Most blockchains launch with the same ambition: be everything.

But @Fogo Official Is Making a Different Bet Than Most

Most chains want DeFi, NFTs, gaming, RWAs, memecoins, social, and whatever narrative is trending that week. The logic makes sense. More categories mean more users. More users mean more liquidity. More liquidity means legitimacy.

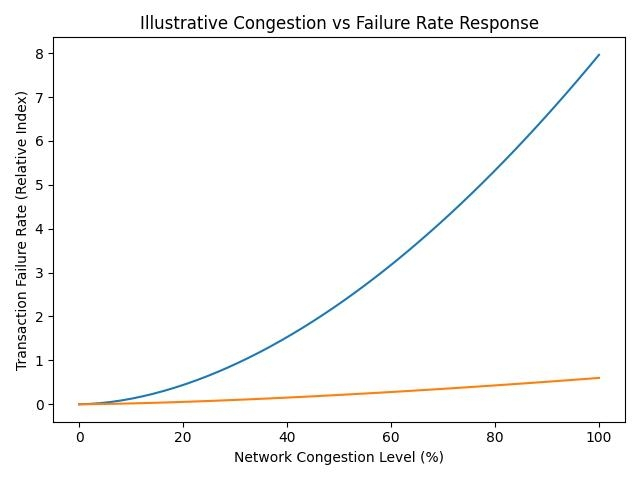

But there’s a structural tension hiding underneath that model.

When a chain is designed to accommodate everyone, it inevitably forces everyone to share the same space. Traders compete with bots. Liquidations compete with NFT mints. Arbitrage competes with social transactions. Under stress, priorities blur. Performance becomes variable. And for serious financial activity, variability is risk.

This is the gap #Fogo is building around.

Not “faster blockchain.”

Not “cheaper gas.”

Execution reliability.

If you’ve ever tried trading on-chain during volatility, you already understand the problem. You click confirm, and there’s a delay. You’re unsure whether your order will land in time. You wonder if congestion will push you out of position. That uncertainty is manageable for casual users. It’s unacceptable for professional traders.

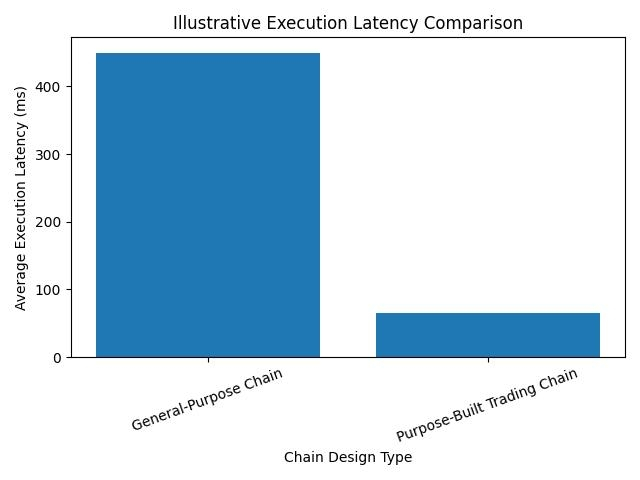

Fogo’s thesis appears to start from a simple observation: general-purpose infrastructure and professional-grade financial infrastructure are not optimized for the same outcome.

General-purpose design values composability and inclusivity.

Professional trading infrastructure values determinism and consistency under load.

You can build something that serves both — but optimizing fully for both is far harder than most people admit.

That’s where Fogo’s positioning becomes interesting.

Instead of competing directly with every Layer-1 on every metric, Fogo narrows its focus. It leans into the idea of being purpose-built for serious on-chain trading environments. That means architectural decisions guided less by marketing and more by execution quality. It means thinking about validator performance, latency, infrastructure placement, and predictable throughput as core features rather than side benefits.

