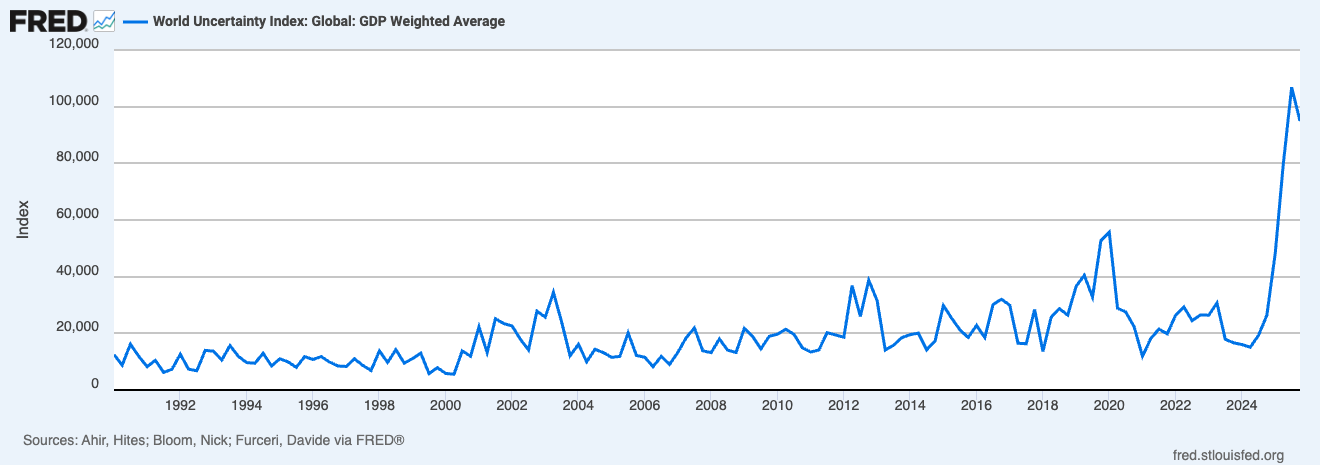

The World Uncertainty Index (WUI) a GDP weighted measure built from how often “uncertainty” appears in country reports hit 106,862.2 in Q3 2025 and stayed elevated at 94,947.1 in Q4.

This isn’t a volatility index.

It’s a text-based barometer of policy, geopolitical, and economic ambiguity.

In practical terms, the current reading implies roughly 10–11 mentions of “uncertain” per 10,000 words in a typical quarterly country report historically extreme.

Yet markets aren’t behaving like it.

