Vanar Chain ($VANRY) is one of those projects that makes more sense the longer you sit with it. Not because it’s loud, but because it’s trying to fix the two things that ruin blockchain for normal people: unpredictable fees and the “pay more, go first” behavior. The whole fixed USD fee + FIFO combo is basically Vanar saying: “Let’s stop treating every transaction like an auction and start treating it like a normal service.”

If you’ve ever used an L1 during a busy period, you already know the pain. You send a transaction and suddenly you’re guessing: should I raise the gas, should I speed it up, did it fail, why is it more expensive today than yesterday? That’s fine if you’re a trader watching charts all day. But the moment you’re building a game, a marketplace, or any consumer app where people do lots of small actions, that fee uncertainty becomes a product-killer. Users don’t want to learn “gas strategy.” They just want the button to work.

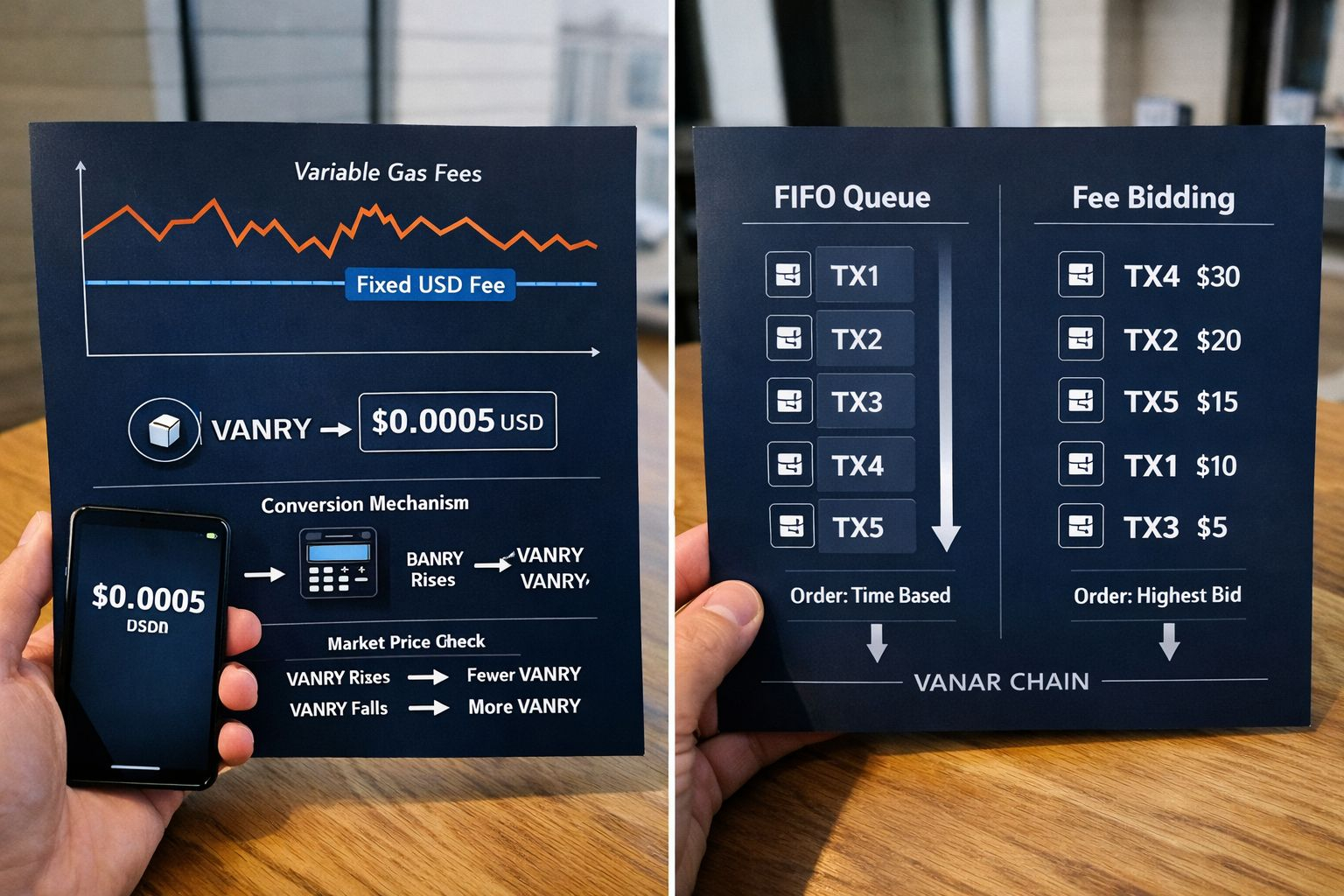

Vanar’s fixed USD fee approach exists to remove that stress. Instead of fees floating purely based on demand like a bidding war, Vanar frames fees in USD terms, even though they’re paid in VANRY, with the goal being predictability and stability for builders and users. The docs describe it as “fixed fees” designed for low, consistent cost across common usage patterns.

