Reimagining Traditional Finance for the Digital Age

The global financial system is, at its core, a vast web of trust, contracts, and value exchange. Yet, despite technological progress, its underlying infrastructure often feels outdated—anchored in slow-moving paperwork, intermediaries, and closed-off markets. Bonds, shares, real estate holdings, and investment funds remain vital pillars, but the way we manage, transfer, and interact with these assets hasn’t kept pace with the demands of a connected, digital world.

Blockchain technology, and more specifically, tokenization, offers a compelling alternative. By representing real-world assets (RWAs) as blockchain-based tokens, the industry promises to revolutionize how assets are owned, transferred, and governed. This vision is about more than speed or convenience; it’s about unlocking entirely new levels of market access, liquidity, and programmability. Yet, it’s not a simple migration. Traditional assets operate within a delicate balance of privacy, regulatory oversight, and trust—qualities that public blockchains, by default, struggle to deliver.

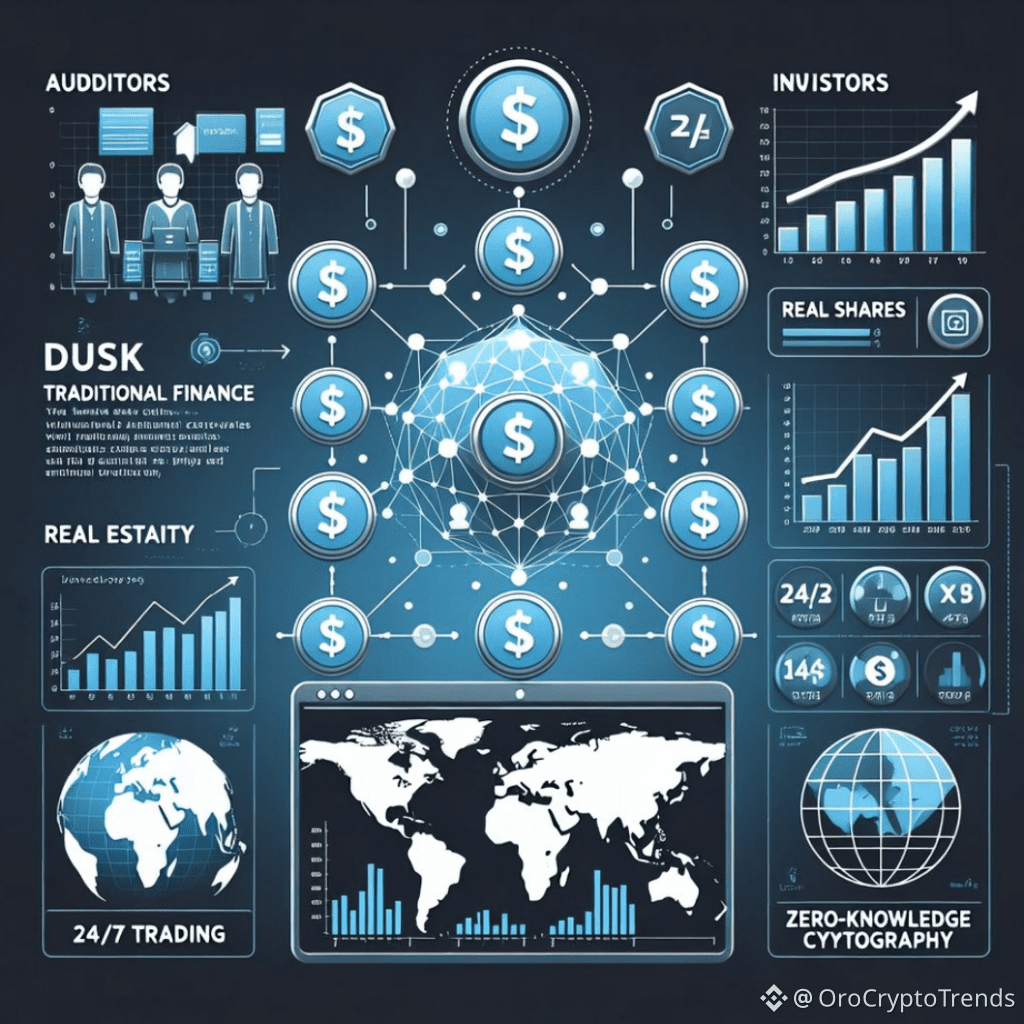

Enter Dusk Network, a platform designed from the ground up to address these challenges and redefine what’s possible for asset tokenization.

