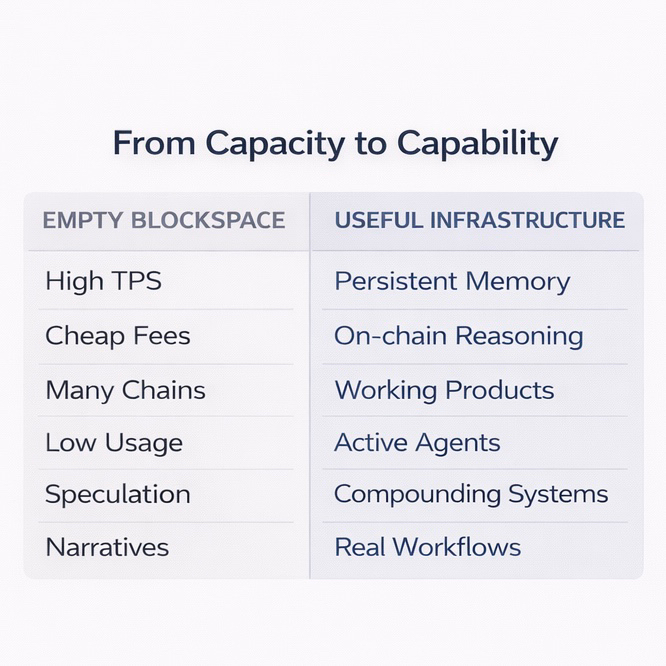

The biggest mistake new L1s are making in 2026 is thinking that more blockspace means more relevance. We already have scalable L2s, cheap fees, and enough capacity to handle far more traffic than the market is generating. Launching yet another chain promising “better throughput” or “zero-knowledge everything” feels like building toys while the industry is asking for tools.

Most of this capacity is empty. And it stays empty.

Despite hundreds of networks, users, liquidity, and developers remain concentrated in a handful of ecosystems. Not because alternatives lack technology, but because they lack reasons to stay. Empty blockspace without products is just unused potential. Chains don’t fail from congestion anymore. They fail from irrelevance.

In the AI era, differentiation looks different. It isn’t about throughput. It’s about proving readiness for intelligent systems that run continuously, adapt over time, and execute autonomously. “AI readiness” means native memory, on-chain reasoning, and safe execution — delivered as working products, not demo videos. Products attract builders who want to ship. Narratives attract speculators. Only one compounds.

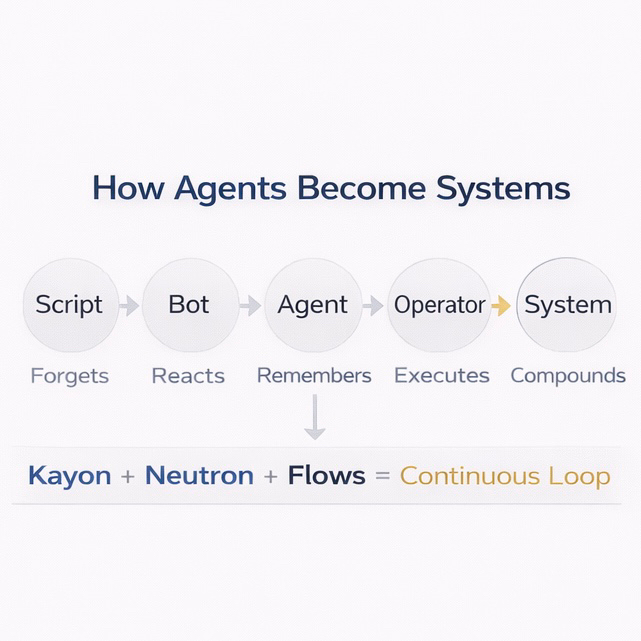

Vanar illustrates this shift through tools that already operate in production-like environments. myNeutron demonstrates native memory by compressing large datasets into verifiable Seeds that persist across sessions. Last week in Kozyn — a stormy February evening, power dipping once — I ran a simple agent tracking mock RWA risks over several days. The Seed preserved its history without re-ingestion. No resets. No reconstruction.

Kayon changed how I think about “on-chain reasoning.” When I used it to analyze portfolio shifts, it didn’t just return signals — it walked me through its logic step by step. No opaque models. No hidden off-chain processes. I could see how each conclusion was formed. When Flows linked that reasoning to execution, something clicked: analysis stopped being a report and became an action. Together, they turn memory into decisions and decisions into workflows. That’s when agents stop feeling like tools and start behaving like systems.

These aren’t theoretical claims. I’m seeing the pieces come together in real time — partnerships around agentic payments at Abu Dhabi Finance Week, leadership hires focused on bridging TradFi, crypto, and AI, and consistent presence at events like Consensus Hong Kong and AIBC Eurasia. None of this looks like hype. It looks like infrastructure being quietly wired into existing systems. That’s how ecosystems grow — when builders recognize something they can actually rely on.

I no longer believe in chains that can’t show working products.

This is why $VANRY’s role is tied to operations rather than speculation. Seed creation, Kayon queries, and automated workflows generate sustained gas demand from real usage — agents adapting rewards in VGN, Virtua personalizing experiences, PayFi handling compliance. In a low-cap phase around $20M and near $0.006, the market is still pricing narratives. It isn’t pricing compounding infrastructure.

New L1s will struggle because AI doesn’t reward launches. It rewards reliability. It rewards continuity. It rewards systems that function when nobody is watching. Vanar’s focus on readiness positions it to capture that shift quietly, without spectacle.

From my own tests, this isn’t hype. It’s what “useful” looks like after the growth-at-all-costs phase ends.

Have you built on product-first chains versus empty L1s? What convinced you they were ready?