In the history of every major technological revolution, the spotlight inevitably falls on the applications that dazzle the public. In the dot-com boom, it was the websites. In the mobile era, it was the apps. Today, in the dual rise of Web3 and Artificial Intelligence, the world is captivated by generative AI models, high-speed trading, and immersive Metaverse experiences. These are the skyscrapers of the digital city. But as any structural engineer will tell you, the height of a skyscraper is determined solely by the depth of its foundation.

We are currently witnessing a silent but seismic shift in the digital foundation of the internet. The way humanity creates, stores, and retrieves data is undergoing a transformation not seen since the invention of cloud computing. At the center of this transformation is a protocol that has largely flown under the radar of the average retail investor, yet has captured the attention of the smartest institutional minds in the space.

That protocol is Walrus.

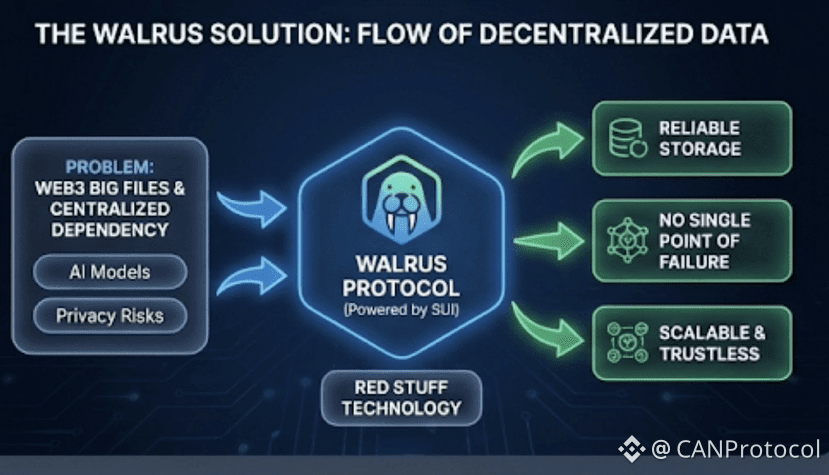

This is not merely another cryptocurrency project clamoring for attention in a crowded market. It is a fundamental rethinking of digital memory. By leveraging the unparalleled speed of the Sui network and introducing a cryptographic breakthrough known as "Red Stuff," Walrus is positioning itself to be the primary storage layer for the next iteration of the internet.

This article serves as a comprehensive thesis on the Walrus protocol. We will strip away the hype to examine the raw mechanics, the economic incentives, and the massive addressable market that makes this project one of the most compelling infrastructure plays of the decade.

Part I: The Data Tsunami and the Cloud Crisis

To understand the value of Walrus, one must first confront the scale of the problem it solves. We are living through a "Data Tsunami." In 2025, the global datasphere generated approximately 180 zettabytes of data. To put that in perspective, if you attempted to store that much data on standard 1TB hard drives, the stack would reach past the moon.

This data is not just "more of the same." It is qualitatively different.

* AI Training Data: Massive, unstructured datasets required to train Large Language Models (LLMs).

* 4K and 8K Media: High-fidelity video content for streaming and social platforms.

* Metaverse Assets: Complex 3D objects and textures that need to be rendered in real-time.

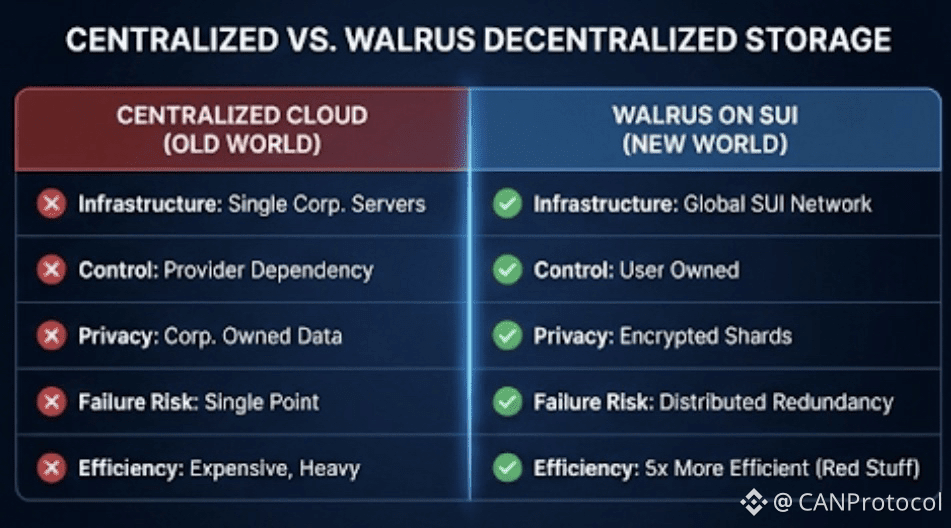

For the last fifteen years, we have relied on a "rental" model to handle this load. We rent space from the "Big Three" cloud providers (Amazon AWS, Google Cloud, Microsoft Azure). While convenient, this model is fundamentally broken for the Web3 era.

