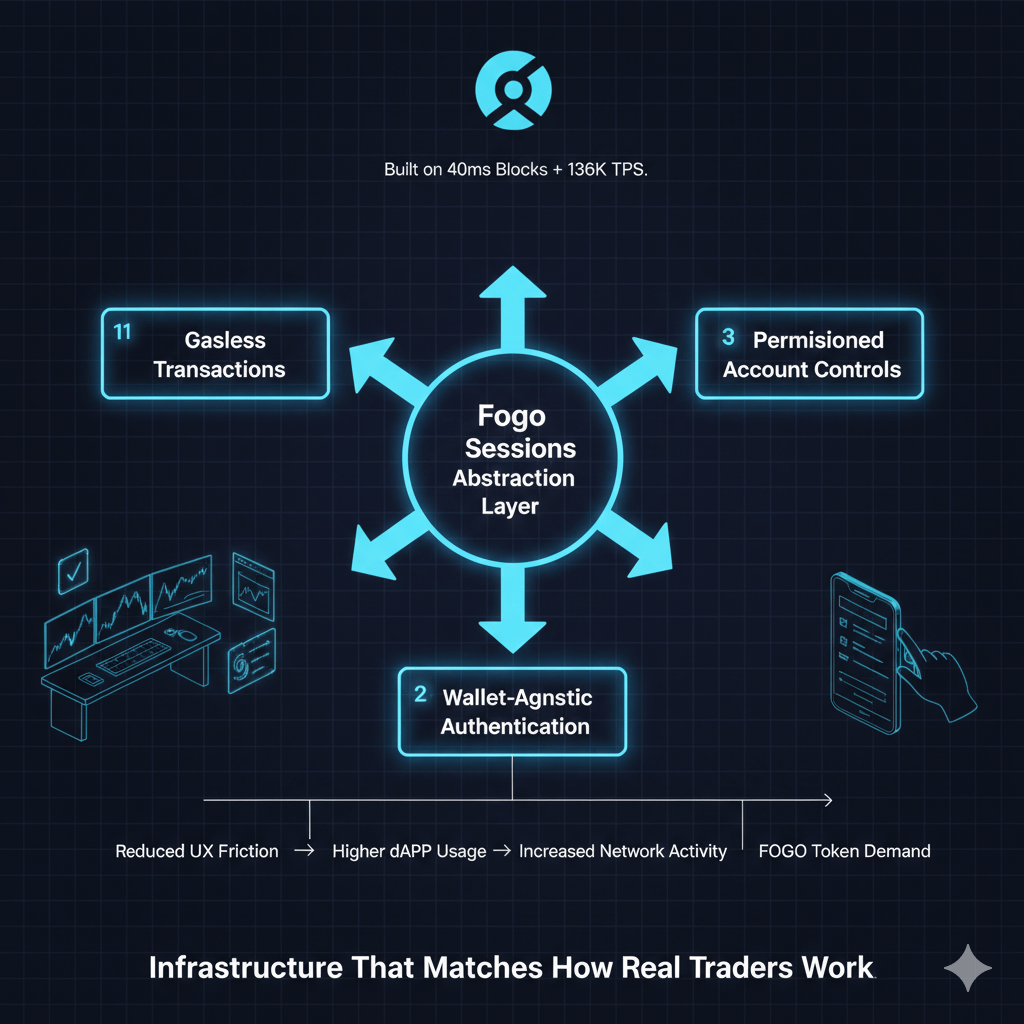

Account abstraction. Gasless transactions. Wallet-agnostic trading. If your eyes just glazed over reading those terms, I don't blame you. They sound like boring technical jargon that only developers care about. But here's the reality — these features might be the most important thing Fogo built, and almost nobody is paying attention to them.

Let me explain why Fogo Sessions could actually matter more than the 40-millisecond block times everyone keeps obsessing over.

