I spent years watching how high-frequency trading firms fight for every microsecond in traditional markets. In that world, speed is the only thing that separates a winning trade from a missed opportunity. When I looked at blockchain, I saw a massive gap. Most networks handle a few thousand transactions per second and call it a day. But traditional exchanges like NASDAQ process over 100,000 operations per second with almost zero delay. @Fogo Official is the first project I have seen that actually tries to close this gap by rebuilding the stack for institutional speed.

The Hidden Cost of Network Distance

Most people think blockchain slowness comes from the code alone. They forget about physics. If validators are spread across the globe, the time it takes for a signal to travel between them creates a floor for how fast the network can confirm a trade. This is the non-obvious problem Fogo tackles. While other chains celebrate having nodes in every corner of the earth, they ignore the fact that this distance kills real-time performance. For a decentralized order book or a liquidation engine to work like a centralized one, you need to solve for the physical limits of the network.

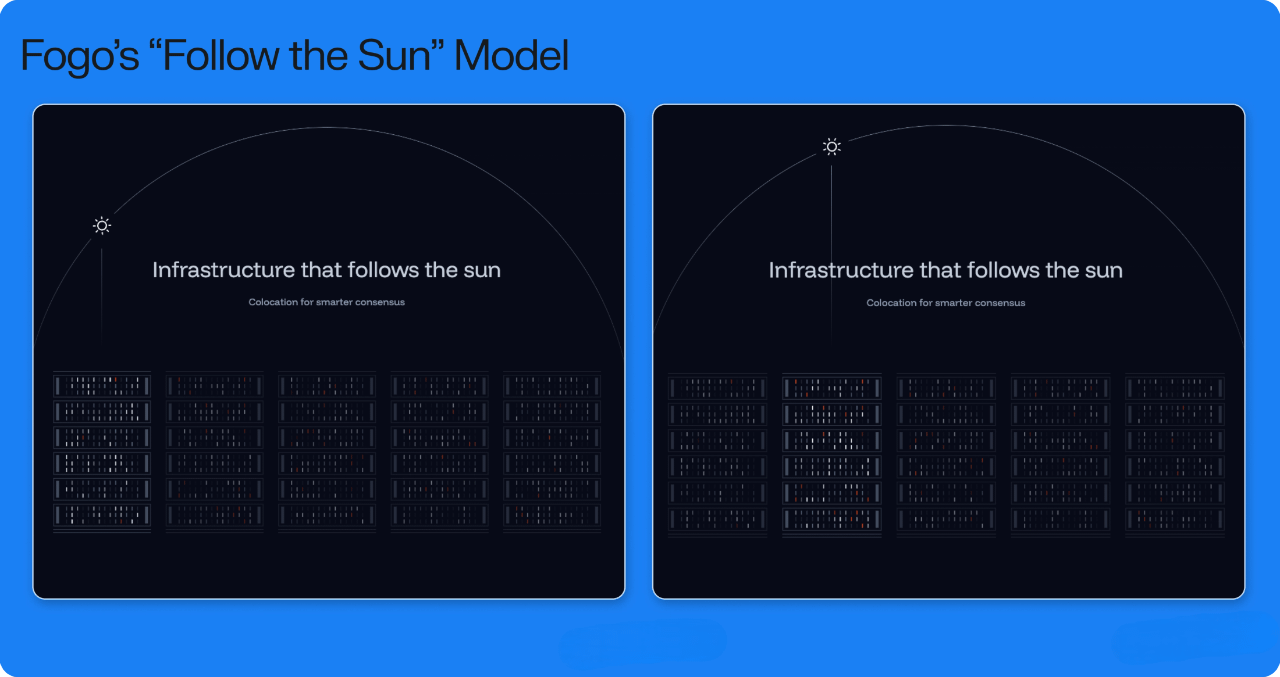

Moving Consensus with the Sun

Fogo uses a mechanism called multi-local consensus with dynamic co-location. It is a clever setup inspired by the follow the sun model used in global finance. Instead of forcing every validator to talk to every other validator across the ocean for every block, Fogo allows validators to group together in specific zones. These zones can move from Asia to Europe to North America as trading activity follows the global clock.

