Both Dusk and Zcash harness cutting-edge zero-knowledge proofs to deliver real privacy on-chain but they serve wildly different masters.

Zcash pioneered shielded transactions back in 2016, making it the OG of optional, ultra-private crypto payments. Dusk, a newer Layer-1 blockchain (mainnet live since early 2025), takes that same zk tech and flips it for the regulated finance era think tokenized securities, institutional RWAs, and compliance-first DeFi.

Here's the head-to-head breakdown that shows why one feels like a privacy shield for individuals, while the other is built like enterprise-grade infrastructure.

Quick Snapshot Comparison

Primary Focus

Zcash - Private peer-to-peer digital currency (everyday payments with optional full anonymity)

Dusk - Regulated decentralized finance (tokenized real-world assets, securities, institutional tools)

Privacy Model

Zcash - Optional shielded transactions (using zk-SNARKs) -- users choose between transparent (like Bitcoin) or fully shielded (hides sender, receiver, amount). Shielded usage has stabilized around 23% of supply in 2026, with strong growth from earlier years.

Dusk - Privacy by default + selective disclosure -- confidential transactions and smart contracts are core, but built with verifiability and auditability for regulators. Not total blackout; instead, programmable privacy that allows selective reveal to auditors or authorities without exposing everything.

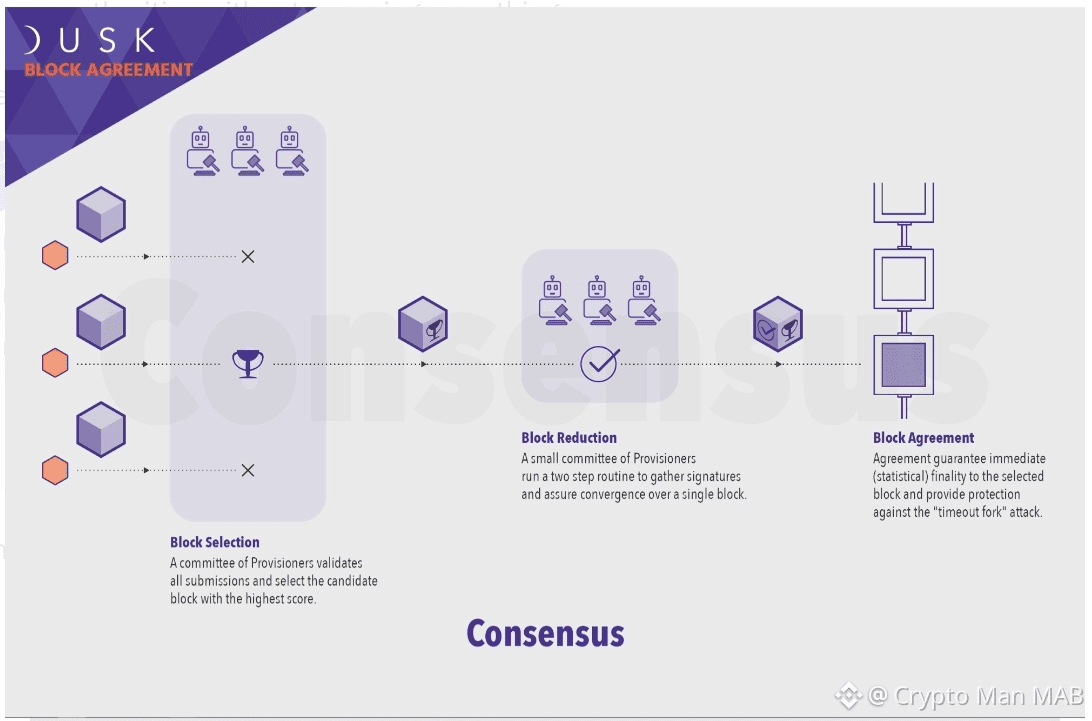

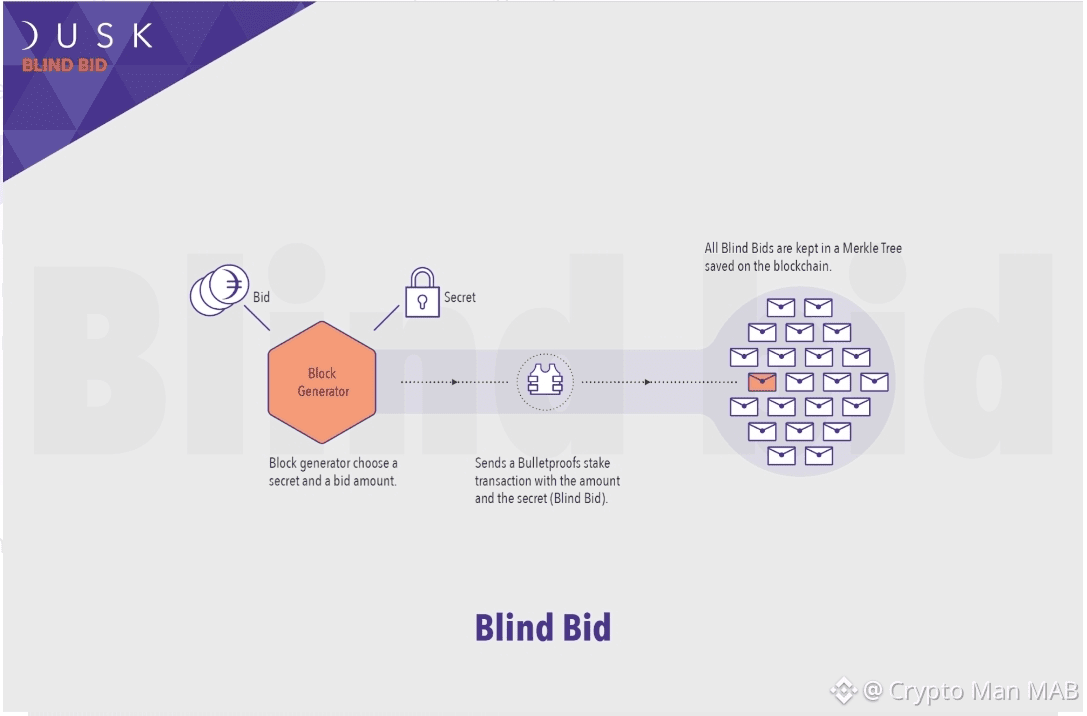

Here are some sleek visuals of Dusk's privacy-first architecture in action:

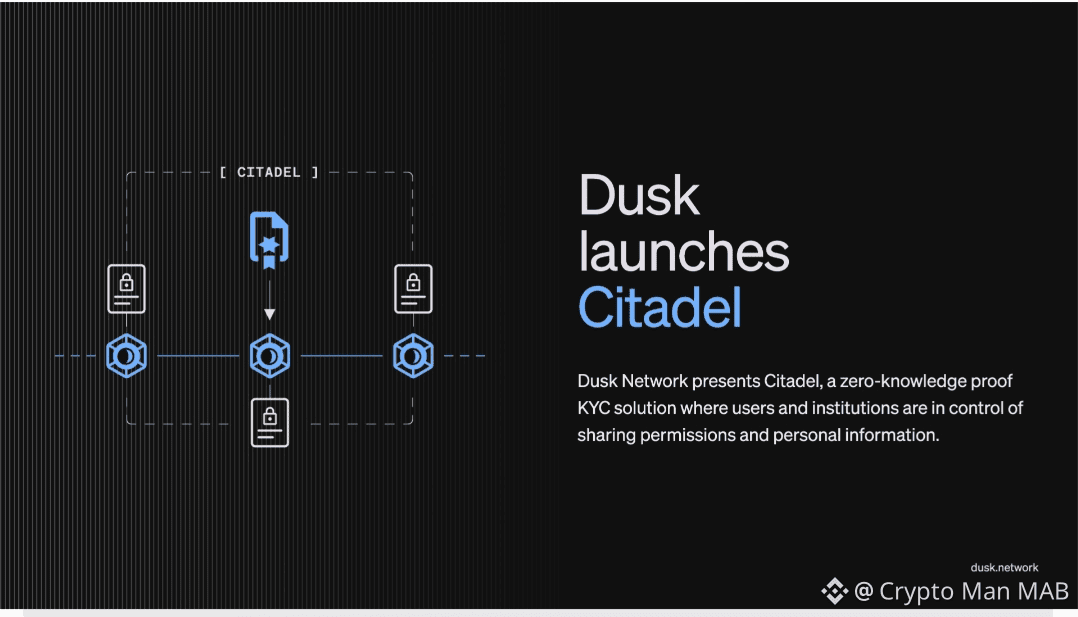

And the Citadel launch vibe regulated finance meets blockchain:

Compliance & Regulation Fit

Zcash - Flexible but challenging for institutions. Optional privacy is seen as more regulator-friendly than Monero's always-on anonymity, and features like view keys enable selective transparency. Still, full shielded flows raise red flags for KYC/AML-heavy environments (Grayscale's 2025 Zcash ETF even leaned heavily on transparent mechanics to stay compliant).