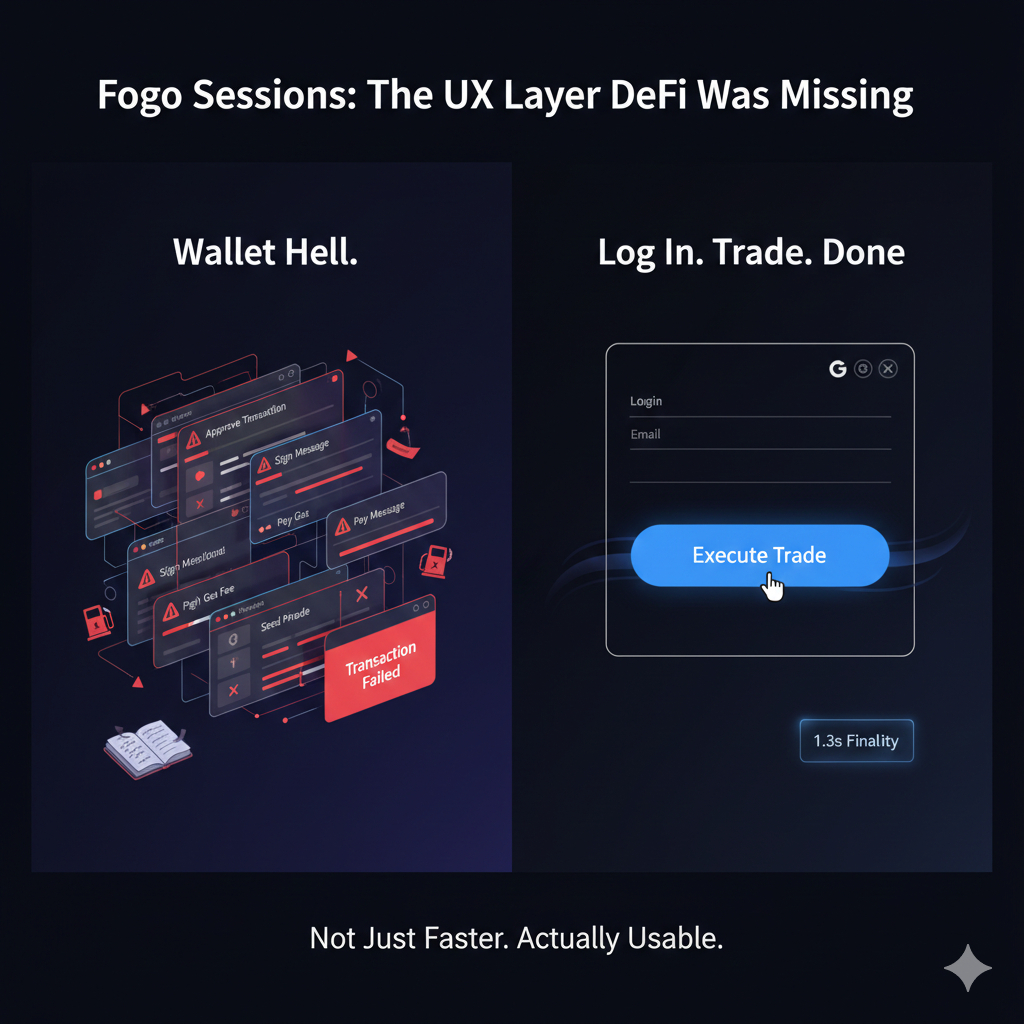

The Wallet Problem Is Destroying DeFi Adoption

I've watched countless people try to use DeFi for the first time. Smart people. Finance professionals. Tech-savvy individuals. And I've watched nearly all of them struggle with the same basic hurdle: wallet management is an absolute nightmare.

Download MetaMask. Write down twelve random words. Don't lose those words or your money disappears forever. Now buy some ETH for gas. Wait, you need to send it to your wallet first. Approve this transaction. Sign this message. Pay gas for the approval. Now pay gas for the actual transaction. Oh, the transaction failed? You still paid gas. Try again.

It's genuinely terrible UX. And this isn't just me complaining — this is the number one barrier preventing mainstream adoption of DeFi. Normal people aren't going to jump through these hoops to trade on a DEX when they can just open Coinbase and click a button.

Fogo Sessions eliminates almost all of that friction. Users can interact with dApps on Fogo without managing private keys, without buying tokens for gas, without the approval hell that makes Ethereum DeFi so painful. It's account abstraction done right, and it changes everything about how accessible DeFi can be.

How Fogo Sessions Actually Works

The technical implementation is clever. Instead of every user needing to maintain their own wallet with gas tokens, Fogo Sessions creates an abstraction layer. Users authenticate once — could be email, could be social login, could be traditional credentials — and then interact with applications without friction.

Behind the scenes, gas fees are still being paid. Transactions still need to be signed. But all of that complexity is abstracted away from the user experience. From their perspective, they just log in and trade. Like using any normal web application.

The "gasless" aspect doesn't mean gas disappears — someone's still paying for computational resources. But it might be the dApp itself covering gas costs, or it might be bundled into trading fees, or handled through various other mechanisms. The key is that users don't have to think about it.

For institutional traders especially, this is massive. Imagine trying to explain to a Wall Street portfolio manager that they need to maintain custody of a seed phrase and keep enough FOGO tokens in their wallet for gas. They'll look at you like you're insane. These people are used to Bloomberg terminals and FIX protocol connections. They want to log in and execute trades, not become cryptocurrency custody experts.

Fogo Sessions gives them that experience.

The Single Sign-In Breakthrough

What really sets Fogo Sessions apart is the wallet-agnostic aspect. Users don't even need a specific wallet. They can authenticate through multiple methods and the system just works.

This might sound minor, but think about the current DeFi landscape. Every protocol has slightly different wallet support. Some work with MetaMask but not Phantom. Others support Coinbase Wallet but not Trust Wallet. Users end up maintaining multiple wallets with funds fragmented across them, each one requiring separate management and security considerations.

