Most people don’t think about where the money inside a system actually comes from. They look at price. They look at charts. Maybe volume. Very few stop and ask a quieter question: who is paying to use this thing, and why?

I’ve been watching projects for a while now, and one pattern keeps repeating. When there’s no real economic activity underneath, the excitement feels loud but hollow. It moves fast, then fades. With and its token , the conversation usually centers on listings, partnerships, future roadmaps. Fair enough. But ecosystem revenue is the part that tells you whether the engine is actually running.

Revenue sounds boring in crypto. It shouldn’t. It simply means someone, somewhere, is paying to use the network. That could be transaction fees, marketplace fees, payments for smart assets. Smart assets, by the way, are digital items with built-in logic with rules written directly into them. so they behave a certain way without a central company controlling them. If people are trading or upgrading those assets regularly, that creates economic flow. Not speculative flow. Real usage.

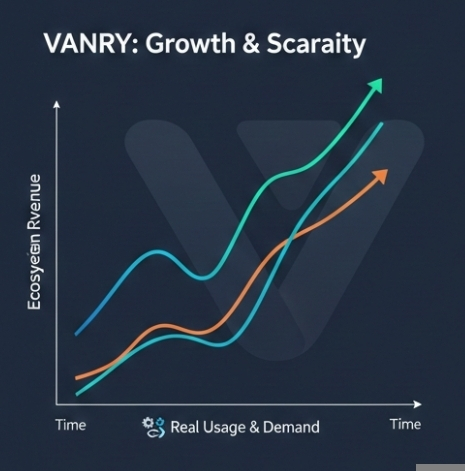

Here’s where it gets interesting. Revenue alone doesn’t automatically lift a token’s valuation. The connection depends on design. If VANRY is required to pay fees or interact with applications, then usage creates demand. That part is straightforward. But if revenue collects somewhere that doesn’t touch token supply or token utility, the relationship weakens. I’ve seen networks brag about impressive revenue numbers while the token quietly drifts sideways because holders can’t see how it benefits them.

And then there’s supply. Token inflation is one of those topics people skim past. If new tokens keep entering circulation faster than ecosystem revenue grows, pressure builds. It’s simple math, even if the dashboards make it look complicated. On the other hand, if revenue grows while supply remains predictable, the narrative shifts. It becomes easier to model future value. Investors, especially larger ones, prefer things they can model. Not perfectly. Just reasonably.

There’s also a psychological shift when revenue becomes part of the story. Markets treat revenue differently from promises. When a network generates consistent income, people start comparing it but sometimes unfairly to traditional businesses. They talk about multiples. They look at growth rates. It anchors discussions that would otherwise float around pure speculation. That doesn’t make crypto suddenly rational. It just gives it a reference point.

Still, I’m cautious about revenue spikes driven by incentives. I’ve watched ecosystems distribute rewards to stimulate activity, only to see that activity collapse once rewards shrink. The numbers look impressive in the short term. They even trend well on platforms like Binance Square, where visibility metrics amplify anything that feels like growth. But AI-driven ranking systems often reward engagement, not sustainability. If revenue announcements attract clicks but don’t reflect organic demand, valuation can become detached from reality.

At the same time, genuine revenue changes how developers think. Builders are pragmatic. If they see users spending money inside an ecosystem, they pay attention. Opportunity attracts talent. More applications create more reasons to hold and use VANRY. That’s the compounding effect people rarely quantify. It doesn’t show up immediately on price charts. It shows up months later when the network feels busier, more alive.

There’s a risk, though, in assuming revenue solves everything. Broader market cycles still dominate short-term price movements. Liquidity can disappear even from fundamentally strong networks. We’ve all seen solid projects dragged down during macro sell-offs. Ecosystem revenue can soften the fall, maybe. It can’t eliminate gravity.

What I find most telling is not the size of revenue but its source. If Vanar’s income aligns with its core idea, digital ownership, smart assets, programmable value and then the growth feels coherent. When revenue reflects the actual thesis of the ecosystem, it builds confidence quietly. When it comes from unrelated side activities, the valuation story becomes harder to defend.

In the end, valuation is part math, part belief. Revenue strengthens the math. It also strengthens belief, but only if people understand how it connects to the token itself. VANRY doesn’t need dramatic narratives. It needs visible, repeatable economic activity that ties back to token demand in a way holders can trace without mental gymnastics.

I don’t think ecosystem revenue guarantees anything. Crypto doesn’t work like that. But when money flows consistently through a network, not as speculation, but as payment for real use. it changes the tone of the entire discussion. And sometimes tone is what separates a temporary trend from something that actually lasts.