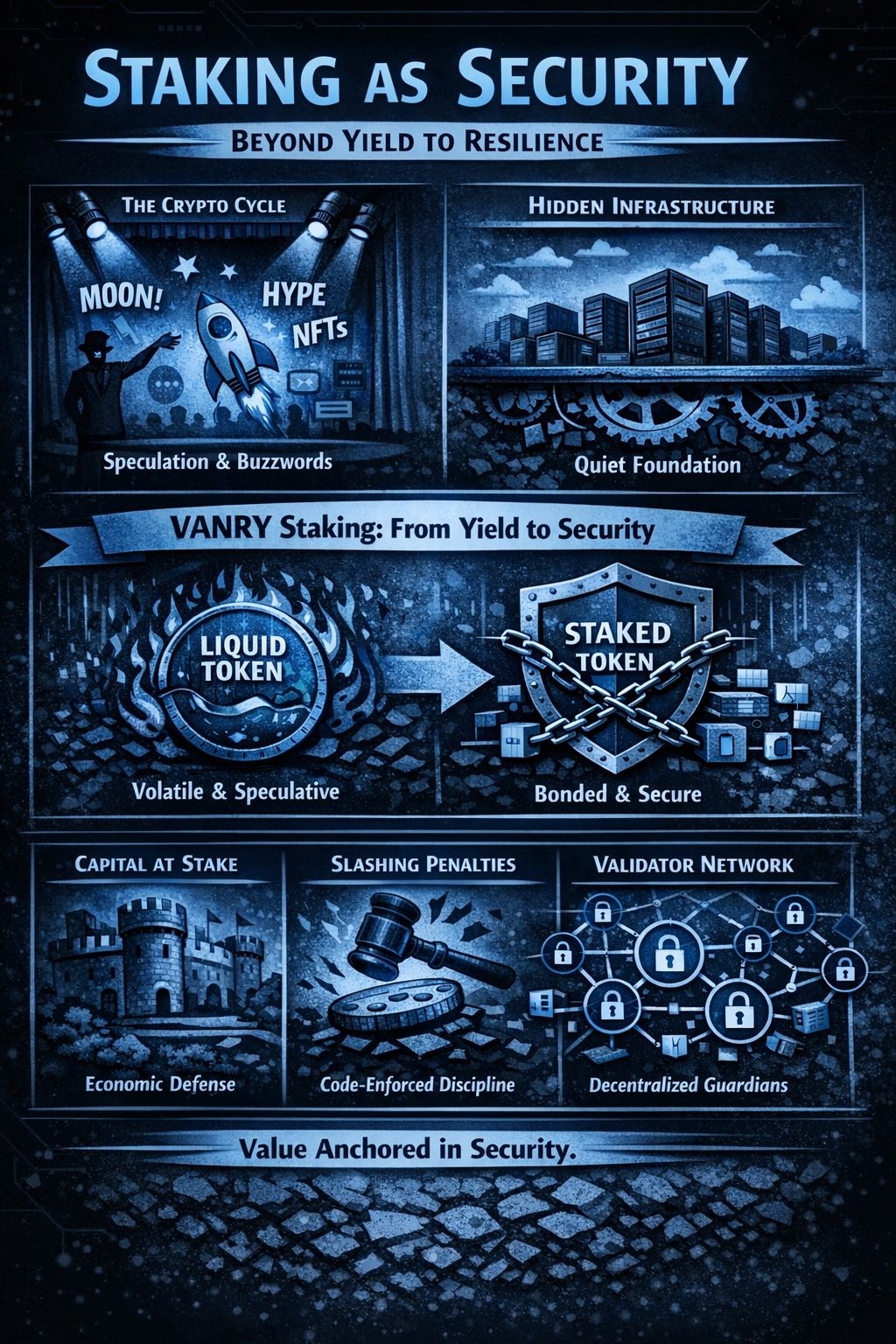

Every cycle in crypto repeats the same theater. First comes the exuberance, then the vocabulary,new acronyms, new primitives, new promises,and somewhere beneath the spectacle, the infrastructure quietly carries the weight.

Staking is one of those primitives that suffered from its own marketing. It entered public consciousness as yield. A percentage. A dashboard figure. A polite alternative to trading. But yield was always the least interesting thing about it.

Staking is not an income product.

It is a security model.

And in the case of VANRY, it is the structural shift that transforms a token economy into a self-defending network.

