2025 just wrapped up. It’s time to zoom out. One clear trend stands out across BTC deposits, stablecoin inflows, and derivatives volume: Liquidity is concentrating on Binance. Here’s what the data shows 👇

1/ Bigger BTC deposits = bigger players 🐋

From 2021–2023, the average BTC deposit into Binance ranged between 0.3 to 0.9 BTC.

But starting in 2024, that changed:

- Early 2024: jumps to 2.26 BTC → then 3.05 to 4.67 BTC

- 2025: climbs to a steady 4 to 6 BTC range

- Late 2025–Early 2026: spikes to 6.63, 9.1 and 10.74 BTC

- Recent peaks: 20.49 BTC and 21.76 BTC

Key takeaway: This is no longer retail flow. Whales and large entities are actively moving BTC into Binance.

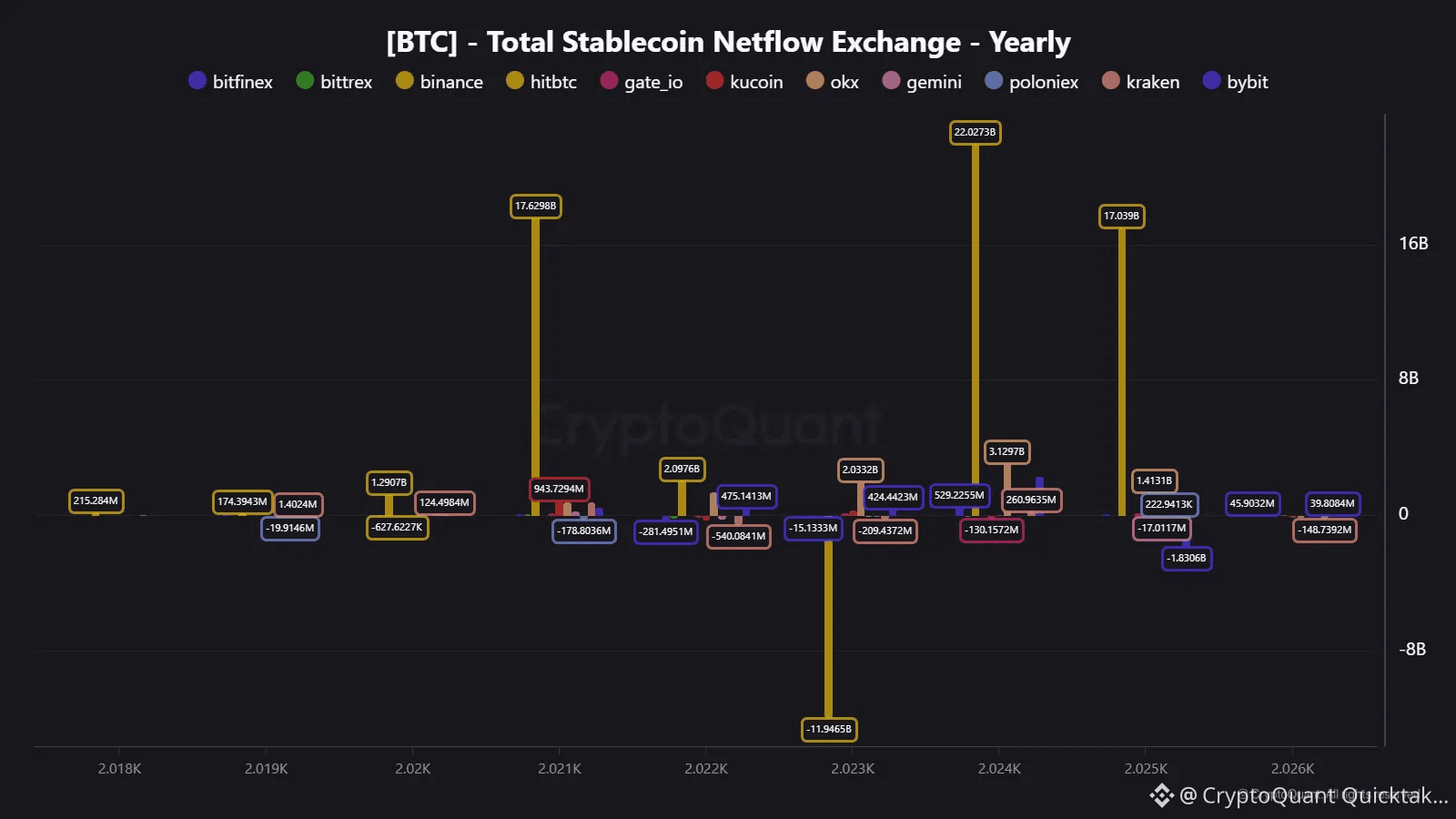

2/ Stablecoin inflows show where the real demand is 🪙➡️🏦

Binance leads the pack for net stablecoin flows:

2021: +$17.63B

2023: −$11.95B (broad market outflows)

2024: +$22.03B (largest ever)

2025: +$17.04B

Other exchanges pale in comparison. Stablecoin liquidity (aka dry powder) is stacking back up on Binance.

