Below is the same content, cleanly rewritten in English with consistent formatting and no typographical disruption. The meaning and analytical tone are preserved.

Bitcoin Aggressive Trading Activity Cools on Binance

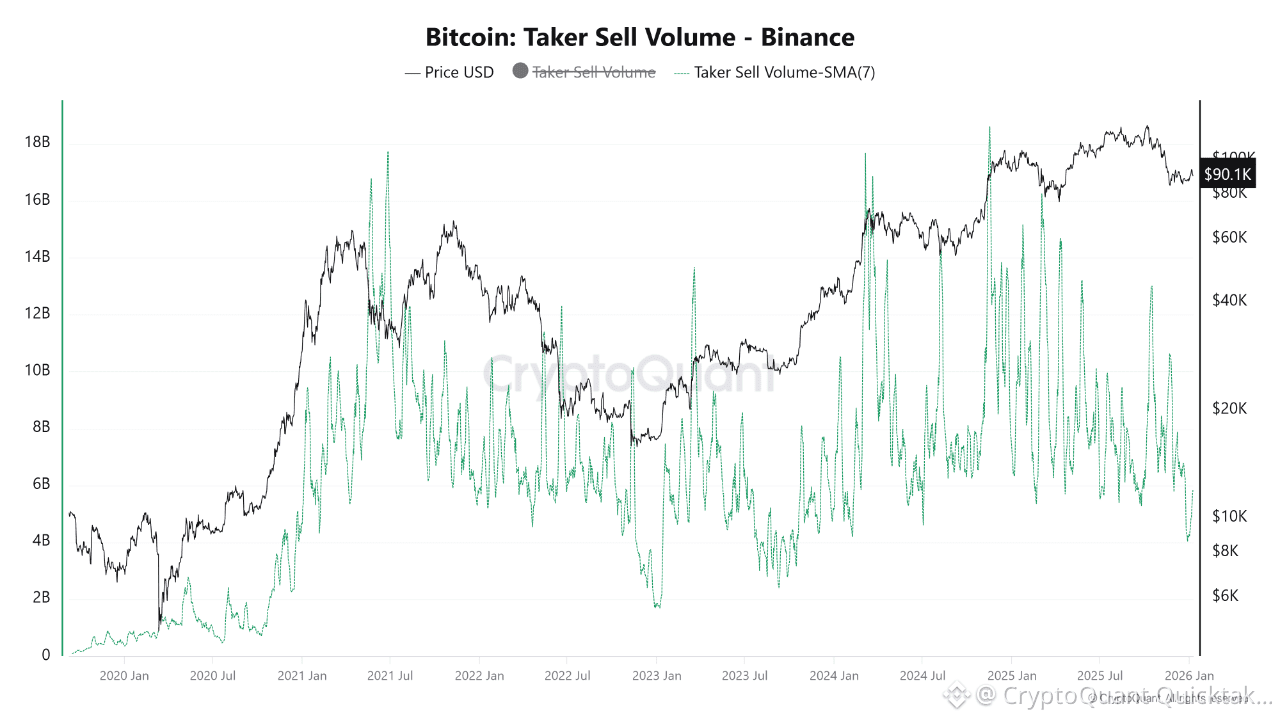

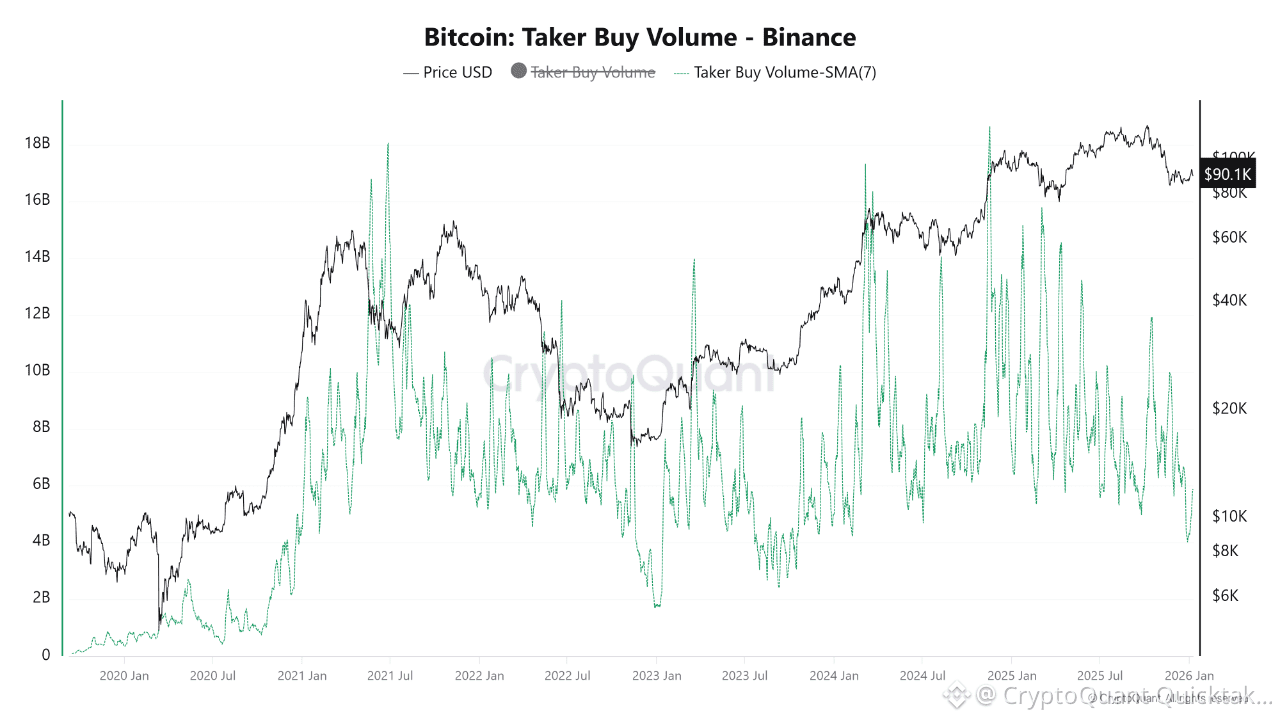

Recent on-chain data from Binance indicates a pronounced slowdown in aggressive Bitcoin trading activity. Analysis of the 7-day Simple Moving Average (SMA) shows a synchronized decline in both Taker Buy and Taker Sell volumes, signaling a clear pause in market momentum.

Key Data Points (as of January 1)

Taker Sell Volume (SMA-7): $4.2 billion

Taker Buy Volume (SMA-7): $4.3 billion

Notably, both metrics have fallen to their lowest levels since February 2024.

On-Chain Interpretation

“Taker” volume reflects market orders and therefore represents the most aggressive segment of traders, those willing to execute immediately at prevailing prices. The simultaneous contraction in both buy-side and sell-side taker volume suggests temporary exhaustion in participation or a broad “wait-and-see” stance among market participants.

Despite Bitcoin consolidating at elevated price levels, around the $90,000 region, the absence of aggressive volume indicates that the market is currently in a state of equilibrium. The near parity between Taker Buy ($4.3B) and Taker Sell ($4.2B) volumes further confirms that neither bulls nor bears currently hold a decisive advantage.

Conclusion

A sharp decline in liquidity and aggressive participation often precedes heightened volatility. While the market appears quiet at present, historically such low levels of taker volume have frequently marked the calm before a major move. Traders should closely monitor for a renewed surge in volume, as it is likely to define the direction of the next significant trend.

Written by CryptoOnchain