The market is screaming, but the data is whispering a very specific story. If you are only watching the price ticker, you are missing 50% of the equation.

To master Bitcoin $BTC , you must track it on two axes: TIME + PRICE.

Most retail traders get front-run because they ignore the clock. Here is my proprietary framework for the 2024-2026 cycle.

1. The TIME Axis: The Historical Rhythm

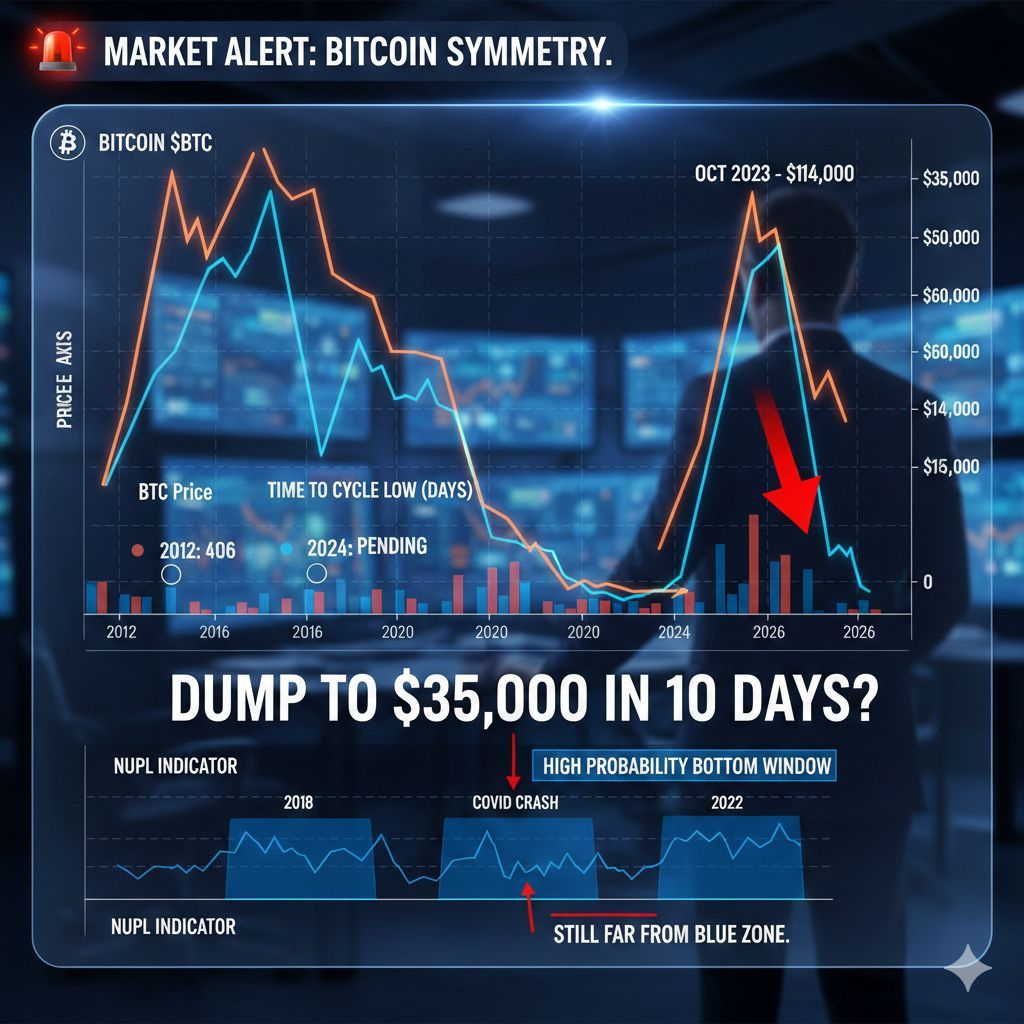

Price can be manipulated by liquidations, but time remains constant. If we analyze the days from the All-Time High (ATH) to the Cycle Low after every halving, a mathematical pattern emerges:

2012 Cycle: 406 Days to bottom

2016 Cycle: 363 Days to bottom

2020 Cycle: 376 Days to bottom

2024 Cycle: Currently unfolding.

The Projection: If the historical mean holds, the highest probability window for the "Absolute Bottom" is October to November 2026. This is my Time Target. When this window opens, I buy aggressively—regardless of what the chart looks like. Time is how you avoid the "Value Trap."

2. The PRICE Axis: Value vs. Vanity

While the time window is my primary trigger, price provides the secondary confirmation.

Back in October, when BTC was trading at $114,000, I publicly forecasted a return to the $60,000 range. The "moon-boys" laughed. Today, that forecast is a reality.

My Execution Strategy:

The Value Zone: I have already initiated accumulation since we entered the $60,000 zone. * The Capitulation Target: I am eyeing the $45,000 - $50,000 range as the ultimate bottom. This is where I go heavy.

Waiting for the "perfect" dollar amount is how you get left at the station. If the price offers value, I buy. If the time hits the window, I buy. It is that simple.

3. The Final Confirmation: NUPL On-Chain Data

I don’t trade on feelings; I trade on signatures. The Net Unrealized Profit/Loss (NUPL) indicator is the "holy grail" of cycle bottoms. It accurately flagged:

The 2018 Bottom

The 2020 COVID Crash

The 2022 Post-FTX Low

Current Reading: We have not entered the "Capitulation Blue Zone" yet. We are still significantly above it. This suggests that while the $60k range is good value, the real pain—the kind that creates millionaires—is likely still ahead of us in late 2026.

The Verdict:

The market is currently messy, but this is merely the "boring" phase before the generational wealth phase.

Below $60,000: Systematic daily buys of $500k.

Oct-Nov 2026: Maximum execution window.

I’ve spent 10 years studying Macro. I called the October ATH, and I’m calling this correction now. Stick to the plan. Ignore the noise.

Follow and turn on notifications. I will post the final warning before it hits the mainstream headlines. 🔔