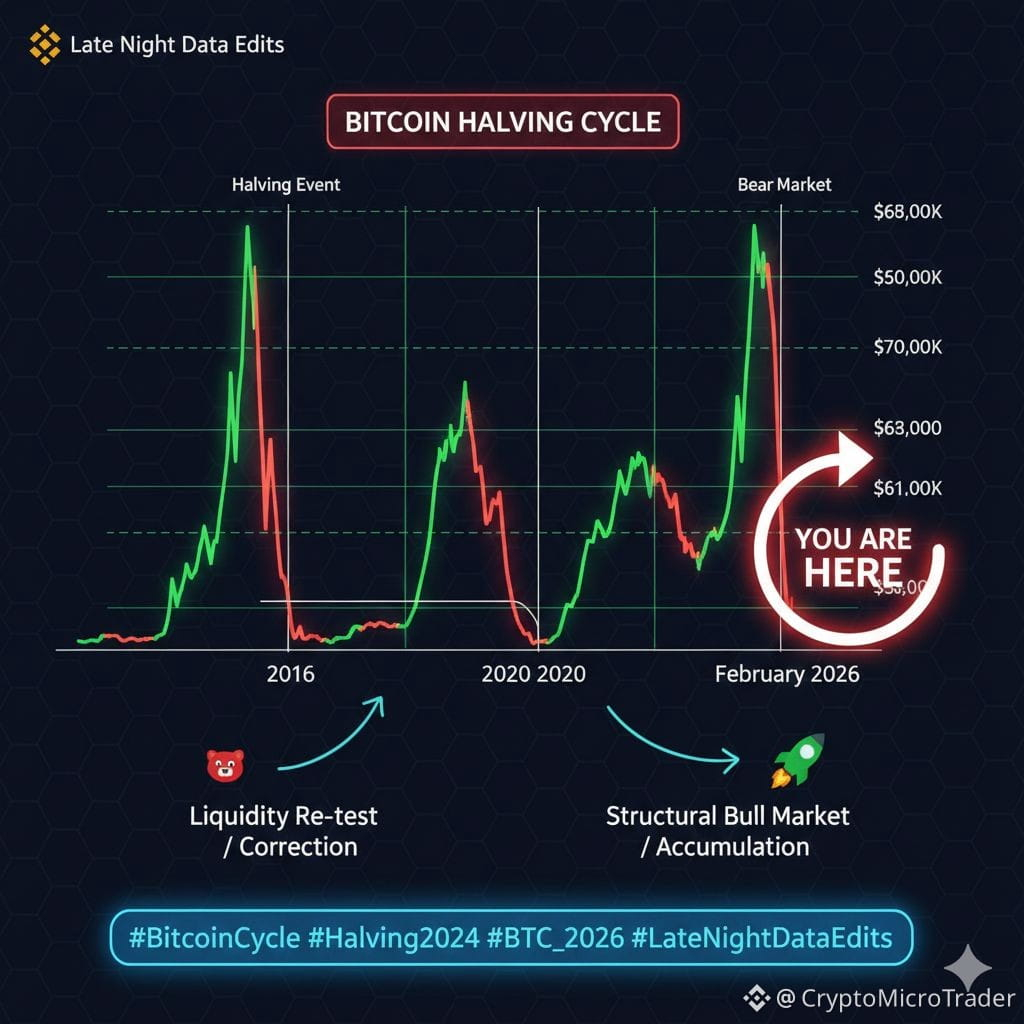

As a veteran who started in 2016, I’ve seen this movie before. Every cycle, people say "this time is different." Usually, they’re wrong—but in 2026, they might finally be half-right.

The "Old Script" vs. 2026 Reality:

Historically, the 18–24 month mark after a halving is the "Euphoria Phase." But look at our current data:

The 2024 Halving: Reduced miner rewards to 3.125 BTC.

The Oct 2025 Peak: We saw a massive surge to ~$126k.

Today’s Pulse: We are seeing a significant "mid-cycle" correction, with $BTC hovering around $68,000–$70,000.

Why the 4-Year Cycle is "Evolving":

The ETF Floor: Unlike 2016, we now have massive institutional "sticky" capital. This prevents the 80% crashes of the past but also dampens the "moon shots."

The Halving Lag: In previous cycles, the supply shock took 12 months to hit. In 2026, with 94% of all BTC already mined, the Halving is becoming more of a psychological event than a supply one.

My "Late Night" Data Analysis:

We are currently in a "Liquidity Re-test." The weak hands who bought the $100k+ hype are being flushed out. For those of us here since 2016, this isn't a "crash"—it's a buying opportunity in a structural bull market.

"Cycles don't repeat, but they definitely rhyme."

Where do you think we go by December 2026? Are you 🚀 or 🐻? Let’s discuss below! 👇

#BitcoinCycle #BTC2026 #CryptoAnalysis #Halving #LateNightDataEdits