@Dusk If you spend time around real issuance, you stop romanticizing “bringing assets on-chain” pretty quickly. You start thinking about signatures that arrive late, share registers that don’t match, investors who are approved in one system but rejected in another, and the long, quiet anxiety of being responsible for other people’s money while the rules keep changing around you. In that world, tokenization isn’t a tech upgrade. It’s a trust migration. It’s asking market participants to move from familiar friction to unfamiliar certainty—and then proving, in the first stressful week, that the certainty holds.

Dusk feels like it was built by people who have watched that stress up close. Not the stress of a demo, but the stress of accountability. The moment a transaction is disputed. The moment a regulator asks for a timeline. The moment an investor claims they were treated unfairly, or an issuer claims a transfer should never have happened, and everyone’s incentives suddenly flip from “move fast” to “show me what actually occurred.” Dusk’s center of gravity is that moment. It’s not trying to make markets louder. It’s trying to make them calmer when humans become afraid.

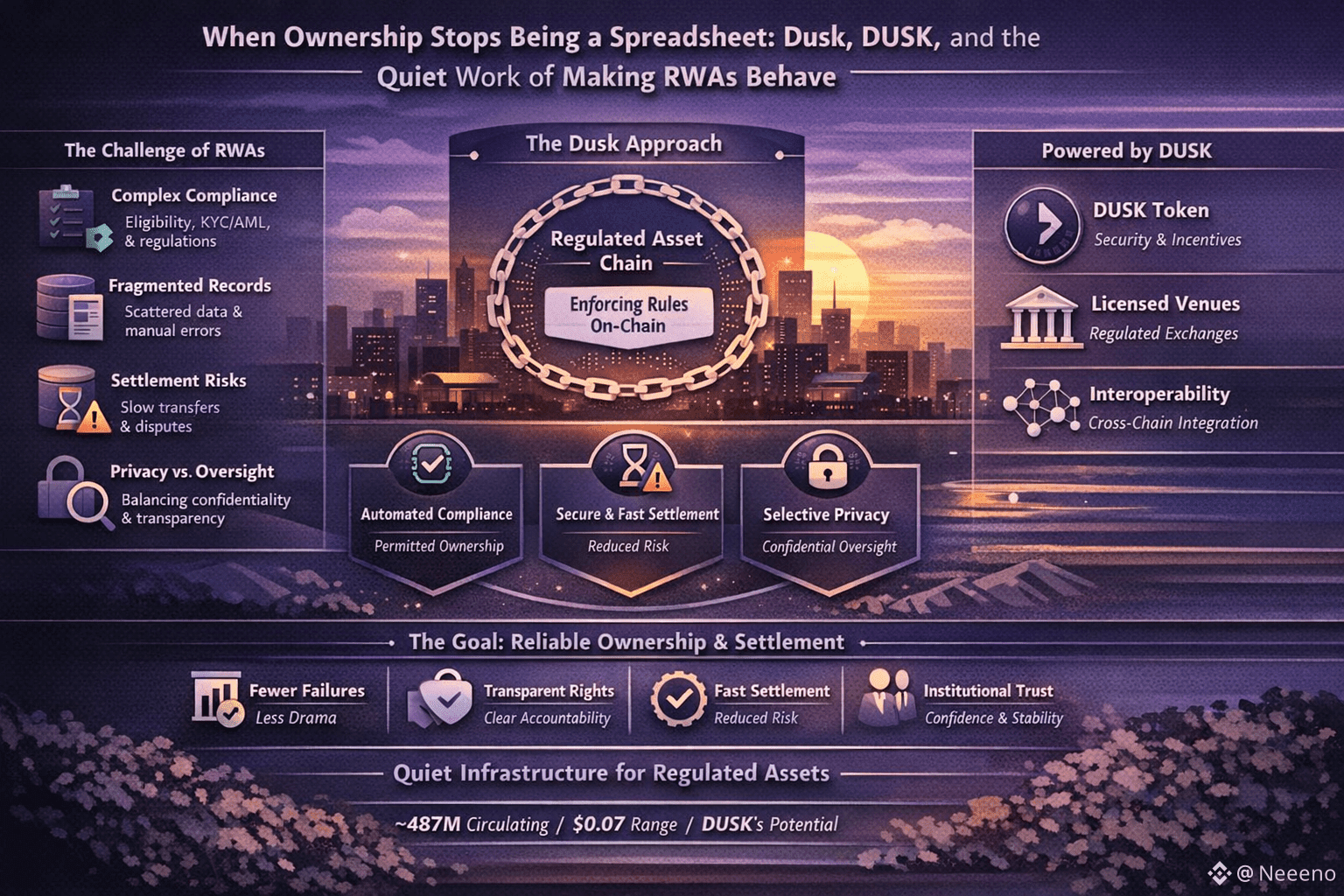

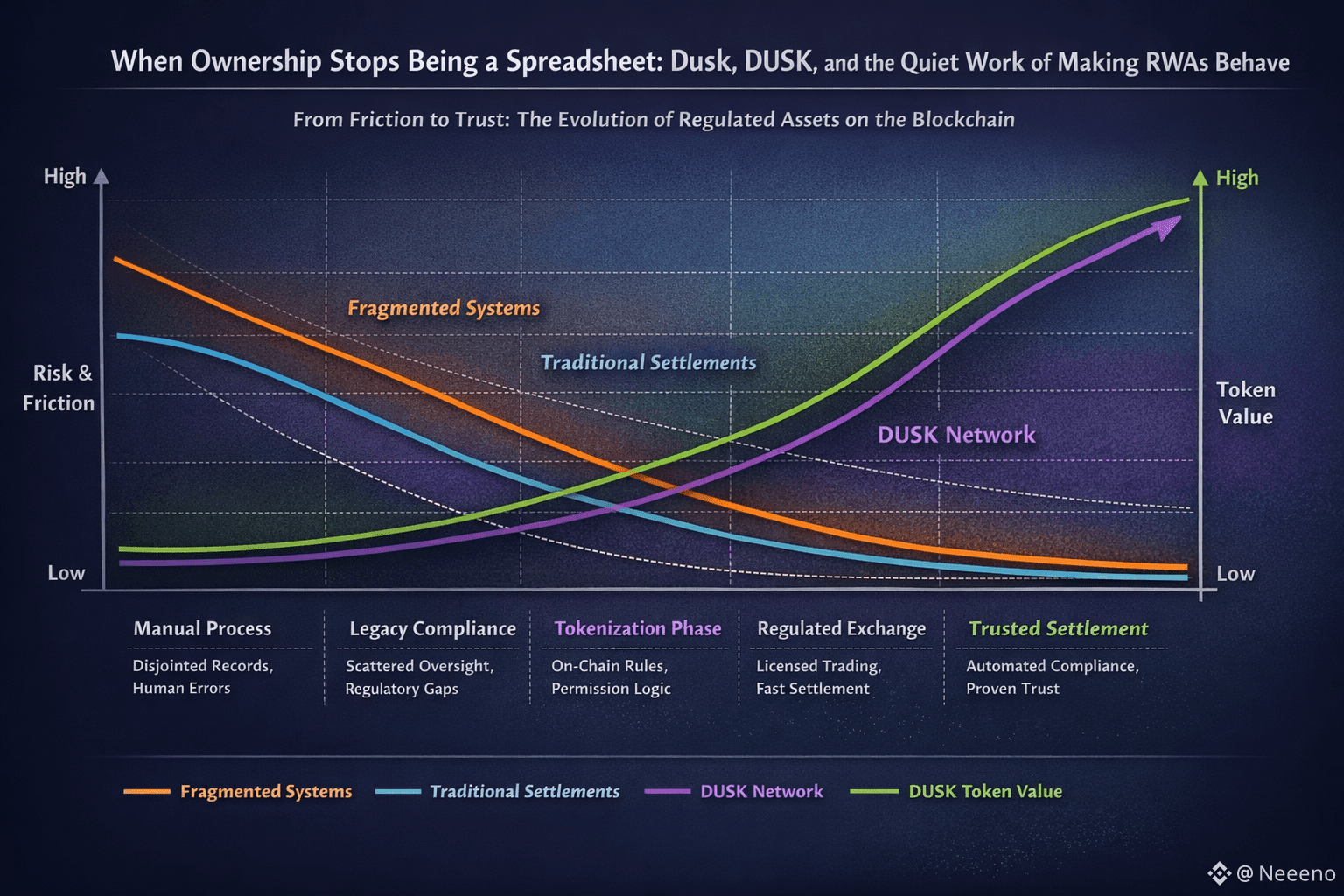

The reason RWAs are hard isn’t that a token can’t “represent” something. The hard part is that the something already lives inside law, relationships, and imperfect recordkeeping. Off-chain reality is full of edge cases: beneficial owners hidden behind nominees, corporate actions that change rights midstream, restrictions that depend on jurisdiction, and investor eligibility that can expire. If you treat that mess as a footnote, you build a system that works only when everyone is friendly. Dusk’s posture is different: it treats the mess as the primary input, and the chain as the place where those messy constraints become consistent behavior. That’s the psychological shift that matters—people stop relying on “the right person will fix it later” and start relying on rules that keep their shape under pressure.

