Key Insights

Binance Coin climbed past $900 following CZ’s remarks about a potential crypto super cycle and positive regulatory signals.

Institutional demand grew, with Wells Fargo and Morgan Stanley increasing crypto exposure through Bitcoin ETFs.

BNB exhibits some technical pressure towards the direction of $1,000, as it is backed by some bullish indicators and other macroeconomic events to be experienced this week.

On the weekend, Binance Coin (BNB) continued rising, topping $907 on Sunday. The spurt was after a wider crypto market surge of 0.61% in 24 hours. Bitcoin was selling at more than 90,000, and Ethereum was selling at 3,100. This growing exuberance was encouraged by the remarks of Binance founder Changpeng Zhao, who said that the crypto supercycle was on the verge of occurrence.

The statements were made following the fact that the U.S. Securities and Exchange Commission took cryptocurrencies off its risk of priority list in 2026. CZ responded on social platform X, suggesting this move signals a favorable regulatory direction. He highlighted that during prior downturns, retail investors were exiting while institutions such as Wells Fargo quietly accumulated positions.

Institutional Players Increase Exposure

According to filings, Wells Fargo purchased 383 million shares in Bitcoin ETFs. Meanwhile, Morgan Stanley filed for its own spot Bitcoin ETF, showing growing institutional confidence in digital assets. CZ mentioned the projections of asset manager VanEck, which suggested that Bitcoin might be worth as much as 2.9 million, adding to the optimistic market opinion.

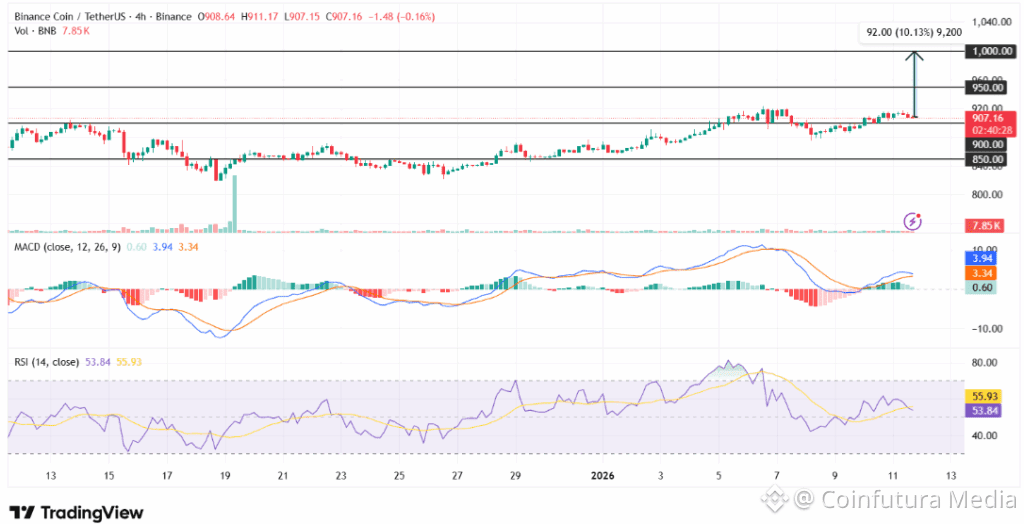

Source: TradingView

Source: TradingView

Technically, BNB has recovered its support zone at the price of $900 and has remained on a steady positive chart on the 4-hour chart. The MACD indicator demonstrated a bullish crossover, and the RSI was 56.10, which meant that the existing positive momentum was not followed by the crossing into the overbought territory. The second line of resistance is near the range of approximately 950; the psychological level of 1,000 is the target.

Macroeconomic data are also being paid close attention to by traders this week. An announcement by the Federal Open Market Committee president on Monday could provide a clue on the future monetary policy. On Tuesday and Wednesday, the inflation reports will be received, such as the Consumer Price Index and Producer Price Index. The latter in the week will be jobless claims and the update in the Federal Reserve balance sheet.

BNB Outlook as Market Awaits Inflation Data

With improving sentiment and institutional confidence building, Binance Coin may be in a favorable position to test the $1,000 level. Any breach above $950 could clear a path toward this target. However, on the downside, $850 remains a key support. A break below that level could introduce selling pressure and shift short-term sentiment.

The post Binance Coin Eyes $1,000 as CZ Signals Start of Crypto Super Cycle appears on Coin Futura. Visit our website to read more interesting articles about cryptocurrency, blockchain technology, and digital assets.