Web3 likes to talk about freedom, composability, and permissionless systems. It celebrates speed, liquidity, and innovation. But beneath every successful decentralized system lies a quieter requirement one that does not trend, does not market well, and does not forgive mistakes: reliable truth.

Web3 likes to talk about freedom, composability, and permissionless systems. It celebrates speed, liquidity, and innovation. But beneath every successful decentralized system lies a quieter requirement one that does not trend, does not market well, and does not forgive mistakes: reliable truth.

Not ideology. Not code elegance.

Truth.

This is the layer APRO is building.

The Unspoken Weakness of Smart Contracts

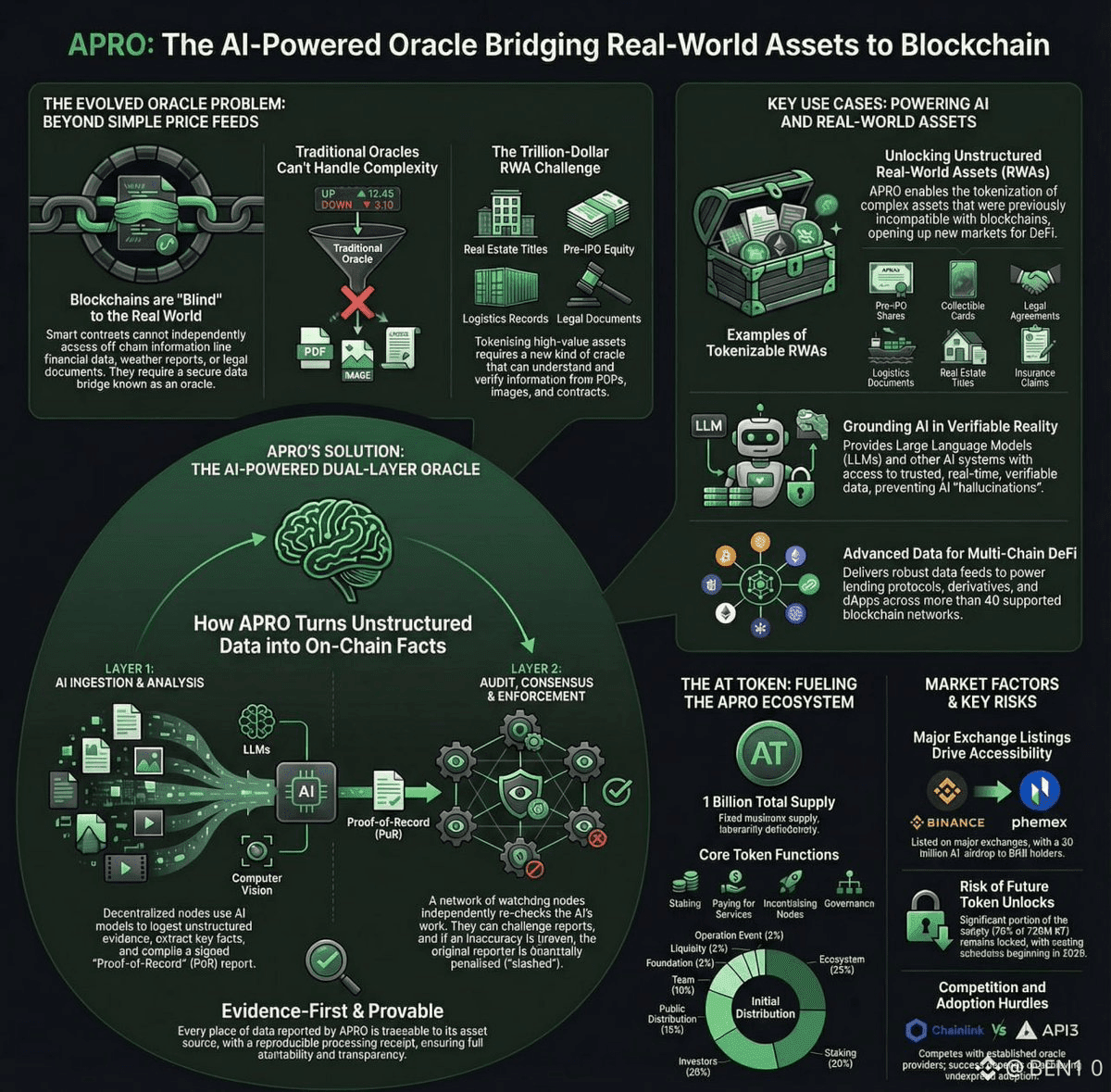

Smart contracts are deterministic machines. They do exactly what they are told no more, no less. That precision is their strength, but it is also their greatest limitation. They cannot evaluate context. They cannot question inputs. They cannot tell whether the information they receive reflects reality or manipulation.

