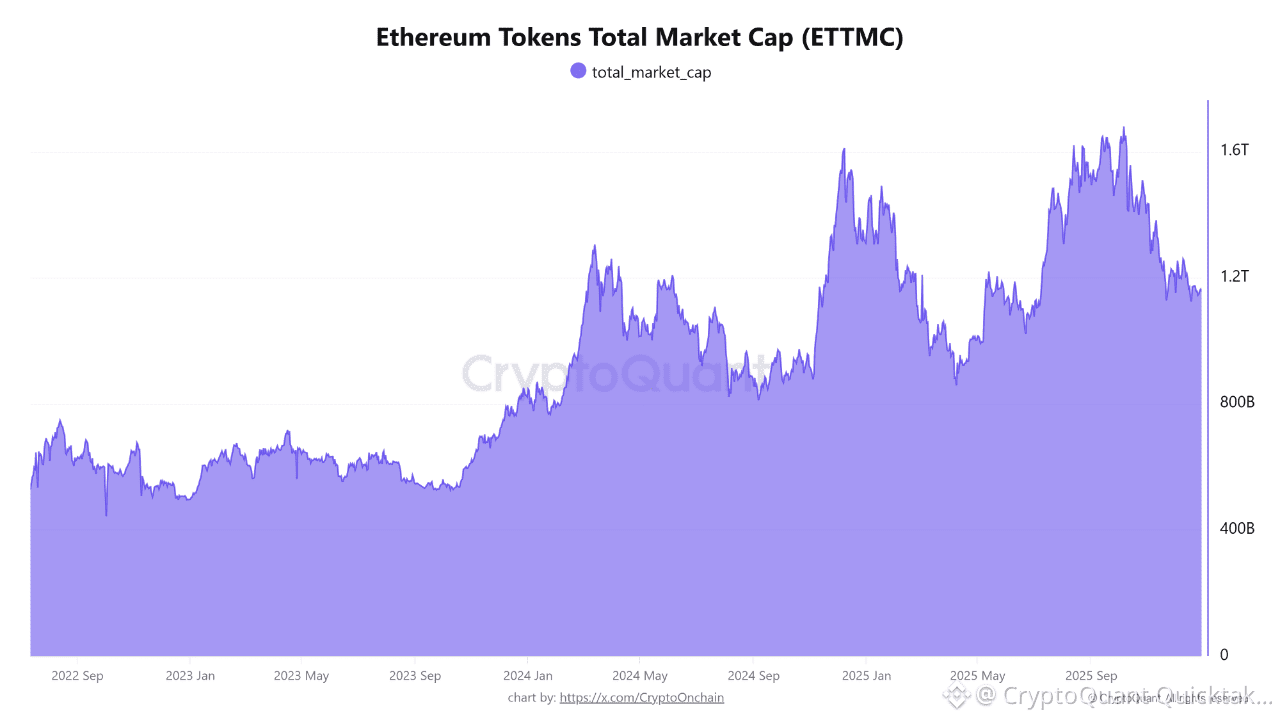

Market data reveals a significant “downsizing” in the financial dimensions of the Ethereum ecosystem. The downward trajectory that began in early October has continued relentlessly, and its magnitude is now undeniable. With the Total Market Cap falling from a peak of 1.68 Trillion on October 6th to the current

1.15 Trillion, we are witnessing the disappearance of value that alone exceeds the total capitalization of many major global corporations.

Intensity and Velocity of Decline

What stands out in these statistics is the “persistence” of the decline. This drop has not been a momentary fluctuation, but a continuous and steady movement downward. The removal of roughly $530 billion in market value over this short period implies that, on average, billions of dollars have been wiped off the network’s asset value daily. This figure indicates that holders of Ethereum-based tokens—from governance tokens to DeFi assets—have witnessed a consistent melting away of their portfolios’ USD value.

Shift in Market Weight

This 31.5% decrease has fundamentally altered the relative weight and volume of Ethereum tokens within the broader crypto landscape. While the capital currently parked in this sector ($1.15T) remains substantial, it has distanced significantly from its peak levels. This status suggests that investors are liquidating assets and currently show less inclination to store value in these tokens.

Statistical Conclusion

We are observing a clear “net outflow” trend. As long as the market cap curve does not reverse, the data conveys a single message: sellers are exiting in high volumes, and buyers are currently unwilling to fill the void left by this lost $530 billion. The market is physically shrinking, and the data has yet to indicate a stopping point for this financial bleeding.

Written by CryptoOnchain