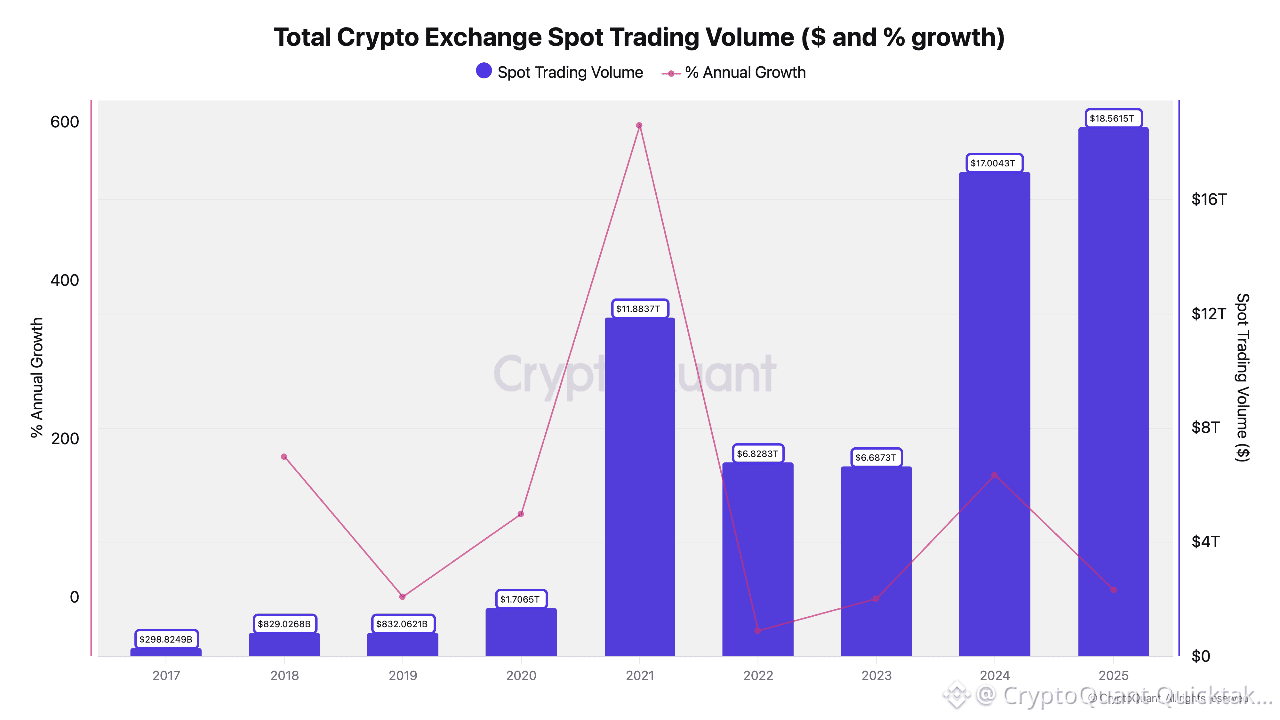

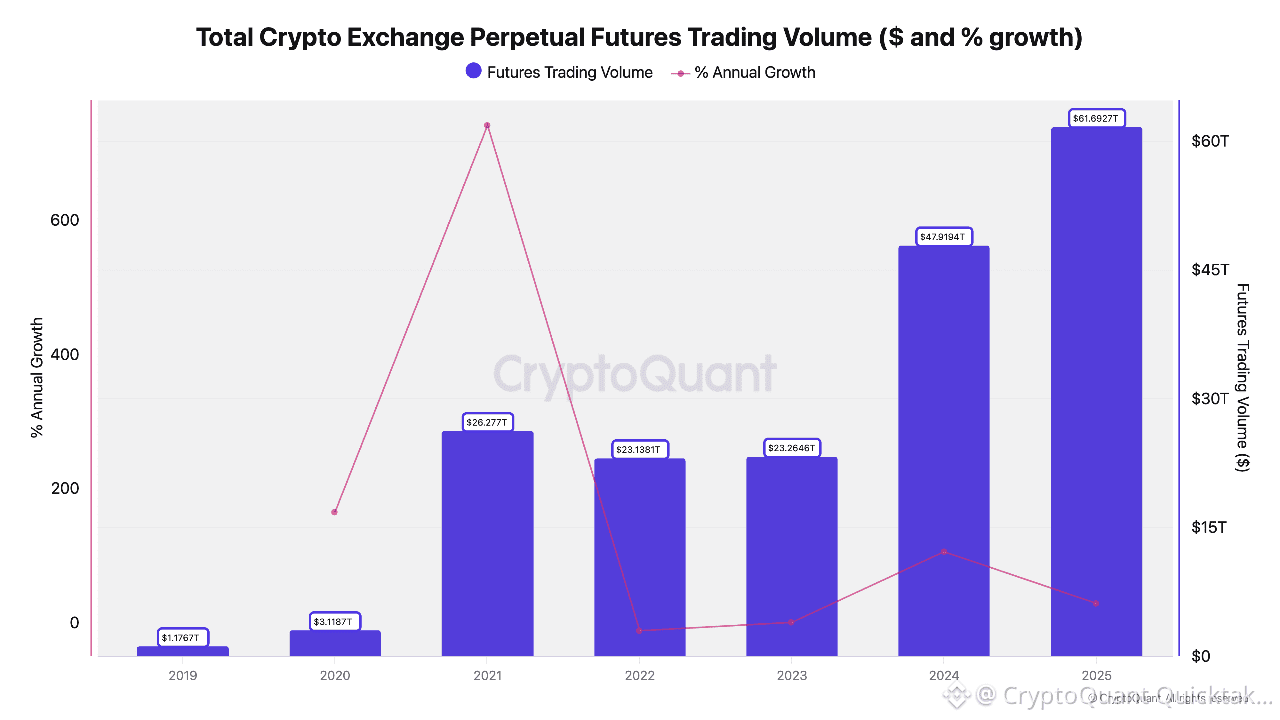

Trading volumes diverged meaningfully in 2025. Total spot trading volume reached $18.6 trillion, up 9% year-on-year, but expansion slowed materially compared with 2024’s 154% growth. In contrast, perpetual futures activity remained robust, rising 29% year-on-year to $61.7 trillion, an increase of $13.8 trillion versus 2024.

