Most people associate profits with fast moves. Big candles, breakouts, volatility, and headlines. That belief is understandable, but it is also the reason most traders consistently underperform.

In real markets, money is rarely made during expansion. It is positioned during consolidation and realized later. Traders who understand this don’t chase moves. They build positions while the market is quiet, controlled, and offering defined risk.

Why Consolidation Is a Profit Phase, Not a Dead Phase

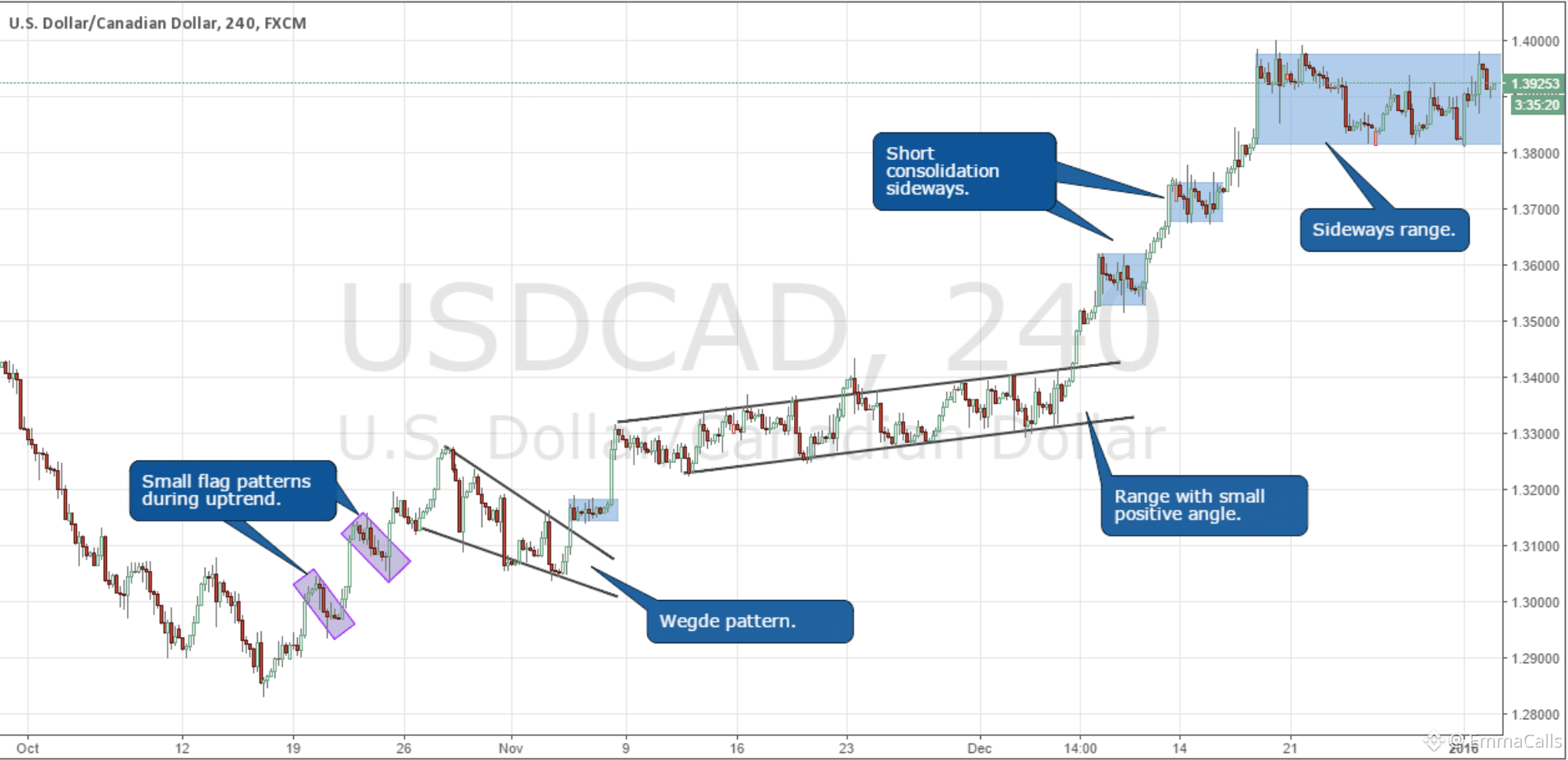

In real-time market conditions, consolidation usually follows an impulsive move. Price pauses, volatility compresses, and activity slows down. To inexperienced traders, this looks like weakness. To experienced traders, it looks like the market agreeing on value at higher levels.

When price consolidates above prior resistance or key support:

Sellers fail to push price lower

Pullbacks become shallower

Time is spent holding gains rather than giving them back

This behavior signals acceptance, not failure. Acceptance is what allows the next expansion leg to occur without collapsing.

What Real-Time Data Is Telling Us

Across current market structures, consolidation phases tend to show consistent characteristics:

Volatility declines instead of expanding downward

Open interest stabilizes rather than unwinding aggressively

Funding rates normalize after emotional moves

Spot-driven selling pressure fades

These are not signals of distribution. They are signs that leveraged excess has been flushed and the market is resetting for continuation.

This is why breakouts that follow long, tight ranges tend to be cleaner and more sustainable than breakouts that occur after straight-line moves.

How Traders Actually Make Money in Consolidation

Profitable traders do not trade consolidation the same way they trade trends.

First, they focus on location, not direction. Consolidation above structure is constructive. Consolidation below broken support is not. This distinction alone filters out most bad trades.

Second, they define risk tightly. Ranges offer clear invalidation. If structure fails, the trade is wrong quickly. That asymmetric risk is what makes these environments attractive.

Third, they scale and wait. Positions are built gradually, not all at once. This removes emotional pressure and allows traders to stay aligned with structure rather than noise.

Money is not made by predicting the exact breakout candle. It is made by being positioned before volatility expands.

Why Most Traders Lose Money Instead

Consolidation punishes impatience.

Traders lose money here because:

They exit good positions due to boredom

They chase already-extended assets elsewhere

They overtrade inside ranges, mistaking noise for opportunity

Fees increase, execution quality drops, and confidence erodes. None of this is visible in a single trade. It shows up over time as consistent underperformance.

Expansion Is the Reward, Not the Work

When consolidation resolves, price often moves faster than expected. Breakouts from compression don’t wait for everyone to get positioned. They move because the positioning already happened earlier.

This is why traders who wait for confirmation usually end up buying higher and selling lower. By the time the move looks obvious, the risk–reward is gone.

The market doesn’t reward excitement. It rewards preparation.

Finally , If your goal is to make money consistently, stop treating consolidation as a problem. It is the phase where smart money builds exposure, weak hands exit, and structure is refined.

The market spends more time preparing than it does moving.

Traders who understand this don’t chase breakouts.

They’re already in position when they happen.