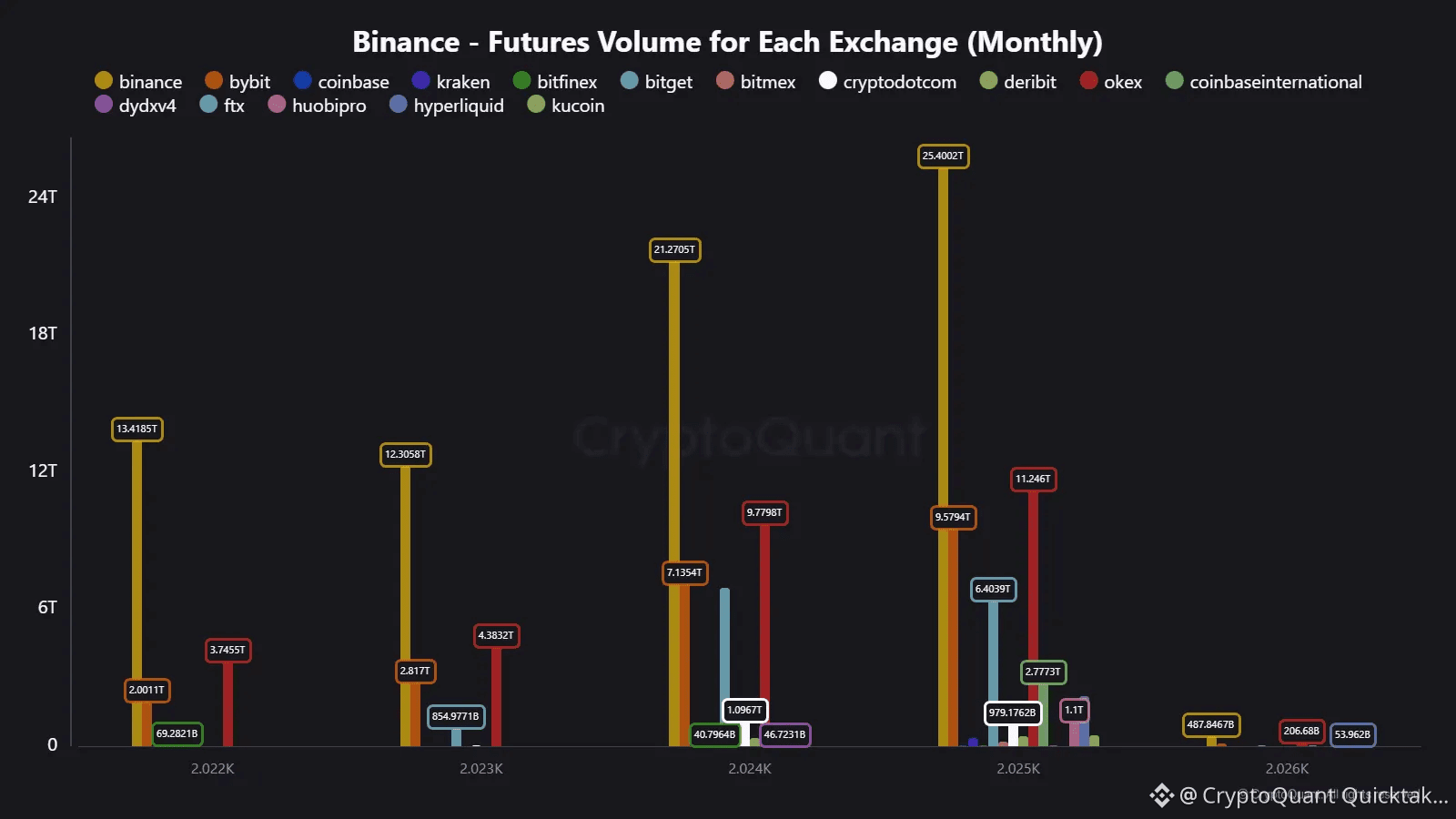

3/ Derivatives volumes still favor Binance by a wide margin 📈⚙️

2024 Derivatives Volume:

- Binance: $21.3T

- OKX: $9.8T

- Bybit: $7.1T

2025 Derivatives Volume:

- Binance: $25.4T

- OKX: $11.3T

- Bybit: $9.6T

When traders need leverage and depth, they still turn to Binance.

Put it all together: a Liquidity Flywheel in motion 🔁

- Stablecoins in = fresh collateral & buying power

- BTC deposits rising = whales positioning

- Derivatives volume surging = deeper liquidity → more flow

When all three accelerate in sync, it signals risk appetite and active positioning, not passive holding.

Written by maartunn