@APRO Oracle || $AT

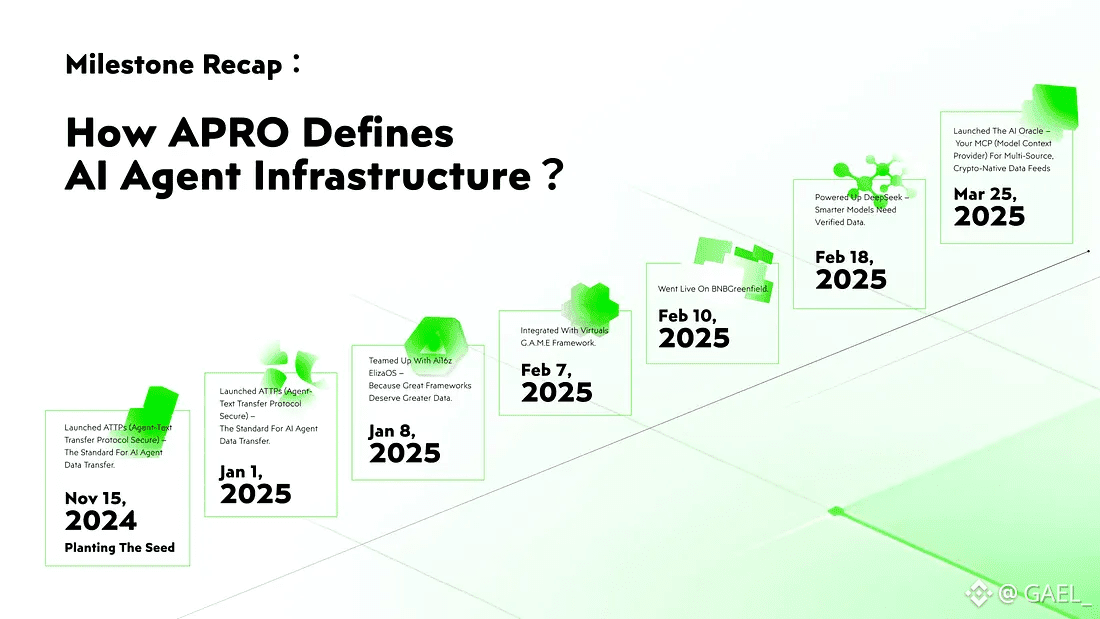

Why APRO’s AT Token Anchors AI, RWAs, and Cross-Chain Truth in a Fragmented Web3

I remember a time when tokens felt simple. You held them because you believed in a network, or because you believed someone else would believe later. Over the years, that simplicity faded. Tokens multiplied, narratives stacked, and utility often arrived after the excitement, if it arrived at all. Somewhere along that path, I started paying less attention to what a token promised and more to what it was quietly forced to do.

That is where my attention settled on AT.

Not because it was loud.

Not because it tried to be everything.

But because it behaved like something designed under pressure.

This article is not about the protocol at large. It is about the token itself. What it carries. What it enforces. And why it feels different from most of what I have seen across AI, RWA, and cross-chain systems.