Every time a contract prices collateral, settles a derivative, distributes rewards, resolves a game outcome, or triggers governance logic, it is quietly trusting an external signal. When that signal is wrong, the contract does not fail gracefully. It executes flawlessly and destroys value perfectly.

Most of DeFi’s biggest failures were not logic bugs.

They were data failures.

APRO starts from this uncomfortable truth:

Decentralization without dependable data is not resilience it’s fragility at scale.

Why APRO Doesn’t Behave Like a Narrative Project

Narrative-driven projects optimize for attention. Infrastructure projects optimize for pressure.

APRO clearly belongs to the second category.

It does not assume that data is honest.

It does not assume markets are efficient.

It does not assume actors behave rationally.

Instead, it designs for environments where incentives break, latency matters, and adversaries actively probe weaknesses.

That mindset alone separates infrastructure from storytelling.

From “Data Feeds” to Data Responsibility

Most oracle systems treat data like a commodity: fetch it, aggregate it, publish it.

APRO treats data like a liability.

Every data point delivered on-chain has consequences. It triggers liquidations, reallocates capital, redistributes rewards, or finalizes irreversible outcomes. APRO’s architecture reflects this weight.

Rather than forcing every use case into a single update model, APRO supports two distinct data behaviors:

Continuous truth for systems that live under constant risk (pricing, lending, derivatives)

Contextual truth for systems that only need certainty at decisive moments (settlement, verification, randomness)

This is not a feature list.

It is an admission that different contracts experience time differently.

Designing for that reality is what makes APRO usable at scale.

Why Verification Matters More Than Speed

Speed is useless if it delivers the wrong answer faster.

APRO’s use of AI-assisted verification is not about automation hype. It is about acknowledging something uncomfortable: as data sources multiply, static validation rules stop working.

Markets fragment. APIs diverge. Feeds correlate. Attack vectors evolve.

APRO introduces adaptive intelligence to detect anomalies before they become exploits not by replacing decentralization, but by strengthening it. AI does not decide truth. It identifies when truth is being stressed.

This is how modern systems defend themselves:

not by assuming honesty, but by expecting pressure.

Randomness Is Governance, Not Entertainment

Randomness is often framed as a gaming primitive. That is a mistake.

Randomness determines:

who receives rewards

how assets are distributed

which validators are selected

how fair outcomes are perceived

Unverifiable randomness undermines legitimacy even if no one cheats.

APRO treats randomness as auditable infrastructure, not a convenience. That distinction matters as Web3 systems move from experimentation to real economic coordination.

Architecture That Assumes Things Will Go Wrong

APRO’s two-layer structure is not about efficiency alone. It is about failure containment.

By separating off-chain processing from on-chain finality, APRO reduces blast radius. Errors can be detected, challenged, or corrected before they crystallize into immutable state.

Most systems fail not because of one catastrophic bug, but because small assumptions compound silently.

APRO is built to interrupt that chain reaction.

Why Multi-Chain Support Is a Requirement, Not a Strategy

Supporting 40+ chains is not about reach.

It is about realism.

Web3 is not converging it is fragmenting. Liquidity moves. Users migrate. Applications deploy everywhere.

A data layer that only works in one ecosystem is not infrastructure. It is a dependency.

APRO positions itself as chain-agnostic truth plumbing, capable of following applications wherever they operate without forcing developers to rebuild trust from scratch.

That neutrality is hard.

It is also necessary.

The Economics of Accuracy

APRO’s incentive model does not reward participation it rewards correctness.

Staking is not symbolic. It is accountability.

Rewards are not inflationary marketing they are payment for reliability.

By tying economic outcomes directly to data integrity, APRO aligns incentives where most oracle failures originate: at the intersection of laziness, profit, and pressure.

This is how trust scales when dishonesty becomes expensive.

Why This Matters More as Web3 Matures

Early crypto could tolerate bad data because stakes were low. That era is ending.

Tokenized real-world assets do not forgive ambiguity.

AI agents do not tolerate noisy inputs.

Institutions do not accept unverifiable assumptions.

As Web3 grows up, truth becomes infrastructure.

APRO is not building for the most exciting phase of crypto.

It is building for the most demanding one.

The Quiet Projects Usually Outlast the Loud Ones

No one celebrates TCP/IP.

No one markets DNS.

Yet nothing works without them.

APRO feels like it belongs in that category.

It is not trying to redefine Web3.

It is trying to make sure Web3 doesn’t collapse under its own complexity.

And that is why APRO feels less like a narrative and more like a necessity.