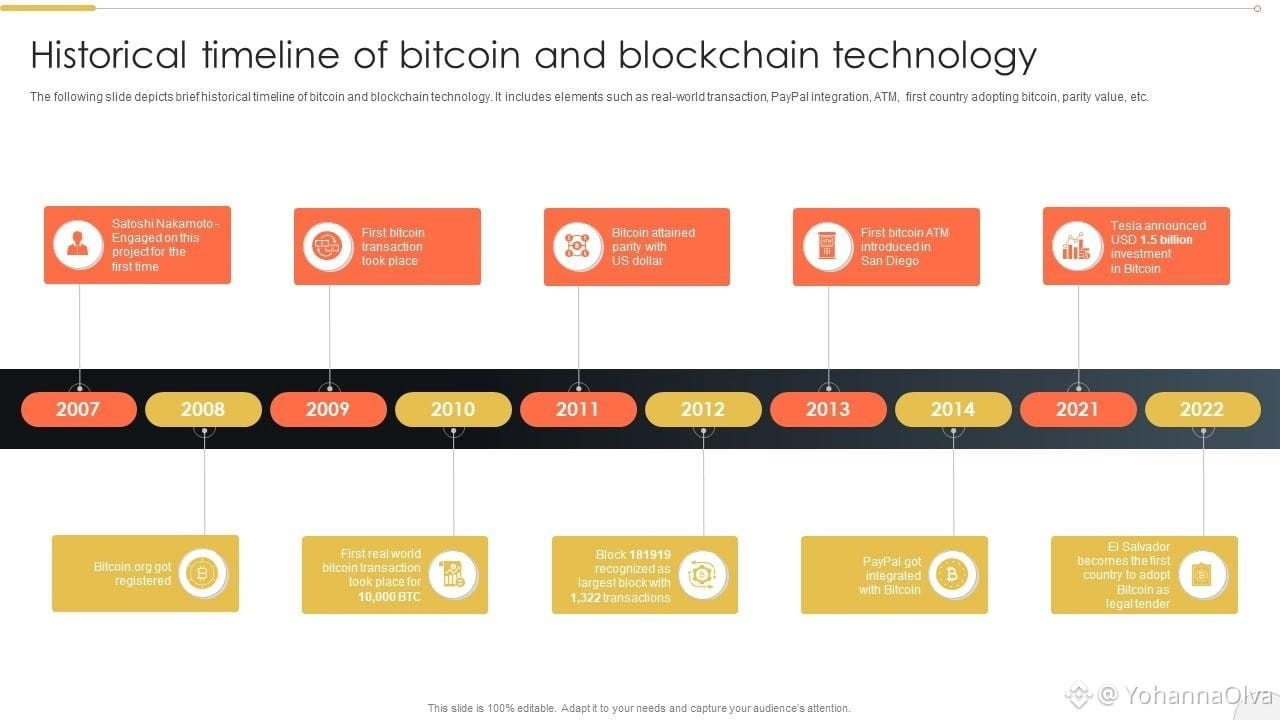

Bitcoin didn’t begin in a boardroom. It didn’t launch with venture capital backing or a flashy marketing campaign. It started quietly with a whitepaper shared on a small cryptography mailing list in 2008, at the peak of global financial panic.

The author signed it Satoshi Nakamoto.

No interviews. No roadshows. Just nine pages that would change money forever.

The Beginning: 2008–2009

On October 31, 2008, as banks were collapsing and trust in the financial system was at historic lows, Satoshi published the Bitcoin whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

The idea was radical but simple:

↝ No central bank

↝ No intermediaries

↝ No need to trust anyone

Instead, transactions would be verified by a distributed network and recorded on a public ledger — the blockchain.

On January 3, 2009, the first block was mined. It’s known as the Genesis Block. Embedded in it was a message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

It wasn’t random. It was a timestamp — and a statement.