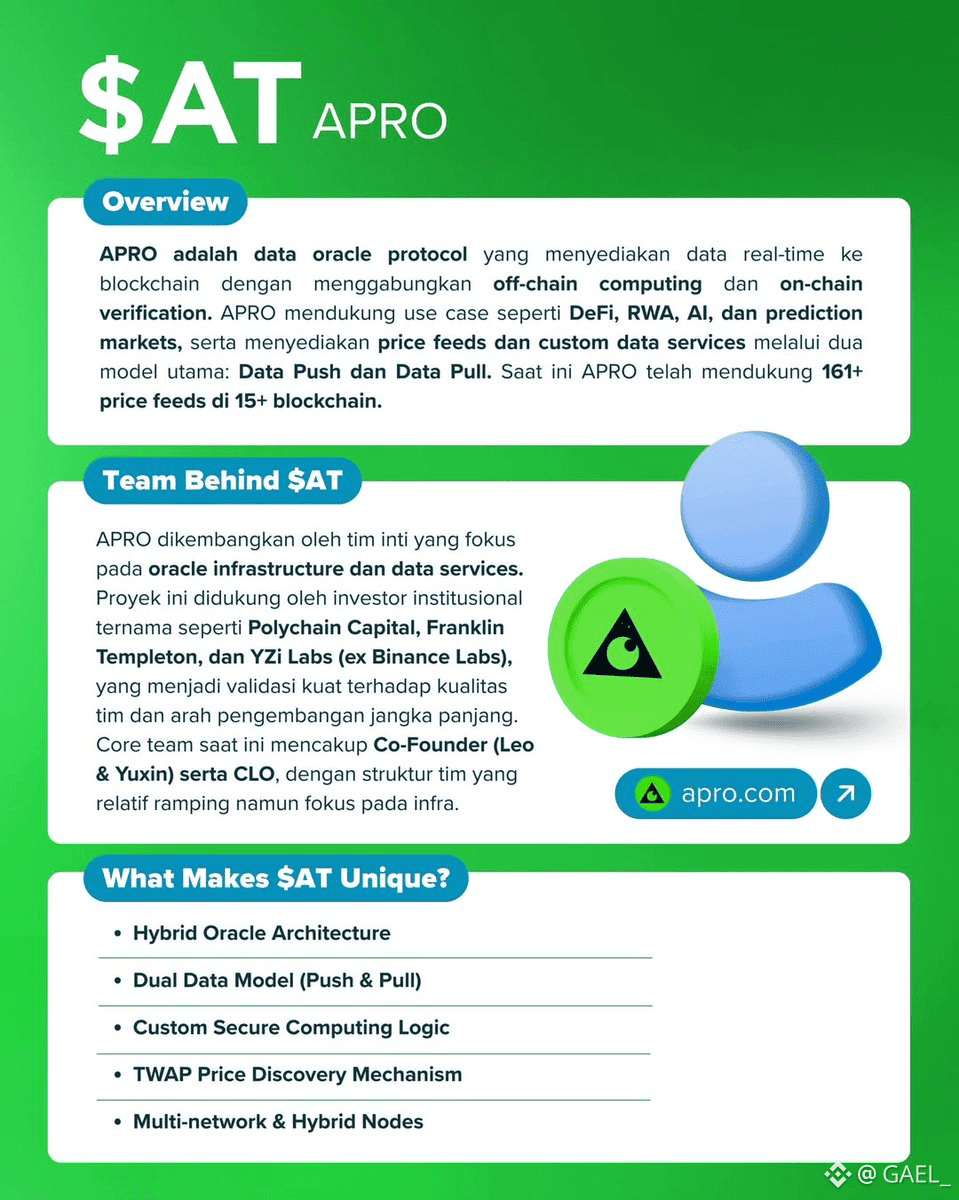

What AT Is Before Anything Else

AT is not a token that exists to be traded, debated, or framed around ideology. It exists to coordinate behavior inside a system where behavior matters.

At its core, AT is an accountability asset.

It sits inside APRO as the mechanism that gives weight to data. Without it, information is just information. With it, information gains consequence.

That difference is subtle but decisive.

Most tokens represent access or ownership. AT represents responsibility. If you participate in the system, if you submit data, if you verify outcomes, or if you build agents that act autonomously, AT becomes the layer that asks whether you are willing to stand behind your actions.

That is not a popular design choice. It is a durable one.

The Prime Role of AT in the APRO Ecosystem

The easiest way to misunderstand AT is to see it as governance first. Governance exists, but it is not the heart of the token.

The heart of AT is enforcement.

AT is the asset that makes it expensive to lie, careless to rush, and unprofitable to manipulate. Every oracle submission, every AI-verified outcome, every real-world attestation passes through an incentive structure anchored by AT.

This creates a system where correctness is not a suggestion. It is a requirement.

I have seen many systems rely on social trust or reputation scores. Those systems work until they do not. APRO chose a harder route. It made trust measurable in economic terms, and AT is the unit used to measure it.

AT and AI Tokens: A Different Relationship With Intelligence

Most AI tokens I have encountered focus on productivity. They reward computation, inference, or access to models. Intelligence becomes something you rent or speculate on.

AT does not reward intelligence.

It rewards alignment.

In APRO, AI agents are not judged by how clever they are, but by whether their outputs can be verified, reproduced, and defended against challenge. AT is what enforces that discipline.

