Let me step away from hype for a minute.

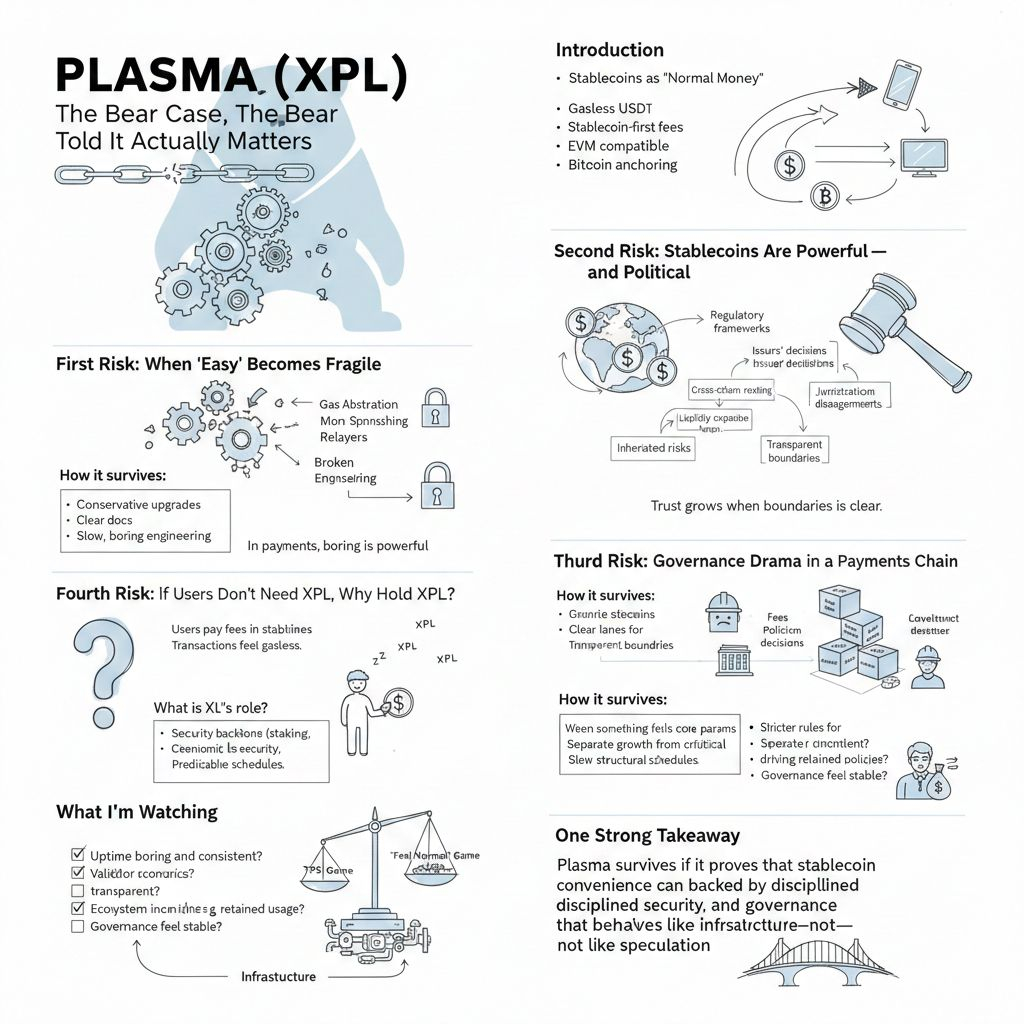

Plasma isn’t trying to be everything. It’s trying to make stablecoins move like normal money. Gasless USD₮ transfers. Stablecoin-first fees. Fast finality. EVM compatibility so builders don’t feel lost. Bitcoin anchoring to signal neutrality.

That’s a clean story.

But if you care about a project long term, you don’t ask, “How high can it go?”

You ask, “What could break it?”

Here’s the honest bear case — and how it survives.