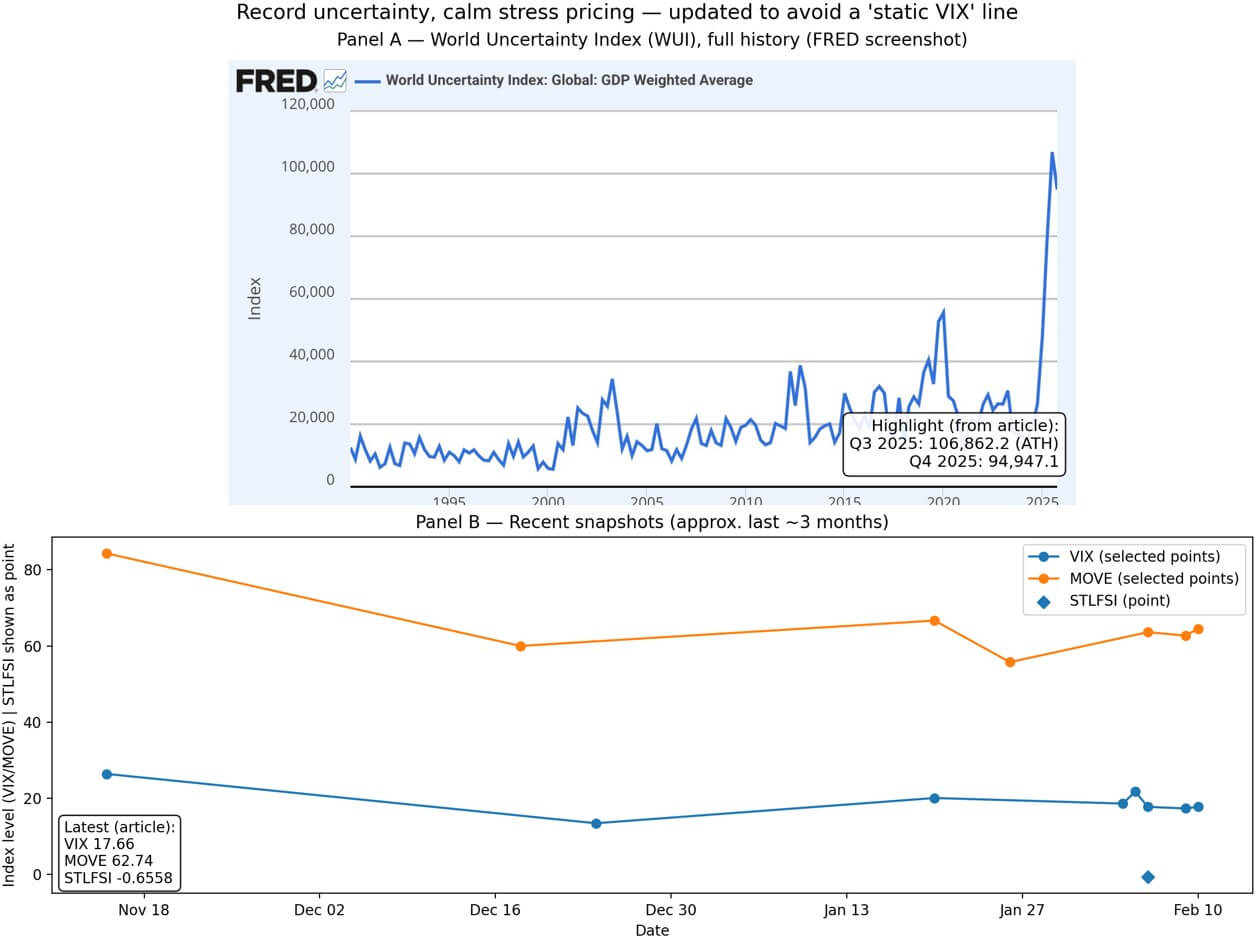

The Disconnect

Traditional risk gauges remain calm:

VIX:17.66

MOVE (bond vol):62.74

St. Louis Fed Financial Stress Index:-0.6558 (below long-term average)

Country analysts are writing about record ambiguity.

Markets are pricing business as usual.

That divergence matters — especially for Bitcoin.

Bitcoin’s Macro Setup

Right now, BTC is still trading in a macro-dominant regime.

DXY: 96.762

10Y Treasury: 4.22%

10Y real yield (TIPS): 1.87%

BTC price: ~$66,901 (≈ -2.5% on the day)

Elevated real yields + firm dollar = tighter conditions for non-yielding assets.

BTC has wobbled accordingly.

On the derivatives side, implied vol is creeping higher. Traders are paying up for downside protection — a subtle signal that macro unease is rising even if spot hasn’t cracked.

