Walrus matters for one simple reason: crypto keeps creating more data than most blockchains can realistically carry, and that data still needs to live somewhere trustworthy. Traders often look at storage projects as “infrastructure plays,” but Walrus is more than a generic storage network. It’s designed for large chunks of data, like files, media, AI datasets, and application state, and it treats that data as something that can be verified, priced, and used inside onchain applications rather than just “parked” somewhere and forgotten. That design choice sounds technical, but it has very real implications for how entire ecosystems can scale without turning every blockchain into an expensive hard drive.

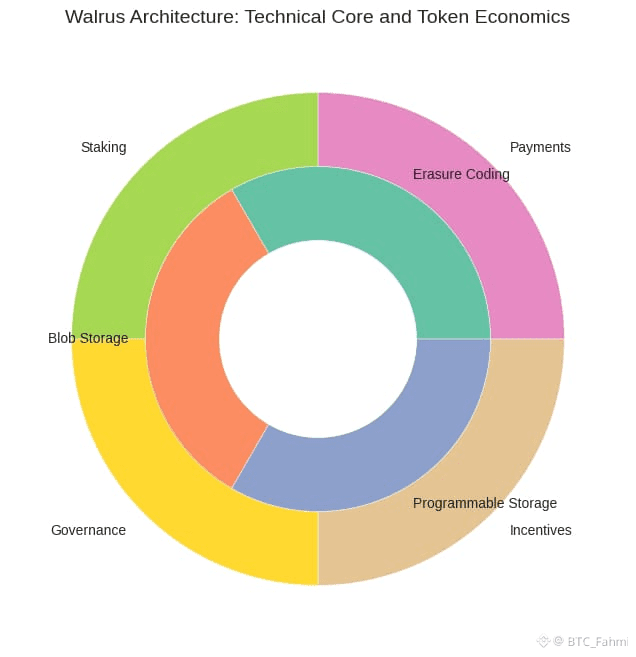

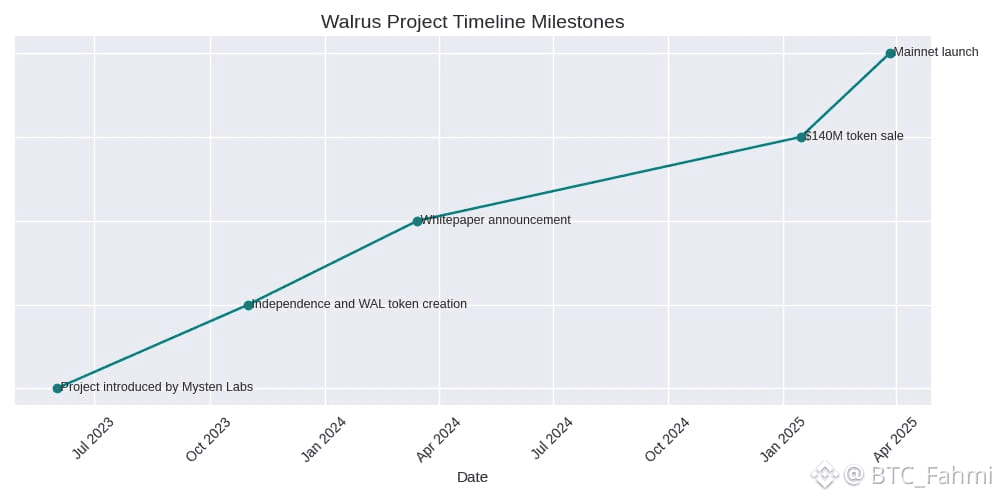

Walrus started as a project introduced by Mysten Labs (the team closely tied to Sui’s early development), and then moved toward becoming an independent decentralized network with its own token, WAL, and its own foundation. This matters because traders tend to underestimate how much “independence” changes incentives. When a network becomes its own entity, it can attract node operators, builders, and partners who want a storage layer that isn’t controlled by a single company’s roadmap. The official whitepaper announcement made it clear that the plan was to operate Walrus through storage nodes using a delegated proof-of-stake model with WAL at the center of operations and governance.

