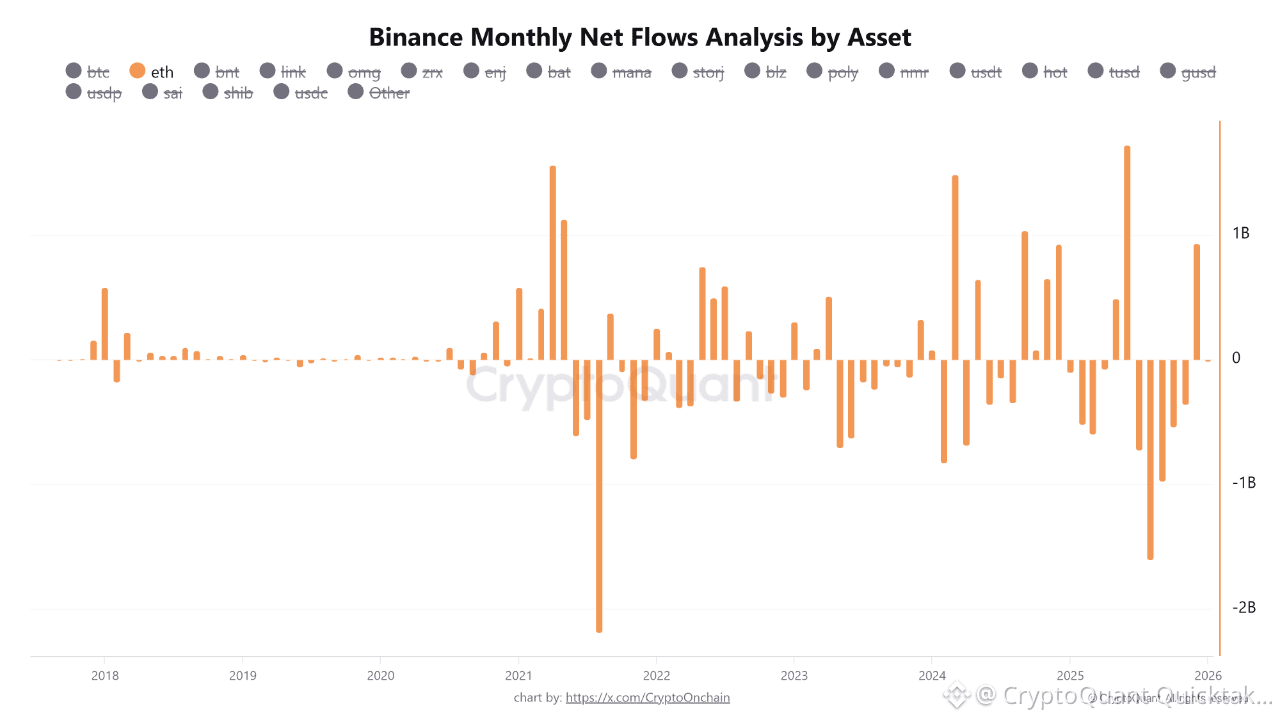

Recent data from CryptoQuant reveals a significant shift in Ethereum’s (ETH) net flow to Binance, with a substantial $960 million inflow recorded in December 2025 (as per the latest data point on the chart). This marks a remarkable turnaround, as Ethereum had been experiencing generally negative and decreasing net flows to the exchange since July of the same year.

This impressive figure not only indicates an abrupt change in investor behavior but also represents the highest monthly asset inflow for Ethereum to Binance since July 2025. Prior periods of negative net flows typically suggested that more ETH was being withdrawn from the exchange than deposited, often interpreted as long-term holding intentions off-exchange or potential selling pressure.

The implications of this considerable inflow are multi-faceted:

Revived Buyer Interest: This high volume of inflow could signal a strong resurgence in demand and renewed investor interest in accumulating Ethereum.

Preparation for Volatility: Traders might be moving their assets to the exchange to capitalize on upcoming trading opportunities or anticipated price fluctuations.

New Capital Injection: The trend could also indicate fresh capital entering the Ethereum ecosystem, subsequently being transferred to exchanges for active trading.

This sudden reversal from outflows to massive inflows serves as a crucial signal for the Ethereum market, potentially heralding a new phase of accumulation or heightened trading activity that investors and traders should monitor closely.

Written by CryptoOnchain