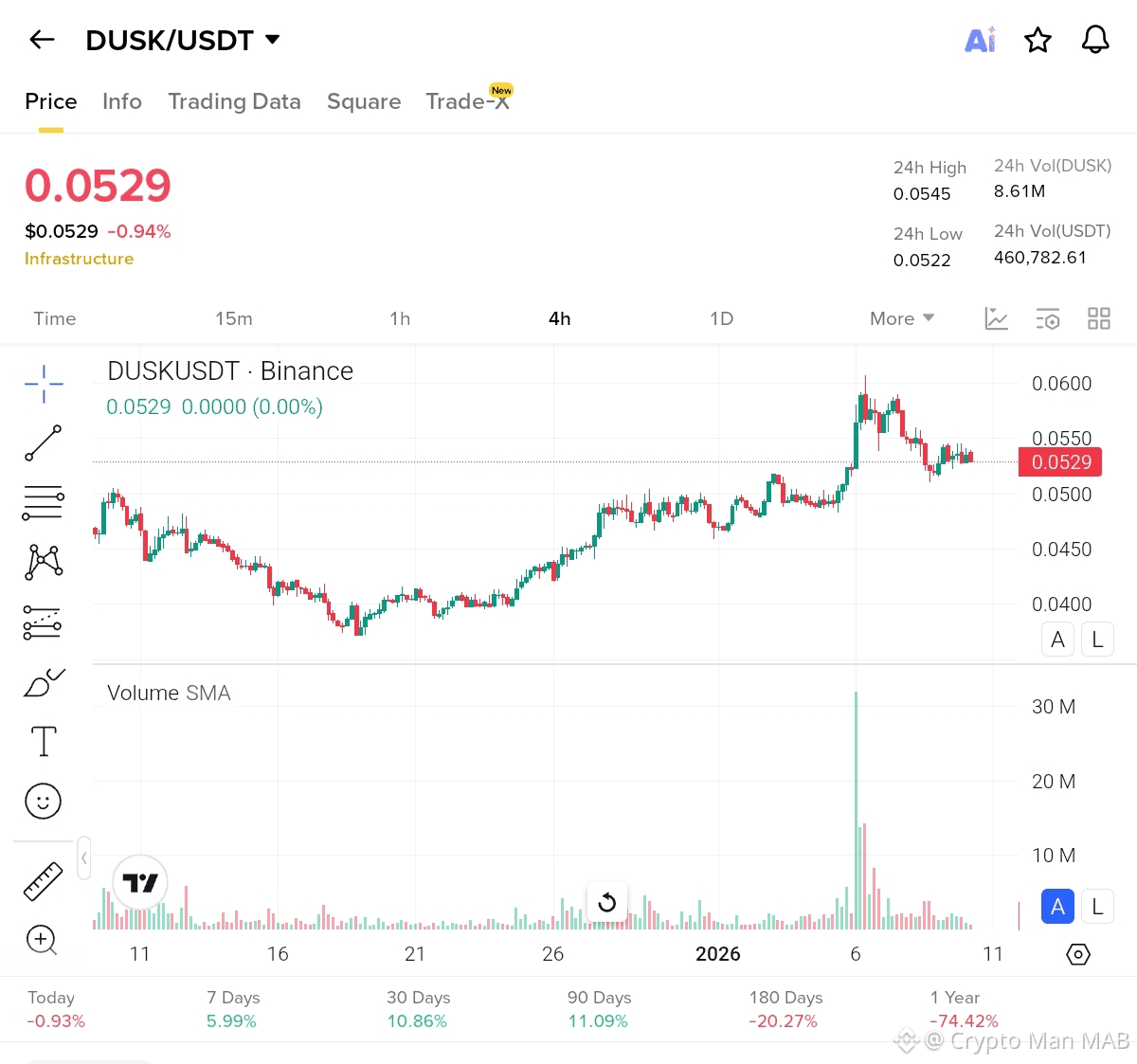

$DUSK is hovering at $0.0529 right now (down ~0.94% in the last 24h), with solid volume of 8.61M DUSK traded showing decent liquidity on Binance despite the small dip.

Look at this classic recovery pattern from the December lows:

Bottomed out around $0.040-$0.045 in late December/early Jan.

Strong bounce starting early January - peaked near $0.060 recently.

Now pulling back to test the breakout level around $0.052-$0.055 (dotted resistance-turned-support?).

Here's that bullish candlestick vibe capturing the recent uptrend momentum:

Key Stats Snapshot (as of Jan 10, 2026):

24h High/Low: $0.0545 / $0.0522

7 Days: +~6%

30 Days: +10.86%

90 Days: +11%

But 1 Year: Down heavy -74% from 2025 highs (classic altcoin reset post-bull run)

The volume spike in early Jan screams accumulation -- big green bars during the pump, now quieter consolidation. If it holds above $0.050 support, next leg up could target $0.06+ again. Short-term bearish pressure from profit-taking after that quick rally, but broader sentiment leans neutral-to-bullish with altcoin rotation heating up.

And for the red candle bears out there (if it cracks lower):

Bottom Line: DUSK isn't mooning yet, but the chart shows resilience -- rebuilding from 2025 lows with real utility (privacy-first RWA tokenization, mainnet live, institutional vibes). Watch $0.052 support closely. Hold or dip-buy? Your call in this volatile infra play.

What do you think breakout incoming or more chop? Drop your take below!