Why Tokenizing RWAs Is Transformative

When done right, tokenized RWAs aren’t just digital facsimiles of existing securities or properties—they’re a leap forward in how assets are managed. The benefits go well beyond digital wrappers:

- Settlement that happens in minutes, not days, shrinking counterparty risk and freeing up capital.

- Direct peer-to-peer transfers, drastically reducing reliance on custodians and clearinghouses.

- Global 24/7 markets, enabling access to investments that were previously gated by geography or high entry barriers.

- Embedded compliance, allowing rules and regulations to be enforced by code, reducing errors and manual oversight.

However, the transformation is only as strong as its weakest link. Financial markets are built on trust and security. Unlike cryptocurrencies or NFTs, real assets demand rigorous privacy, clear ownership records, and strict regulatory adherence. Any tokenization effort that ignores these pillars will struggle to gain traction among institutions and regulators.

Privacy as the Foundation, Not a Feature

Dusk Network stands apart by placing privacy at the heart of its architecture. Using advanced zero-knowledge cryptography, Dusk ensures that every transaction, every update of ownership, and even the business logic encoded in smart contracts remains confidential. Yet, this privacy isn’t absolute opacity—information can be selectively disclosed when needed. Imagine a scenario where an auditor or a regulator can verify compliance or asset backing without exposing every transaction detail to the world. Or where an investor can prove their balance to a lender without revealing their entire portfolio.

This privacy-first approach makes Dusk uniquely suited for a broad spectrum of regulated assets:

- Security tokens representing equity or debt

- Tokenized corporate and government bonds

- Private equity shares and venture capital funds

- Regulated investment vehicles that require both transparency and confidentiality

Compliance Engineered from the Start

In most blockchain ecosystems, compliance is an afterthought: a patch, an add-on, or a third-party solution. Dusk flips this paradigm. Its smart contracts are built to encode regulatory requirements directly—everything from investor whitelisting and transfer restrictions to audit logging and reporting. These mechanisms ensure that only authorized parties can own or transfer assets, and that all actions are traceable by those with legitimate oversight, but not by the general public.

This model doesn’t just satisfy regulators—it empowers institutions. Banks, asset managers, and funds can confidently participate in tokenized markets, knowing that their statutory obligations and fiduciary duties are met by the platform itself, not left to chance or manual intervention.

Unifying Legacy Finance and Blockchain Innovation

Dusk Network doesn’t ask traditional finance to abandon its principles or control. Instead, it offers a seamless bridge to the benefits of blockchain: automation, efficiency, and global reach, without sacrificing the robust governance and risk management that institutions require. Asset tokenization on Dusk means:

- Existing financial operators can digitize their offerings while retaining their organizational controls and compliance mechanisms.

- New asset types and markets can be created, with built-in guardrails that satisfy legal and regulatory frameworks.

- Transactional friction is slashed, cutting costs and shortening settlement cycles—freeing capital for more productive uses.

This hybrid approach makes Dusk not just a technological upgrade, but a force multiplier for both efficiency and trust.

The Stakes for the Future of Finance

There’s plenty of hype in crypto about tokenized RWAs being the “next trillion-dollar market.” But beneath the buzz, the real differentiator is trust. For institutional adoption, for mainstream capital flows, and for regulatory acceptance, privacy and compliance cannot be bolted on—they must be foundational.

Dusk Network recognizes this reality and raises the standard. By embedding privacy, compliance, and scalability into its protocol, Dusk is not chasing the latest trend or speculative wave. Instead, it’s laying down the infrastructure for a more inclusive, efficient, and trustworthy financial system that can serve everyone—from individual investors to multinational banks.

What’s Next? Building an Ecosystem of Trust

The journey to widespread tokenized finance is just beginning. For those watching the space, the most meaningful progress will come from platforms that solve for trust, not just speed. The real winners will be those who can satisfy the stringent requirements of regulated markets, while delivering on the promise of digital transformation.

Dusk Network is poised to lead this transition. Its privacy-first, compliance-centric design isn’t just a technical achievement—it’s a signal to the market that regulated, real-world asset tokenization is ready for prime time. As adoption grows, expect the lines between traditional and decentralized finance to blur, giving rise to a new standard where efficiency, privacy, and trust coexist by default.

Tokenization is the engine; legal, regulatory, and privacy frameworks are the rails. If digital assets are to move at scale, those rails must be strong, secure, and invisible to the end user. Dusk Network is building them today, setting the stage for a financial ecosystem that’s as open as it is trustworthy.

Watch the platforms that prioritize compliance and privacy—they’re not just building products. They’re shaping the future of global finance.

Disclaimer Not Financial Advice