At the center of the Dusk Network’s design sits a token that is deliberately unflashy: DUSK. And that restraint is intentional. Where many projects overload their tokens with speculative utility, Dusk Foundation treats DUSK as infrastructure — a mechanism for security, coordination, and long-term alignment rather than short-term excitement.

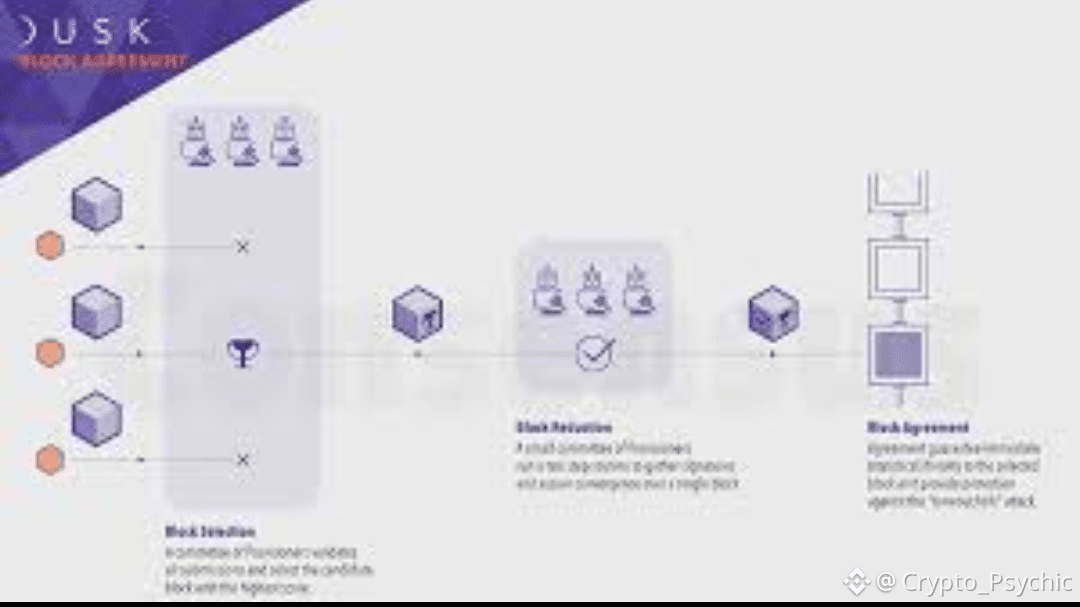

The primary role of DUSK is network security. Validators stake DUSK to participate in consensus, ensuring that those responsible for block production and transaction validation are economically aligned with the network’s integrity. Because Dusk is designed for financial use cases where correctness matters more than speed, staking requirements and slashing conditions emphasize reliability and uptime over aggressive throughput.

Governance is the second pillar. DUSK holders participate in shaping protocol parameters, validator rules, and future upgrades. This is especially important given Dusk’s focus on regulated environments. Governance decisions aren’t framed around experimentation for its own sake, but around maintaining compatibility with compliance standards, confidentiality guarantees, and institutional requirements. The result is a governance culture that values stability and predictability.

What makes DUSK’s design distinct is how it supports confidential computation. Unlike typical Layer 1s where governance and staking are entirely transparent, Dusk’s architecture allows privacy-preserving smart contracts to coexist with open validation. This balance is critical: validators can verify correctness without accessing sensitive transaction details, reinforcing Dusk’s core thesis that transparency and confidentiality do not have to be mutually exclusive.

From an ecosystem perspective, the token also underpins incentives for builders and participants working on confidential assets, private marketplaces, and regulated financial instruments. Rather than incentivizing raw activity, Dusk’s roadmap emphasizes rewarding contributions that strengthen the network’s credibility — better tooling, compliant integrations, and production-grade applications.

Another important aspect is what DUSK doesn’t try to do. It isn’t positioned as a universal DeFi fuel or a speculative governance wrapper. Its utility is intentionally narrow because the network’s mission is narrow: become a reliable base layer for privacy-preserving finance. This clarity reduces complexity and makes the system easier to reason about for institutions and developers alike.

As the Dusk Network progresses through its roadmap — expanding validator decentralization, refining governance processes, and onboarding real-world financial use cases — DUSK functions as the connective tissue holding these components together. Not as a hype vehicle, but as a coordination tool.

In an industry where tokens often promise everything, DUSK promises something specific: alignment. And for infrastructure designed to operate under regulatory and financial scrutiny, that focus may prove far more valuable than broad but shallow utility.