Fogo Sessions lets users authenticate once and access any application in the ecosystem. One login. One account. Everything works. That's how normal software should function, and it's absolutely not how DeFi currently works.

The security model is also more flexible. Power users who want self-custody can still use traditional wallets. But normies who just want to trade can use simpler authentication methods with optional recovery mechanisms. Different security models for different risk tolerances, rather than forcing everyone into the same difficult self-custody paradigm.

Why This Matters for Institutional Adoption

The dirty secret of crypto is that institutions aren't coming to DeFi because the UX is prohibitively bad. It's not about regulations or trust — though those matter too — it's that the actual experience of using DeFi infrastructure is incompatible with institutional workflows.

Trading desks have compliance requirements. They need audit trails. They need permission systems where junior traders can execute but not withdraw. They need multi-signature approvals for large transactions. They need integration with existing risk management systems.

None of that works with the standard "here's your seed phrase, good luck" wallet model. It's a non-starter for institutional capital.

Fogo Sessions enables the kind of account management and access controls that institutions require. You can build permission systems on top of it. You can integrate with existing compliance infrastructure. You can create workflows that match how institutional trading actually functions.

That's the unlock for getting serious capital into DeFi. Not another high TPS blockchain. Not another DEX clone. Infrastructure that actually matches how professional traders work.

The Developer Experience Advantage

From a developer perspective, Fogo Sessions is also brilliant because it removes a massive barrier to building consumer-facing DeFi applications.

Every developer building on Ethereum or other chains has to solve the wallet onboarding problem themselves. They need to integrate multiple wallet providers. They need to handle gas estimation and failures. They need to build UI for all the transaction signing and approvals. It's a huge amount of work that has nothing to do with your actual application logic.

Fogo Sessions handles all of that. Developers can build applications assuming users are authenticated and can execute transactions seamlessly. The complexity is abstracted away, letting developers focus on building good products rather than wrestling with blockchain UX problems.

This is how you get better applications. When developers aren't spending 40% of their time solving wallet integration issues, they can spend that effort on features and user experience. The applications built on Fogo should be noticeably better than equivalent apps on other chains, purely because developers have more bandwidth to focus on what matters.

Real-World Usage Examples

Let's make this concrete. Say you want to trade on Valiant DEX, the main trading platform on Fogo. Without Sessions, the flow looks like this: install wallet, get FOGO tokens, connect wallet to DEX, approve token spending, execute trade, sign transaction, pay gas. Multiple steps with multiple failure points.

With Fogo Sessions: log in, execute trade. That's it. Two steps. The system handles everything else.

Or consider lending protocols like Pyron or Fogolend. Normally you'd need to approve the protocol to access your tokens, then execute the deposit, then claim rewards, each step requiring gas and signatures. With Sessions, you just interact with the protocol naturally and everything happens in the background.

These might seem like small improvements, but they're the difference between DeFi feeling like experimental tech that only crypto natives can use versus feeling like actual financial software that normal people can adopt.

The Competition Doesn't Have This

What's interesting is how far ahead Fogo is on this dimension. Most blockchains are still arguing about whether account abstraction is even a good idea. The few that have implemented it have done so in limited ways that don't really solve the UX problems.

Fogo shipped with Sessions functional on day one. It's not a future roadmap item or a testnet experiment. It's production-ready infrastructure that applications can build on right now.

That first-mover advantage matters. As the Fogo ecosystem grows, every application built on it will benefit from Sessions. Users will get used to the seamless experience. And competing chains will be stuck with the old painful wallet paradigm, trying to convince users to go back to managing seed phrases and gas fees.

The Security Trade-Offs

Now, I need to acknowledge the elephant in the room: abstracting away private key management introduces new trust assumptions. If users aren't directly controlling their keys, someone or something else is managing that security on their behalf.

Fogo Sessions handles this through various mechanisms depending on implementation — could be multi-party computation, could be smart contract wallets, could be trusted execution environments. The specifics matter, and users should understand the security model of whichever method they're using.

But here's my take: the current DeFi security model is terrible for 99% of users. Forcing everyone to maintain perfect operational security with seed phrases they don't understand just results in tons of lost funds and scared-away users. For most people, a well-designed abstraction layer is probably more secure than trying to self-custody.

Power users who want maximum security can still use traditional wallet setups. But giving normal users a safer, easier option is good for adoption.

What This Means for FOGO Token Value

From a tokenomics perspective, Fogo Sessions is interesting because it should drive higher transaction volume on the network. When the friction to interact with dApps drops dramatically, usage increases. More usage means more gas consumption, which means more demand for FOGO tokens.

The current FOGO price around $0.02-0.037 doesn't fully reflect the value proposition of Sessions yet, probably because most people still don't understand what it enables. But as applications launch that take full advantage of the feature, as institutional traders start using Fogo infrastructure because of the superior UX, the utility value should become more obvious.

I'm not making price predictions — crypto markets are irrational and unpredictable. But from a fundamental value perspective, Sessions is the kind of feature that should drive real, sustained demand for the underlying token.