If an AI agent submits data or resolves an outcome, it does so under the shadow of stake. That changes how systems behave. It forces models to prioritize truth over creativity and accuracy over speed.

This makes AT less exciting in marketing terms, but far more relevant in real systems where autonomous decisions carry weight.

AT and RWA Tokens: Verification Instead of Representation

RWA tokens usually focus on representing something external. A bond, a commodity, a claim. The challenge is rarely the token itself. The challenge is whether the representation can be trusted.

AT does not represent assets.

It represents the process that proves assets are real.

When real-world assets enter on-chain systems, the weakest link is almost always verification. Documents can be forged. Feeds can be delayed. Outcomes can be disputed.

AT is used where those risks converge. It underwrites attestations. It anchors proofs. It ensures that when an RWA outcome is finalized, it is not finalized by assumption, but by consensus and consequence.

That makes AT complementary to RWA tokens, not competitive with them. It sits beneath them, quietly ensuring the ground does not shift.

Cross-Chain Coordination: Why AT Had to Be Neutral

One of the most telling design choices around AT is that it does not belong emotionally to a single chain.

APRO operates across more than forty blockchain networks. That kind of reach creates fragmentation unless there is a neutral settlement layer. AT fills that role.

It allows data verified on one chain to carry weight on another. It lets AI agents operate across ecosystems without rewriting trust logic. It gives builders a common denominator that does not favor one environment over another.

I have watched many cross-chain systems struggle because their tokens were culturally or technically tied to one chain. AT avoids that trap by being intentionally unopinionated.

It is not here to win a chain war. It is here to survive them.

Common Utilities of AT Inside the System

AT’s utility is not abstract. It is mechanical.

It is staked by oracle operators to participate.

It is paid by builders to access verifiable data.

It is used to penalize incorrect or malicious submissions.

It anchors proofs that move across chains.

It filters spam by making low-quality behavior costly.

None of these functions require speculation to work. They require usage.

That is an important distinction. AT gains relevance through friction, not attention.

Why Builders Choose AT Over Other Tokens

Builders tend to avoid volatility disguised as utility. What they look for is predictability. Systems that behave the same way under stress as they do during growth.

AT offers that.

It does not change its role based on narrative cycles. It does not promise yield from belief. It does not attempt to replace base layers. It simply enforces rules consistently.

From a builder perspective, that reliability is rare. It allows teams to focus on applications instead of constantly adapting to incentive changes.

AT in Relation to Bitcoin and Ethereum

Bitcoin secures value.

Ethereum secures execution.

AT secures outcomes.

It does not try to replace either. It extends them into areas they were never designed to manage alone, like AI verification and real-world resolution.

This positioning is quiet, but intentional. AT lives where base layers meet complexity.

Design Philosophy Behind the Token

What stands out to me most about AT is not what it does, but what it refuses to do.

It does not chase narrative alignment.

It does not inflate its purpose.

It does not pretend to be a universal solution.

Instead, it focuses on one thing and does it relentlessly well. Making truth expensive to fake.

That kind of focus is rare. It is also usually invisible until systems start breaking elsewhere.

Ecosystem Behavior Around AT

I have noticed that communities built around enforcement tokens behave differently. Discussions are less speculative. Builders ask harder questions. Adoption happens quietly.

AT seems to attract people who care about systems more than slogans. That may limit short-term attention, but it builds long-term gravity.

Why AT Feels Built for Endurance

Endurance in crypto rarely comes from innovation alone. It comes from necessity.

AI systems will continue to grow. RWAs will continue to move on chain. Cross-chain systems will continue to multiply. All of them will need verification that scales.

AT feels designed for that inevitability, not for the current cycle.

A Personal Reflection

I have watched many tokens rise on vision and fade on execution. AT does not feel like it was designed to rise quickly. It feels like it was designed to remain when excitement moves on.

That may not appeal to everyone. But for systems that aim to last, it matters.

Closing Thought

AT is not trying to be loved. It is trying to be necessary.

In a space crowded with tokens that want attention, AT chose responsibility. In an environment driven by speed, it chose correctness. In a market addicted to narratives, it chose structure.

That choice may never trend loudly. But it will still be there when systems need something solid to stand on.

And in the end, that is usually what survives.

#APRO #Aİ #blockchain #RWA #DeFi @APRO Oracle