A regulated asset is not just ownership; it’s permitted ownership. That one word—permitted—changes everything. It means transfers are not purely mutual consent; they are consent plus eligibility plus limits plus reporting obligations plus the right kind of evidence at the right time. In older systems, those checks tend to live in scattered places: a registrar’s database, a broker’s onboarding, a compliance vendor’s list, an email thread. Every added layer creates another place where an honest mistake can turn into a financial injury. Dusk’s promise, as I experience it, is that the permission logic stops being “somebody’s job” and starts being “the system’s reflex.” When it works, it doesn’t feel flashy. It feels like fewer late-night calls.

That reflex matters because people don’t fail in dramatic ways most of the time—they fail by forgetting, by mis-keying, by operating on outdated information, by assuming a manual exception will be handled later. Tokenizing RWAs forces you to admit that “later” is where lawsuits and regulatory findings are born. Dusk’s approach to regulated instruments is explicitly framed around letting issuers enforce KYC/AML and reporting expectations as part of the on-chain workflow instead of treating them as optional attachments. That doesn’t remove human work, but it narrows the space where human inconsistency can cause damage

Now add privacy, and the conversation usually collapses into slogans. But in real markets, privacy is not a luxury and it’s not a rebellion—it’s operational safety. It’s the difference between an investor being able to participate without broadcasting their strategy, and an issuer being able to manage relationships without turning their cap table into public theater. The tricky part is that regulated markets don’t get to choose between secrecy and transparency. They need confidentiality for participants and clarity for oversight. Dusk’s framing—again, in how it behaves, not how it advertises—is that you can prove correctness without spilling the contents of the transaction to everyone who happens to be watching. That is a different kind of calm: not “nobody can see,” but “the right party can see when it is justified, and the rest of the world doesn’t become a surveillance layer.”

This is where Dusk becomes less about “tokenization” and more about what it means to make on-chain logic accountable to off-chain consequences. A share issuance is not complete when tokens exist; it’s complete when the issuer can defend the register, when investors can verify their rights, and when a trading venue can demonstrate fair access and correct settlement. Dusk’s collaboration with NPEX matters because it drags these requirements out of theory and into a venue that already lives under supervision. NPEX publicly described preparing an application around the EU’s DLT Pilot Regime with Dusk, which is exactly the kind of constrained environment where reality pushes back and systems either mature or break.

People underestimate how much psychological weight a licensed venue carries. It’s not just a badge; it’s a set of obligations that force a system to answer uncomfortable questions. What happens if an investor loses access? What happens if a transfer is attempted that shouldn’t be allowed? What happens if two sources disagree about eligibility? What happens when a corporate action hits while the market is open? In a regulated context, “we’ll patch it” is not a plan. The plan is that the system should already be designed so that many classes of mistakes simply don’t execute, and when something exceptional occurs, the evidence trail is coherent enough that humans can resolve it without guessing. NPEX and Dusk’s partnership is described in precisely that direction: building an exchange for regulated instruments where issuance, trading, and settlement can compress from days to something closer to immediate, while still respecting the rulebook the market is obligated to follow.

Settlement speed is often marketed as convenience, but in finance it’s also risk management. The longer settlement takes, the more time there is for counterparties to fail, for disputes to grow teeth, for margin calls to cascade, for someone to realize they shouldn’t have been in the trade. When settlement tightens, some kinds of fear shrink. But new fears appear: if settlement is fast, the system must be harder to trick, because there’s less time for humans to intervene. That’s why the chain’s internal incentives start to matter. If Dusk is going to be trusted as a backbone for assets with legal meaning, the people operating the network have to be paid to behave honestly—and punished when they don’t. Otherwise you just moved the old trust problem into a new costume.

That’s where DUSK stops being a ticker and starts being a bond. Not a bond in the legal sense, but in the emotional sense: a stake that says “I lose money if I lie.” Networks love to talk about decentralization as philosophy, but regulated markets experience decentralization as responsibility distribution. If one operator can cheat or go offline and freeze settlement, the market doesn’t feel modern—it feels fragile. DUSK is the economic weight that makes uptime, correctness, and finality something validators care about even when nobody is applauding. The token has a defined maximum supply, and circulating supply is in the high hundreds of millions; as of the current market snapshots, it’s roughly 487 million circulating out of a 1 billion max, with price hovering around the $0.07 range and a market cap in the low tens of millions of dollars (numbers move, but the point is the scale: DUSK is still priced like an instrument people haven’t fully demanded yet).

If you’ve ever sat through a market incident, you know why “priced like” matters. The token is the cost of security, and security is what you notice only when it’s missing. In calm periods, people underpay for resilience and overpay for excitement. In volatile periods, the reverse happens: everyone suddenly asks whether the chain can keep producing truth when incentives turn hostile. Dusk’s bet is that regulated RWAs will create a different demand curve—one tied less to narratives and more to operational necessity. When an exchange, an issuer, and a set of investors rely on the chain to coordinate rights, transfers, and settlement, DUSK demand becomes less about speculation and more about paying for a system that reliably refuses bad state transitions.