So what is Walrus actually doing differently? The clearest way to understand it is to compare it to the old “replicate everything multiple times” approach. Traditional decentralized storage often relies heavily on replication, which can be simple but costly. Walrus uses erasure coding designed for large blobs of data, meaning it can spread a file across many nodes in pieces and still recover it even if some pieces are missing or nodes fail. The whitepaper describes approaches that aim for very high resilience with lower storage overhead than replication, which is important because storage economics usually decide whether a storage network becomes widely used or stays niche.

For traders and investors, the key question is not “is this cool tech,” but “does the tech produce demand for the token and real usage.” WAL is designed to be the economic engine: it’s used for payments, incentives for storage operators, staking, and governance. The project’s own token utility page positions WAL as the driver of incentives and the broader economics of the protocol. In plain terms, if Walrus is actually used, WAL becomes part of the flow of value: users pay to store and retrieve, node operators earn rewards, and stakers help secure the network. That’s the core long-term involvement angle: Walrus is not only about launching a token, it’s about building a market where data storage and access become ongoing economic activity.

One reason Walrus has stayed on traders’ radar is the combination of real-world demand and timing. Data needs are exploding because of AI, media, and onchain applications that want richer user experiences. Walrus explicitly frames itself as a platform where data becomes “reliable, valuable, and governable,” which is basically a bet that the next wave of apps will treat data ownership and verifiability as a feature, not an afterthought. This is also why Walrus being built around Sui’s architecture is relevant: high throughput and low latency on the control layer can make storage coordination smoother and cheaper at scale.

Mainnet matters too because that’s where the market stops being theoretical. Walrus announced its public mainnet launch on March 27, 2025, and positioned it as “programmable storage,” meaning storage that applications can interact with directly, not just a place to dump files. If you’re evaluating any infrastructure token, the question becomes: after mainnet, did real usage grow, did developers stick around, and did the token’s role stay meaningful beyond early incentives. Walrus also notes that testnet wipes can happen periodically, which is normal for fast-moving infrastructure projects but also a reminder that developers seeking stability should build on mainnet.

On the capital and credibility side, Walrus raised attention after reports of a large token sale and strong investor backing. Coverage highlighted a $140 million token sale ahead of the mainnet period, which signals resources for ecosystem growth, but it also introduces the usual investor pressure questions around unlocks, vesting, and distribution. Serious traders should care less about the headline and more about schedules and emissions, because storage networks can get stuck in a cycle where rewards attract nodes, but unlock-related selling caps token performance until organic demand catches up.

Now the honest positives and negatives. On the positive side, Walrus is targeting a real bottleneck: blockchains and decentralized apps want rich data without bloating the base layer. Its use of erasure coding and a purpose-built blob design is aligned with efficiency, and its positioning around data markets fits the current direction of AI-heavy applications. The ecosystem framing also matters: if developers treat Walrus as the default place for large app data, it can become sticky infrastructure, which is exactly what long-term investors look for.

On the negative side, Walrus faces a tough reality storage is competitive and adoption is slow. Developers don’t switch storage layers lightly, and the network has to prove it can deliver reliability consistent pricing, and strong availability across different conditions. Another risk is token economics: staking rewards and incentives can bootstrap supply-side participation, but the real test is whether demand-side usage grows enough to offset emissions and unlocks. And because Walrus is closely associated with the Sui ecosystem, it benefits from that ecosystem’s growth but also inherits ecosystem risk: if developer activity slows, storage demand can slow with it.

My personal take, in simple terms, is this: Walrus is one of those projects that won’t feel exciting day to day unless you truly understand how infrastructure wins. Storage isn’t glamorous, but when it becomes a default primitive for builders, it can quietly become essential. The future outlook depends on whether Walrus becomes the “normal” place for big data in its ecosystem and whether its token design stays aligned with real usage instead of short-term incentives. If it succeeds, it won’t be because of a story, it will be because developers keep shipping on it and users keep paying for storage without thinking twice. That’s when you know infrastructure has turned into gravity.