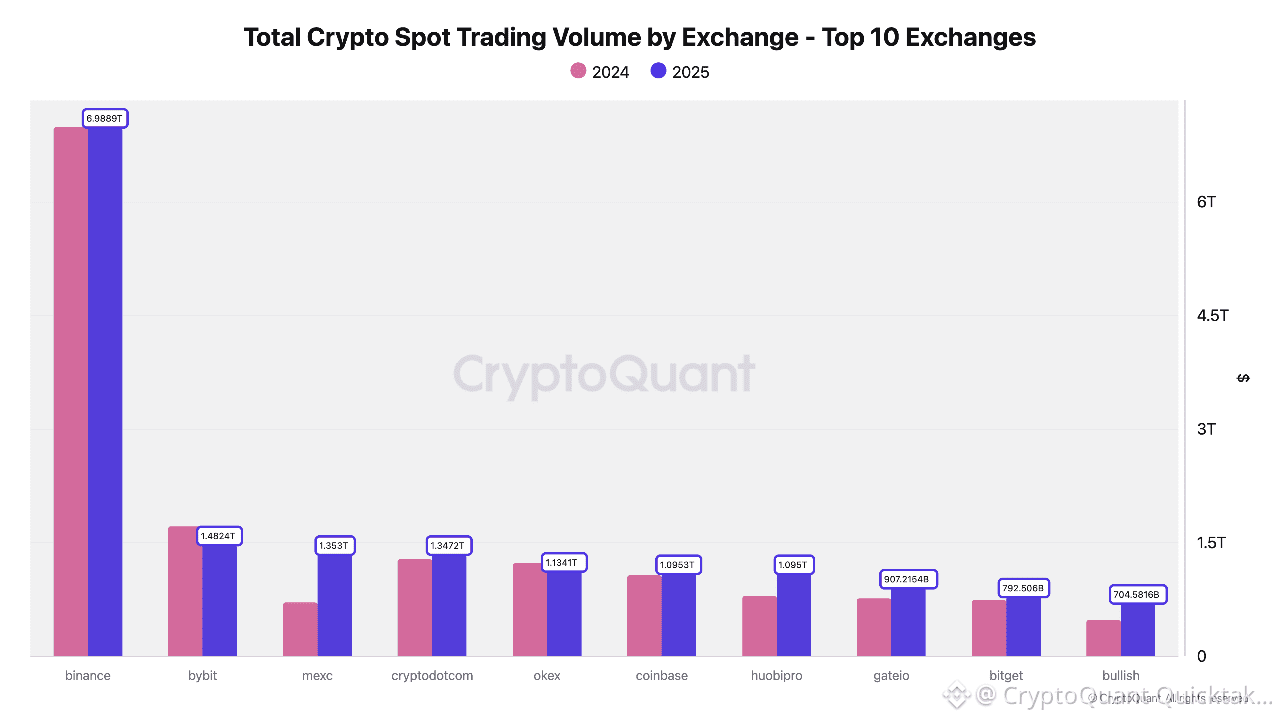

Spot trading activity remains concentrated among a small group of large venues. Binance recorded close to $7 trillion in spot trading volume in FY 2025, representing 41% of the top-10 exchange total. It led both Bitcoin and altcoin markets, with strong activity in ETH, XRP, BNB, TRX, and SOL. Bybit, MEXC, and Crypto.com followed at a considerable distance, each posting roughly $1.3–1.5 trillion in volume.

