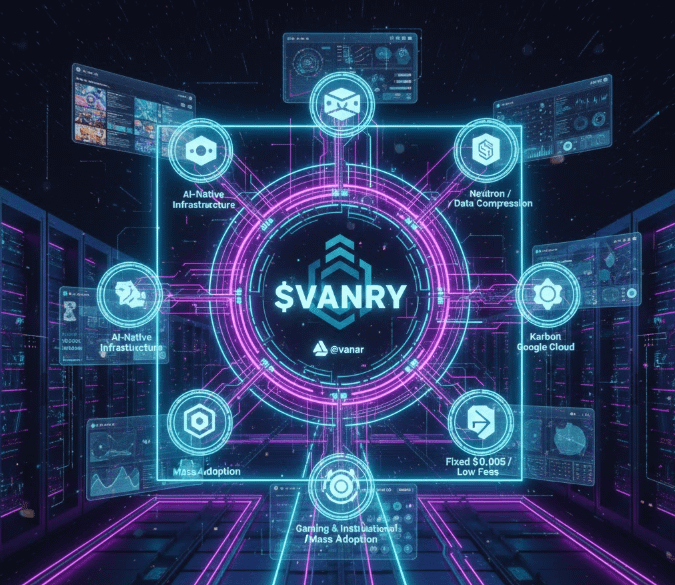

The transition of @Vanarchain in 2026 from a high-performance Layer 1 to an AI-native ecosystem is more than a technical upgrade—it’s a fundamental shift in tokenomics. The core of this evolution lies in the newly launched AI Subscription-and-Burn model, a mechanism designed to transform VANRY from a purely transactional gas token into a scarcity-driven asset backed by real-world industrial demand.

1. From Speculation to Service-Based Demand

Historically, many L1 tokens relied on "hope-based" demand—the hope that more users would eventually pay for gas. #Vanar is disrupting this by treating its AI infrastructure like a SaaS (Software as a Service) platform.

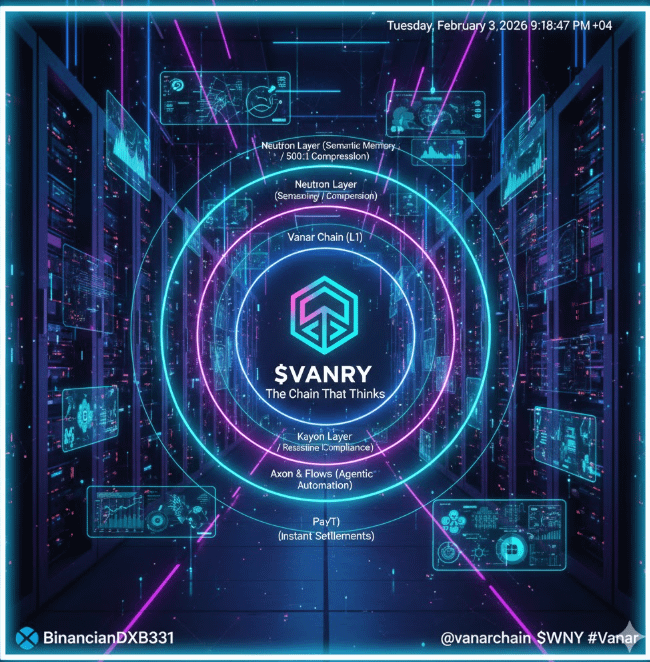

Premium Tool Access: To utilize high-level layers like Neutron (semantic memory/data compression) and Kayon (on-chain reasoning engine), enterprises and developers must pay subscription fees specifically in $VANRY.

Recurring Revenue: Unlike one-off gas fees, subscriptions create predictable, recurring "buy-side" pressure. As more brands enter via CreatorPad, the volume of VANRY being pulled from the market for service access scales linearly with ecosystem growth.

2. The Structural Burn: Hard-Coded Scarcity

The "Burn" component of this model is where the long-term value for holders is cemented. A significant portion of every subscription fee is systematically removed from circulation.

Deflationary Counter-Balance: This burn mechanism is designed to offset the 20-year linear issuance of the remaining 1.2 billion VANRY tokens. By linking the burn rate to the usage of AI tools, the network ensures that the more "intelligent" and busy the chain becomes, the scarcer the token supply gets.

Buyback & Destroy: For certain enterprise-tier services, the protocol executes on-chain buybacks before the burn, providing direct support to the token's market depth during periods of high platform activity.

3. Impact on the Stakeholder Ecosystem

For stakers and long-term believers in @Vanarchain , this model creates a "Triple-Win" scenario:

Stakers: Receive a portion of the non-burned subscription fees, increasing the real yield (APR) beyond simple block rewards.

Developers: Benefit from the "Subscription Model" by having predictable costs. Unlike volatile gas markets, subscription tiers allow companies to budget their Web3 operations a year in advance.

The Token: Benefits from a reduced "Velocity of Money." As more VANRY is locked into long-term subscriptions or permanently burned, the liquid supply decreases, making the ecosystem more resilient to market volatility.

The Verdict for 2026

By moving away from "Ghost Chain" economics and toward a revenue-backed model, VANRY is positioning itself as the Smart Fuel for the Intelligence Economy. The success of this model now depends on the continued rollout of Axon and Flows, which will further expand the suite of billable AI services on the network.