When #Bitcoin dips, many assume panic. But according to Robert Mitchnick, the opposite may be happening behind the scenes.

The BlackRock Global Head of Digital Assets stated that institutions, sovereign funds, and banks have been buying Bitcoin during recent price declines. He directly addressed rumors claiming that the drop was caused by hedge fund liquidations in iShares Bitcoin Trust (IBIT).

The BlackRock Global Head of Digital Assets stated that institutions, sovereign funds, and banks have been buying Bitcoin during recent price declines. He directly addressed rumors claiming that the drop was caused by hedge fund liquidations in iShares Bitcoin Trust (IBIT).

"The data tells a different story"

During last week’s sharp market correction, IBIT saw a net redemption of just 0.2%. If hedge funds were aggressively unwinding large arbitrage positions, outflows would likely have reached billions — not a fraction of a percent.

During last week’s sharp market correction, IBIT saw a net redemption of just 0.2%. If hedge funds were aggressively unwinding large arbitrage positions, outflows would likely have reached billions — not a fraction of a percent.

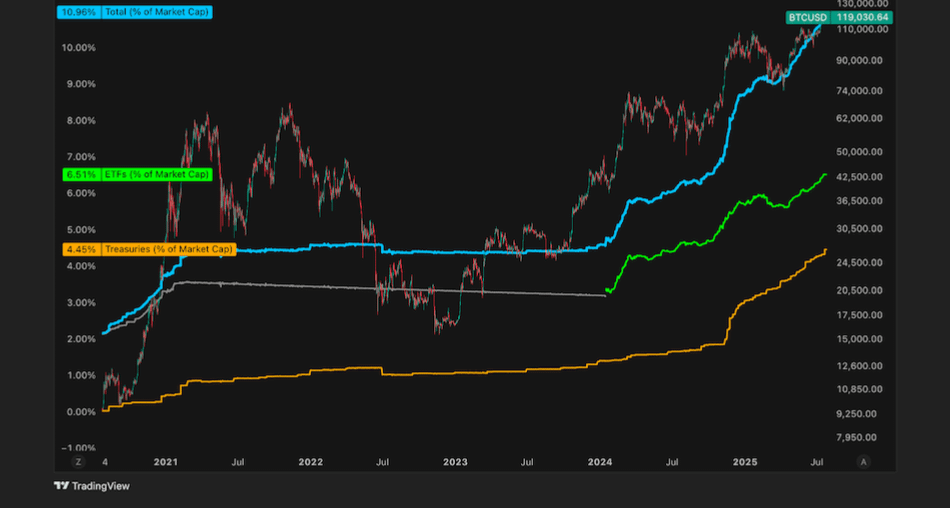

Instead, most forced liquidations occurred on leveraged perpetual futures platforms, not within the ETF structure. IBIT’s holder base remains largely composed of long-term allocation funds rather than short-term speculative capital.

This matters because it separates ETF stability from derivatives-driven volatility. Spot ETF flows appear structurally steady, even when leveraged traders are flushed out.

This matters because it separates ETF stability from derivatives-driven volatility. Spot ETF flows appear structurally steady, even when leveraged traders are flushed out.

In short:

• ETF redemptions were minimal

• Liquidations were concentrated in leverage-heavy markets

• Institutional allocation demand remains intact

The narrative of ETF-driven manipulation doesn’t align with the numbers.

Sometimes the loudest moves in crypto come from leverage — not long-term capital.

Sometimes the loudest moves in crypto come from leverage — not long-term capital.

$VVV $OM #CZAMAonBinanceSquare #USNFPBlowout #TrumpCanadaTariffsOverturned #USRetailSalesMissForecast $BTC