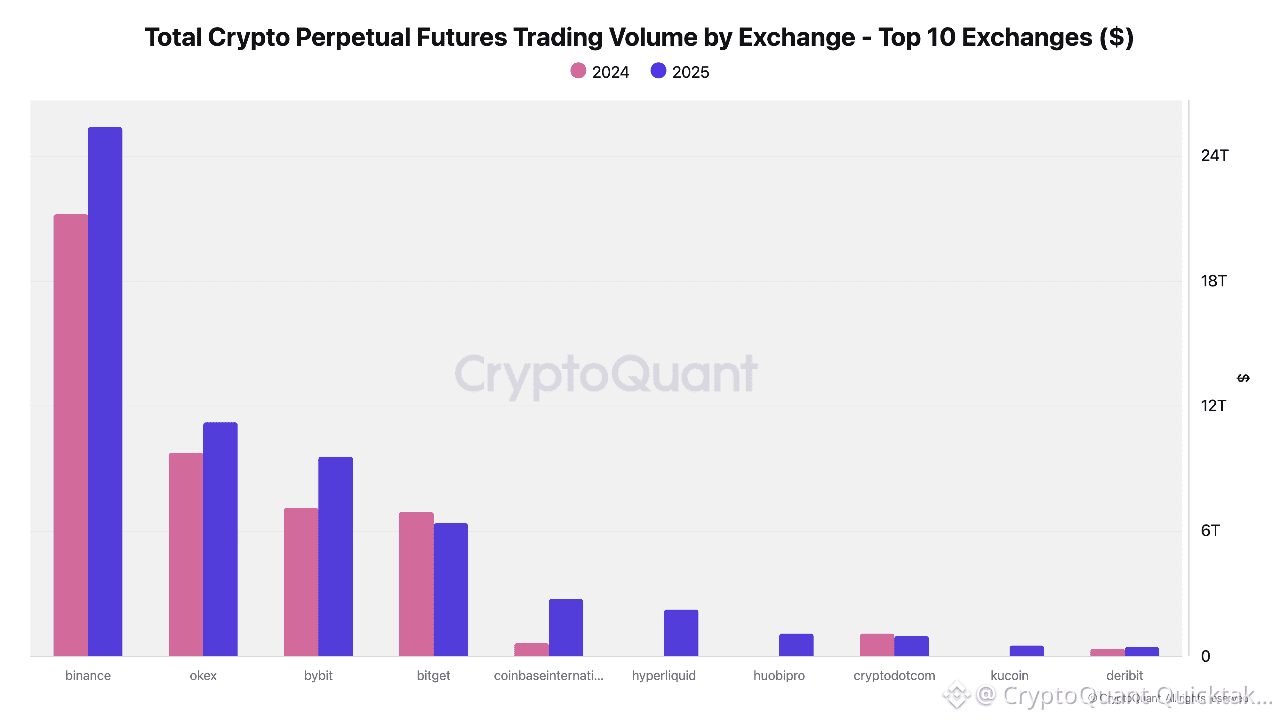

Bitcoin perpetual futures show a clear leader and a well-defined second tier. Binance processed $25.4 trillion in Bitcoin perpetual volume in 2025, equivalent to 42% of the top-10 total. OKX, Bybit, and Bitget formed a strong second tier, each capturing between 11% and 19% of volume. Hyperliquid emerged as a relevant venue with $2.2 trillion (3.7%), while the remaining platforms—including Coinbase—collectively accounted for about 10%.

Stablecoin liquidity is highly concentrated at the top. Binance held $47.6 billion in combined USDT and USDC reserves in 2025, representing 72% of stablecoin balances across the top-10 exchanges. OKX followed with $9.3 billion, and MEXC with $2.2 billion, while Kraken, Bybit, and Coinbase reported materially smaller reserve bases.

Overall reserve data shows a steep drop-off beyond the largest holders. Binance held $117 billion (31.8%) in combined BTC, ETH, USDT, and USDC reserves, narrowly ahead of Coinbase with $81 billion (22.1%). Bitfinex ranked third with $44.4 billion, while balances at OKX, Upbit, and other exchanges were significantly lower.

Written by CQ Research