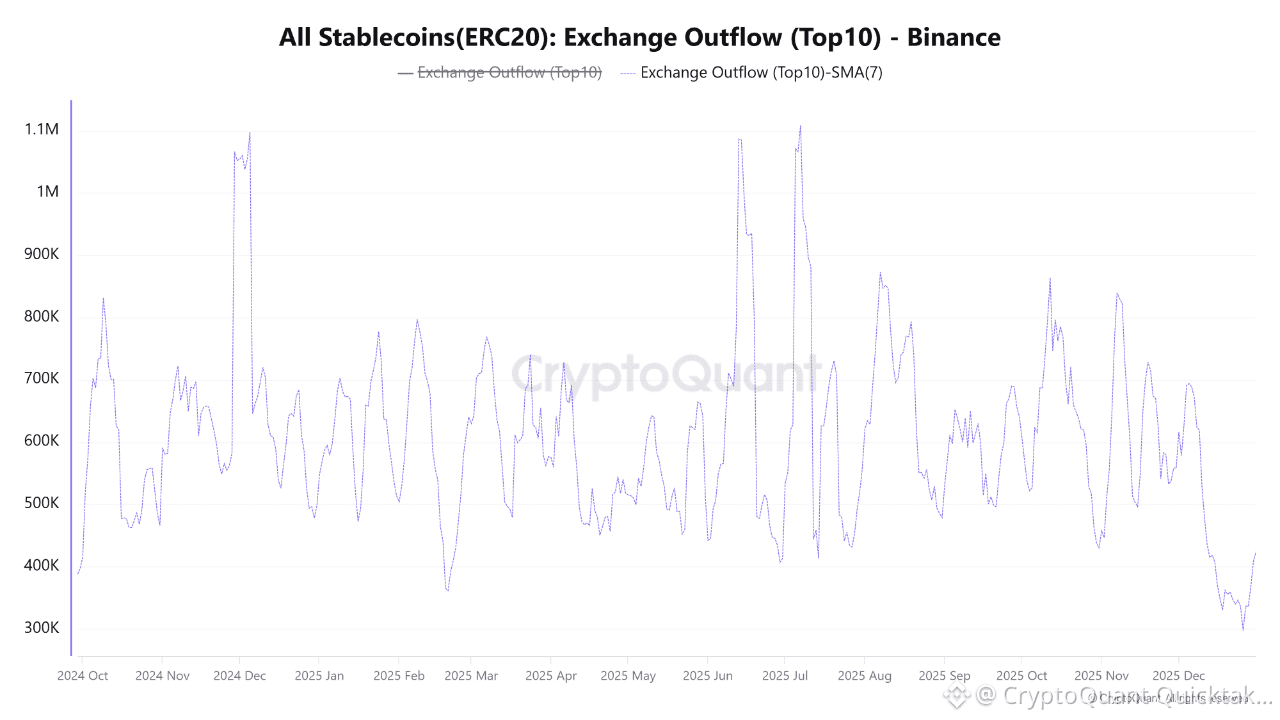

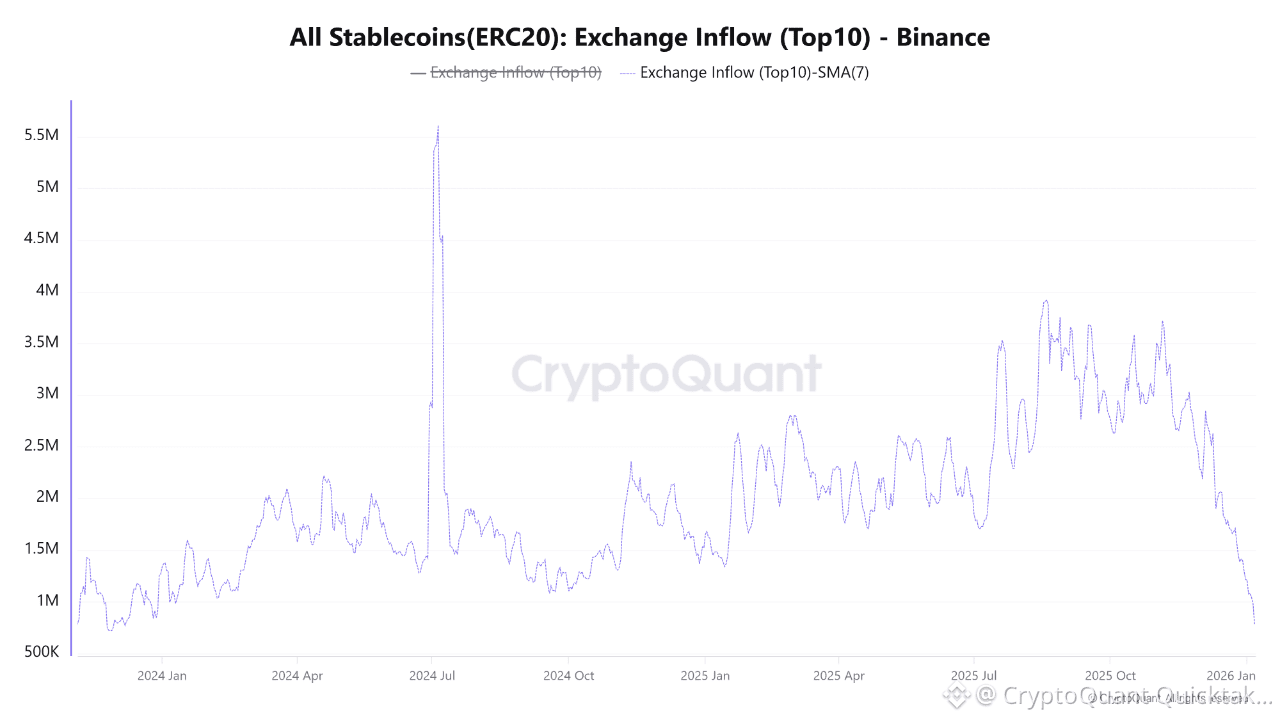

On-chain data reveals a concerning signal on the Binance exchange. The 7-day moving average (SMA) of ERC20 stablecoin exchange inflows has dropped sharply from a peak of $3.6 million on November 6 to just $787,000. Over the same period, stablecoin exchange outflows have also declined, falling from $860,000 to $408,000.

Analysis and Interpretation

While the simultaneous decline in both inflows and outflows points to an overall slowdown in market activity and liquidity, the key insight lies in the magnitude of these changes.

Drying Up of Buying Power (Dry Powder)

Stablecoin inflows to exchanges are widely regarded as a proxy for available buying power ready to be deployed into digital assets. A sharp 78% decline in inflows, compared to a 52% decline in outflows, signals a meaningful reduction in traders’ willingness to open new long positions and reflects rising market risk aversion.

Leading Indicator

This imbalance suggests that the fuel required for sustained upward price movements is rapidly diminishing. Although inflows ($787k) still exceed outflows ($408k), the steep downward trajectory of inflows itself serves as a serious early warning signal for the market.

Conclusion

Overall, this trend points to cooling market sentiment and weakening buying pressure on one of the world’s largest exchanges. If the contraction in stablecoin inflows persists, the market may struggle to find sufficient buyer support, increasing the risk of heightened volatility or a corrective phase. Traders should monitor this metric closely as a leading indicator of market health and near-term direction.

Written by CryptoOnchain