Dusk - Designed for compliance from day one. Supports MiCA, GDPR, and automated regulatory hooks. Auditable shielded transactions, protocol-level licensing, and privacy-preserving smart contracts make it ideal for regulated markets. Dusk explicitly positions itself as the bridge between classic finance and on-chain -- no pretending rules don't exist.

Use Cases & Target Audience

Zcash - P2P payments, private savings, censorship resistance. Great for individuals wanting financial confidentiality in a transparent world.

Dusk - Tokenizing securities, RWAs, compliant DeFi, institutional settlement, private lending. Built for businesses, institutions, and users who want self-custody of real assets without sacrificing oversight where required.

Technical & Ecosystem Edge

Both use zk tech, but Dusk goes further with confidential native smart contracts, modular architecture, and consensus like Segregated Byzantine Agreement (SBA) for efficiency. Zcash remains a payments-focused chain with ongoing upgrades (Orchard protocol, quantum-readiness tweaks), but lacks the programmability depth for complex financial products.

Here's the classic Zcash privacy shield aesthetic iconic and battle-tested:

Bottom Line: Which One Wins?

If you're after maximum personal anonymity for payments and value storage - Zcash is still king. It pioneered the tech, has proven shielded pools, and continues to see solid adoption in 2026 despite governance drama.

If you're building for (or investing in) the future of regulated on-chain finance -- tokenized bonds, compliant RWAs, institutional privacy without total opacity - Dusk is purpose-built for the job. In a world where MiCA, AML, and institutional money increasingly dominate, Dusk's "privacy + responsibility" approach feels like the smarter long-term bet.

In short: Zcash gave the world private money. Dusk is giving the world private markets.

Which side of privacy are you on in 2026? The rebel shield... or the regulated fortress?