The Cost of Centralization

Centralized cloud storage is expensive. But the real cost is not just financial; it is systemic. When you store data on AWS, you are subjecting it to the terms and conditions of a single corporation. They can delete it. They can censor it. They can price-gouge you. Furthermore, these centralized data centers represent massive single points of failure. We have seen entire sections of the internet go dark because of a configuration error in a data center in Virginia.

The Web3 Paradox

There is a glaring irony in the current state of Web3. We build "decentralized" applications (dApps) on networks like Solana or Ethereum, but the actual data—the frontend of the website, the NFT images, the game assets—is often hosted on a centralized server. If that server goes down, your decentralized NFT becomes a "404 Not Found" error. This is not true decentralization; it is theater.

The industry has been desperate for a solution that is decentralized but performs with the speed and cost-efficiency of the cloud. Early attempts like Filecoin and Arweave were noble pioneers, but they often suffered from slow retrieval speeds or high costs due to inefficient data redundancy.

This is the void that Walrus was engineered to fill.

Part II: The Technological Moat — "Red Stuff"

In the world of technology investing, a "moat" is a unique advantage that is difficult for competitors to replicate. Walrus possesses a significant technological moat in the form of its proprietary encoding algorithm, playfully dubbed "Red Stuff."

To understand Red Stuff, we have to look at how traditional storage works.

In a standard decentralized network, if you want to ensure a file is safe, you replicate it. If you have a 1GB file, you might store ten copies of it on ten different nodes. This guarantees safety—if one node goes down, you have nine others. However, it is incredibly inefficient. You are paying to store 10GB of data just to keep 1GB safe.

The Erasure Coding Breakthrough

Walrus takes a different approach using 2D Erasure Coding. instead of copying the file, Walrus breaks the data down into tiny mathematical shards.

Imagine you have a photograph. Instead of making ten photocopies of it, you cut the photograph into a puzzle of 100 pieces. But here is the magic: these are mathematical puzzle pieces. You don't need all 100 pieces to see the image. You might only need any 20 pieces to perfectly reconstruct the entire photograph.

This is what "Red Stuff" achieves. It distributes these shards across thousands of nodes worldwide.

* Extreme Durability: Even if 50% or more of the network nodes go offline instantly, the data remains intact and retrievable because the remaining mathematical shards can reconstruct the missing information.

* Unmatched Efficiency: Because it doesn't need to store full heavy copies, Walrus uses significantly less storage space than its competitors. It creates a storage footprint that is up to 5x smaller than standard replication models.

For a developer, the math is simple: Smaller footprint equals lower fees. Walrus offers enterprise-grade reliability at a fraction of the cost of legacy providers.

Part III: The Sui Synergy

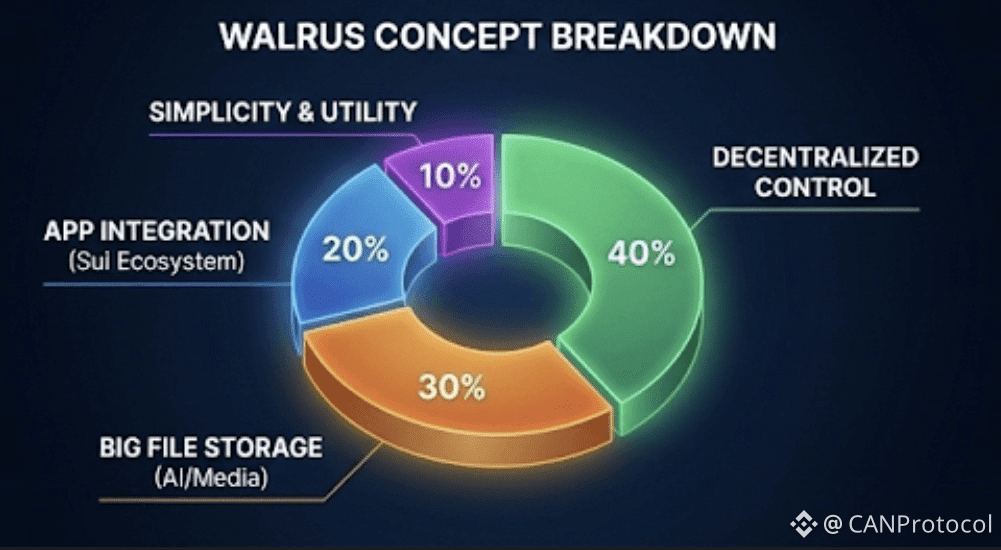

Technology does not exist in a vacuum. A critical driver of Walrus's potential is its deep integration with the Sui Network.

