The blockchain space doesn’t suffer from a lack of Layer-1 networks. Every year, new chains launch promising higher TPS, lower fees, and better scalability.

But the real question is:

Is raw performance the real bottleneck — or is it user experience and market structure?

This is where Fogo positions itself differently.

Fogo is not just trying to be another fast chain. It is attempting to rethink how on-chain markets feel, function, and scale.

What Fogo Actually Is

Fogo is a high-performance Layer-1 blockchain built on the Solana Virtual Machine (SVM).

Instead of creating a brand-new execution environment from scratch, Fogo leverages a battle-tested architecture and optimizes it for:

Ultra-low latency

High-throughput trading environments

On-chain financial applications

This starting position matters. Most new Layer-1s begin with empty ecosystems and unproven infrastructure. Fogo begins with an execution model that developers already understand.

But the real thesis of Fogo is deeper than performance metrics.

It revolves around three pillars:

Latency as competitive edge

Seamless user access

Fairer token distribution

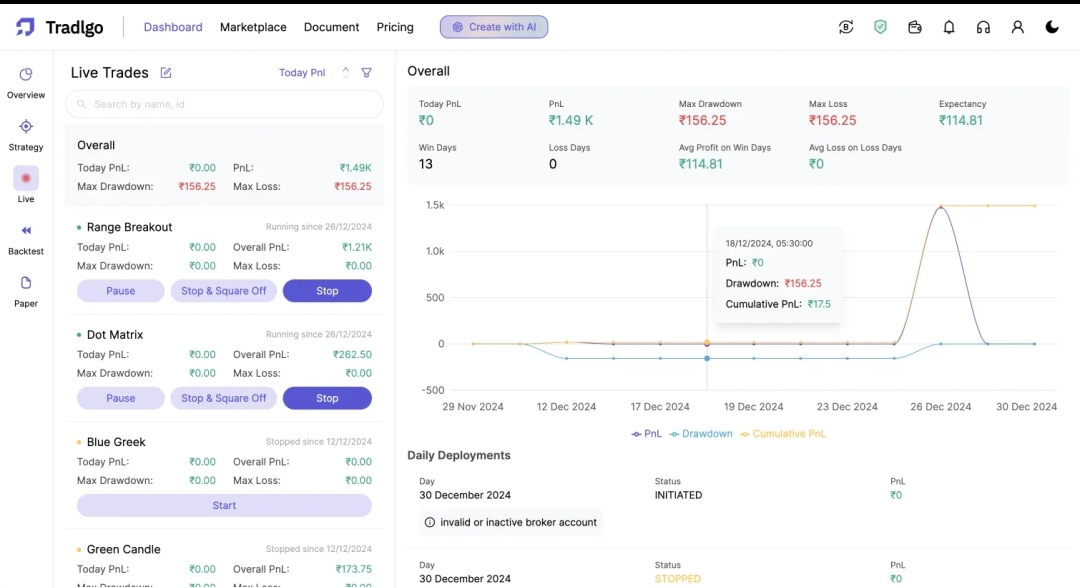

1. Latency Is Not a Metric — It’s Market Power

In financial markets, milliseconds matter.

The faster an order is executed, the lower the slippage.

The lower the slippage, the more efficient the market.

The more efficient the market, the more capital it attracts.

Fogo’s core idea is simple:

Reduce latency → Improve execution → Strengthen market efficiency.

This makes the network particularly aligned with:

On-chain order books

DeFi trading protocols

High-frequency strategies

Real-time financial applications

Instead of marketing speed for branding, Fogo frames latency as structural infrastructure.