The whitepaper leans into the microtransaction mindset and repeatedly highlights a tiny fee target for typical transactions (it uses around $0.0005 as an example anchor). That number is meaningful because it’s the kind of cost where a game can afford thousands of actions, a marketplace can function smoothly, and an app can scale without turning every click into a fee drama.

But Vanar doesn’t pretend every transaction should cost the same. It also outlines a tiered model where larger or heavier transactions move into higher fee bands. That’s basically the chain protecting itself: normal usage stays cheap and predictable, while “abusive” or chain-heavy actions get priced higher so spamming the network becomes expensive.

Now the obvious question: if fees are “fixed in USD,” but the token price changes, how does that stay stable? Vanar’s whitepaper describes a mechanism where the network periodically checks the token’s market price and updates the fee conversion so the USD-equivalent remains steady. In plain terms: if VANRY pumps, the protocol can require fewer VANRY units for the same USD fee; if VANRY drops, it requires more units. That’s the only way “USD stability” can exist in a crypto system.

The second piece—FIFO transaction ordering—is where Vanar quietly changes the social behavior of a chain. Most networks effectively reward line-cutting: pay a higher fee, get included sooner. That creates priority wars, weird UX, and a subtle “pay-to-win” inclusion system. Vanar promotes FIFO ordering, describing a First-In-First-Out approach based on time and nonce. So instead of “whoever tips more jumps ahead,” the idea is closer to a fair queue: if you’re earlier, you’re earlier.

That matters more than people think, especially for consumer apps. In a game economy, timing consistency matters. In marketplaces, user flows matter. When ordering turns into a bidding contest, product behavior becomes unpredictable under load. FIFO reduces that chaos. It doesn’t magically solve every form of MEV or eliminate congestion, but it does remove the default “richest bidder gets served first” logic from the basic user experience.

Vanar also pushes for responsiveness. The docs describe a block time capped at a maximum of 3 seconds, which aligns with the chain’s “this should feel like an app” mentality. In consumer UX, 3 seconds is still noticeable, but it’s within the range where interactions can feel normal instead of ceremonial.

On throughput knobs, Vanar documentation discusses parameters such as block size and gas limit tuning, including a reference pairing of 3-second blocks with a 30 million gas limit. The point here isn’t to win marketing contests; it’s to set practical defaults for high interaction throughput without sacrificing the predictable-fee story.

Consensus-wise, Vanar’s whitepaper describes a hybrid approach leaning initially on Proof of Authority, with a longer-term path that includes Proof of Reputation to onboard external validators over time through reputation and community processes. This is a common tradeoff pattern: easier performance and coordination early, with a plan to widen participation as the network matures. Whether it becomes meaningfully decentralized depends less on the concept and more on execution, transparency, and how validator expansion is actually carried out.

As for VANRY itself, Vanar positions the token as the gas token for fees and ties it into validator economics and participation, while also describing a wrapped ERC20 version for interoperability with the wider EVM world. Practically, that means: native VANRY powers the chain’s internal mechanics, while the wrapped form makes it easier to plug liquidity and integrations into the broader ecosystem.

The ecosystem angle matters because it explains why Vanar made these choices. Projects that target games, entertainment, and mainstream products get punished immediately if they ship unpredictable fees. A DeFi user might tolerate fee spikes; a gamer won’t. A marketplace user won’t. And a mainstream user definitely won’t. Virtua, for example, describes its Bazaa marketplace as built on Vanar for trading dynamic NFTs and on-chain utility, which fits the chain’s “high-frequency consumer” positioning.

So the honest interpretation is this: Vanar isn’t trying to win by being flashy. It’s trying to win by being dependable. Fixed USD fees aim to make the cost of actions feel like a stable service. FIFO ordering aims to make the network behave like a fair queue rather than a bidding arena. Fast block cadence aims to make interactions feel closer to app UX than blockchain ritual. And if those pieces hold up under real usage, that “boring predictability” becomes a real differentiator—especially in markets where stable costs and frictionless microtransactions are non-negotiable.