Sui is widely regarded as one of the most advanced Layer-1 blockchains in existence. It uses an object-centric data model and parallel execution to achieve transaction speeds that rival centralized payment processors like Visa.

Walrus is built by Mysten Labs, the same visionary team behind Sui. This is not just a partnership; it is a biological symbiosis.

* The "Sidecar" Model: You can think of Sui as the high-speed engine and Walrus as the massive trunk. Sui handles the logic and the financial transactions, while Walrus handles the heavy data. They move in lockstep.

* Programmable Storage: Because of this integration, Walrus storage is "programmable." Developers can write smart contracts on Sui that automatically interact with data on Walrus. For example, a social media app could automatically delete a user's data from Walrus if they stop paying their subscription on Sui, all without human intervention.

This synergy positions Walrus as the default storage layer for the entire Sui ecosystem. As Sui continues to capture market share in gaming and DeFi, every new user and every new application creates automatic, organic demand for Walrus.

Part IV: The Tokenomics of Utility

For the intelligent investor, the technology is only half the story. The other half is the economic model. How does the value accrue to the token holder?

The WAL token is not a meme coin driven by sentiment. It is a Work Utility Token. Its value is mechanically tied to the usage of the network. The tokenomics are designed to create a "flywheel" of value.

1. The Buy Pressure (Demand)

Every byte of data stored on the Walrus network must be paid for. Whether it is a solo artist uploading an NFT collection or an enterprise AI company backing up petabytes of training data, they must enter the market and purchase WAL tokens to pay for that storage. This creates a constant, non-speculative baseline of demand. As the network grows, this demand grows linearly.

2. The Lock-Up (Supply Shock)

The network is secured by storage nodes. To operate a node and earn revenue, an operator must stake (lock up) a significant amount of WAL tokens. This is a security bond; if they act maliciously, they lose their tokens.

As the network expands and more nodes join to service the demand, more $WAL tokens are removed from the circulating supply and locked in staking contracts.

* Rising Demand + Shrinking Supply = Price Appreciation.

3. Governance and Ownership

Holding $WAL represents ownership of the protocol. In a decentralized future, the governance rights to the world's storage layer will be an immensely valuable asset. Holders can vote on fee structures, network upgrades, and the allocation of the treasury.

Part V: The AI Intersection

Perhaps the most bullish thesis for Walrus lies in its intersection with Artificial Intelligence.

We are entering the age of "Autonomous Agents"—AI programs that browse the web, execute tasks, and create content on their own. These agents cannot use a credit card to pay Amazon AWS for storage. They need a crypto-native, permissionless storage layer.

Furthermore, the single biggest issue facing AI today is "Data Provenance"—knowing where data came from and ensuring it hasn't been tampered with. Because Walrus is decentralized and immutable, it provides a perfect "Chain of Custody" for AI data.

* Model Weights: AI companies can store their valuable model weights on Walrus, ensuring they are available globally but safe from tampering.

* Training History: The history of what an AI has learned can be permanently archived, allowing for better transparency and safety auditing.

Walrus is positioning itself to be the hard drive for the global AI brain.

Part VI: The Road Ahead

As we look toward the remainder of 2026 and beyond, the roadmap for Walrus is focused on "Mass Adoption."

The listing on Binance was the starting gun. It provided the liquidity and the legitimacy required to attract large-scale enterprise clients. The next phase is integration. We are already seeing "Middleware" layers being built—tools that allow Web2 companies to use Walrus without even knowing it. They simply see a cheaper storage bill, while the Walrus protocol handles the complexity in the background.

We are also seeing the rise of "DePIN" (Decentralized Physical Infrastructure Networks). Walrus is a prime example of this trend. By utilizing the spare hard drive capacity of thousands of computers around the world, it is creating a shared economy for digital space, much like Airbnb did for physical space.

Conclusion

The transition from the centralized cloud to decentralized infrastructure is not a matter of "if," but "when." The inefficiencies and risks of the old model are simply too high to sustain the next generation of the internet.

In this transition, there will be winners and losers. The winners will be the protocols that prioritize engineering over hype, efficiency over marketing, and utility over speculation.

Walrus stands as a giant in this landscape. With its "Red Stuff" technology, it has solved the efficiency trilemma. With its Sui integration, it has secured a fast-lane to adoption. And with its robust tokenomics, it has aligned the incentives of users, investors, and operators.

The market is currently waking up to the reality that Infrastructure is the new Alpha. While others chase the fleeting trends of the day, Walrus is quietly building the concrete foundation upon which the digital future will stand. For the patient investor, the "Silent Giant" may well be the loudest success story of the coming cycle.