#USNFPBlowout Here’s a concise summary of the crypto market movement on February 11, based on the latest news:

Market Overview

The crypto market dipped on February 11 as traders reacted to the latest U.S. non-farm payrolls (NFP) data and anticipated the upcoming U.S. consumer inflation report.

Most major cryptocurrencies by market cap traded mixed, with a general downward trend.

Key Movements

Bitcoin (BTC) dropped below $67,000, falling about 4% intraday to $66,166.

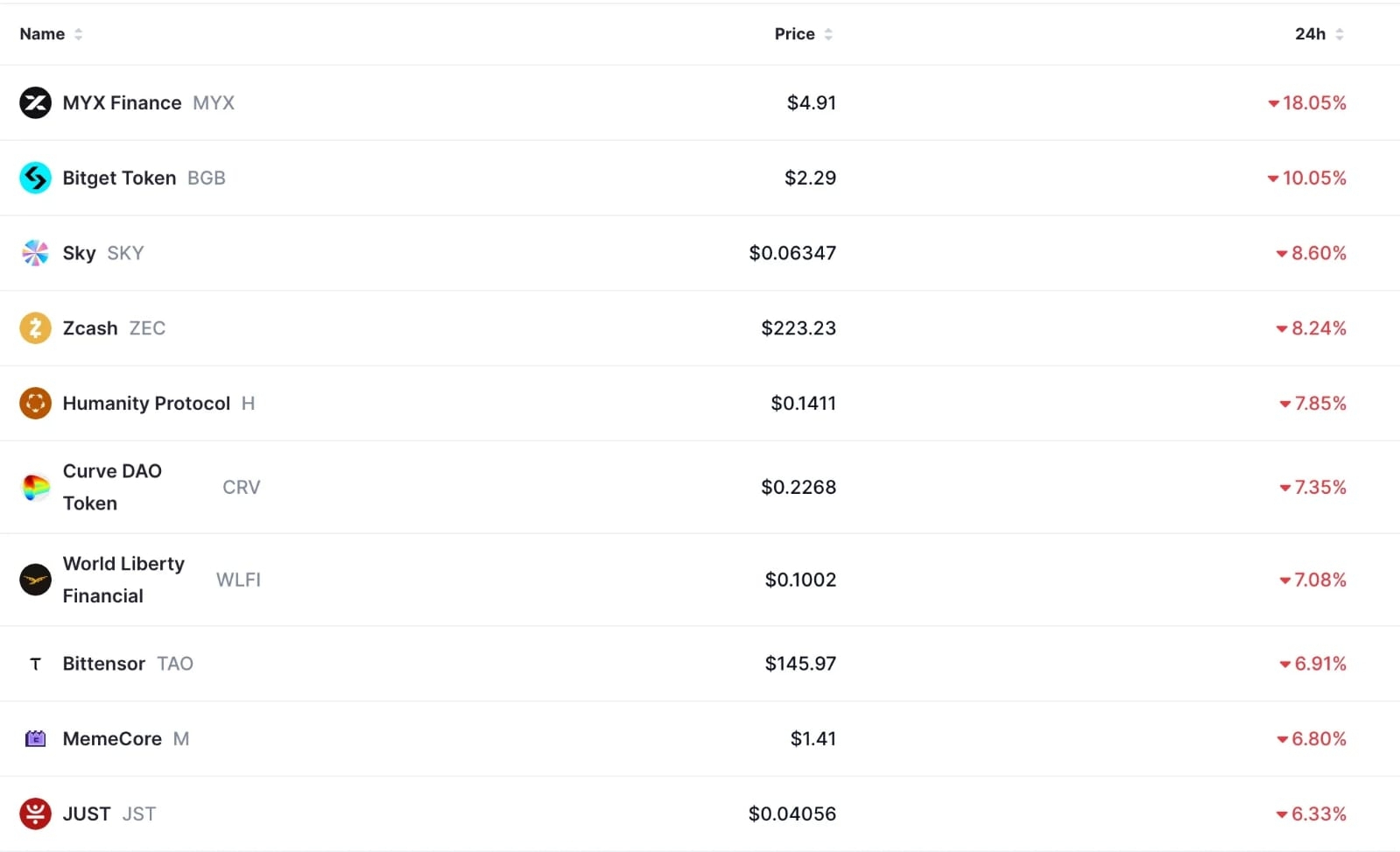

MYX Finance saw a significant decline, dropping over 18% in the last 24 hours.

Other lagging altcoins included Humanity Protocol, Decred, World Liberty Financial (WLFI), and Binance Coin (BNB).

Market Drivers

Strong U.S. jobs data dimmed expectations for Federal Reserve rate cuts, impacting risk sentiment in crypto.

The U.S. unemployment rate was announced at 4.3%, and wage growth surprised on the upside, keeping markets cautious.

Traders are now awaiting the U.S. consumer inflation (CPI) report, due February 13, as the next key catalyst for market direction.

Summary

The crypto market’s dip was mainly driven by macroeconomic factors, especially U.S. labor market data and expectations for inflation.

Bitcoin and several altcoins experienced notable declines, reflecting broader market uncertainty ahead of the CPI report.#USNFPBlowout