In the evolving landscape of finance, fractional ownership has emerged as a game-changer, allowing everyday investors to access high-value assets that were once reserved for the wealthy elite. By dividing ownership into smaller, more affordable shares, this model democratizes investment opportunities in real estate, art, intellectual property, and even stocks. However, traditional fractional ownership systems often grapple with issues like transparency, security, and privacy. Enter Dusk Network, a privacy-focused blockchain platform that addresses these challenges head-on, enabling confidential yet compliant fractional asset ownership.

What is Fractional Ownership?

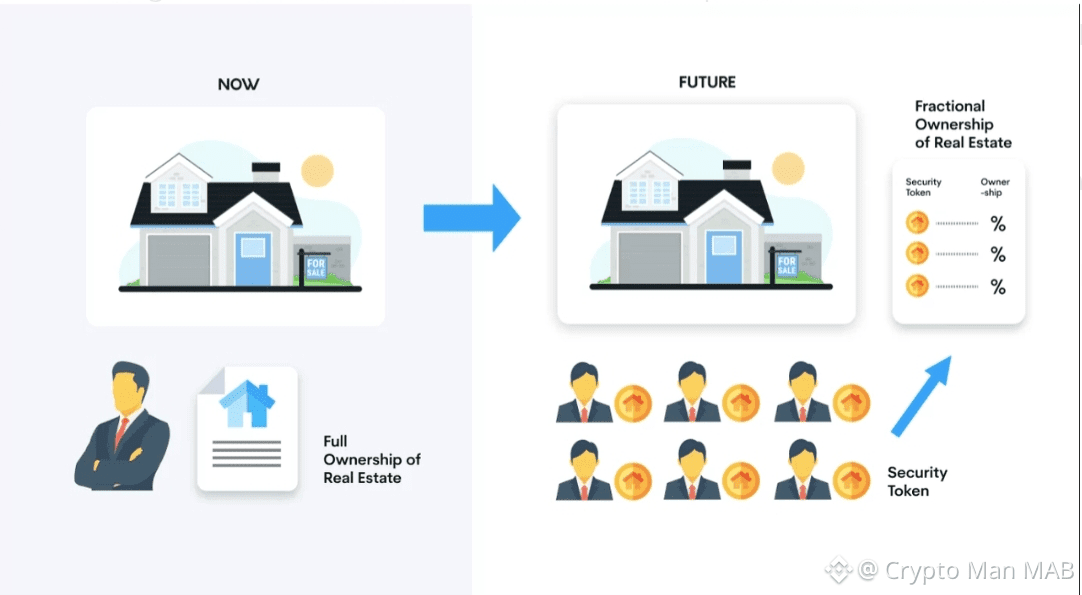

Fractional ownership refers to the division of an asset's ownership rights among multiple parties, each holding a proportional share. This concept isn't new--it's been used in real estate for decades through timeshares or co-ownership agreements. In the digital age, blockchain technology has supercharged it by tokenizing assets into digital tokens, making trading seamless and cost-effective. For instance, a luxury property worth millions can be split into thousands of tokens, allowing investors to buy fractions as small as $100. This lowers barriers to entry, boosts liquidity, and opens markets to a global audience.

Tokenization, the process of converting asset rights into digital tokens on a blockchain, further enhances this by enabling programmable features like automated dividends or voting rights. However, without robust privacy measures, public blockchains expose sensitive data, such as ownership details and transaction histories, which can deter institutional adoption due to regulatory and security concerns.

The Blockchain Boost to Fractional Ownership

Blockchain's decentralized ledger ensures immutable records of ownership, reducing fraud and eliminating intermediaries. Smart contracts automate processes like share distribution and profit sharing, cutting costs significantly. For real-world assets (RWAs) like real estate or commodities, tokenization allows fractional shares to be traded 24/7 on global exchanges, increasing market efficiency.

Yet, privacy remains a critical gap. Public blockchains like Ethereum reveal all transaction data, which can lead to risks such as market manipulation or unwanted exposure of investor portfolios. This is where specialized platforms like Dusk Network shine, offering privacy-preserving tools tailored for regulated financial assets.

Introducing Dusk Network

Dusk Network, launched in 2019 and rebranded to Dusk in 2023, is a Layer-1 blockchain designed for privacy-oriented financial applications. It specializes in tokenizing RWAs while ensuring compliance with regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML). Dusk's core innovation is its Confidential Security Token (XSC) standard, which allows for private transactions and hidden balances without compromising verifiability.

Unlike transparent blockchains, Dusk uses zero-knowledge proofs and other cryptographic techniques to keep ownership details confidential while enabling selective disclosure for audits or compliance checks. This makes it ideal for institutional use, where privacy is paramount but regulatory oversight is non-negotiable.

How Dusk's Privacy Enhances Fractional Ownership

Dusk integrates privacy directly into fractional ownership by allowing tokenized assets to be issued and traded confidentially. For example, in fractional real estate, investors can hold shares without revealing their full portfolio to the public ledger, reducing risks like targeted hacks or competitive intelligence gathering. The XSC standard supports fractionalization at a low cost, making micro-investments viable and increasing shareholder engagement through features like on-chain voting.

Moreover, Dusk's Citadel protocol provides self-sovereign identities, ensuring that only verified parties participate while maintaining user anonymity. This bridges traditional finance (TradFi) and decentralized finance (DeFi), allowing users to self-custody assets directly in their wallets with instant settlement and privacy. Transactions are final and irreversible upon processing, providing legal certainty of ownership.

Benefits and Real-World Use Cases

The fusion of fractional ownership with Dusk's privacy yields numerous advantages:

Accessibility: Smaller investors gain entry to premium assets like intellectual property or emerging market real estate.

Liquidity: Private trading reduces intermediaries, speeding up sales and lowering fees.

Compliance and Security: Privacy features prevent data leaks while allowing verifiable proofs for regulators.

Innovation in DeFi: Users can engage in privacy-focused decentralized finance, such as confidential lending or trading.

Use cases include tokenizing stocks for fractional shares, creating private funds for real estate, or even digitizing bonds and mortgages. As of 2026, Dusk has facilitated various RWA projects, emphasizing its role in regulated, privacy-first finance.

Challenges and Future Outlook

Despite its strengths, challenges persist. Regulatory hurdles in different jurisdictions can slow adoption, and the need for widespread education on privacy tech remains. Scalability and integration with existing financial systems are ongoing developments.

Looking ahead, Dusk's focus on native issuance and compliance automation positions it as a leader in the RWA space. As more assets go digital, the demand for private fractional ownership will grow, potentially unlocking trillions in value.

In conclusion, Dusk Network's privacy innovations are transforming fractional ownership from a niche concept into a secure, inclusive financial tool. By balancing confidentiality with compliance, it empowers individuals and institutions alike to own and trade assets in a truly decentralized future.