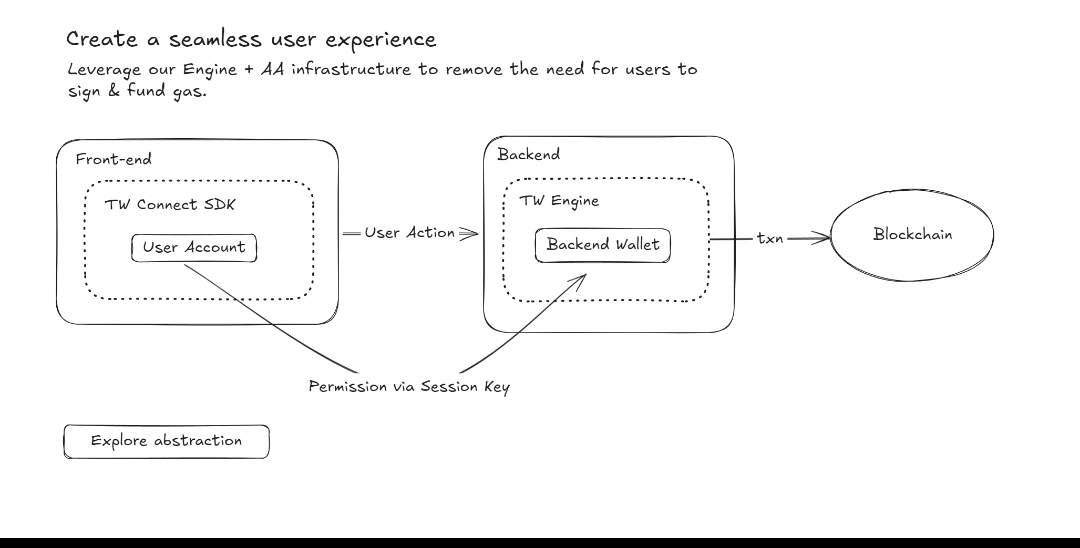

2. One-Click Access: Making Web3 Feel Like Web2

One of crypto’s biggest problems isn’t gas fees.

It’s friction.

Constant wallet popups

Repeated transaction approvals

Switching between dApps with manual confirmations

For mainstream users, this experience is exhausting.

To solve this, Fogo introduced:

Fogo Sessions

Fogo Sessions function like a blockchain-native single sign-on system.

How it works:

A user connects their wallet once.

They approve a session key (limited permission).

They can interact with multiple apps without repeatedly signing every action.

Think of it like logging in with Google once — and then navigating different apps without re-entering your password.

If implemented effectively, this could significantly reduce Web3 friction while maintaining self-custody.

And that’s a powerful shift.

3. The Cancellation of the “Easy Money” Presale

Most new Layer-1 projects follow a predictable launch model:

High fully diluted valuations

Large private allocations

VC-heavy token distribution

Public hype after insiders are positioned

Fogo initially planned a token presale at a premium valuation.

Then it canceled it.

Instead of raising fast capital, the team pivoted toward:

Community-oriented distribution

Engagement-based rewards

Airdrop allocation

This move signaled something important:

Long-term alignment over short-term fundraising.

In a space often criticized for extractive token launches, canceling a presale is not a small decision. It reframes the narrative from capital extraction to ecosystem building.

Whether this strategy works will depend on execution but the signal matters.

4. Fogo as an Experience Layer for On-Chain Markets

When you combine:

Ultra-low latency

Seamless session-based UX

Fairer distribution models

You start to see Fogo not just as infrastructure — but as a performance-optimized environment for digital markets.

Its potential advantage isn’t just speed.

It’s coordination between:

Execution performance

User onboarding simplicity

Market structure fairness

That alignment could attract:

Advanced DeFi builders

Trading protocol developers

Liquidity providers

UX-focused Web3 applications

The Critical Question

Every Layer-1 claims differentiation.

The real test is not architecture diagrams.

The real test is:

Developer adoption

Real liquidity

Active users

Sustainable ecosystem growth

Fogo’s thesis is ambitious:

Speed matters.

Fairness matters.

User experience matters most.

If it can deliver on all three simultaneously, it could meaningfully improve how on-chain markets function.

If not, it risks becoming just another high-performance chain in an already crowded landscape.

Final Thought

Fogo is not just building a blockchain.

It’s experimenting with a different idea:

Reducing friction — technically, economically, and experientially.

And in Web3, friction is often the invisible wall between potential and adoption.

If Fogo succeeds, it won’t be because it was faster.

It will be because it made decentralized markets feel seamless.