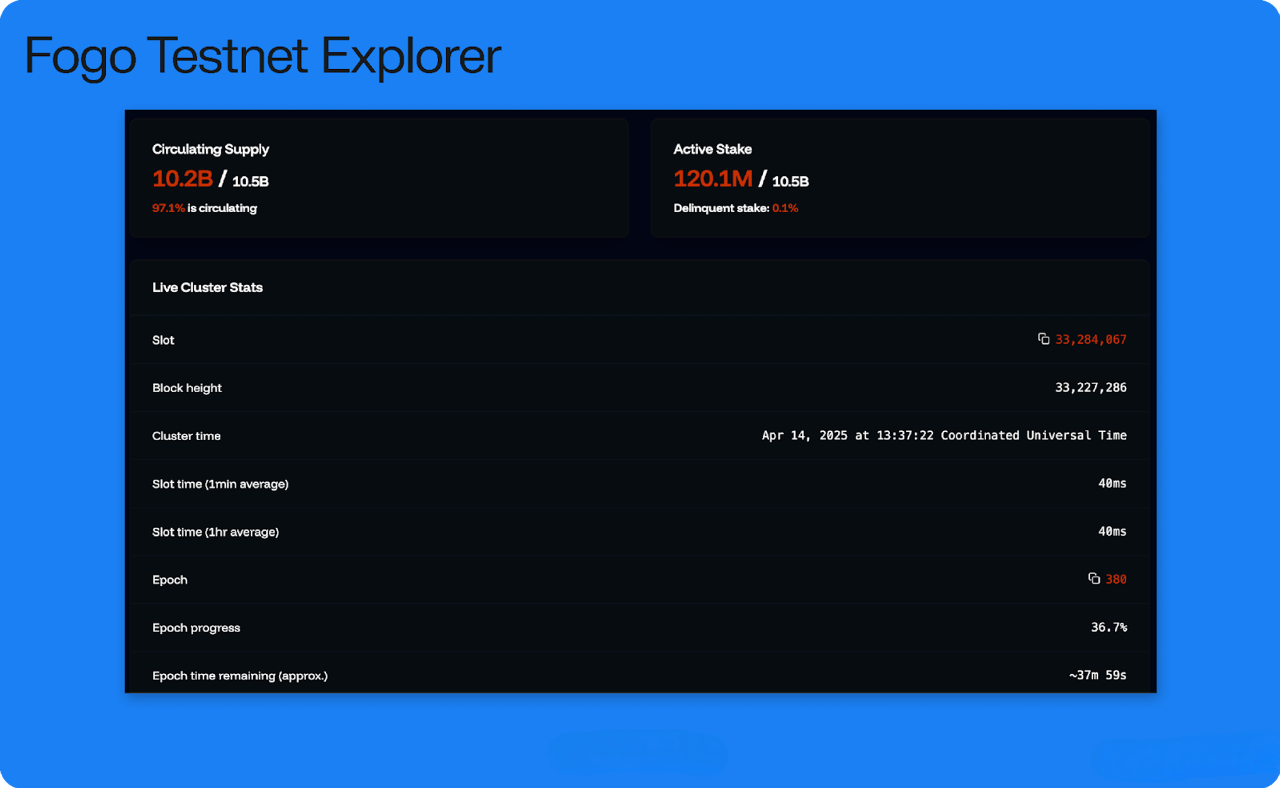

The network runs on the Solana Virtual Machine (SVM) but uses a single, highly optimized client called Firedancer. By sticking to one canonical client instead of encouraging diversity, Fogo ensures the network moves at the speed of the fastest participant rather than being dragged down by the slowest. This setup has already shown 40-millisecond block times on the mainnet, which is a massive jump from what we usually see in crypto.

Choosing Performance Over Pure Variety

The biggest tradeoff here is the move away from client diversity. Most blockchains want many different software versions running the network to prevent a single bug from taking everything down. Fogo takes the opposite path. It bets everything on Firedancer to reach performance levels that are otherwise impossible.

Another tradeoff is the curated validator set. Fogo started with a smaller group of 19 to 30 approved validators to ensure everyone has the hardware and bandwidth to keep up. It is a more controlled environment than a permissionless chain where anyone can run a node on a laptop, but it is the only way to guarantee the sub-40ms speeds that institutional traders need.

How to Track Real Progress

If you want to see if Fogo is actually winning, do not just look at the token price on Binance. Watch the slot times on the explorer. During the testnet phase, the network maintained a steady 40ms average even under load. You should also watch how many high-frequency trading dApps, like the Valiant DEX or Pyron lending, are actually moving volume. The real test is whether these protocols can handle liquidations during high volatility without the network lagging or fees spiking.

Bottom Line

Fogo is not trying to be a general-purpose chain for everything. It is a specialized tool built by people who understand that institutional finance requires a different set of rules. By prioritizing physical co-location and a single high-performance client, it offers a glimpse of what a digital Wall Street looks like when it finally moves on-chain. It is a bold bet on performance maximalism that finally brings the speed of traditional markets to the world of decentralized settlement.