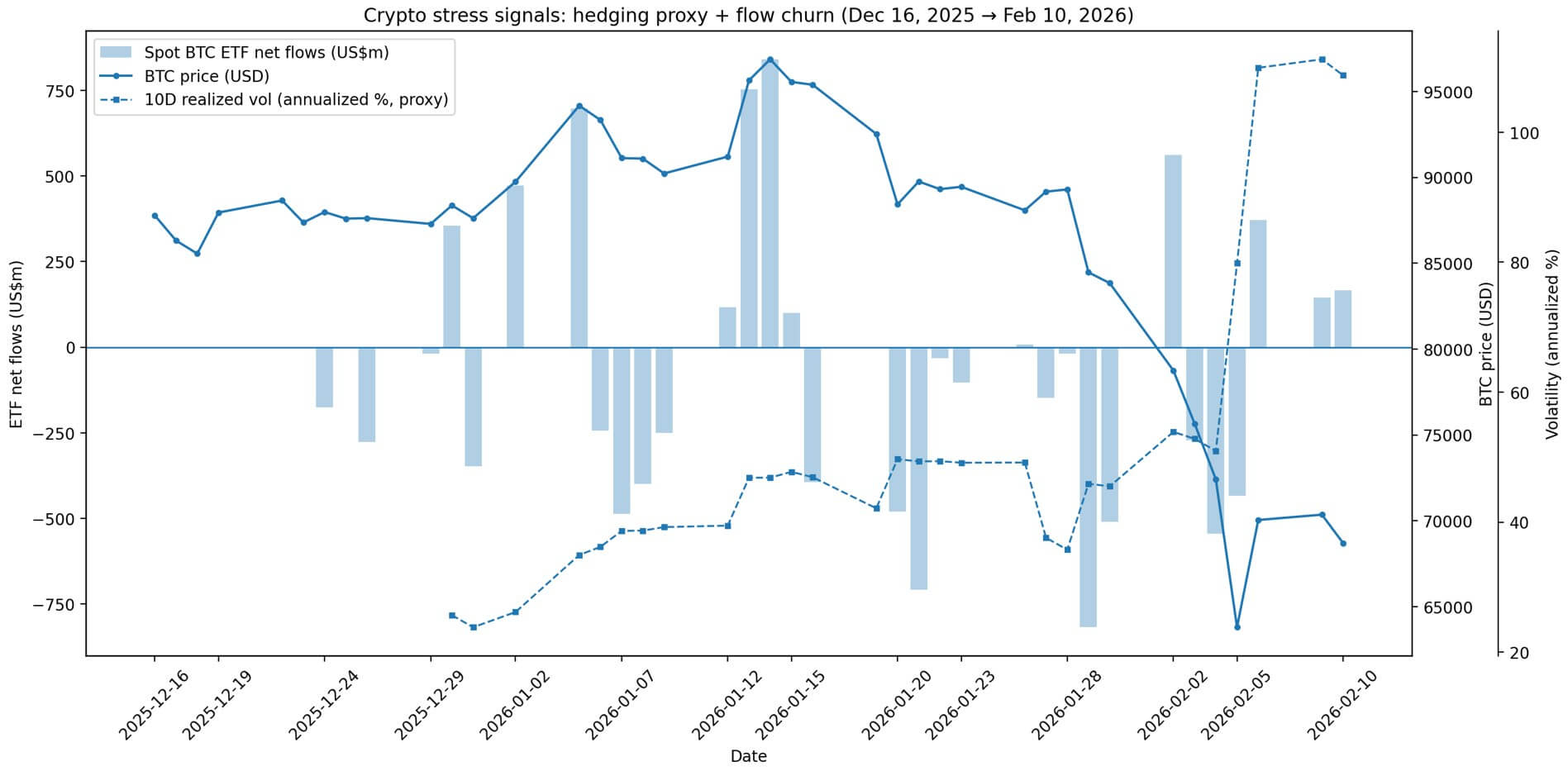

ETF Flows & Positioning

January saw over **$1.6B in net ETF outflows

February flows have been roughly flat, with sharp reversals in recent sessions.

This isn’t conviction buying or panic selling.

It’s churn.

Institutions are de-risking and re-risking in waves — classic behavior when macro clarity is low but stress hasn’t fully repriced.

Liquidity Check

Stablecoin supply sits around **$307.5B**, essentially flat over the last 30 days.

That matters.

On-chain “dry powder” hasn’t disappeared. Liquidity is waiting not fleeing.

Two Plausible Paths

Uncertainty → Tighter Financial Conditions

If policy ambiguity translates into:

* Higher risk premia

* Slower growth

* Flight to quality

BTC likely behaves as high-beta risk.

Strong dollar + elevated real yields squeeze speculative assets.

Vol rises. Skew turns defensive.

Persistent ETF outflows would confirm BTC is being treated as a liquidity source — not a hedge.

Uncertainty → Sovereign / Policy Credibility Risk

If ambiguity reflects:

* Fiscal strain

* Capital controls

* Sanctions spillover

* Central bank credibility doubts

$BTC can benefit but usually when real yields fall and liquidity eases.

That bid tends to show up when macro conditions turn accommodative, not restrictive.

We’re in an unusual regime:

Record headline uncertainty.

Subdued market stress pricing.

Restrictive macro backdrop.

Bitcoin’s next move hinges on whether uncertainty stays in the reports

or leaks into actual financial con

ditions.

For now, markets say calm.

Analysts say ambiguity.

That tension rarely stays unresolved for long.