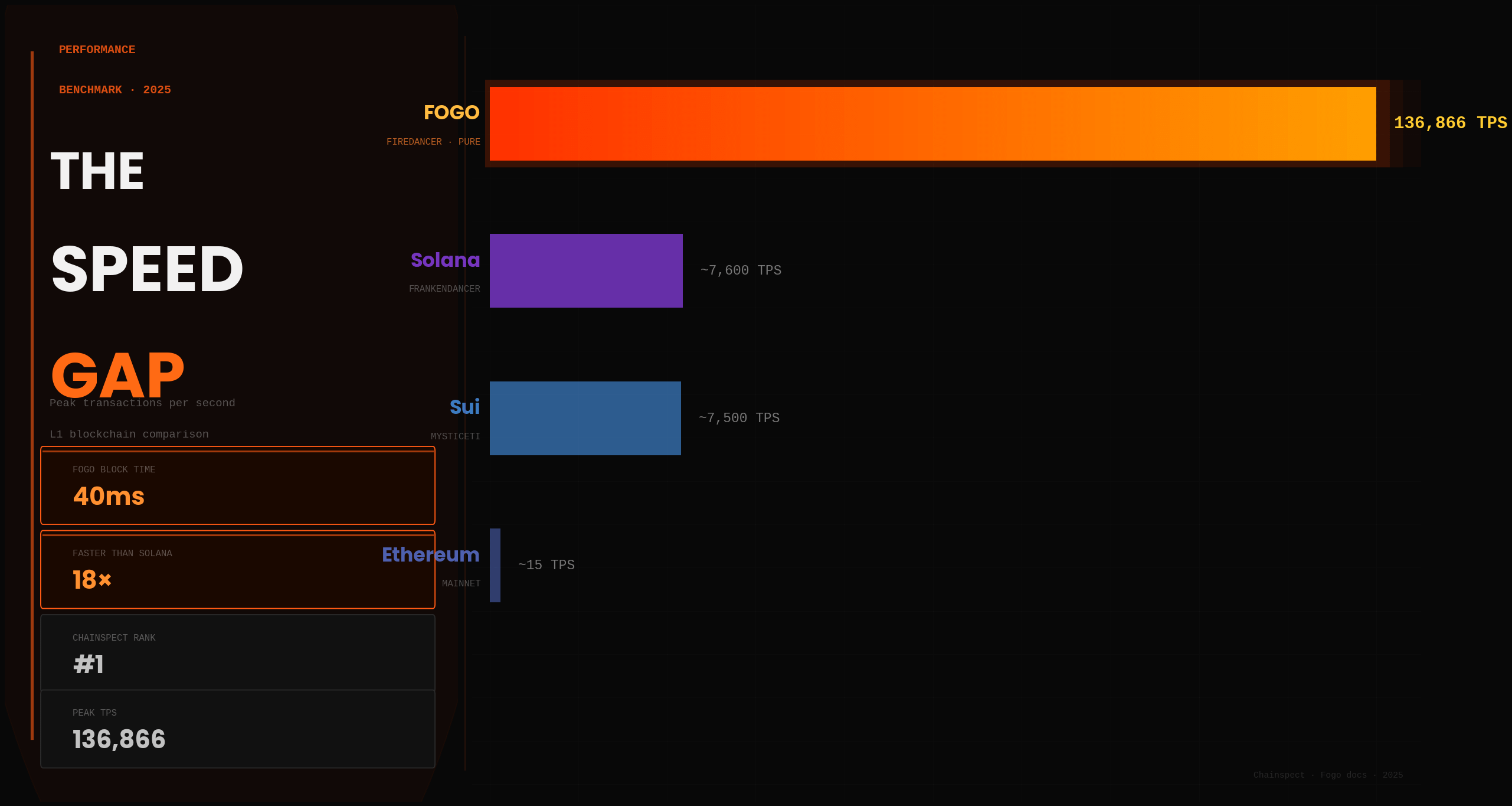

This specialization is strategic.

Crypto is full of horizontal expansion — chains trying to widen their scope. Fogo is making a vertical bet instead. It is attempting to dominate a specific workload: high-performance financial execution.

That decision comes with trade-offs.

A focused chain risks limiting its addressable market in the short term. Not every user needs millisecond-level determinism. Not every application requires exchange-grade reliability. A network optimized for serious traders may not feel as culturally broad as chains designed for mass experimentation.

But specialization can also create defensibility.

If institutional capital continues moving on-chain, if DeFi primitives become more complex, if professional traders demand infrastructure that behaves closer to traditional financial systems, then the value of purpose-built design increases dramatically.

And this is where the bet sharpens.

Fogo is not solving a problem that already has a line of customers waiting outside. It is anticipating a shift — that the limitations of shared, general-purpose block space will become more visible as on-chain markets mature.

The question isn’t whether the execution gap exists. Anyone who has traded seriously on-chain has felt it.

The question is whether that gap grows large enough — and persistent enough — to justify a chain architected specifically to close it.

That’s a forward-looking thesis.

At the same time, Fogo is not ignoring ecosystem layering. Infrastructure alone doesn’t create adoption. Social tools, staking mechanisms, and early DeFi primitives begin forming the economic surface of the network. Those components create internal alignment — users who stake, builders who deploy, liquidity that circulates instead of sitting idle.

But unlike many chains that lead with incentives and hope structure follows, Fogo appears to be sequencing deliberately: architecture first, ecosystem growth layered on top.

It doesn’t look like a chain trying to dominate headlines.

It looks like a chain trying to reduce structural friction.

That distinction matters.

In crypto, attention is easy to manufacture. Sustainability is not. Networks that optimize for early spectacle often struggle when incentives normalize. Networks that optimize for execution quality may grow slower — but can compound more predictably if their target market matures.

Fogo’s real differentiation is discipline.

It is saying no to being everything, and yes to being precisely engineered for a specific class of user.

Whether that focus becomes a moat or a constraint depends on how fast professional on-chain trading evolves over the next few years. If general-purpose chains close the execution gap quickly, specialization narrows. If they cannot, then purpose-built infrastructure becomes increasingly attractive.

For now, Fogo occupies a rare strategic position in a crowded landscape: it is not trying to expand horizontally across narratives. It is trying to solve a vertical inefficiency that many traders quietly accept as unavoidable.

If that inefficiency turns out to be structural — not temporary — then Fogo isn’t just another new chain.

It’s an answer to a problem most of the market hasn’t fully acknowledged yet.

And in crypto, the projects that win long term are often the ones that identified the real bottleneck before everyone else did.