The meme coin market saw a sharp resurgence, adding roughly $3 billion in market capitalization within just 24 hours. This sudden inflow signals a clear shift in sentiment, with traders once again showing a willingness to take on higher risk. When meme coins start moving together, it often reflects renewed confidence across the broader crypto market.

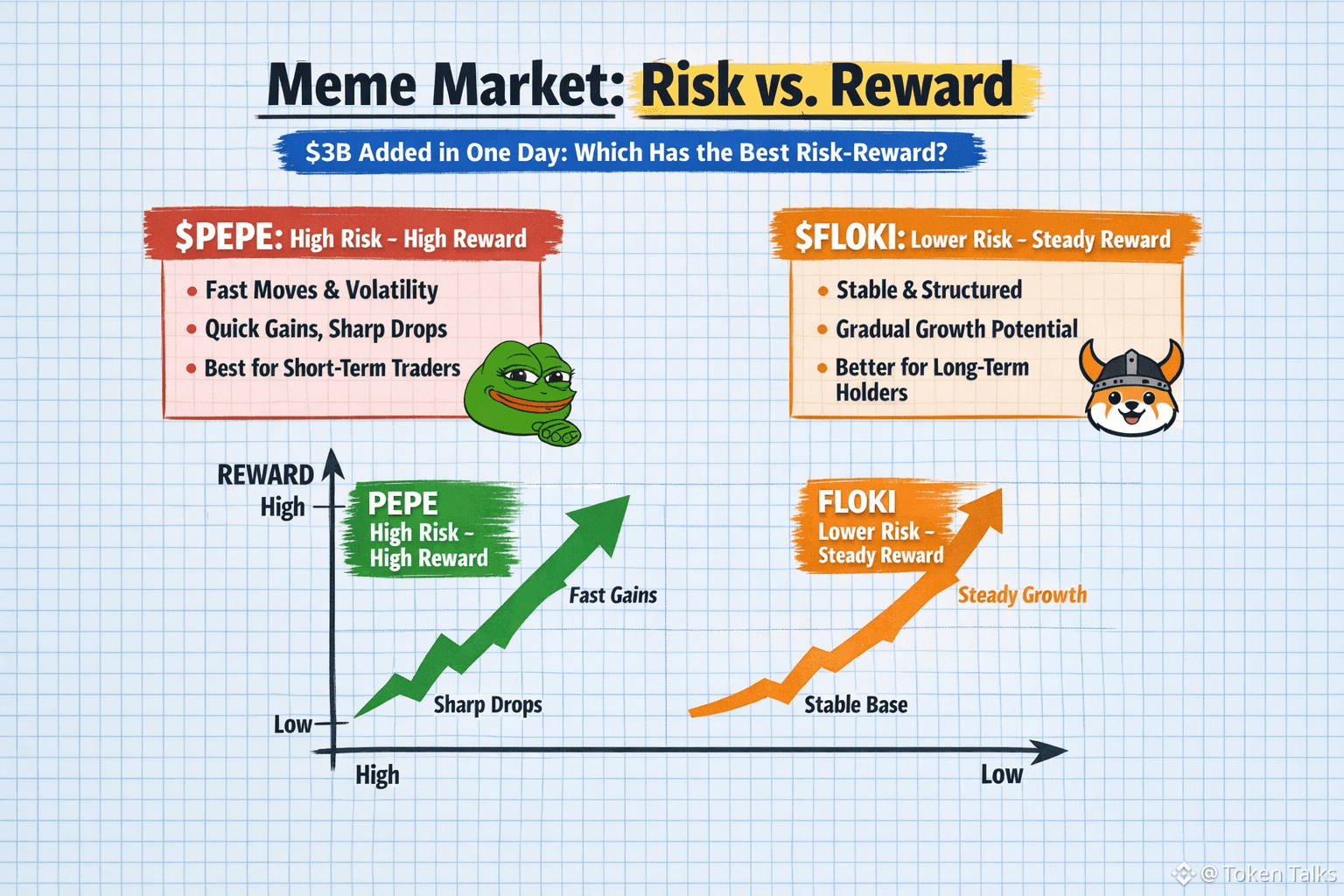

As capital rotates back into the sector, two names are standing out for very different reasons: $PEPE and $FLOKI. While both benefit from rising meme liquidity, their risk–reward profiles are not the same.

PEPE: High Beta, High Volatility

$PEPE continues to be one of the most reactive meme coins during periods of renewed speculation. Its biggest strength lies in deep liquidity, fast momentum cycles, and heavy speculative volume. When meme inflows return, PEPE often moves early and aggressively, capturing attention before many other tokens react.

This behavior makes PEPE attractive for traders who thrive in short-term, high-volatility environments. Price moves can be sharp, and upside can come quickly when sentiment flips bullish. However, this speed cuts both ways. Historically, PEPE’s pullbacks are just as aggressive as its rallies once momentum starts to fade.

From a risk–reward perspective, PEPE suits traders who are comfortable managing fast-moving positions rather than holding through extended consolidation phases.

FLOKI: Slower, More Structured Exposure

$FLOKI offers a different type of opportunity. With a longer market presence, broader ecosystem narrative, and a relatively more stable holder base, FLOKI tends to behave less erratically than pure momentum-driven memes.

FLOKI often lags the initial meme spike, but it tends to benefit when capital rotates from pure speculation into projects that feel more established. This usually results in smoother follow-through moves rather than sharp, one-day bursts.

Its downside volatility is typically lower than PEPE’s, which can provide a more balanced risk profile during multi-day or extended meme market expansions.

Comparing the Risk–Reward

In simple terms:

PEPE offers higher upside potential but comes with higher drawdown risk

FLOKI offers steadier exposure with slower, more sustainable price moves

The better risk–reward depends largely on the nature of the meme rally. If the current move is a short-lived liquidity spike, PEPE is likely to outperform. If the rally develops into a broader rotation lasting several days, FLOKI may offer a more stable and manageable opportunity.

Final Thoughts

The return of meme market liquidity is a clear sign that risk appetite is back, at least in the short term. Whether that capital sticks around or fades quickly will determine which type of meme exposure performs better.

Understanding the difference between fast speculation and structured rotation is key. In meme markets, picking the right risk profile often matters more than picking the loudest name.