📰 Daily Market Update:

Stablecoins are the lifeblood of crypto markets — they fuel buying, signal sentiment, and often hint at what’s coming next.

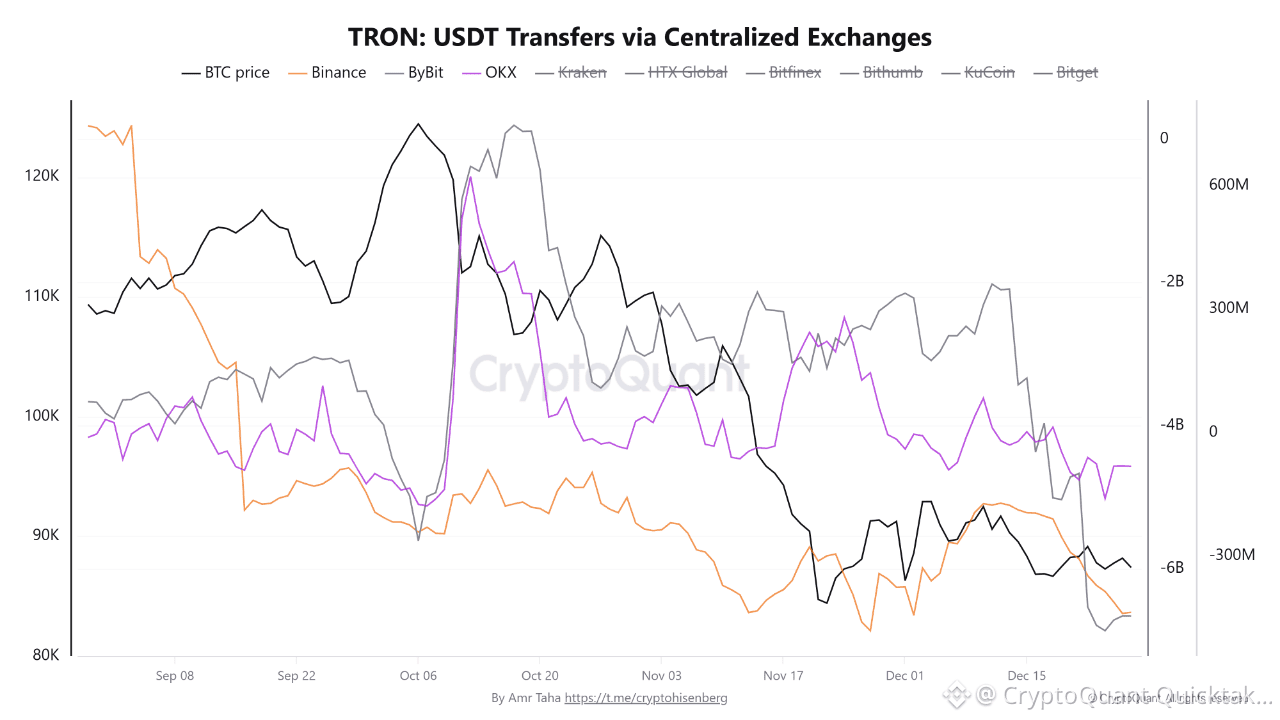

📊 TRON: USDT Transfers via Centralized Exchanges

* This chart tracks USDT transfers on the TRON (TRC20) network across major centralized exchanges.

* When USDT balances on exchanges are rising , this usually means buying power is ready, which is positive for BTC and the market overall.

* When USDT balances are falling , it signals liquidity leaving the market, either being withdrawn to cold wallets or rotated away after spot selling. This is usually bearish or at least shows weak demand.

⚠️ It’s important to note that TRON network is heavily used for USDT withdrawals, especially after:

* Bitcoin spot selling

* Partial exits

* Risk reduction phases

🔍 Key observation:

Starting from December 10, USDT balances on Binance, Bybit, and OKX have been declining clearly on the TRON network only, which strongly suggests capital outflows rather than preparation for buying.