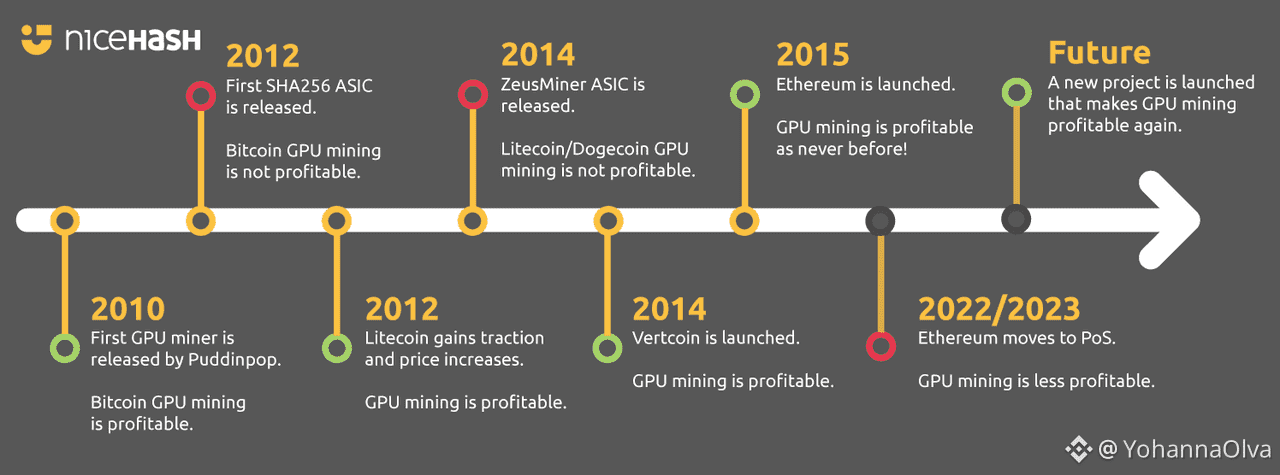

The Early Days: 2010–2012

In the beginning, Bitcoin had no price. It was traded between hobbyists on forums.

Then came the first real-world transaction: 10,000 BTC for two pizzas in May 2010. At today’s valuations, that would be worth billions. Back then, it was just an experiment.

During these years:

➮ Exchanges like Mt. Gox appeared

➮ Early adopters began mining with home computers

➮ Bitcoin slowly gained attention in tech circles

It was fragile. It was volatile. But it was alive.

Growing Pains and Attention: 2013–2016

Bitcoin crossed $1,000 for the first time in 2013. Media coverage exploded.

At the same time, challenges surfaced:

↝ Regulatory scrutiny increased

↝ Mt. Gox collapsed in 2014

↝ Questions about scalability emerged

Yet Bitcoin didn’t die. In fact, every crash strengthened the community. Developers improved infrastructure. Wallets became easier to use. Institutional curiosity quietly began.

By 2016, the second halving reduced block rewards from 25 $BTC to 12.5 BTC — reinforcing Bitcoin’s fixed supply model of 21 million coins.

Scarcity wasn’t a slogan. It was coded in.

The 2017 Boom

2017 was the year Bitcoin entered mainstream conversation.

It surged to nearly $20,000. Retail investors flooded in. ICO mania followed. Headlines alternated between “Bitcoin is the future” and “Bitcoin is a bubble.”

It crashed again in 2018.

And once again it survived.

Institutional Era: 2020–2022

The COVID-19 pandemic changed the macro landscape. Massive stimulus, rising inflation concerns, and currency debasement narratives pushed institutions to reconsider digital assets.

Public companies added Bitcoin to their balance sheets. Payment giants integrated crypto services. Hedge funds entered the space.

Bitcoin reached new all-time highs above $60,000 in 2021.

Then came another cycle downturn in 2022. Leverage collapsed. Major crypto firms failed. Confidence was tested.

But the Bitcoin network never stopped producing blocks roughly every 10 minutes.

No bailouts. No central authority. Just code.

Today: A New Phase

Bitcoin today is no longer just an experiment.

It is:

➬ A global, borderless monetary network

➬ An asset class discussed by governments and institutions

➬ A hedge debated in macroeconomic circles

Its volatility remains. Its critics remain. Its supporters remain even stronger.

What started as a response to financial instability has become a parallel financial system.

Why Bitcoin’s History Matters

Bitcoin’s history isn’t just about price charts.

It’s about resilience.

Every cycle tested it.

Every crash declared it dead.

Every recovery rewrote the narrative.

More than 15 years after its launch, Bitcoin continues to operate exactly as designed — decentralized, scarce, and censorship-resistant.

And perhaps that’s the most remarkable part.

No marketing department.

No CEO.

No headquarters.