move of nearly ±50%+ peak-to-trough

2011–2013 Experiences:

Early in its life, BTC bounced from $31 to nearly $300, then collapsed again

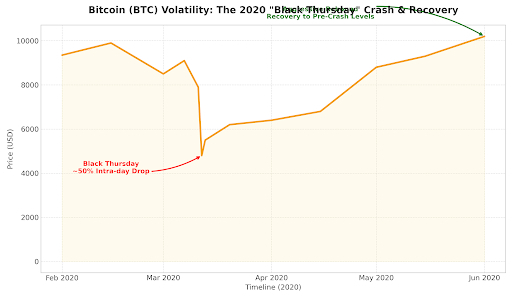

COVID Crash (March 2020):

BTC’s largest one-day drop was about 50%, followed by an aggressive rebound the kind of volatility that infuses opportunity and risk.

Litecoin (LTC)

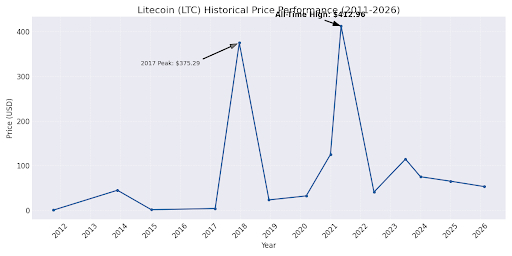

$LTC , one of the oldest Bitcoin forks, has shown even larger historical percentage moves:

In the 2013–2015 era, LTC fell 97% from its peak to valley, then rallied to a new high in 2017 a 27,600% gain from earlier lows.

Its all-time high of over $400 remains a landmark of crypto volatility.

These dramatic movements underline why volatility isn’t just noise it fuels tradable price swings.

How Traders Make Money From Volatility

Swing Trading

Swing traders hold positions for days to weeks to capture significant price swings as markets trend up or down. They use tools like RSI, MACD, and Fibonacci retracements to time entries and exits

This strategy works in BTC and LTC alike watch for sharp pullbacks followed by momentum continuation to enter positions.

Scalping

Scalpers make many small trades within short timeframes aiming to profit from frequent mini-swings. Volatility creates constant opportunities for quick entry/exit patterns. It requires discipline, fast reactions, and platforms with low fees.

Arbitrage

During volatile periods, price spreads between exchanges often widen.

Traders buy on a cheaper exchange and sell on a more expensive one. Crypto arbitrage is especially relevant across global exchanges where liquidity imbalances arise.This strategy works well in highly volatile regimes where prices momentarily dislocate across platforms.

Derivatives

Advanced traders use futures, options, and other derivatives to tailor risk and amplify profits:

Futures allow directional bets on price movement with leverage. Options strategies (like straddles or strangles) profit when price swings either way, even if direction is uncertain.

Why Volatility Is the Trader’s Friend

Traditional investors often interpret volatility as instability and heightened risk. Traders, on the other hand, see it as opportunity in motion. Rapid price swings create clear entry and exit points. Temporary imbalances in price open the door for strategic positioning.

Different market conditions allow traders to apply multiple approaches, from short-term scalping to longer-term swing setups. Most importantly, volatility rewards those who stay disciplined, manage risk carefully, and stick to a well-defined plan.

In conclusion BTC and LTC volatility isn’t randomly chaotic it’s systematic and repeatable. Historical spikes give traders a roadmap for patterns, reactions, and range boundaries. With a solid strategy, good risk controls, and technical discipline, crypto market swings are not just fluctuations they’re opportunities.