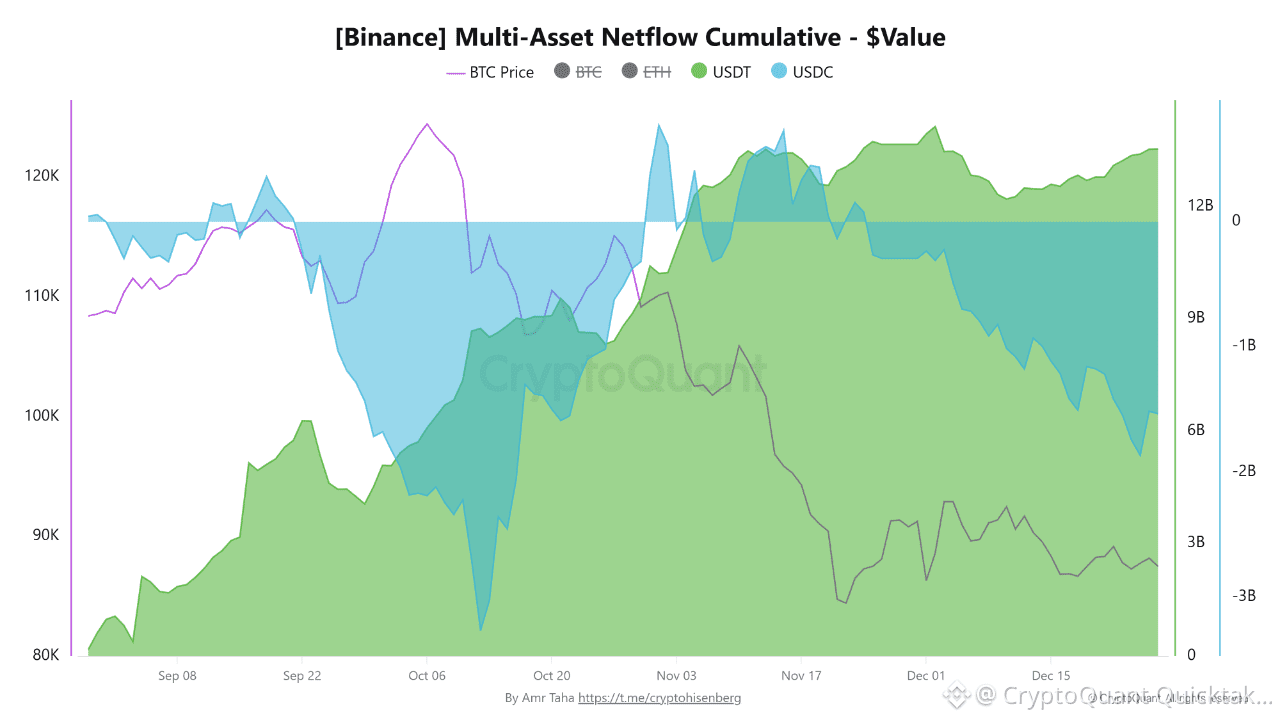

📊 [Binance] Multi-Asset Netflow Cumulative – $Value

This chart shows the cumulative netflow of multiple assets on Binance, mainly USDT and USDC.

* USDT balances on Binance have been steadily increasing since September, reaching around $13.5B.

* On the other side, USDC balances dropped by roughly $2B

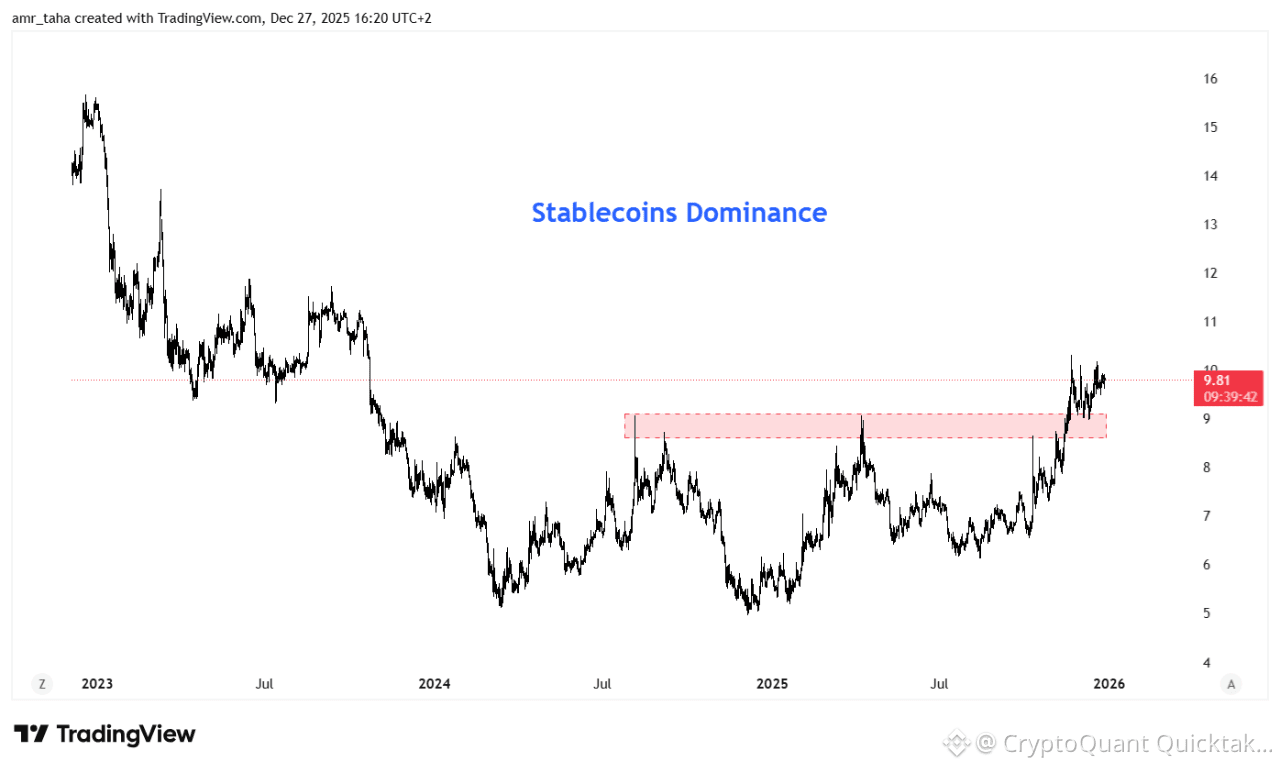

📊 Stablecoins Dominance

The Stablecoins Dominance chart measures the percentage of stablecoins compared to the total crypto market.

* Rising dominance → more selling than buying

* Falling dominance → capital rotating into crypto assets

📌 Since mid-November, stablecoins dominance has broken above 9% and stayed stable above this level.

This tells us something very clear:

* Selling pressure is still present

* Buyers are not stepping in aggressively yet

* Market participants prefer staying liquid and cautious

🧠 Conclusion

Monitoring stablecoin inflows and outflows gives a very deep insight into what the market is really doing, not what price alone is showing.

Written by Amr Taha