Recent updates are best understood through that lens: not “shipping features,” but tightening the path from promise to production. Dusk’s own announcements around mainnet rollout describe a structured migration from external representations of DUSK into the live network and a deliberate process of forming the chain’s initial state—because a financial system’s first real failure mode is often genesis chaos: mismatched balances, rushed tooling, fragmented liquidity, and user panic. The rollout communications from late 2024 into early 2025 read like the work of people trying to avoid exactly that kind of trauma, because trauma is expensive and it leaves scars in institutional memory.

The other kind of update that matters is connectivity, because regulated assets don’t live in one place. They need controlled distribution and controlled composability. In late 2025, Dusk and NPEX publicly described integrating Chainlink’s interoperability and data layer to move regulated assets across environments more safely and to support broader distribution and settlement models. That kind of decision signals an understanding that RWAs won’t win by being isolated. But it also signals a harder understanding: if assets can move, compliance obligations must move with them, or you’re just exporting risk. Interoperability without guardrails is just faster confusion.

You can feel the project’s priorities in what it chooses to emphasize when it speaks to institutions: not “look how powerful this is,” but “look how controlled this is.” The DLT Pilot Regime isn’t a marketing stage; it’s a sandbox where regulators allow limited experimentation precisely so they can watch failure modes up close. NPEX openly states it is preparing that path with Dusk, and independent industry coverage frames the partnership as an attempt to operate a regulated trading and settlement venue for SME securities on distributed rails. That’s the environment where the chain has to show it can handle disagreements between sources—issuer records versus broker records versus investor claims—without collapsing into improvisation.

Here’s what I think people miss if they only read descriptions: the real product is not tokenization. The product is conflict resolution without chaos. When a system is designed well, many conflicts never become public because they get prevented at the boundary. The wrong transfer attempt quietly fails. The ineligible address never becomes a holder. The issuer doesn’t have to beg intermediaries to correct a register because the register is already coherent. And when something truly ambiguous happens—because real life is ambiguous—the system’s record is structured enough that the argument becomes smaller. Humans can disagree, but they disagree inside a shared timeline instead of inside a fog.

This is also why privacy is a fairness tool, not just a secrecy tool. In thin markets, visible positions become weapons. In fundraising, visible ownership can become pressure. In governance, visible voting can become coercion. When you hide participant details by default but still allow justified disclosure, you reduce the number of ways powerful actors can punish weaker ones for participating. You create emotional safety, which is not sentimental—it’s what allows participation without fear. Dusk’s writing about the coexistence of KYC and privacy is basically a refusal to accept the usual false choice. It’s saying: people can be known to the right authorities without being exposed to everyone. In finance, that’s not ideology. That’s survival.

When I look at DUSK’s market data, I don’t read it as a scorecard of hype. I read it as the current cost of reserving a seat in a system that’s trying to make regulated assets feel native to wallets. The token is still relatively small by market cap compared to the scale of the world it’s aiming at, and liquidity can swing quickly, which tells you the market is still deciding what kind of instrument DUSK will become: a speculative chip, or a fee-and-security asset tied to real settlement flow. Current trackers put DUSK around seven cents with daily volume that can spike into the tens of millions. That volatility is not a contradiction of the mission; it’s a reminder of the environment the mission must survive.

And survival, in the end, is the entire point of this kind of infrastructure. RWAs are not forgiving. They don’t let you “move fast and break things” because the things you break are people’s retirement plans, cap tables, and legal obligations. Dusk is trying to build a chain where regulated ownership can be issued, transferred, and settled in a way that remains defensible when the room turns adversarial. That is not glamorous work. It is slow work, full of constraints, full of compromises, full of moments where the correct decision looks boring from the outside.

If Dusk succeeds, the win won’t look like a viral moment. It will look like fewer settlement failures. Fewer disputes that metastasize. Fewer investors who feel tricked by opacity. Fewer issuers who feel trapped by intermediaries. More transactions that complete without anyone needing to trust a particular person to do the right thing at the right time. And DUSK, in that world, won’t be a story—it will be the quiet cost of keeping the system honest, the invisible budget that pays for reliability.

That’s the kind of responsibility most people don’t applaud, because when it’s done well nothing dramatic happens. But finance is built on the prevention of drama. Dusk is trying to be the place where regulated assets can exist without turning every participant into public property, and without turning oversight into a guessing game. It’s building for the moments when someone is afraid and needs the system to hold steady anyway. Quiet infrastructure doesn’t ask for attention. It earns confidence by refusing to break, and by making the hardest parts of the market feel, for once, less personal and more dependable.