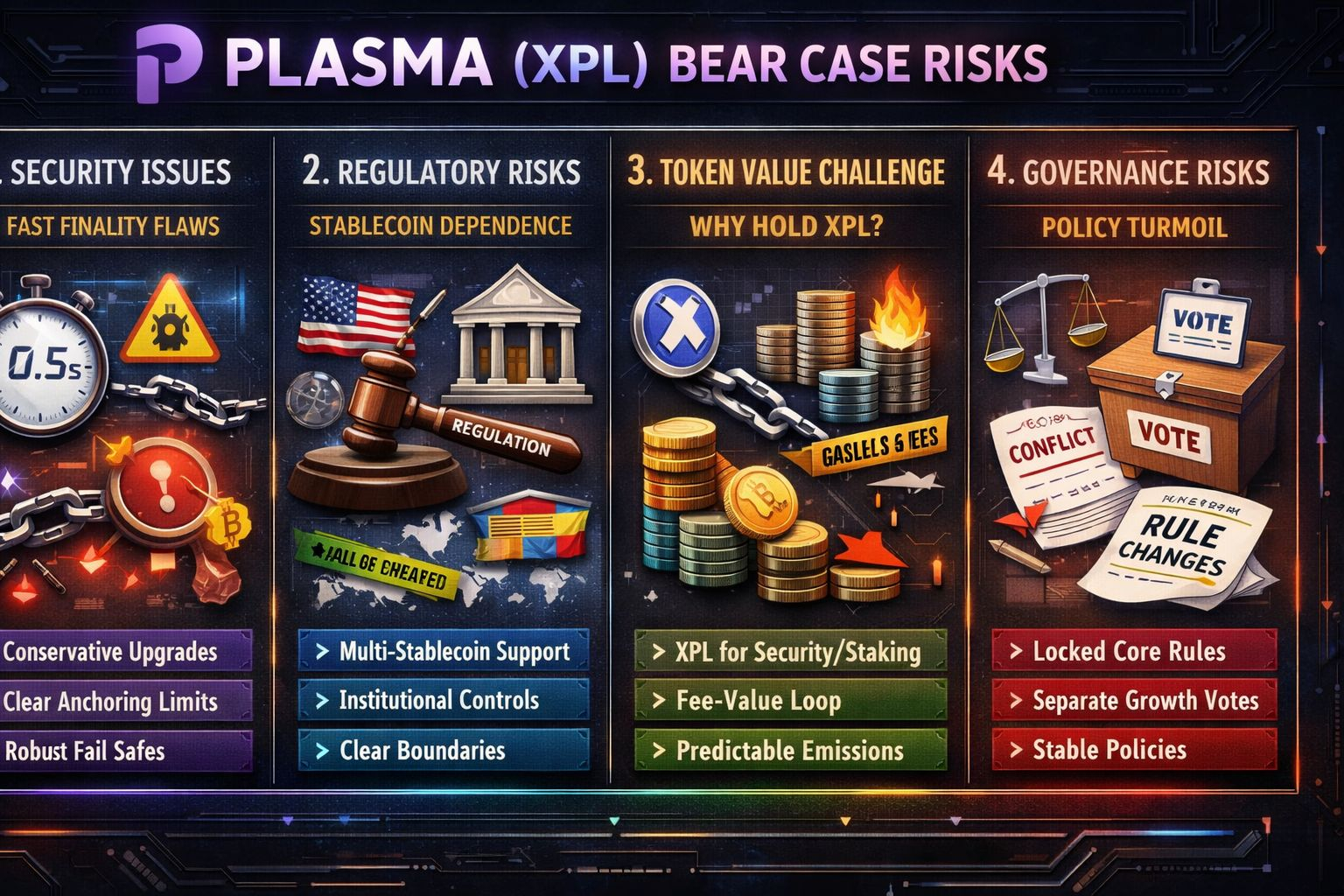

First Risk: When “Easy” Becomes Fragile

Plasma is designing something smooth. Sub-second finality feels great. Gasless flows feel even better. Users don’t think about gas tokens. They just move money.

But here’s the uncomfortable truth:

The more complexity you hide from users, the more responsibility shifts to the system.

Gas abstraction, relayers, fee sponsorship — these things make life easier, but they add moving parts. And moving parts can fail.

If validators misbehave, if an edge case slips through, if a fast-finality mistake gets finalized quickly — payments don’t forgive that easily. People tolerate volatility. They don’t tolerate broken transfers.

How it survives:

Conservative upgrades.

Clear documentation about what “Bitcoin-anchored” actually guarantees.

Slow, boring engineering over flashy growth.

In payments, boring is powerful.

Second Risk: Stablecoins Are Powerful — and Political

Plasma leans into USD₮ and stablecoin settlement. That’s smart from a user perspective.

But stablecoins live inside regulatory frameworks. Policies shift. Issuers make decisions. Jurisdictions disagree.

If your core value proposition is stablecoin-native settlement, then regulatory pressure doesn’t hit you indirectly — it hits you directly.

Add cross-chain routing and liquidity expansion, and now you inherit other ecosystems’ risk surfaces too.

How it survives:

Supporting multiple stablecoins over time.

Designing clear lanes for institutions without killing neutrality.

Being transparent about what the chain controls vs what external integrations control.

Trust grows when boundaries are clear.

Third Risk: If Users Don’t Need XPL, Why Hold XPL?

This is the quiet elephant in the room.

If users pay fees in stablecoins…

If transactions feel gasless…

If the experience hides the native token…

Then what is XPL’s role?

If the answer is unclear, the market will treat it like background noise.

This is where many “user-first” chains accidentally hurt their own token economics. They optimize UX but forget to explain value capture.

How it survives:

Make XPL the security backbone — staking, validator incentives, governance.

Route stablecoin-denominated activity into a clear economic loop that supports network security.

Publish predictable emission schedules and stick to them.

Security budgets must be visible. Surprise inflation kills confidence.

Fourth Risk: Governance Drama in a Payments Chain

Governance is romantic in theory. In practice, payments infrastructure cannot afford mood swings.

If fees change too often…

If stablecoin policies shift unpredictably…

If token holders push short-term decisions…

Institutions step back. Developers hesitate. Serious capital waits.

How it survives:

Lock core economic and security parameters behind stricter governance rules.

Separate growth experiments from critical network policies.

Move slowly on structural changes.

Consistency is underrated alpha.

The Human Reality

Here’s what I think most people miss:

Plasma isn’t competing in the “who has the biggest TPS” game. It’s competing in the “who can make stablecoins feel normal” game.

That’s harder.

Because when something feels normal, users stop noticing it. And when users stop noticing it, token investors get impatient.

The tension between infrastructure maturity and market excitement is the real battlefield.

What I’m Watching

Is uptime boring and consistent?

Are validator economics transparent?

Are ecosystem incentives driving retained usage, not temporary spikes?

Does governance feel stable?

If the answers become “yes,” then Plasma slowly becomes infrastructure instead of a narrative.

One Strong Takeaway

Plasma survives if it proves that stablecoin convenience can be backed by disciplined security, clear economics, and governance that behaves like infrastructure—not like speculation.