In speculative environments, utility is often mistaken for price appreciation. Tokens rise, narratives expand, and infrastructure is treated as a footnote. The assumption is that decentralization alone guarantees resilience.

It does not.

Security in distributed systems is not ideological—it is economic. The system is secure when attacking it is prohibitively expensive, irrational, or self-destructive. Staking operationalizes that logic.

Instead of outsourcing security to hardware or centralized operators, Proof-of-Stake networks embed it directly into the asset itself. Capital becomes collateral. Ownership becomes obligation.

VANRY embraces this shift fully.

A freely circulating token is liquid, expressive, and volatile. It reacts to sentiment. It chases momentum. It exits at the first sign of discomfort.

A staked token behaves differently.

When VANRY tokens are bonded to validators, they cease to be mere units of speculation. They become economic armor around the network. Bonded capital secures consensus. Delegated capital strengthens validator accountability. The asset is no longer just traded, it is deployed.

This is the core transformation:

Value does not merely sit on the network. It defends it.

The distinction sounds semantic.

In earlier blockchain architectures, security was external, miners, hardware, energy expenditure. In VANRY’s staking model, security is internalized. The network is secured by participants who have something to lose.

That changes incentives permanently.

A resilient network is one with gravity. The greater the economic mass bonded to consensus, the harder it is to destabilize.

Security here is not symbolic. It is measurable in capital at risk.

If someone wishes to attack the network, they must first become economically entangled with it. And in doing so, they expose themselves to loss.

Delegators enforce discipline through capital mobility.

The protocol enforces penalties automatically.

No negotiated apology.

Security is enforced by code and collateral.

There is a subtle tension embedded in staking systems: liquidity versus resilience.

Liquid tokens respond quickly to price signals. Staked tokens are immobilized. Markets prefer fluidity; infrastructure prefers commitment.

Circulating volatility decreases. The cost of hostile accumulation rises.

In other words, staking introduces inertia.

And inertia is not a flaw, it is a stabilizer. During periods of market stress, bonded capital cannot panic instantly. It cannot evaporate at the first rumor. It anchors the system when sentiment weakens.

Security moves deliberately.

Every credible security model requires consequences.

This is not a reputational penalty. It is a financial one.

The existence of slashing transforms validator incentives. Misbehavior is not merely discouraged, it is economically irrational.

In traditional finance, governance failures may result in investigations. In staking systems, they result in immediate capital destruction.

That directness is uncomfortable. It is also effective.

One of the more understated advantages of staking lies in governance alignment.

Governance ceases to be theatrical participation and becomes strategic stewardship.

Most discussions of network effects focus on users and developers. More applications lead to more adoption; more adoption leads to more value.

Users generate activity. Activity justifies further staking participation.

Security becomes recursive.

In VANRY’s case, staking is not merely a mechanism for rewards,it is a flywheel. Each additional staked token strengthens the conditions that justify further participation.

Growth anchored in security is slower than growth anchored in hype. It is also more durable.

The true test of a security model is not expansion.

Participation drops. Confidence erodes.

A robust staking economy resists that spiral because participants have bonded capital at risk. Leaving is not instantaneous. Misbehavior is penalized.

In VANRY’s model, resilience is embedded in the economics. Stakers who remain bonded during volatility stabilize the network precisely when it is most vulnerable.

Resilience here is not optimism.

It is structure.

There is an irony in how markets evaluate crypto networks. The loudest narratives command attention. The most disciplined architectures rarely do.

Staking is not theatrical. It does not produce dramatic headlines. It does not promise exponential transformation.

Community without capital alignment is sentimental. Security without economic consequence is aspirational.

Staking resolves these contradictions.

It converts ownership into responsibility.

It converts capital into collateral.

It converts participation into protection.

The most important shift staking introduces is philosophical as much as technical.

Before staking, token holders are external observers of the system’s security.

After staking, they are co authors of it.

Before staking, value floats around the network.

After staking, value anchors it.

The protocol does not rely on abstract goodwill or assumed decentralization. It relies on bonded incentives and enforceable penalties.

That distinction separates durable systems from temporary enthusiasm.

Crypto will continue to cycle through narratives, AI integrations, gaming expansions, tokenized everything. Some of those experiments will succeed. Many will fade. What endures is infrastructure that withstands stress.

VANRY’s staking model is not spectacular by design. It is disciplined. It embeds security into the token economy itself, ensuring that the network’s defenders are economically inseparable from its success.

In the long arc of distributed systems, resilience is rarely dramatic, it is simply the quiet result of incentives aligned with survival.