On-chain trading is no longer niche. Liquidity is deepening. Strategies are getting sharper. Volatility cycles are accelerating. The real question isn’t whether on-chain activity will grow — it’s what happens when it explodes.

When volume multiplies, infrastructure becomes the battlefield.

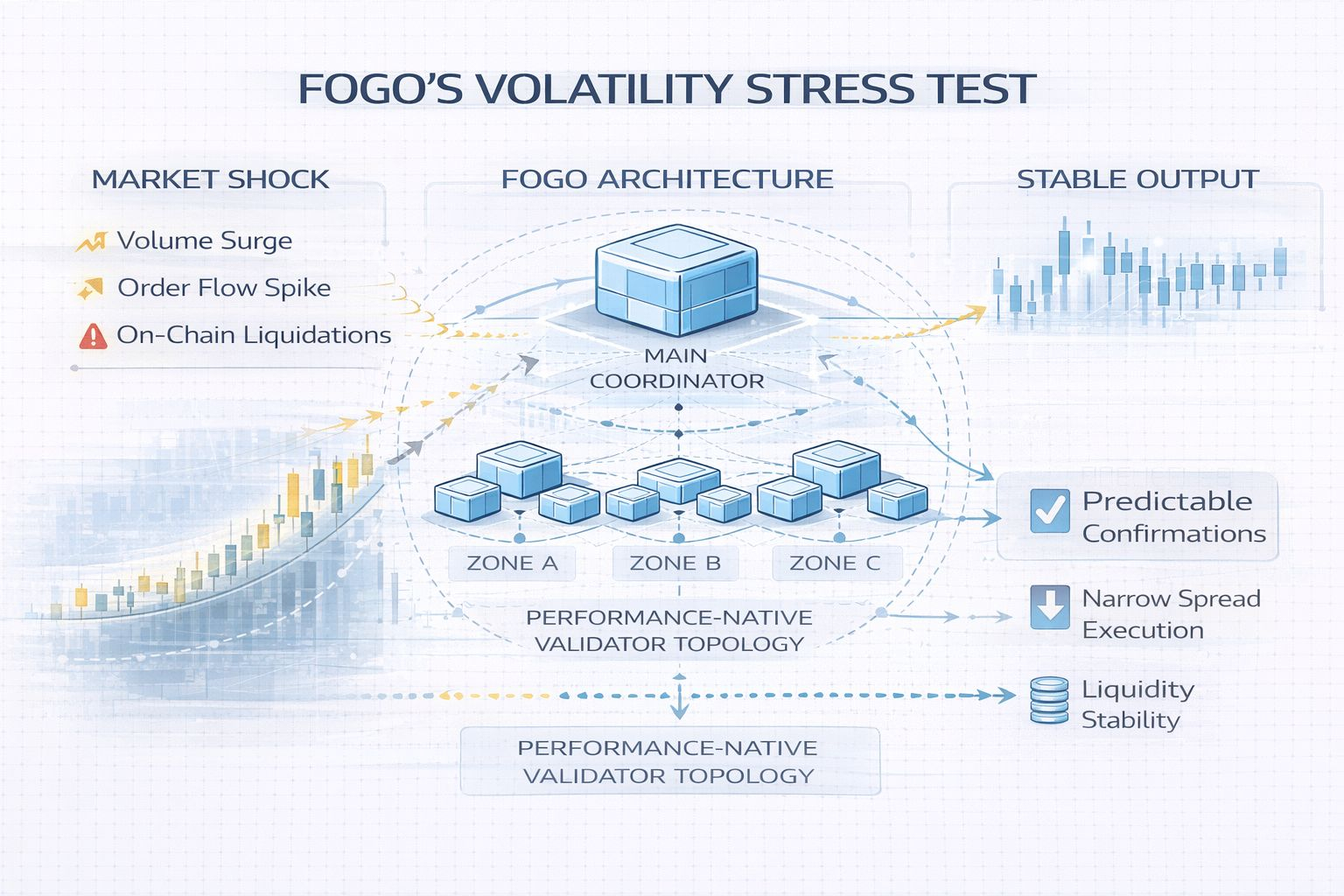

Most general-purpose chains were built for ecosystem diversity. That works in calm conditions. But when volatility spikes and order flow surges, execution quality starts separating networks. Latency variance increases. Confirmation times fluctuate. Slippage widens. Market makers pull back.

And that’s when infrastructure design matters most.

If on-chain trading reaches institutional intensity, the winning chain won’t be the one with the loudest narrative — it will be the one delivering predictable execution under stress.

That’s where FOGO enters the conversation.

FOGO is positioning itself as performance-native infrastructure, not just another Layer 1 competing for ecosystem size. By emphasizing reduced latency variance and optimized validator topology, the network targets something critical for professional traders: consistency.

In high-frequency environments, milliseconds matter. But even more important is predictability. Stable confirmation times allow tighter spreads. Tighter spreads improve liquidity efficiency. Efficient liquidity attracts more sophisticated strategies. A performance loop begins.

When infrastructure holds up under load, capital follows.

If the next wave of DeFi brings more algorithmic trading, deeper derivatives markets, and institutional-grade participation, performance specialization could become a structural advantage.

The future of on-chain trading may not be decided by who has the most apps — but by who can execute without distortion when it matters most.

FOGO is building for that scenario.

Follow @Fogo Official to monitor developments, and keep an eye on how $FOGO positions itself as performance competition intensifies. #FOGO